Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

Subject 1. Bond Prices and the Time Value of Money

#basic-concepts #cfa #cfa-level-1 #fixed-income #has-images #reading-54-introduction-to-fixed-income-valuation

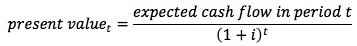

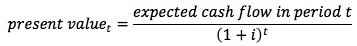

The idea that the value of any financial asset equals the present value of its expected cash flows is the fundamental principle of valuation. This principal is applicable to bonds, stocks and other financial assets. The present value of cash flows is calculated by discounting the cash flows at appropriate interest rates.

t = the number of years to receive the cash flow

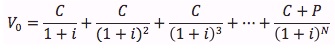

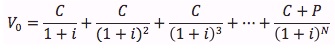

The cash flows of a bond have two components: periodic coupon payments and principal repayment at maturity, or when the bond is retired. Both the amount and the timing of the cash flows should be identified to value the bond.

For example a five-year Treasury coupon note with a par-value of $1,000 has a 10% coupon. Its cash flows are as follows:

For a given discount rate, the present value of a single cash flow to be received in the future is the amount of money that must be invested today to generate that future value. The present value of a cash flow will depend on when a cash flow will be received (i.e., the timing of a cash flow) and the discount rate (i.e., interest rate) used to calculate the present value.

i = the discount rate

t = the number of years to receive the cash flow

The sum of the present value for a security's expected cash flows is the value of the security:

N = the number of annual periods till maturity

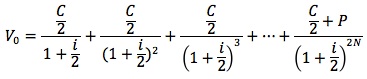

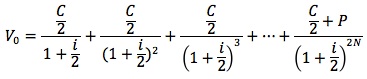

The convention of the bond market is to quote annual interest rates that are double semi-annual rates. For most bonds coupon payments are semi-annual. Coupon payments are adjusted by dividing the annual coupon payment by two and adjusting the discount rate by dividing the annual discount rate by two:

The differences are:

A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. It is priced at a discount below par value when the coupon rate is less than the market discount rate. The amount of any premium or discount is the present value of the "excess" or "deficiency" in the coupon payments relative to the yield-to-maturity.

Yield-to-Maturity is the interest rate that will make the present value of the cash flows from a bond equal to its price. It is the promised rate of return on a bond if an investor buys and holds the bond to its maturity date.

Consider a 10%, two-year bond selling for $1,036.30 (selling at premium). The cash flows for this bond are (1) four payments of $50 every six months, and (2) a payment of $1,000 two years from now.

$1036.30 = $50/(1 + YTM/2)1 + $50/(1 + YTM/2)2 + $50/(1 + YTM/2)3 + $1050/(1 + YTM/2)4. Through trial and error or by using a financial calculator, YTM is found to be 8%.

If you want to change selection, open original toplevel document below and click on "Move attachment"

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.