Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

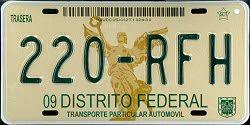

#essay-tubes-session #has-images #reading-placas-del-df

Common types of non-current liabilities reported in a company’s financial statements include long-term debt (e.g., bonds payable, long-term notes payable), finance leases, pension liabilities, and deferred tax liabilities.

If you want to change selection, open original toplevel document below and click on "Move attachment"

A non-current liability (long-term liability) broadly represents a probable sacrifice of economic benefits in periods generally greater than one year in the future. Common types of non-current liabilities reported in a company’s financial statements include long-term debt (e.g., bonds payable, long-term notes payable), finance leases, pension liabilities, and deferred tax liabilities. This reading focuses on bonds payable and leases. Pension liabilities are also introduced.

A non-current liability (long-term liability) broadly represents a probable sacrifice of economic benefits in periods generally greater than one year in the future. Common types of non-current liabilities reported in a company’s financial statements include long-term debt (e.g., bonds payable, long-term notes payable), finance leases, pension liabilities, and deferred tax liabilities. This reading focuses on bonds payable and leases. Pension liabilities are also introduced. This reading is organised as follows. Section 2 describes and illustrates the accounting for long-term bonds, including the issuance of bonds, the recording of interest exp

Parent (intermediate) annotation

Open itA non-current liability (long-term liability) broadly represents a probable sacrifice of economic benefits in periods generally greater than one year in the future. Common types of non-current liabilities reported in a company’s financial statements include long-term debt (e.g., bonds payable, long-term notes payable), finance leases, pension liabilities, and deferred tax liabilities. This reading focuses on bonds payable and leases. Pension liabilities are also introduced.

Original toplevel document

Reading 31 Non-Current (Long-Term) Liabilities IntroductionA non-current liability (long-term liability) broadly represents a probable sacrifice of economic benefits in periods generally greater than one year in the future. Common types of non-current liabilities reported in a company’s financial statements include long-term debt (e.g., bonds payable, long-term notes payable), finance leases, pension liabilities, and deferred tax liabilities. This reading focuses on bonds payable and leases. Pension liabilities are also introduced. This reading is organised as follows. Section 2 describes and illustrates the accounting for long-term bonds, including the issuance of bonds, the recording of interest exp

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.