Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

Subject 6. Yield Measures for Floating-Rate Notes and Money Market Instruments

#basic-concepts #cfa #cfa-level-1 #fixed-income #has-images #reading-54-introduction-to-fixed-income-valuation

Floating-Rate Notes

To calculate the bond equivalent yield for a 365-day year:

AOR = (365/90) x (100 - 99.375)/99.375 = 2.55%

Interest rate volatility affects the price of a fixed-rate bonds. A floating-rate note (a floater, or an FRN) maintains a more stable price than a fixed-rate note because interest payments adjust for changes in market interest rates. With a floater, interest rate volatility affects future interest payments.

The quoted margin is typically the specified yield spread over or under the reference rate, which is often LIBOR. It is used for compensating the investor for the difference in the credit risk of the issuer and that implied by the reference rate.

The discount margin, also known as the required margin, is the spread required by investors and to which the quoted margin must be set in order for the FRN to trade at par value on a rate reset date. Changes in the discount margin usually come from changes in the issuer's credit risk.

Money Market Instruments

Unique characteristics:

- Yield measures are annualized but not compounded.

- Often quoted using non-standard interest rates (discount rate or add-on rate? 360-day year or 365-day year? redemption value amount (FV) or price at issuance (PV)?)

- Different periodicities

Money market instruments need to be converted to a common basis for analysis.

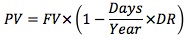

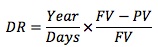

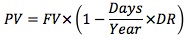

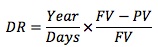

Discount rate:

Note that the denominator is FV, not PV. The rate of return is therefore understated.

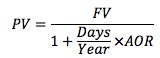

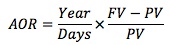

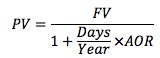

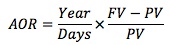

Add-on rate:

Note the only difference: the denominator is PV, not FV.

Bond equivalent yield: money market rate stated on a 365-day add-on rate basis.

Example

90-day T-bill, face value 100, quoted discount rate: 2.5% for an assumed 360-day year.

PV = 100 x (1 - 90/360 x 0.025) = 99.375

To calculate the bond equivalent yield for a 365-day year:

AOR = (365/90) x (100 - 99.375)/99.375 = 2.55%

If you want to change selection, open original toplevel document below and click on "Move attachment"

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.