Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

Subject 1. Analysis Tools and Techniques

#cfa #cfa-level-1 #financial-analysis-techniques #financial-reporting-and-analysis #has-images

Financial analysis techniques are useful in summarizing financial reporting data and evaluating the performance and financial position of companies. The results of financial techniques provide important inputs into security valuation.

Ratios

Ratios express one quantity in relation to another. As analytical tools, ratios are attractive because they are simple and convenient. They can provide a profile of a company, its economic characteristics and competitive strategies, and its unique operating, financial, and investment characteristics.

Ratio analysis is essential to comprehensive financial analysis. However, analysts should understand the following aspects when dealing with ratios:

- A ratio is not "the answer." A ratio is an indicator of some aspect of a company's performance in the past. It does not reveal why things are as they are. Also, a single ratio by itself is not likely to be very useful. For example, a current ratio of 2:1 may be viewed as satisfactory. If, however, the industry average is 3:1, such a conclusion may be questionable.

- Differences in accounting policies can distort ratios (e.g., inventory valuation, depreciation methods).

- Not all ratios are necessarily relevant to a particular analysis. Analysts should know the questions for which they want to find answers and know the questions that particular ratios can help answer.

- Ratio analysis does not stop with computation; interpretation of the result is also important.

Limitations: There are a significant number of estimates and subjective information that go into financial statements and therefore it is imperative that the analyst understands the numbers before calculating and relying on ratio analyses based on these numbers. An analyst needs to ask questions like:

- How homogeneous is the company? Are the ratios comparable between divisions within a company? It is critical to derive comparable industry ratios. However, many companies have multiple lines of business, making it difficult to identify the appropriate industry to use in comparing companies. Companies are required to provide segmented information that allows the user to see the impact of various segments on the overall company.

- Are the results of the ratio analysis consistent? An analyst needs to look at several ratios in conjunction in order to form a sensible conclusion. The total portfolio of the company should be used instead of only one set of ratios. A company must be viewed along all these lines since the company may have strengths and/or weaknesses in different areas. For example, a highly profitable company may have very poor short-term liquidity.

- Is the ratio within a reasonable range for the industry? Analysts must look at a range of values for a particular ratio because a ratio can be too high or too low.

- Are alternative companies' accounting treatments comparable? In comparsons companies, even within the same industry, companies may be using different accounting treatments and/or different estimates to capture the same event. Companies can use different estimates to calculate depreciation or bad debt expenses. Companies can use different inventory methods and may have operating versus capital leases in the financial statements. All of these accounting choices and estimates affect financial statements. Alternative treatments can cause a difference in results for the same events, especially when dealing with non-U.S. companies.

Common-size Analysis

Raw numbers hide relevant information that percentages frequently unveil. Common-size statements normalize balance sheet, income statement, and cash flow statement items to allow easier comparison of different-sized companies. They reduce all the dollar amounts to a percentage of a common amount.

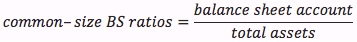

- A common-size balance sheet expresses all balance sheet accounts as a percentage of total assets.

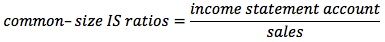

- A common-size income statement expresses all income statement items as a percentage of sales. Common-size income statement ratios are especially useful in studying trends in costs and profit margins.

- Analysts can use common-size statement analysis for the cash flow statement. Two prescribed approaches are the total cash inflows/total cash outflows method and the percentage of net revenue method.

These ratios can be used to compare financial statements of different-size companies or of the same company over different periods.

- Cross-sectional analysis compares a company to the industry or other comparable companies for a particular ratio. Comparable companies should be from the same industry, employ the same technology, appeal to similar clienteles, pursue similar marketing strategies, and be similar in size (as measured by sales or total assets). The division of the industry into subsets according to size and characteristics may be valuable in making meaningful comparisons. For example, the "computer industry" covers a huge range of companies and it may not be meaningful to compare IBM to the ratios exhibited by small companies. Multi-industry companies can be handled by appropriate cross-sectional analysis with companies operating across the same range of industries, or alternatively by constructing composite industry average ratios to match a company's structure. However, comparability may be impaired due to the fact that no two firms are exactly the same, and companies may use different depreciation and inventory valuation methods.

- Time series (trend) analysis compares a company's performance to itself over time to examine the trend of a particular ratio. It aims to detect changes in the company's operations over time. However, several problems are inherent:

- Ratios may be affected by changes in a company's internal factors, such as production, marketing, and financial policies.

- Ratios are based on accounting data provided on a historical cost basis; thus, inflation may cause spurious trends in ratios or render them non-comparable.

- Comparability may also be impaired due to changes in depreciation or inventory valuation methods across time.

- The benchmark comparison ratios may suffer from the same problems, leaving the company's problems or strengths unnoticed.

Common-size statement ratios are useful to:

- Compare companies of different sizes.

- Identify trends over time within an individual company.

- Examine the relative size of items or the relative change in items in a company's financial statement.

Graphs

Graphs facilitate comparison of performance and financial structure over time, highlighting changes in significant aspects of business operations. In addition, graphs provide analysts with a visual overview of risk trends in a business. Graphs may also be used effectively to communicate analysts' conclusions regarding aspects of financial conditions and risk management.

If you want to change selection, open original toplevel document below and click on "Move attachment"

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.