Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

Subject 5. Credit Risk vs. Return: Yields and Spreads

#basic-concepts #cfa #cfa-level-1 #fixed-income #has-images #los-57-i #reading-57-fundamentals-of-credit-analysis

The higher the credit risk, the greater the required yield and potential return demanded by investors. Over time, bonds with more credit risk offer higher returns but with greater volatility of return than bonds with lower credit risk.

Yield spread is the difference in yield between two securities.

- The yield of a corporate bond = yield on a risk-free bond + yield spread

- The yield spread here is composed of the liquidity premium and the credit spread: yield spread = liquidity premium + credit spread

Yield spreads, especially credit spreads, become wider during economic contractions. In times of credit improvement or stability, however, credit spreads can narrow sharply as well. This is known as "flight to quality".

Factors that affect yield spreads include: the credit cycle, economic conditions, financial market performance, market making capacity, and supply/demand conditions.

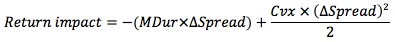

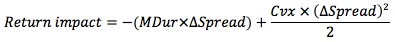

How do spread changes affect the price of and return on these bonds? The impact depends on two factors:

- The basis point spread change

- The sensitivity of price to yield as reflected by modified duration and convexity

A credit curve is essentially the spread over treasuries of various maturities for a single bond issuer. It is typically upward-sloping, meaning the longer the bond maturity, the wider the spread.

If you want to change selection, open original toplevel document below and click on "Move attachment"

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.