Edited, memorised or added to reading queue

on 07-Jul-2014 (Mon)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Yield to Maturity

ng period return, as the two often differ. Yield to maturity is generally given in terms of Annual Percentage Rate (APR), and it is an estimation of future return, as the rate at which coupon payments can be reinvested at is unknown. However, <span>for zero coupon bonds, the yield to maturity and the rate of return are equivalent since there are no coupon payments to reinvest. Another way of putting it is that the yield to maturity is the rate of return that makes the present value (PV) of the cash flow generated by the bond equal to the price. Yield to maturi

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Yield curve - Wikipedia, the free encyclopedia

orward interest rates, zero coupon bond prices, or zero coupon bond yieldsLocal regression using kernelsLinear programming In the money market practitioners might use different techniques to solve for different areas of the curve. For example <span>at the short end of the curve, where there are few cashflows, the first few elements of P may be found by bootstrapping from one to the next. At the long end, a regression technique with a cost function that values smoothness might be used. How the yield curve affects bond prices[edit] There is a time dimension to the analysis

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

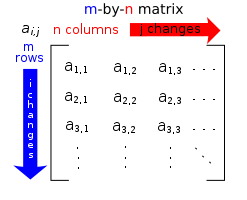

Matrix (mathematics) - Wikipedia, the free encyclopedia

Matrix (mathematics) From Wikipedia, the free encyclopedia Jump to: navigation, search "Matrix theory" redirects here. For the physics topic, see Matrix string theory. <span>Each element of a matrix is often denoted by a variable with two subscripts. For instance, a2,1 represents the element at the second row and first column of a matrix A. In mathematics, a matrix (plural matrices) is a rectangular array[1] of numbers, symbols, or expressions, arranged in rows and columns.[2][3] The individual items in a matrix are called

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Yield to maturity - Wikipedia, the free encyclopedia

ds6 See also7 References8 External links Main assumptions[edit] The main underlying assumptions used concerning the traditional yield measures are: The bond will be held to maturity.All coupon and principal payments will be made on schedule.<span>All the coupons are reinvested at an interest rate equal to the yield-to-maturity.[3]The yield is usually quoted without making any allowance for tax paid by the investor on the return, and is then known as "gross redemption yield". It also does not make an

Flashcard 149624929

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 149624993

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe concept of current yield is closely related to other bond concepts, including yield to maturity, and coupon yield. The relationship between yield to maturity and the coupon rate is as follows: When a bond sells at a discount, YTM > current yield > coupon yield.When a bond sells at a premium, coupon yield > current yield > YTM.When a bond sells at par, YTM = current yield = coupon yield

Original toplevel document

Bond valuation - Wikipedia, the free encyclopedias simply the coupon payment as a percentage of the face value . Coupon yield is also called nominal yield. Current yield[edit] The current yield is simply the coupon payment as a percentage of the (current) bond price . Relationship[edit] <span>The concept of current yield is closely related to other bond concepts, including yield to maturity, and coupon yield. The relationship between yield to maturity and the coupon rate is as follows: When a bond sells at a discount, YTM > current yield > coupon yield.When a bond sells at a premium, coupon yield > current yield > YTM.When a bond sells at par, YTM = current yield = coupon yield Price sensitivity[edit] Main articles: Bond duration and Bond convexity The sensitivity of a bond's market price to interest rate (i.e. yield) movements is measured by its duration, and,

Flashcard 149625004

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itis closely related to other bond concepts, including yield to maturity, and coupon yield. The relationship between yield to maturity and the coupon rate is as follows: When a bond sells at a discount, YTM > current yield > coupon yield.<span>When a bond sells at a premium, coupon yield > current yield > YTM.When a bond sells at par, YTM = current yield = coupon yield<span><body><html>

Original toplevel document

Bond valuation - Wikipedia, the free encyclopedias simply the coupon payment as a percentage of the face value . Coupon yield is also called nominal yield. Current yield[edit] The current yield is simply the coupon payment as a percentage of the (current) bond price . Relationship[edit] <span>The concept of current yield is closely related to other bond concepts, including yield to maturity, and coupon yield. The relationship between yield to maturity and the coupon rate is as follows: When a bond sells at a discount, YTM > current yield > coupon yield.When a bond sells at a premium, coupon yield > current yield > YTM.When a bond sells at par, YTM = current yield = coupon yield Price sensitivity[edit] Main articles: Bond duration and Bond convexity The sensitivity of a bond's market price to interest rate (i.e. yield) movements is measured by its duration, and,

Flashcard 149625022

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itand coupon yield. The relationship between yield to maturity and the coupon rate is as follows: When a bond sells at a discount, YTM > current yield > coupon yield.When a bond sells at a premium, coupon yield > current yield > YTM.<span>When a bond sells at par, YTM = current yield = coupon yield<span><body><html>

Original toplevel document

Bond valuation - Wikipedia, the free encyclopedias simply the coupon payment as a percentage of the face value . Coupon yield is also called nominal yield. Current yield[edit] The current yield is simply the coupon payment as a percentage of the (current) bond price . Relationship[edit] <span>The concept of current yield is closely related to other bond concepts, including yield to maturity, and coupon yield. The relationship between yield to maturity and the coupon rate is as follows: When a bond sells at a discount, YTM > current yield > coupon yield.When a bond sells at a premium, coupon yield > current yield > YTM.When a bond sells at par, YTM = current yield = coupon yield Price sensitivity[edit] Main articles: Bond duration and Bond convexity The sensitivity of a bond's market price to interest rate (i.e. yield) movements is measured by its duration, and,

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Elasticity vs. Slope?

Best Answer helper answered 5 years ago <span>Constant slope does not imply constant elasticity. To see this, consider the linear demand function Q=a-bP, which has constanst slope equal -b. But the elasticity implied by this demand function is E=(dQ/dP)(P/Q)=-b(P/Q). Since the ratio P/Q gets smaller and smaller as Q increases, demand is more leastic at high prices and less elastic at low prices. This makes intuitive sense, since it is reasonable that quantity demanded is more sensitive at high prices than it is at low prices. A demand function of the form Q=b/P is called a constant elasticity demand function. To see this, note that E=(dQ/dP)(P/Q)=(-b/P^2)(P/Q)=(-b/P^2)(P/... a constant. More generally, if

Flashcard 149625084

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Wikipedia, the free encyclopedia

lopedia that anyone can edit. 4,549,964 articles in English ArtsBiographyGeography HistoryMathematicsScience SocietyTechnologyAll portals From today's featured article No. 34 Squadron is a Royal Australian Air Force (RAAF) squadron, <span>responsible for the transport of VIPs, including members of the Australian government, the Governor-General, and visiting dignitaries. The squadron has a secondary role providing emergency transport

lopedia that anyone can edit. 4,549,964 articles in English ArtsBiographyGeography HistoryMathematicsScience SocietyTechnologyAll portals From today's featured article No. 34 Squadron is a Royal Australian Air Force (RAAF) squadron, <span>responsible for the transport of VIPs, including members of the Australian government, the Governor-General, and visiting dignitaries. The squadron has a secondary role providing emergency transport