Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

Subject 2. Common Ratios

#cfa #cfa-level-1 #financial-analysis-techniques #financial-reporting-and-analysis #has-images

The ratios presented in the textbook are neither exclusive nor uniquely "correct." The definition of many ratios is not standardized and may vary from analyst to analyst, textbook to textbook, and annual report to annual report. The analyst's primary focus should be the relationships indicated by the ratios, not the details of their calculations.

Activity Ratios

A company's operating activities require investments in both short-term (inventory and accounts receivable) and long-term (property, plant, and equipment) assets. Activity ratios describe the relationship between the company's level of operations (usually defined as sales) and the assets needed to sustain operating activities. They measure how well a company manages its various assets.

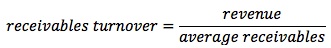

- Receivables turnover measures the liquidity of the receivables - that is, how quickly receivables are collected or turn over. The lower the turnover ratio, the more time it takes for a company to collect on a sale and the longer before a sale becomes cash.

This ratio provides a better level of detail than the current or quick ratio. A company could have a favorable current or quick ratio, but if the receivables turn over very slowly, these ratios would not be a good measure of liquidity. The same applies for the inventory turnover below.

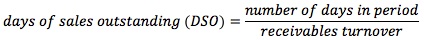

This ratio also implies an average collection period (the number of days it takes for the company's customers to pay their bills):

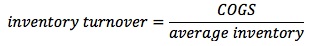

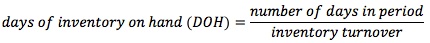

Remember, as with all ratios, these ratios are industry specific. The nature of the industry dictates a higher or lower receivables or inventory turnover. For receivables turnover, analysts don't want to derive too much from the norm, since a low number indicates slow-paying customers that cause capital to be tied up in receivables and bad debt and a high number indicates overly stringent credit terms that hurt sales. If a company's credit policy is 30 days and the days of sales outstanding is 45 days, then the credit policy needs to be reviewed. - Inventory turnover measures how fast the company moves its inventory through the system. The lower the turnover ratio, the longer the time between when the good is produced or purchased and when it is sold.

An abnormally high inventory turnover and a short processing time could mean inadequate inventory, which could lead to outages, backorders, and slow delivery to customers, adversely affecting sales. An extremely low inventory turnover value implies capital is being tied up in inventory and could signal obsolete inventory.

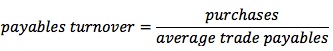

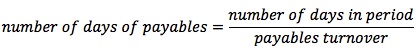

- Payable turnover measures the length of time a company has to pay its current liabilities to suppliers. This ratio examines the use of trade credit. The longer the time, the better it is for the company, since it is an interest-free loan and offsets the lack of cash from receivables and inventory turnovers.

The following measures the number of days it takes for the company to pay its bills.

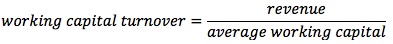

- Working capital turnover measures how efficiently a company generates revenue with its working capital. Working capital is defined as current assets minus current liabilities.

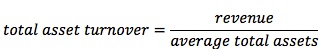

- Total asset turnover is a measure of how many dollars of sales are generated by a dollar of assets. This number is smaller in capital-intensive industries since they have a higher investment in property, plants and equipment. It is also affected by the amount of leasing that is done by a company. Therefore, the ratio is very industry specific.

Accounting choices do affect ratios. Analysts must always be aware of accounting choices and how they affect the calculation of ratios. If a company leases most of its assets and they are classified as operating leases, which means they are not recorded on the balance sheet, then the company will have fewer assets and therefore a higher turnover ratio.

If a company writes down assets due to impairment, in the years following the write-down, assets will be lower and the turnover ratio higher.

The range of the asset turnover values should be consistent with the industry.- An exceedingly high ratio might imply too few assets for the potential business (sales) or the use of outdated, fully depreciated assets.

- A low ratio might imply capital tied up in an excess of assets relative to the needs of the company.

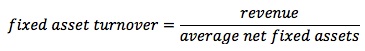

The utilization of specific assets (e.g., receivables, inventories) should be examined to identify the cause of the change in total asset turnover. - Fixed asset turnover is a measure of a company's utilization of fixed assets.

net assets = gross fixed assets - depreciation on fixed assets.

This ratio should be compared to the industry norm. The impact of leased assets should be considered, particularly for industries such as retail and airlines that lease most of their fixed assets.

An abnormally high turnover ratio indicates that a company does not have enough capacity to meet potential demand or that the company may have obsolete equipment. Therefore, age of assets also affects this ratio. A higher ratio, caused by old assets, might look positive on the surface, but it would also imply the need for capital expenditures in the near future. Analysts must consider other factors (like age of assets) when considering which company is in a better position for the future. Age of assets is viewed as a factor by analysts because older assets imply the need for future cash outflows to replace assets. The ratio might look better for a company with older assets but the company is actually in a less favorable position than a comparable company that has replaced its assets and is using more efficient assets.

An abnormally low turnover ratio indicates that too much capital is tied up in excess assets.

Liquidity Ratios

Liquidity ratios measure the ability of a company to meet short-term obligations. Major liquidity ratios such as current ratio, quick ratio, and cash ratio are discussed in Reading 26 [Understanding Balance Sheets].

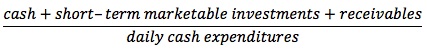

- The defensive internal ratio measures how long a company can pay its daily cash expenditures using only its existing liquid assets, without additional cash flow coming in. It provides an intuitive "feel" for a company's liquidity, albeit a most conservative one. It compares currently available "quick" sources of cash with the estimated outflows needed to operate the company: projected expenditures.

This ratio represents a "worst case" scenario, indicating the number of days a company could maintain its current level of operations with its present cash resources but without considering any additional revenues. - The cash conversion cycle is the time period that exists from when the company pays out money for the purchase of raw materials to when it gets the money back from the purchasers of the company's finished goods. In short, it measures the number of days the company's cash is tied up in the business. When the company buys raw materials, it commits capital to inventory. At the same time, suppliers provide interest-free loans to the company by carrying its payables, thus offsetting the company's capital commitment. After the products are sold, the capital is then tied up in receivables for the collection period. The cash conversion cycle is a measure of how fast a dollar spent returns to the company in payment for a sale. A very high cash conversion cycle indicates that too much capital is tied up in the sales process.

Cash Conversion Cycle = DOH + DSO - Number of Days of Payables

Note: Analysts should be aware of the impact of accounting choices and accounting transactions on liquidity ratios. For example, payment of an accounts receivable has no effect since one current asset is increasing and another is decreasing. Capitalizing a lease decreases the current ratio, since capitalizing a lease puts a liability on the balance sheet and the portion due in the next year is classified as a current liability. An increase in the turnover ratio decreases the number of days for collection of a receivable or sale of inventory and hence shortens the cash conversion cycle. Use of LIFO versus FIFO in periods of rising prices results in a lower inventory balance and hence a lower current ratio.

Solvency Ratios

Solvency ratios measure the ability of a company to meet long-term obligations. Major solvency ratios such as debt ratios are discussed in Reading 26 [Understanding Balance Sheets].

Coverage Ratios

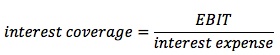

- Interest coverage ratio measures how many times over a company could pay its interest out of earnings. The higher the ratio, the less likely that the company cannot meet its interest payments, and consequently, the lower the financial risk.

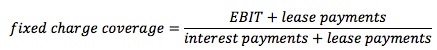

This ratio shows how far earnings could decline before it would be impossible to pay interest charges from current earnings. - Fixed charge coverage measures a company's ability to meet all fixed payment obligations, including interest payment on debt, entire lease payments (not limited to the interest component), and dividends on preferred stock. Lease payments are fixed payments just like debt and interest payments. Preferred dividends are grossed-up (on the same basis as the other items in the formula), because preferred dividends are paid from after-tax dollars.

Analysts may be required to adjust these ratios for accounting choices as well. If interest is capitalized, it reduces the interest expense in the current year and the interest is added to the cost of the asset. As a result, interest coverage will look more positive, since some of the interest for the current year will not be included in the interest expense and, hence, the ratio will be higher.

Profitability Ratios

Profitability ratios measure the ability of a company to generate profits from revenue and assets.

Return on Sales

Net profit margin and gross profit margin are discussed in Reading 25 [Understanding Income Statements].

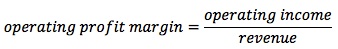

- Operating profit margin relates a company's operating income to its net sales.

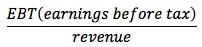

Operating profit, also known as earnings before Interest and Taxes (EBIT), is gross profit minus sales, general and administrative expenses (SG&A). It is profit before interest and taxes. The variability of this ratio over time is a prime indicator of the business risk of a company. - Pre-tax margin:

Since profit margin is valuable as a predictor of future earnings, an analyst needs to decide whether to back out other items, such as restructuring charges, in determining what represents income from "continuing" operations. These non-recurring items are considered part of continuing operations but may not be the best predictor of future earnings. Given the current problems in financial reporting, analysts should consider whether certain income statement items should be added/deleted from net income to obtain a better indicator of future earnings. In addition, any "quality of earnings" items should be considered, as should their potential effect on these operating performance ratios. For example, if a company decreased its bad debt expense calculation, it would improve the current year's net income but this might result in a larger expense being recorded in subsequent years. Analysts should be prepared to answer numerous ratio questions based on quality of earnings issues and their effects on ratios.

Return on Investment

The following ratios measure the percentage returns on capital employed.

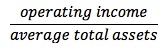

- Operating ROA =

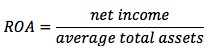

- ROA measures the return earned by a company on its assets.

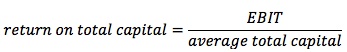

The problem is that net income is the return to equity-holders, whereas assets are financed by both equity-holders and creditors. - Return on total capital indicates a company's return on all the capital employed (debt, preferred stock, and common stock). It measures return on all sources of funding.

where total capital = debt + equity.

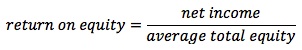

This ratio should match the perceived risk of the company. A return well below the industry norm shows the company is losing its competitiveness within the industry. - ROE (Return on equity) measures return on total equity capital only. This includes both preferred and common equity owners.

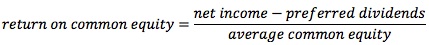

- Return on common equity is also a useful indicator. This ratio is

This ratio reflects the financial risk assumed by the common stockholder.

Integrated Financial Ratio Analysis

Ratios can also be combined and evaluated as a group to better understand how they fit together and how efficiency and leverage are tied to profitability. The information from one ratio category can be helpful in answering questions raised by another category. The most accurate overall picture comes from integrating information from all sources. Please refer to the textbook for examples.

If you want to change selection, open original toplevel document below and click on "Move attachment"

Discussion

Do you want to join discussion? Click here to log in or create user.