7. ANALYSIS OF THE INCOME STATEMENT

#cfa-level-1 #financial-reporting-and-analysis #has-images #income-statement

This topic will be discussed in detail in Reading 27 [Financial Analysis Techniques].

Income Statement Ratios

The following operating profitability ratios measure the rates of profit on sales (profit margins).

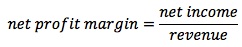

- Net Profit Margin shows how much profit is generated on every dollar of sales.

Net income is earnings after tax but before dividends (EBIT - interest - taxes). It should be based on earnings from the company's continuing operation because the analysis is to forecast the company's future performance. Thus analysts should not consider earnings from discontinued operations, gains or losses from the sale of discontinued operations, and non-recurring income or expenses.

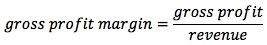

- Gross Profit Margin equals percent of sales available after deducting cost of goods sold.

This percentage is available to cover selling, general and administrative costs, and also earn a profit. It indicates the basic cost structure of a company and shows the company's cost-price position. Comparing this ratio with the industry average over time shows the company's relative profitability within the industry.

- A declining gross profit may indicate increasing costs of production or declining prices.

- The ratio can be affected by changes in the company's product mix: a change toward items with higher (lower) margin raises (reduces) the gross profit margin.

- A small change in gross profit can result in a much larger change in profit margin if the company has high fixed costs.