Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

The Investment Opportunity Frontier

#4-3-the-investment-opportunity-set #cfa #cfa-level-1 #economics #has-images #microeconomics #reading-14-demand-and-supply-analysis-consumer-demand #section-4-the-opportunity-set #study-session-4

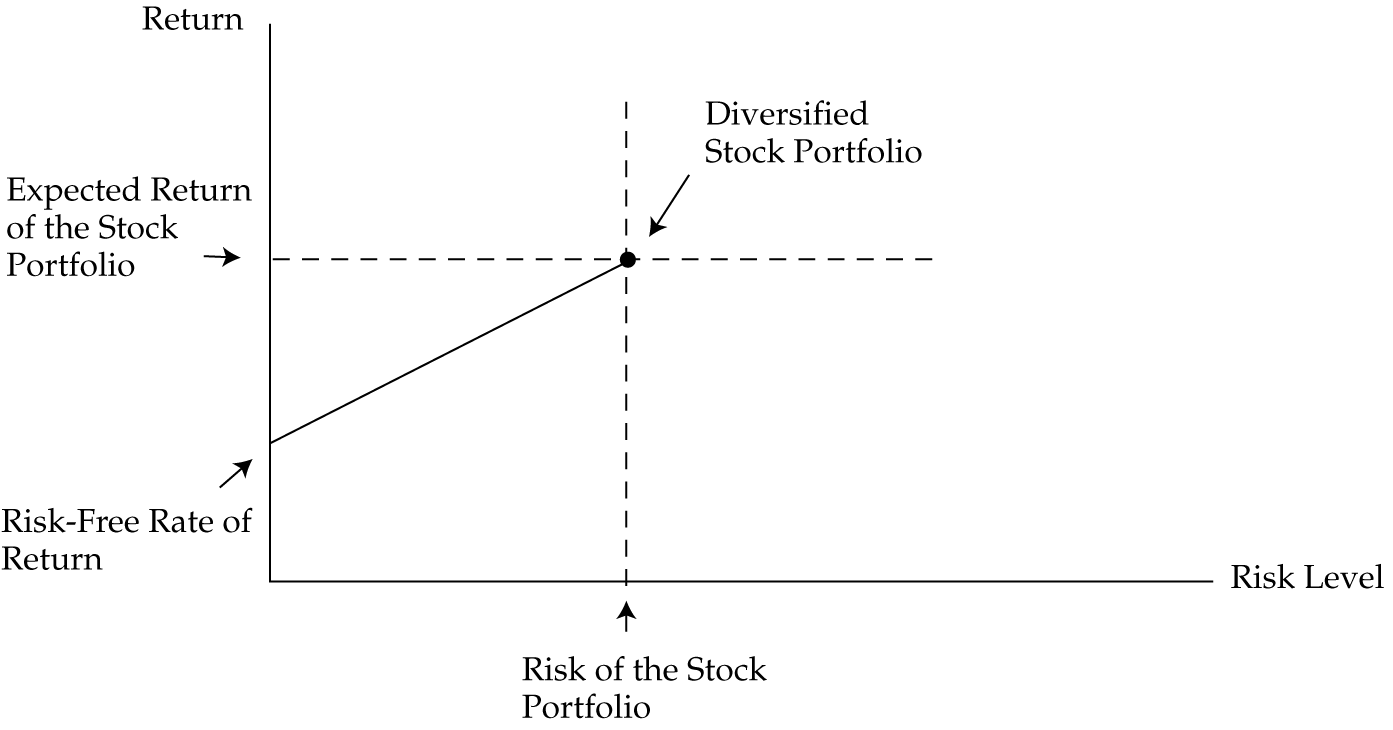

Consider two investments, one in virtual risk-free asset, (Treasury bills), the other a diversified index of common shares. To invest in a risky asset, they expect a higher rate of return.

The investor could choose to put some funds in the risk-free asset and the rest in the common shares index. For each additional dollar invested in the common shares index, he can expect to receive a higher return, though not with certainty; so, he is exposed to more risk in the pursuit of a higher return.

We can structure her investment opportunities as a frontier that shows the highest expected return consistent with any given level of risk, as shown in Exhibit 10 . The investor’s choice of a portfolio on the frontier will depend on her level of risk aversion.

The investor could choose to put some funds in the risk-free asset and the rest in the common shares index. For each additional dollar invested in the common shares index, he can expect to receive a higher return, though not with certainty; so, he is exposed to more risk in the pursuit of a higher return.

We can structure her investment opportunities as a frontier that shows the highest expected return consistent with any given level of risk, as shown in Exhibit 10 . The investor’s choice of a portfolio on the frontier will depend on her level of risk aversion.

If you want to change selection, open original toplevel document below and click on "Move attachment"

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.