Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

Subject 3. Flat Price, Accrued Interest, and the Full Price

#basic-concepts #cfa #cfa-level-1 #fixed-income #has-images #reading-54-introduction-to-fixed-income-valuation

Coupon interest is paid not daily, but monthly, semi-annually or annually. If an investor sells a bond between coupon payments and the buyer holds it until the next coupon payment, the entire coupon interest earned for the period will be paid to the buyer. The seller gives up the interest from the time of the last coupon payment to the time until the bond is sold. The amount of interest over this period that will be received by the buyer (even though it was earned by the seller) is called accrued interest.

Accrued interest is calculated as a proportional share of the next coupon payment using either the actual/actual or 30/360 method to count days.

The amount that the buyer pays the seller the agreed upon price for the bond plus accrued interest is called the full price (dirty price). The agreed-upon bond price without accrued interest is simply referred to as the flat price (clean price). Flat prices are quoted in order to not to misrepresent the daily increase in the full price as a result of interest accruals.

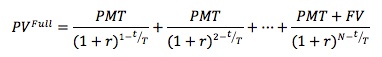

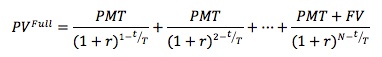

Here is how to calculate the full price:

Note that the next coupon payment is discounted for the remainder of the coupon period.

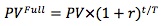

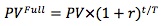

An easier formula is used to to get the present value of the bond at the last coupon payment date and find its (future) value on the settlement date.

If you want to change selection, open original toplevel document below and click on "Move attachment"

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.