Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

#bonds #duration #finance #has-images

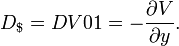

The dollar duration or DV01 is defined as negative of the derivative of the value with respect to yield:

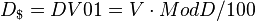

so that it is the product of the modified duration and the price (value):

($ per 1 percentage point change in yield)

($ per 1 percentage point change in yield)

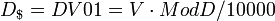

or

($ per 1 basis point change in yield)

($ per 1 basis point change in yield)

If you want to change selection, open document below and click on "Move attachment"

Bond duration - Wikipedia, the free encyclopedia

ar change in price for a $100 nominal bond for a one percentage point change in yield, is ($ per 1 percentage point change in yield) where the division by 100 is because modified duration is the percentage change. Dollar duration, DV01[edit] <span>The dollar duration or DV01 is defined as negative of the derivative of the value with respect to yield: so that it is the product of the modified duration and the price (value): ($ per 1 percentage point change in yield) or ($ per 1 basis point change in yield) The DV01 is analogous to the delta in derivative pricing (The Greeks) – it is the ratio of a price change in output (dollars) to unit change in input (a basis point of yield). Dollar dur

Bond duration - Wikipedia, the free encyclopedia

ar change in price for a $100 nominal bond for a one percentage point change in yield, is ($ per 1 percentage point change in yield) where the division by 100 is because modified duration is the percentage change. Dollar duration, DV01[edit] <span>The dollar duration or DV01 is defined as negative of the derivative of the value with respect to yield: so that it is the product of the modified duration and the price (value): ($ per 1 percentage point change in yield) or ($ per 1 basis point change in yield) The DV01 is analogous to the delta in derivative pricing (The Greeks) – it is the ratio of a price change in output (dollars) to unit change in input (a basis point of yield). Dollar dur

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.