Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

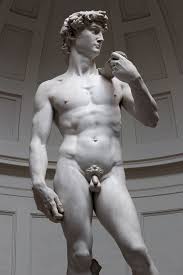

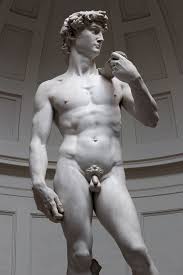

#estatua-session #has-images #reading-david-de-miguel-angel

A fixed-income security is an instrument that allows governments, companies, and other types of issuers to borrow money from investors.

If you want to change selection, open original toplevel document below and click on "Move attachment"

Judged by total market value, fixed-income securities constitute the most prevalent means of raising capital globally. A fixed-income security is an instrument that allows governments, companies, and other types of issuers to borrow money from investors. Any borrowing of money is debt. The promised payments on fixed-income securities are, in general, contractual (legal) obligations of the issuer to the investor. For companies, fixed-inc

Judged by total market value, fixed-income securities constitute the most prevalent means of raising capital globally. A fixed-income security is an instrument that allows governments, companies, and other types of issuers to borrow money from investors. Any borrowing of money is debt. The promised payments on fixed-income securities are, in general, contractual (legal) obligations of the issuer to the investor. For companies, fixed-income securities contrast to common shares in not having ownership rights. Payment of interest and repayment of principal (amount borrowed) are a prior claim on the company’s earnings and assets compared with the claim of common shareholders. Thus, a company’s fixed-income securities have, in theory, lower risk than that company’s common shares. In portfolio management, fixed-income securities fulfill several important roles. They are a prime means by which investors—individual and institutional—can prepare to fund, with some degree of safety, known future obligations such as tuition payments or pension obligations. The correlations of fixed-income securities with common shares vary, but adding fixed-income securities to portfolios including common shares is usually an effective way of obtaining diversification benefits. Among the questions this reading addresses are the following: What set of features define a fixed-income security, and how do these features determine the scheduled cash flows? What are the legal, regulatory, and tax considerations associated with a fixed-income security, and why are these considerations important for investors? What are the common structures regarding the payment of interest and repayment of principal? What types of provisions may affect the disposal or redemption of fixed-income securities? Embarking on the study of fixed-income securities, please note that the terms “fixed-income securities,” “debt securities,” and “bonds” are often used interchangeably by experts and non-experts alike. We will also follow this convention, and where any nuance of meaning is intended, it will be made clear.1 The remainder of this reading is organized as follows. Section 2 describes, in broad terms, what an investor needs to know when investing in fixed-income securities. Sectio

Parent (intermediate) annotation

Open itJudged by total market value, fixed-income securities constitute the most prevalent means of raising capital globally. A fixed-income security is an instrument that allows governments, companies, and other types of issuers to borrow money from investors. Any borrowing of money is debt. The promised payments on fixed-income securities are, in general, contractual (legal) obligations of the issuer to the investor. For companies, fixed-inc

Original toplevel document

Reading 50 Fixed-Income Securities: Defining Elements (Intro)Judged by total market value, fixed-income securities constitute the most prevalent means of raising capital globally. A fixed-income security is an instrument that allows governments, companies, and other types of issuers to borrow money from investors. Any borrowing of money is debt. The promised payments on fixed-income securities are, in general, contractual (legal) obligations of the issuer to the investor. For companies, fixed-income securities contrast to common shares in not having ownership rights. Payment of interest and repayment of principal (amount borrowed) are a prior claim on the company’s earnings and assets compared with the claim of common shareholders. Thus, a company’s fixed-income securities have, in theory, lower risk than that company’s common shares. In portfolio management, fixed-income securities fulfill several important roles. They are a prime means by which investors—individual and institutional—can prepare to fund, with some degree of safety, known future obligations such as tuition payments or pension obligations. The correlations of fixed-income securities with common shares vary, but adding fixed-income securities to portfolios including common shares is usually an effective way of obtaining diversification benefits. Among the questions this reading addresses are the following: What set of features define a fixed-income security, and how do these features determine the scheduled cash flows? What are the legal, regulatory, and tax considerations associated with a fixed-income security, and why are these considerations important for investors? What are the common structures regarding the payment of interest and repayment of principal? What types of provisions may affect the disposal or redemption of fixed-income securities? Embarking on the study of fixed-income securities, please note that the terms “fixed-income securities,” “debt securities,” and “bonds” are often used interchangeably by experts and non-experts alike. We will also follow this convention, and where any nuance of meaning is intended, it will be made clear.1 The remainder of this reading is organized as follows. Section 2 describes, in broad terms, what an investor needs to know when investing in fixed-income securities. Sectio

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.