Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

Subject 2. Exchange Rate Quotations

#cfa #cfa-level-1 #economics #economics-in-a-global-context #has-images #reading-21-currency-exchange-rates

Most countries use a system of direct quotation. A direct exchange rate quote gives the home (domestic) currency price of a certain quantity of the foreign currency quoted (Domestic Currency/Foreign Currency, or DF/FC). In this case, the home currency is the price currency and the foreign currency is the base currency.

For example, the price of foreign currency is expressed in yen in Japan and pesos in Mexico. Direct quotation is used in most countries. For an American investor, a quote €:$ = 1.25 is a direct quote; he is expected to pay $1.25 for a €. Note that when there are two currencies, the base currency is always mentioned first, the opposite order of the actual ratio (price currency / base currency).

Indirect quotation (FC/DC) is also used in some markets. It is just the opposite of a direct quote; they are reciprocals of each other. For example, a bank in London will quote the value of the pound sterling (GBP) in terms of the foreign currency (i.e., £:$ = 1.4410).

Example

For a U.S. resident, ¥:$ = 0.0085 is the direct quote for Japanese yen and $:¥ = 119.46 is the indirect quote for Japanese yen.

In a direct quote, an appreciation of the foreign currency (a depreciation of the domestic currency) causes an increase in the direct quote.

- The domestic currency moves in the opposite direction of the exchange rate.

- The foreign currency moves in the same direction as the exchange rate.

The opposite is true for an indirect quote: the domestic (foreign) currency moves in the same(opposite) direction as the exchange rate.

Bid-Ask (Offer) Quotes and Spreads

Dealers (e.g., banks) do not normally charge a commission on their currency transactions but they profit from the spread between the buying and selling rates on both spot and forward transactions. Quotes are always in pairs: the first rate is the buy, or bid, price (for a dealer); the second is the sell, or ask, offer (for a dealer). The ask rate is usually higher than that bid rate, so the dealer can make a profit. The average of the bid and ask price is known as the midpoint price: midpoint price = (Ask + Bid) / 2.

When direct quotations are converted to indirect quotations, bid and ask quotes are reversed. That is:

- The direct ask price is the reciprocal of the indirect bid price.

- The direct bid price is the reciprocal of the indirect ask price.

- No matter how the quote is made, dealers will always buy low and sell high.

For example, here is a direct quote for the Japanese yen from the U.S. perspective: ¥:$ = 0.0081-83. That is, the dealer is willing to buy ¥ at $0.0081 (direct bid price) and sell them at $0.0083 (direct ask price). The indirect bid price is (1/0.0083) $:¥ = 120.48 and the indirect ask price is (1/0.0081) = $:¥ = 123.45.

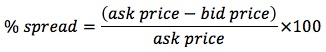

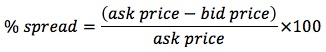

The bid-ask spread is the spread between bid and ask rates for a currency: Bid-ask spread = ask price - bid price. It is usually stated as a percentage of the ask price:

For example, with GBP quoted at £:$ = 1.4419 - 28, the percentage spread is: (1.4428 - 1.4419) x 100 / 1.4428 = 0.062%.

Note that the percentage spread is the same irrespective of whether the exchange rate is expressed in direct or indirect quotations.

The bid-ask spread is based on the breadth and depth of the market for that currency as well as on the currency's volatility.

If you want to change selection, open original toplevel document below and click on "Move attachment"

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.