Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

Subject 1. The Foreign Exchange Market

#cfa #cfa-level-1 #economics #economics-in-a-global-context #has-images #reading-21-currency-exchange-rates

An exchange rate is the current market price at which one currency can be exchanged for another. The convention used in the reading is the number of units of one currency (price currency) that one unit of another currency (base currency) will buy.

Let's say a:b = S.

- a is the price currency.

- b is the base currency.

- S is the cost of one unit of currency b in terms of currency a.

For example, US$ : £ = 1.5 indicates that £1 is priced at US$1.5.

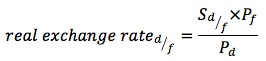

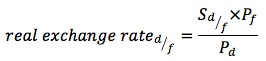

The exchange rate above is referred to as the nominal exchange rate. The real exchange rate is the nominal rate adjusted somehow by inflation measures.

For example, if country A has an inflation rate of 10%, country B an inflation rate of 5%, and no changes in the nominal exchange rate took place, then country A now has a currency whose real value is higher than before.

Market Functions and Participants

A foreign exchange market is a place where foreign exchange transactions take place. Measured by average daily turnover, the foreign exchange market is by far the largest financial market in the world. It has important effects, either directly or indirectly, on the pricing and flows in all other financial markets.

There is a wide diversity of global FX market participants that have a wide variety of motives for entering into foreign exchange transactions. Commercial companies undertake FX transactions during cross-border purchases and sales of goods and services. Hedge funds trade FX currencies for hedging or even speculative purposes. Central banks use their FX reserves to stabilize the market and control the money supply. Large dealing banks provide FX price quotes to their clients. With so many different market participants, motives, and strategies, it is very difficult to describe the FX market adequately with simple characterizations.

If you want to change selection, open original toplevel document below and click on "Move attachment"

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.