Edited, memorised or added to reading queue

on 27-Dec-2016 (Tue)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1428234833164

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itSometimes auctions are used to seek equilibrium prices. Common value auctions sell items that have the same value to all bidders, but bidders can only estimate that value before the auction is completed. Overly optimistic bidders overestimate the true va

Original toplevel document

SUMMARYven price, the quantity demanded exceeds the quantity supplied, there is excess demand and price will rise. If, at a given price, the quantity supplied exceeds the quantity demanded, there is excess supply and price will fall. <span>Sometimes auctions are used to seek equilibrium prices. Common value auctions sell items that have the same value to all bidders, but bidders can only estimate that value before the auction is completed. Overly optimistic bidders overestimate the true value and end up paying a price greater than that value. This result is known as the winner’s curse. Private value auctions sell items that (generally) have a unique subjective value for each bidder. Ascending price auctions use an auctioneer to call out ever increasing prices until the last, highest bidder ultimately pays his/her bid price and buys the item. Descending price, or Dutch, auctions begin at a very high price and then reduce that price until one bidder is willing to buy at that price. Second price sealed bid auctions are sometimes used to induce bidders to reveal their true reservation prices in private value auctions. Treasury notes and some other financial instruments are sold using a form of Dutch auction (called a single price auction) in which competitive and non-competitive bids are arrayed in descending price (increasing yield) order. The winning bidders all pay the same price, but marginal bidders might not be able to fill their entire order at the market clearing price. Markets that work freely can optimize society’s welfare, as measured by consumer surplus and producer surplus. Consumer surplus is the difference between the total value

Flashcard 1428241911052

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open ity optimistic bidders overestimate the true value and end up paying a price greater than that value. This result is known as the winner’s curse. Private value auctions sell items that (generally) have a unique subjective value for each bidder. <span>Ascending price auctions use an auctioneer to call out ever increasing prices until the last, highest bidder ultimately pays his/her bid price and buys the item. Descending price, or Dutch, auctions be

Original toplevel document

SUMMARYven price, the quantity demanded exceeds the quantity supplied, there is excess demand and price will rise. If, at a given price, the quantity supplied exceeds the quantity demanded, there is excess supply and price will fall. <span>Sometimes auctions are used to seek equilibrium prices. Common value auctions sell items that have the same value to all bidders, but bidders can only estimate that value before the auction is completed. Overly optimistic bidders overestimate the true value and end up paying a price greater than that value. This result is known as the winner’s curse. Private value auctions sell items that (generally) have a unique subjective value for each bidder. Ascending price auctions use an auctioneer to call out ever increasing prices until the last, highest bidder ultimately pays his/her bid price and buys the item. Descending price, or Dutch, auctions begin at a very high price and then reduce that price until one bidder is willing to buy at that price. Second price sealed bid auctions are sometimes used to induce bidders to reveal their true reservation prices in private value auctions. Treasury notes and some other financial instruments are sold using a form of Dutch auction (called a single price auction) in which competitive and non-competitive bids are arrayed in descending price (increasing yield) order. The winning bidders all pay the same price, but marginal bidders might not be able to fill their entire order at the market clearing price. Markets that work freely can optimize society’s welfare, as measured by consumer surplus and producer surplus. Consumer surplus is the difference between the total value

Flashcard 1428875250956

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itl Poder Legislativo para éste lo estudie, analice y, en su caso, siguiendo el proceso que señala la Constitución Política de los Estados Unidos Mexicanos, se convierta en ley; a la Cámara que primero recibe el proyecto de ley se le llama <span>Cámara de Origen. <span><body><html>

Original toplevel document

2.1 CLASIFICACIÓN DE LAS FUENTES DEL DERECHOso mediante el cual los órganos del Estado, (el Congreso de la Unión, que se conforma por la Cámara de Diputados y Cámara de Senadores), crean las normas jurídicas generales, abstractas y obligatorias que integrarán la ley. <span>En nuestro sistema mexicano existen seis etapas para la creación de una ley, a saber: iniciativa, discusión, aprobación, sanción, publicación e iniciación de la vigencia. Al hablar del proceso legislativo surge la idea de un procedimiento que ha de seguirse para la creación de las leyes federales o locales, acto que en nuestra Constitución se consigna en los artículos 71 y 72, que a continuación se explican: a) Iniciativa, el derecho de iniciar leyes, conforme al artículo 71 de nuestra Constitución Política de los Estados Unidos Mexicanos, le compete al Presidente de la República, a los Diputados y Senadores, al Congreso de la Unión y a las Legislaturas de los Estados. Las iniciativas presentadas por el Presidente de la República, por las Legislaturas de los Estados o por las Diputaciones de los mismos, pasarán desde luego a comisión. Las que presentaren los diputados o los senadores, se sujetarán a los trámites que designe el Reglamento de Debates. La iniciativa de ley es un proyecto que se presenta al Poder Legislativo para éste lo estudie, analice y, en su caso, siguiendo el proceso que señala la Constitución Política de los Estados Unidos Mexicanos, se convierta en ley; a la Cámara que primero recibe el proyecto de ley se le llama Cámara de Origen. b) Discusión es el acto por el cual las Cámaras deliberan acerca de las iniciativas, a fin de determinar si deben o no ser aprobadas,11 debaten sobre la proposición que se les ha hecho, exponiendo los puntos de vista que existan a favor o en contra de ella y formulando los puntos de vista que consideran pertinentes para el perfeccionamiento del proyecto. Una vez que la iniciativa de ley ha sido estudiada, discutida y revisada por la Cámara de Origen, si se considera que es prudente, se procede al siguiente paso del proceso legislativo: la aprobación. c) Aprobación, aquí los integrantes de la Cámara de Origen dan su autorización a la iniciativa para que ésta se convierta en ley, una vez aprobada la iniciativa, se envía a la otra Cámara, a cual se denomina Cámara Revisora, para que ésta también la discuta. La aprobación pude ser total o parcial, la primera de ellas se da cuando aceptan que la iniciativa, una vez discutida y analizada, fue autoriza por la Cámara de Origen para que se apruebe la ley; la segunda, se da cuando la iniciativa de ley tiene observaciones, por tal motivo elaborarán la propuesta de reformas o adiciones que se consideren pertinentes y sea discutida nuevamente. d) Sanción, una vez que la iniciativa de ley ha sido aprobada por las dos Cámaras, se debe enviar el Ejecutivo para que éste ordene su publicación, y es el acto por el cual el Presidente de la República manifiesta, mediante su firma, la aprobación del proyecto de ley que le envían las Cámaras, a este hecho se le llama sanción Sin embargo, el Presidente de la República puede hacer observaciones, y en este caso, la devolverá a la Cámara de Origen, en donde será discutido de nuevo, y su fuere confirmado por las dos terceras partes del número total de votos de la Cámara de Origen, y pasará otra vez a la Cámara Revisora, en la cual se analizarán las observaciones, y si la iniciativa también fuere confirmada por la misma mayoría, el proyecto se declarará y será enviado al Ejecutivo para su promulgación; así, en caso de que las observaciones sean aceptadas, el procedimiento será el mismo para el caso de la revisión. A la facultad que tiene el Presidente de la República para hacer observaciones o rechazar iniciativas de ley aprobadas por las Cámaras, se le denomina derecho de veto. El Ejecutivo dispone de un término de 10 días hábiles para ejercer el derecho de veto, pues se entiende que si pasado ese término sin que devuelva el proyecto de ley a su Cámara de Origen, éste ha sido aceptado por el Ejecutivo, si se da el caso de que en ese término concluyan o se suspendan las sesiones del Congreso, la devolución deberá hacerse el primer día hábil en que el Congreso reinicie sus sesiones. f) Promulgación, una vez que el proyecto de ley ha sido aceptado por el Poder Ejecutivo, se procede a la promulgación, que es la aprobación expresa del Ejecutivo, donde se manifiesta la orden de publicación y que se ejecute dicha ley. 32 g) Publicación, una vez que la ley fue promulgada, ésta debe ser puesta en conocimiento de la población. Se publica en el Diario Oficial de la Federación, que es el medio de comunicación que utilizan las autoridades federales para dar a conocer a la población las resoluciones administrativas, las leyes y otros avisos de importancia general. Respecto a la publicación de las leyes que emiten los Estados, éstas se realizan por medio de la Gaceta de Gobierno del Estado. h) Iniciación de la vigencia, aquí es donde la ley empieza a tener fuerza obligatoria para toda la población. En México, existen dos sistemas para que inicie la vigencia de una ley, a saber: El sucesivo consiste en que la ley entra en vigor tres días después de la publicación en el Diario Oficial de la Federación, en los lugares en los cuales no se publiquen el diario oficial, se dará un día más por cada 40 kilómetros o fracción que exceda la mitad de distancia entre el lugar de publicación y el sitio donde habrá de iniciarse la vigencia. Este sistema está considerado en el artículo 3 del Código Civil Federal, y es utilizada en el caso de que la ley no establezca la fecha en que entrará en vigor. El sincrónico es cuando la propia ley señala el día que iniciará su vigencia, en este caso, entrará en vigor en todos los lugares de su aplicación en la fecha establecida, esto lo señala el artículo 4 del Código Civil Federal. 2.1.3.2 La costumbre Es la regulación de la conducta surgida espontáneamente de un grupo social y de observancia voluntaria para quienes lo constituy

Flashcard 1429084179724

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIt was systematically and intensively exercised in the reading of the Latin classics and in t he composition of Latin prose and verse by boys in the grammar schools of England and the continent during the sixteenth century. This was the training that formed the int ellectual habits of Shakespeare and other Renaissance writers.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1435006012684

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itUna misma letra puede representar distintos valores diferenciándolos por medio de comillas; por ejemplo: a a " , a'", que se leen a prima, a se gunda, a tercera, o también por medio de subíndices; por ejemplo: alt a2, (h, que se leen a subuno, a subdos, a subtres.

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

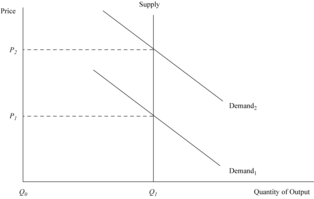

er competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open it2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. <span>Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Dema

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

Flashcard 1435730840844

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the mark

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1435738180876

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Economic rent

ng the resource or good onto the market and sustain its use . Demand determines the price level and the magnitude of economic rent that is coming from the market. Exhibit 1 shows it. P 1 is the price level that yields a <span>normal profit to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created.

Flashcard 1435741064460

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Economic rent

to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as <span>(P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an in

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itnternally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent <span>Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases,

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itfrom the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. <span>How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of exist

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itconomic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. <span>From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in dema

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. <span>If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supp

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itonsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. <span>When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itom the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. <span>EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. <span><body><html>

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

Flashcard 1435752074508

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open it007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. <span>Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it.<span><body><html>

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

Flashcard 1435756793100

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itBecause of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve).

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

Flashcard 1435760200972

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFrom an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price.

Original toplevel document