Edited, memorised or added to reading queue

on 28-Mar-2016 (Mon)

|

Discounted Cash Flow Applications

#analyst #has-images #notes #quantitative-methods-basic-concepts

Holding Period ReturnWhen analyzing rates of return, our starting point is the total return, or holding period return (HPR). HPR measures the total return for holding an investment over a certain period of time, and can be calculated using the following formula:

It has two important characteristics:

Example A stock is currently worth $60. If you purchased the stock exactly one year ago for $50 and received a $2 dividend over the course of the year, what is your holding period return? Rt = ($60 - $50 + $2)/$50 = 0.24 or 24% The return for time period t is the capital gain (or loss) plus distributions divided by the beginning-of-period price (dividend yield). Note that for common stocks the distribution is the dividend; for bonds, the distribution is the coupon payment. The holding period return for any asset can be calculated for any time period (day, week, month, or year) simply by changing the interpretation of the time interval. Return can be expressed in decimals (0.05), fractions (5/100), or as a percent (5%). These are all equivalent. Learning Outcome Statements c. calculate and interpret a holding period return (total return);

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. The functions of the financial system

#market-organization-and-structure

Helping People Achieve Their Purposes in Using the Financial System

The financial system helps people:

Determining Rate of Return The price in the financial system is the rate of return. It is the interaction of the broad forces of supply and demand. There are many different prices (rates of return) as there are many different types of assets in the financial system. For example, equities have higher rates of return than T-bills. All of these rates are determined in the financial system. Prices rapidly adjust to new information. The prevailing price is fair because it reflects all available information regarding the asset. Capital Allocation Efficiency In the financial markets investors distinguish good firms from bad firms. This lets the market channel capital to good firms and away from problem firms. Timely and accurate information is available on the price and volume of past transactions and the prevailing bid-price and ask-price. Such information facilitates the rapid flow of capital to its highest value uses. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. The functions of the financial system

#analyst #market-organization-and-structure

Helping People Achieve Their Purposes in Using the Financial System

The financial system helps people:

Determining Rate of Return The price in the financial system is the rate of return. It is the interaction of the broad forces of supply and demand. There are many different prices (rates of return) as there are many different types of assets in the financial system. For example, equities have higher rates of return than T-bills. All of these rates are determined in the financial system. Prices rapidly adjust to new information. The prevailing price is fair because it reflects all available information regarding the asset. Capital Allocation Efficiency In the financial markets investors distinguish good firms from bad firms. This lets the market channel capital to good firms and away from problem firms. Timely and accurate information is available on the price and volume of past transactions and the prevailing bid-price and ask-price. Such information facilitates the rapid flow of capital to its highest value uses. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. The functions of the financial system

#analyst-notes #market-organization-and-structure

Helping People Achieve Their Purposes in Using the Financial System

The financial system helps people:

Determining Rate of Return The price in the financial system is the rate of return. It is the interaction of the broad forces of supply and demand. There are many different prices (rates of return) as there are many different types of assets in the financial system. For example, equities have higher rates of return than T-bills. All of these rates are determined in the financial system. Prices rapidly adjust to new information. The prevailing price is fair because it reflects all available information regarding the asset. Capital Allocation Efficiency In the financial markets investors distinguish good firms from bad firms. This lets the market channel capital to good firms and away from problem firms. Timely and accurate information is available on the price and volume of past transactions and the prevailing bid-price and ask-price. Such information facilitates the rapid flow of capital to its highest value uses. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 2. Assets and contracts

#analyst-notes #market-organization-and-structure

There are many different ways one can use to classify assets and contracts. The most common way is to classify them into one of these categories: debts, equities, currencies, derivatives (contracts), commodities, and real estate. In this subject we briefly describe the numerous assets and contracts available and provide a brief overview of each. Fixed-Income Investments They have a contractually mandated payment schedule. Their investment contacts promise specific payments at predetermined times. Investors who acquire fixed-income securities are really lenders to the issuers. Specifically, you lend some amount of money, the principal, to the borrower. In return, the borrower promises to make periodic interest payments and to pay back the principal at the maturity of the loan. Bonds, notes, bills, CDs, commercial paper, repo agreements, loan agreements, and mortgages are examples of fixed-income investments. Preferred stock is classified as a fixed-income security because its yearly payment is stipulated as either a coupon (e.g. 5% of the face value) or a stated dollar amount. Although preferred dividends are not legally binding as are the interest payments on a bond, they are considered practically binding because of the credit implications of a missed dividend. Equities Equities differ from fixed-income securities because their returns are not contractual. They represent residual ownership in companies after all claims - including any fixed-income liabilities of the company - have been satisfied. Common stocks represent ownership of a firm. Owners of the common stock of a firm share in the company's successes and problems. A warrant allows the holder to purchase the firm's common stock from the firm at a specified price for a given time period. It provides the firm with future common stock capital when the holder exercises the warrant. Pooled Investments Rather than directly buying an individual stock or bond, you may choose to acquire these investments indirectly by buying shares in an investment company that owns a portfolio of individual stocks, bonds, or a combination of the two. People invest in pooled investment vehicles to benefit from the investment management services of their managers. Examples of these pooled investments include money market funds, bond funds, stock funds, balanced funds, etc. Currencies The currency market is a worldwide decentralized over-the-counter financial market for the trading of currencies. The market participants include commercial banks, central banks, retail brokers, etc. Contracts Financial contracts include the following:

Commodities Commodities include agricultural products, energy, metals, etc. Commodities complement the investment opportunities offered by shares of corporation that extensively use these raw materials in their production processes. Real Assets Real assets include tangible assets such as real estate, airplanes, machinery, or lumber stands. They are often illiquid and have high transaction costs compared to stocks and bonds. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 3. Financial intermediaries

#analyst-notes #market-organization-and-structure

Financial intermediaries are institutions that function as the line of communication between buyers and sellers in the financial system. Functioning as a middleman, a financial intermediary seeks to match investors who have specific financial goals with investments opportunities that can aid in the achievement of those goals.

Brokers, Exchanges, and Alternative Trading Systems A broker executes trade orders on behalf of a customer. A block broker helps fill larger orders. Investment banks help their corporate clients raise capital by issuing shares or bonds. They also help their corporate identify and acquire other companies. An exchange is like a market where stocks, bonds, options and futures, and commodities are traded. Most exchanges offer different categories of membership and regulate their members' behavior when trading on the exchange. They also regulate the issuers that list their securities on the exchange. Alternative trading systems (ATSs) are non-exchange trading venues that bring together buyers and sellers of securities. ATSs do not exercise regulatory authority over their subscribers and do not discipline subscribers other than exclusion from trading. For example, an electronic communication network (ECN) connects major brokerages and individual traders so that they can trade directly between themselves without having to go through a middleman. Dark pools are ATSs that don't display the orders which are usually very large. Dealers A dealer trades for its own accounts. Individual dealers provide liquidity to investors by trading the securities for themselves. They buy or sell with one client and hope to do the offsetting transaction later with another client. In practice, most brokerages are in fact broker-dealer firms. That is, as a broker, the brokerage conducts transactions on behalf of clients, and, as a dealer, it trades on its own account. In the U.S. most broker-dealers must register with the SEC. Securitizers Securitization is a structured finance process that distributes risk by aggregating assets in a pool (often by selling assets to a special purpose entity), then issuing new securities backed by the assets and their cash flows. The securities are sold to investors who share the risk and reward from those assets. In most securitized investment structures, the investors' rights to receive cash flows are divided into "tranches": senior tranche investors lower their risk of default in return for lower interest payments, while junior tranche investors assume a higher risk in return for higher interest. Financial intermediaries securitize many assets such as mortgages, car loans,, credit card receivables, and banks loans. Depository Institutions and Other Financial Corporations They accept monetary deposits from savers and investors, and then lend these deposits to borrowers. Both the depositors and borrowers benefit from the services they provide. Depository institutions also provide other services such as transaction services, credit services, etc. Insurance Companies Insurance involves pooling funds from many insured entities (e.g. policyholders) in order to pay for relatively uncommon but severely devastating losses which can occur to these entities. The insured entities are therefore protected from risk for a fee. In other words, risks are transferred from these entities to the insurance company. The insurance company connects customers who want to insure risks with investors who are willing to bear those risks. Insurance companies make money in two ways:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 4. Positions

#analyst-notes #market-organization-and-structure

A long position is owning or holding securities or contracts. For example, an owner of 100 shares of Apple common stock is said to be "long the stock". Being long indicates an expectation of rising share/contract prices.

A short sale allows investors to profit from a decline in a security's price if they believe the security is overpriced. In this procedure an investor (the seller) borrows shares of stock from another investor (the lender) through a broker and sells the shares. The lender keeps the proceeds of the sale as collateral. Later, the investor (the short seller) must repurchase the shares in the market in order to return the shares that were borrowed (covering the short position) to the lender. If the stock price has fallen, the shares will be repurchased at a lower price than that at which they were initially sold, and the short seller reaps a profit equal to the drop in price times the number of shares sold short. For options, to be long means you are the buyer of the option. To be short means you are the seller of the option. Since the put option contract holder (long) has the right to sell the underlying to the option writer, he or she is actually short the underlying instrument. The profit in short selling is limited to the value of the security, but the loss is theoretically unlimited. In practice, as the price of a security rises the short seller will receive a margin call from the broker, demanding that the short seller either to cover his short position (by purchasing the security) or to provide additional cash in order to meet the margin requirement for the security, which effectively places a limit on the amount that can be lost. Leveraged Positions Margin transactions occurs when investors who purchases stocks borrow part of the purchase price of the stock from their brokers, and leave purchased stocks with the brokerage firm because the securities are used as collateral for the loan. The interest rate of the margin credit charged by the broker is typically 1.5% above the rate charged by the bank making the loan. The bank rate (called the call money rate) is normally about 1% below the prime rate. The market value of the collateral stock minus the amount borrowed is called the investor's equity. Investors can achieve greater upside potential, but they also expose themselves to greater downside risk. The leverage equals 1/margin%. Buying stocks on margin increases the investment's financial risk and thus requires a higher rate of return.

Example Suppose an investor initially pays $6,000 toward the purchase of $10,000 worth of stock ($100 shares at $100 per share), borrowing the remaining from the broker. The maintenance margin is set to be 30%. The initial percentage margin is 60%. If the price of the stock falls to $57.14, the value of his stock will be $5,714. Since the loan is $4,000, the percentage margin now is (5,714 - 4,000) / 5714 = 29.9%. The investor will get a margin call. When investors acquire stock or other investments on margin, they are increasing the financial risk of the investment beyond the risk inherent in the security itself. They should increase their required rate of return accordingly. R... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 5. Orders

#analyst-notes #market-organization-and-structure

Orders are instructions to trade. They always specify instrument, side (buy or sell), and quantity.

Orders usually also provide several other instructions. Execution Instructions They indicate how to fill the order. Market orders are simple buy or sell orders that are to be executed immediately at current market prices. They provide immediate liquidity for someone willing to accept the prevailing market price. A limit order is an order that sets the maximum or minimum at which you are willing to buy or sell a particular stock. For instance, if you want to buy stock ABC, which is trading at $12, you can set a limit order for $10. This guarantees that you will pay no more than $10 to buy this stock. Once the stock reaches $10 or less, you will automatically buy a predetermined amount of shares. On the other hand, if you own stock ABC and it is trading at $12, you could place a limit order to sell it at $15. This guarantees that the stock will be sold at $15 or more. The primary advantage of a limit order is that it guarantees that the trade will be made at a particular price; however, it's possible that your order will not be executed at all if the limit price is not reached. Traders choose order submission strategies on the basis of how quickly they want to trade, the prices they are willing to accept, and the consequences of failing to trade. Validity Instructions They indicate when the order may be filled. A day order (the most common) is a market or limit order that is in force from the time the order is submitted to the end of the day's trading session. A good-till-canceled order requires a specific canceling order. It can persist indefinitely (although brokers may set some limits, for example, 90 days). An immediate-or-cancel order (IOC) will be immediately executed or canceled by the exchange. Unlike a fill-or-killorder, IOC orders allow for partial fills. An order may be specified on the close or on the open, then it is entered in an auction but has no effect otherwise. Different types of orders allow you to be more specific about how you'd like your broker to fulfill your trades. When you place a stop or limit order, you are telling your broker that you don't want the market price (the current price at which a stock is trading), but that you want the stock price to move in a certain direction before your order is executed. With a stop order, your trade will be executed only when the security you want to buy or sell reaches a particular price (the stop price). Once the stock has reached this price, a stop order essentially becomes a market order and is filled. For instance, if you own stock ABC, which currently trades at $20, and you place a stop order to sell it at $15, your order will only be filled once stock ABC drops below $15. Also known as a "stop-loss order", this allows you to limit your losses. However, this type of order can also be used to guarantee profits. For example, assume that you bought stock XYZ at $10 per share and now the stock is trading at $20 per share. Placing a stop order at $15 will guarantee profits of approximately $5 per share, depending on how quickly the market order can be filled. Stop orders are particularly advantageous to investors who are unable to monitor their stocks for a period of time, and brokerages may even set these stop orders for no charge. One disadva... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 6. Primary security markets

#analyst-notes #market-organization-and-structure

The primary markets are those in which new issues of bonds, preferred stock, or common stock are sold by government units, municipalities, or companies to acquire new capital.

Two important rules in the primary capital markets:

New stock issues are divided into two groups:

A rights issue is an option that a company can opt for to raise capital under a secondary market offering or seasoned equity offering of shares to raise money. It is a special form of shelf offering or shelf registration. With the issued rights, existing shareholders have the privilege to buy a specified number of new shares from the firm at a specified price within a specified time. Government bond issues are sold at Federal Reserve auctions. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 7. Secondary security market and contract market structures

#analyst-notes #market-organization-and-structure

The secondary markets permit trading in outstanding issues; that is, stocks or bonds already sold to the public are traded between current and potential owners.

Secondary markets support primary markets.

Trading Sessions Securities exchanges differ in when the stocks are traded. In a call market, trading for individual stocks takes place at specified times. The intent is to gather all the bids and asks for the stock and attempt to arrive at a single price where the quantity demanded is as close as possible to the quantity supplied.

In a continuous market, trades occur at any time the market is open. Stocks are priced either by auction or by dealers. In an auction market, there are sufficient willing buyers and sellers to keep the market continuous. In a dealer market, enough dealers are willing to buy or sell the stock. Please note that dealers may exist in some auction markets. These dealers provide temporary liquidity and ensure market continuity if the market does not have enough activity. Although many exchanges are considered continuous, they (e.g. NYSE) also employ a call-market mechanism on specific occasions. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 8. Well-functioning financial systems

#analyst-notes #market-organization-and-structure

Well-functioning financial systems have the following characteristics:

A well-functioning financial system promotes wealth by ensuring that capital allocation decisions are well made. It also promotes wealth by allowing people to share the risks associated with valuable products that would otherwise not be undertaken. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 9. Market regulation

#analyst-notes #market-organization-and-structure

Regulators generally seek to promote fair and orderly markets in which traders can trade at prices that accurately reflect fundamental values without incurring excessive transaction costs. Governmental agencies and self-regulating organizations of practitioners provide regulatory services that attempt to make markets safer and more efficient.

The objectives of market regulation are to:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. Index definition and calculations of value and returns

#analyst-notes #has-images #security-market-indices

A security market index is a means to measure the value of a set of securities in a target market, market segment or asset class. The constituent securities selected for inclusion in the security market index are intended to represent the target market.

There are usually two versions of the same index:

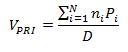

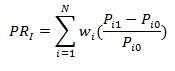

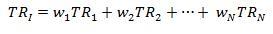

Single Period Returns The single period price return of an index is the weighted average of price returns of the individual securities:  or,

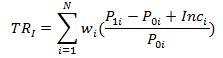

Since the total return of an index includes price appreciation and income, we need to add the weighted average of income to the above formula to calculate the single period total return:

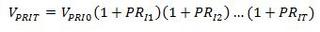

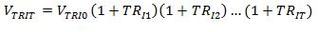

or,  Multiple-Period Returns The single period returns should be linked geometrically.  Similarly, to calculate the total return over multiple periods:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 2. Index construction and management

#analyst-notes #has-images #security-market-indices

The steps to construct and manage a security market index:

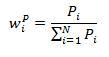

Price Weighting It is an arithmetic average of current prices. Index movements are influenced by the differential prices of the components. The weight of each security is calculated using this formula:

The index itself is computed by:

Example The shares of firm A sells for $100, and the shares of firm B sells for $25. The initial price index is (100 + 25) / 2 = 62.5. The divisor is therefore 2.

Price-weighting is simple, but a price-weighted index has a downward bias.

Both Dow Jones Industrial Average (DJIA) and Nikkei-Dow Jones Average use this method to weight an index. Equal Weighting All stocks carry equal weight regardless of their price or market value. A $1 stock is as important as a $10 stock, and a firm with $200 million market value is the same as one with $200 billion. The actual movements in the index are typically based on the arithmetic average of the percent changes in price or value for the stocks in the index: each percent change has equal weight. Such an index can be used by individuals who randomly select stock for their portfolio and invest the same dollar amount in each stock. The weight of each security is calculated using this formula:  |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 3. Uses of market indices

#analyst-notes #security-market-indices

Security market indices are used:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 4. Different types of security market indices

#analyst-notes #security-market-indices

Equity Indices

There are different types of equity indices. A broad market index represents an entire given equity market. Examples are Russell 3000, Wilshire 5000 Total Market Index, etc. Local indices of individual countries lack consistency in sample selection, weighting, or computational procedures. Global equity indexes are created to solve this comparability problem. A multi-market index represents multiple security markets. For example, the Dow Jones World Stock Index includes 2,200 companies in 33 countries. A sector index measures the performance of a narrow market segment, such as biotechnology sector. It can be used to determine if a portfolio manager is good at sector allocation or not. It can also be used to track the performance of sector-specific funds. Style strategies focus on the underlying characteristics common to certain investments. Growth is a different style than value, and large capitalization investing is a different style than small stock investing. A growth strategy may focus on high price-to-earnings stocks, and a value strategy on low price-to-earnings stocks. Style indices are created to represent such securities. Fixed Income Indices The creation and computation of bond-market indices is more difficult than a stock market series.

All bond indices indicate total rates of return for the portfolio of bonds, including price change, accrued interest, and coupon income reinvested. They are relatively new and not widely published. Most of indices are market-value weighted. Bond indices can be categorized based on their broad characteristics, such as type of issuer, currency, maturity and credit rating. For example, there are different indices for government bonds, high-yield bonds, corporate bonds and mortgage-backed securities. Commodity Indices There are five major commodity sectors: energy, grains, metals, food and fiber and livestock. A commodity price index is a fixed-weight index of selected commodity prices, which may be based on spot or futures prices. It is designed to be representative of the broad commodity asset class or a specific subset of commodities, such as energy or metals.

Real Estate Investment Trust Indices The types of real estate indices include appraisal indices, repeat sales indices, and REIT indices which track the performance of public traded REITs. Hedge Funds Indices There are many indices that track the hedge fund industry. Since hedge funds are illiquid, heterogeneous and ephemeral, it is really hard to construct a satisfactory index. Funds' participation in an index is voluntary, leading to self-selection bias because those funds that choose to report may not be... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. The concept of market efficiency

#analyst-notes #market-efficency

An efficient capital market is one in which security prices adjust rapidly to the arrival of new information and the current prices of securities reflect all information about the security. Therefore, it is also called an informationally efficient capital market. Why should capital markets be efficient? Competition is the source of efficiency, and price changes should be independent and random.

In an efficient market, the expected returns implicit in the current price of the security should reflect its risk. Investors buying the security should receive a return that is consistent with the perceived risk of the security. In an efficient capital market the majority of portfolio managers cannot beat a buy-and-hold policy on a risk-adjusted basis. An index fund which simply attempts to match the market at the lowest cost is preferable to an actively managed portfolio. Market Value versus Intrinsic Value

In an efficient market, the two values should be very close or the same. In other words, in an efficient market at any point in time the actual price of a security will be a good estimate of its intrinsic value. Though market value and the intrinsic value may differ across time, the discrepancy will get corrected as new information arrives. In an inefficient market, the two may differ significantly. Factors Affecting a Market's Efficiency Some factors contribute to and impede the degree of efficiency in a financial marke

Transaction costs and information-acquisition costs should also be considered when evaluating market efficiency. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 2. Forms of market efficiency

#analyst-notes #market-efficency

There are three versions of the Efficient Market Hypothesis (EMH); they differ by their notions of what is meant by the term "all available information".

Implications of EMHs Technical Analysis The assumptions of technical analysis directly oppose the notion of efficient markets.

Therefore, technical analysts believe that good traders can detect the significant stock price changes before others do. However, as confirmed by most studies, the capital market is weak-form efficient as prices fully reflect all market information as soon as the information becomes public. Though prices may not be adjusted perfectly in an efficient market, it is unpredictable whether the market will over-adjust or under-adjust at any time. Therefore, technical analysts should not generate abnormal returns and no technical trading system should have any value. Fundamental Analysis Fundamental analysts believe that

Therefore, by accurately estimating the intrinsic value, a fundamental analyst can achieve abnormal returns by making superior market timing decisions or acquiring undervalued securities. Fundamental analysis involves aggregate market analysis, industry analysis, company analysis and portfolio management. However, using historical data to estimate the relevant variables is as much an art and a product of hard work as it is a s... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 3. Market pricing anomalies

#analyst-notes #market-efficency

Are the hypotheses supported by the data? Are there market patterns that lead to abnormal returns more often than not?

A market anomaly is a security price distortion in the market that seems to contradict the efficient market hypothesis. There are different categories of market anomalies. Time-Series Anomalies Calendar anomalies question whether some regularities exist in the rates of return during the calendar year that would allow investors to predict returns on stocks. The January anomaly, also called small-firm-in-January effect, says that many people sell stocks that have declined in price during the previous months to realize their capital losses before the end of the tax year. Such investors do not put the proceeds from these sales back into the stock market until after the turn of the year. At that point the rush of demand for stock places an upward pressure on prices that results in the January effect. The effect is said to show up most dramatically for the smallest firms because the small-firm group includes stocks with the greatest variability of prices during the year (and the group therefore includes a relatively large number of firms that have declined sufficiently to induce tax-loss selling). Another possible reason for January effect on stock markets is strategic selling by institutional investors at the end of their reporting periods. Portfolio managers may be reluctant to report holdings of stocks in their annual reports that have performed poorly in the previous period. Therefore, the managers sell these stocks at the end of their accounting periods (usually end of December). This so-called window-dressing was suggested as a source of the January effect by Haugen and Lakonishok (1988). Despite numerous studies, the January anomaly poses as many questions as it answers. Other calendar studies include monthly effect, weekend or day of the week effect, and intraday effect. Momentum and Overreaction Anomalies. The debate surrounding investor overreaction and contrarian investing is one of the most extensive and controversial areas of research in finance. The overreaction anomaly, evidenced by long-term reversals in stock returns, was first identified by De Bondt and Thaler (1985), who showed that stocks which perform poorly in the past three to five years demonstrate superior performance over the next three to five years compared to stocks that have performed well in the past. The study provided evidence that abnormal excess returns could be gained by employing a strategy of buying past losers and selling short past winners, or the contrarian strategy. Although the overreaction anomaly and market momentum do seem to exist, researchers have argued that the existence of momentum is rational, and the additional return (based on the contrarian investment strategy) would come simply at the expense of increased risk. Cross-Sectional Anomalies If the semi-strong EMH is true, all securities should have equal risk-adjusted returns because security prices should reflect all public information that would influence the security's risk. Using public information, is it possible to determine what stocks will enjoy above-average, risk-adjusted returns? The size effect relates to the impact of size (measured by the total market value) on risk-adjusted rates of return. Some researchers found that the small firms outperformed the large firms after considering risk and transaction costs. Basu's study concluded that publicly available P/E ratios possessed valuable information, and the risk-adjusted returns for stocks in the lowest P/E ratio quintile were superior to those in the highest P/E ratio quintile. This is known as the value effect. Fama and French found that both size and BV/MV ratio are significant when included together, and they dominate other ratios. The dramatic dependence o... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 4. Behavioral finance

#analyst-notes #market-efficency

Some investors behave highly irrationally and make predictable errors. Behavior finance is a field of finance that proposes psychology-based theories to explain stock market anomalies. Within behavioral finance, it is assumed that the information structure and the characteristics of market participants systematically influence individuals' investment decisions as well as market outcomes. There have been many studies that have documented long-term historical phenomena in securities markets that contradict the efficient market hypothesis and cannot be captured plausibly in models based on perfect investor rationality. Behavioral finance attempts to fill the void.

Loss Aversion It is a theory that people value gains and losses differently and, as such, will base decisions on perceived losses rather than perceived gains. Thus, if a person were given two equal choices, one expressed in terms of possible losses and the other in possible gains, people would choose the former. Overconfidence Most people consider themselves to be better than average in most things they do. For example, 80% of drivers contend that they are better than "average" drivers. Is that really possible? Studies show that money managers, advisors, and investors are consistently overconfident in their ability to outperform the market. Most fail to do so, however. Other behavior theories include representativeness, gambler's fallacy, mental accounting, etc. Information Cascades Information cascading is defined as a situation in which an individual imitates the trades of other market participants and completely disregards his or her own private information. A related concept is herding, which is clustered trading that may or may not be based on information. Some researchers argue that institutional investors trade together because they receive correlated private information or infer private information from previous trades, and institutional herding helps prices to more quickly reflect market information and improve market efficiency. The result is that trading does not incorporate information and prices can move away from fundamentals. Some researchers argue that information cascades help promote market efficiency. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. CFA Institute Professional Conduct Program

#analyst-notes #code-of-ethics-and-standards-of-professional-conduct

The basic structure for enforcing the Code and Standards: Rules of Procedure.

The Disciplinary Review Committee (DRC) enforces the Code and Standards. Professional Conduct staff monitor compliance through Professional Conduct Statements, public complaints, public information, and media reports. The rules related to information-gathering and conviction follow a criminal justice system approach. The procedures require a careful investigation of the charges followed by a hearing, findings and appeal. An overview follows:

Authorized sanctions include suspension or revocation of membership/designation, private/public censure, and private reprimand. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 2. The Six Components of the Code of Ethics

#analyst-notes #code-of-ethics-and-standards-of-professional-conduct

Members and Candidates must:

The Code of Ethics establishes the framework for ethical decision-making in the investment profession. It applies to CFA Institute's members, CFA charterholders and CFA candidates. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 3. The Seven Standards of Professional Conduct

#analyst-notes #code-of-ethics-and-standards-of-professional-conduct

I. PROFESSIONALISM A. Knowledge of the Law. Members and candidates must understand and comply with all applicable laws, rules, and regulations (including the CFA Institute Code of Ethics and Standards of Professional Conduct) of any government, regulatory organization, licensing agency, or professional association governing their professional activities. In the event of conflict, members and candidates must comply with the more strict law, rule, or regulation. Members and candidates must not knowingly participate or assist in and must dissociate from any violation of such laws, rules, or regulations. B. Independence and Objectivity. Members and candidates must use reasonable care and judgment to achieve and maintain independence and objectivity in their professional activities. Members and candidates must not offer, solicit, or accept any gift, benefit, compensation, or consideration that reasonably could be expected to compromise their own or another's independence and objectivity. C. Misrepresentation. Members and candidates must not knowingly make any misrepresentations relating to investment analysis, recommendations, actions, or other professional activities. D. Misconduct. Members and candidates must not engage in any professional conduct involving dishonesty, fraud, or deceit or commit any act that reflects adversely on their professional reputation, integrity, or competence. II. INTEGRITY OF CAPITAL MARKETS A. Material Nonpublic Information. Members and candidates who possess material nonpublic information that could affect the value of an investment must not act or cause others to act on the information. B. Market Manipulation. Members and candidates must not engage in practices that distort prices or artificially inflate trading volume with the intent to mislead market participants. III. DUTIES TO CLIENTS A. Loyalty, Prudence, and Care. Members and candidates have a duty of loyalty to their clients and must act with reasonable care and exercise prudent judgment. Members and candidates must act for the benefit of their clients and place their clients' interests before their employer's or their own interests. B. Fair Dealing. Members and candidates must deal fairly and objectively with all clients when providing investment analysis, making investment recommendations, taking investment action, or engaging in other professional activities. C. Suitability.

D. Performance Presentation. When communicating investment performance information, members or candidates must make reasonable efforts to ensure that it is fair, accurate, and complete. E. Preservation of Confidentiality. Members and candidates must keep information about current, former, and prospective clients confidential unless:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. Standard I (A) Knowledge of the Law

#analyst-notes #guidance-for-standards-i-vii

I. PROFESSIONALISM

A. Knowledge of the Law. Members and Candidates must understand and comply with all applicable laws, rules, and regulations (including CFA Institute's Code of Ethics and Standards of Professional Conduct) of any government, regulatory organization, licensing agency, or professional association governing their professional activities. In the event of conflict, Members and Candidates must comply with the more strict law, rule, or regulation. Members and candidates must not knowingly participate or assist in and must dissociate from any violation of such laws, rules, or regulations. This standard adopts principles that apply to the general activities of members and candidates. As with any service there are certain rules and regulations that members and candidates need to abide by, although they are not required to have detailed knowledge of all laws. A. Relationship between the Code and Standards and local law. Members and candidates should always aspire to the highest level of ethical conduct. This statement assists members in avoiding legal and ethical traps and violations of the Code of Ethics. In general, members in all countries should comply at all times with the Code and Standards. Since laws in different countries may establish different standards, the rule of thumb is to choose the stricter regulations.

Example You are working in the foreign office of a U.S.-based firm. Analysts in this foreign country routinely solicit insider information and use it as the basis for trading decisions. You are told that this is not illegal in this country. In this case, the Code and Standards are stricter. They prohibit use of material nonpublic information. You should refrain from trading on the basis of insider information. B. Don't participate or assist in violations. Don't knowingly break or help others break laws. If a member:

Note:

Example An associate of yours is engaging in illegal trading practices and he tells you to refrain from disclosing this because it will make the firm look bad and it is highly profitable. You should choose one of the three actions above. If you seek legal counsel and are told that the activity is actually not illegal, you have met your obligation. This assumes that you believe the legal counsel to be competent. If you report your associa... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 2. Standard I (B) Independence and Objectivity

#analyst-notes #guidance-for-standards-i-vii

I. PROFESSIONALISM B. Independence and Objectivity. Members and Candidates must use reasonable care and judgment to achieve and maintain independence and objectivity in their professional activities. Members and Candidates must not offer, solicit, or accept any gift, benefit, compensation, or consideration that reasonably could be expected to compromise their own or another's independence and objectivity. Every member must avoid situations that may result in a potential conflict of interest. External sources may try to influence the investment process by offering investment managers a variety of perks. Excessive gifts or lavish investor relation functions could prejudice a member's opinions about a sponsor. One type of benefit is the allocation of shares in oversubscribed IPOs to investment managers for their personal accounts. Every member shall avoid situations that might cause or be perceived to cause a loss of independence or objectivity in recommending investments or taking investment action. Modest gifts and entertainment are acceptable. For example, gifts that do not exceed $100 may be accepted, as well as entertainment. Gifts from clients can be distinguished from gifts given by other parties seeking to influence a member to the detriment of clients. Gifts from clients are deemed less likely to impair a member's independence than gifts from other parties seeking to influence the member's outlook. Members and candidates must disclose to their employers any such benefits from clients. Example 1 You are an analyst for the banking industry. The head of investor relations for one of the larger firms in this industry offers to take you to dinner at a posh restaurant and discuss the upcoming quarterly earnings figures. He provides you with a new state-of-the-art titanium golf club as his limo drops you off at the end of the evening. He calls you the next day to ask if your report on his firm is progressing and indicates that there is a job waiting for you at the bank if you decide to leave your current position. First, the bank officer may have violated his fiduciary duty to his shareholders if he provided you with material nonpublic information. Regardless, you have been wined and dined and received a gift and a job offer from a senior officer of a firm you evaluate. Even if these inducements do not compromise your independence and objectivity, they may provide that perception. This violates the standard. Example 2 An analyst follows the stock of company XYZ. He is invited by XYZ for a visit to the company. XYZ pays all travel expenses for him. In general, when allowing companies to pay for expenses, analysts should ensure that such arrangements do not impinge on their independence and objectivity. In this case, as long as the trip is strictly for business without lavish hospitality, such payment is acceptable. Example 3 An analyst is asked by a firm's executives to issue favorable recommendations to secure the client's business. The analyst should conduct the review and make the recommendation based on his or her own independent and objective view. Note that members may experience pressure from their own firms to issue favorable reviews of certain companies. In a full-service investment house, the corporate finance department may be an underwriter for a company's securities and be loath to antagonize that company by publishing negative research reports. Example 4 Steve, a portfolio manager, directs a large amount of his commission business to a London brokerage house. In appreciation for all the business, the London brokerage house gives Steve two tickets to travel anywhere in Europe. Steve fails to disclose receiving this package to his supervisor. Steve has violated the standard because accepting these perks, worth more than $100, may hinder his independence and objectivity. Procedur... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 3. Standard I (C) Misrepresentation

#analyst-notes #guidance-for-standards-i-vii

I. PROFESSIONALISM

C. Misrepresentation. Members and Candidates must not knowingly make any misrepresentations relating to investment analysis, recommendations, actions, or other professional activities. Members and candidates shall not make any statements, orally or in writing, that misrepresent:

A misrepresentation is any untrue statement of a fact or any statement that is otherwise false or misleading. This standard relates to misrepresentations by members about their qualifications and services, and it disallows any misleading guarantees about investments and their returns. Members and candidates shall not make or imply, orally or in writing, any assurances or guarantees regarding any investment except to communicate accurate information regarding the terms of the investment instrument and the issuer's obligations under the instrument. It prohibits statements or assumptions that an investment is "guaranteed," or that superior returns can be expected based on the member's past success. This standard applies to oral representations, advertising, electronic communications (including web pages and emails) and written materials (whether publicly disseminated or not). Note: This standard does not rule out correct statements that some investments are actually guaranteed in some way with guaranteed returns. Examples of these types of investments would be insurance contracts or short-term treasury securities. This standard also prohibits plagiarism in the preparation of material for distribution to employers, associates, clients, prospects or the general public. Plagiarism involves copying or using substantially the same materials as those prepared by others without acknowledging the source of that material. The only exception is copying factual information, as published by several recognized financial institutions, as well as statistical information.

In ethical terms, a member or candidate indulging in plagiarism is not conducting himself or herself with integrity. By plagiarizing, he or she is not only stealing the ideas of others, but also exposing himself or herself to violations of other standards by making recommendations that may not have a reasonable basis and may not avoid material misrepresentations. Procedures for compliance Members can prevent unintentional misrepresentations of the qualifications of services the member or the member's firm is capable of performing if each member understands the limit of the individual's or firm's capabilities and the need to be accurate and complete in presentations. Firms can provide guidance for employees who make written or oral presentations to clients or potential clients by providing a written list of the firm's available services and a description of the firm's qualification, and compensations that are both accurate and suitab... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 4. Standard I (D) Misconduct

#analyst-notes #guidance-for-standards-i-vii

I. PROFESSIONALISM

D. Misconduct. Members and Candidates must not engage in any professional conduct involving dishonesty, fraud, or deceit, or commit any act that reflects adversely on their professional reputations, integrity, or competence. Members and candidates shall not compromise the integrity of the CFA designation, or the integrity or validity of the CFA examinations. Standard I (A) states the obligation to comply with all applicable laws and regulations. This standard addresses personal behavior that will reflect poorly on the profession as a whole. Any act that involves lying, cheating, stealing, or other dishonest conduct, if the offence reflects adversely on a member or candidate's professional (not personal) activities, would violate the standard. Procedures for compliance Members and candidates should encourage their employers to:

Example 1 An investment advisor executes excessive trading volume to generate fees. He tells clients that the high level of trading in their discretionary accounts is needed to maintain proper diversification. If this statement is misrepresentative, the advisor is clearly engaging in professional misconduct. Example 2 A portfolio manager has three martinis at lunch and returns to the office to resume his regular duties. If the manager's judgment is impaired and he is engaging in investment decision-making activities, he is in violation of this standard. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 5. Standard II (A) Material Nonpublic Information

#analyst-notes #guidance-for-standards-i-vii

II. INTEGRITY OF CAPITAL MARKETS

A. Material Nonpublic Information. Members and Candidates who possess material nonpublic information that could affect the value of an investment must not act or cause others to act on that information. Information is material if its disclosure may affect the price of a security, or if reasonable investors would want to know the information before investing. Topics which should be considered material in an insider trading context include:

The source or relative reliability of the information also determines materiality. The less reliable a source, the less likely the information provided would be considered material. Information is nonpublic if it has not been disseminated to the marketplace in general, or if investors have not had an opportunity to react to the information. Note that disclosing the information to a selected group of analysts does not make it public. For example, a disclosure made to a room full of analysts does not make the disclosed information "public." Note that this standard prohibits use of material nonpublic information, not:

Members are prohibited from seeking out or using any inside information in analyzing investments, making investment recommendations, or making investment decisions if:

Mosaic Theory Insider trading violations should not result when a perceptive analyst reaches a conclusion about a corporate action or event through an analysis of public information and items of nonmaterial nonpublic information (i.e., a "mosaic" of information). Under mosaic theory, financial analysts are free to act without risking liability. That is, a financial analyst may use nonpublic information as the basis for investment recommendations and decisions even if that conclusion would have been material inside information had it been communicated directly to the analyst by a company. Procedures for compliance If members receive inside information in confidence, they shall make reasonable efforts to achieve public dissemination of material nonpublic information disclosed in breach of duty. This effort usually means encouraging the issuing company to make the information public. Members and their firms should adopt written compliance procedures designed to prevent trading while in the possession of material nonpublic information. The most common and widespread approach to preventing insider trading by employees is an information barrier known as a "fire wall." The purpose of a fire wall is to prevent communication of material nonpublic information and other sensitive information from one department of a firm to other departments. The minimum elements of such a precaution include the following:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 6. Standard II (B) Market Manipulation QUIZ 1

#analyst-notes #guidance-for-standards-i-vii

II. INTEGRITY OF CAPITAL MARKETS B. Market Manipulation. Members and Candidates must not engage in practices that distort prices or artificially inflate trading volume with the intent to mislead market participants. Market manipulation is a deliberate attempt to interfere with the free and fair operation of the market. It includes practices that distort security prices or trading volume with the intent to deceive people or entities that rely on information in the market. Market manipulation examples include:

The intent of the action is critical to determining whether it is a violation of this standard. The standard does not prohibit legitimate trading strategies that exploit a difference in market power, information, or other market inefficiencies. It also does not prohibit transactions done for tax purposes (e.g., selling and immediately buying back a particular stock). |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 7. Standard III (A) Loyalty, Prudence, and Care

#analyst-notes #guidance-for-standards-i-vii

III. DUTIES TO CLIENTS

A. Loyalty, Prudence, and Care. Members and Candidates have a duty of loyalty to their clients and must act with reasonable care and exercise prudent judgment. Members and Candidates must act for the benefit of their clients and place their clients' interests before their employer's or their own interests. This standard relates principally to members who have discretionary authority over the management of client's assets. Fiduciary duty refers to the obligations of loyalty and care in regard to the responsibility of managing someone else's assets. A fiduciary duty is a position of trust.

Fiduciary standards apply to a large number of persons in varying capacities, but exact duties may differ in many respects, depending on the nature of the relationship with the client or the type of account under which the assets are managed. The first step in fulfilling a fiduciary duty is to determine what the responsibility is and the identity of the "client" to whom the fiduciary duty is owed.

A fiduciary must make investment decisions in the context of the portfolio as a whole rather than by individual investments within the portfolio. The fiduciary should thoroughly consider the risk of loss, potential gains, diversification, liquidity and returns. Often a manager may direct clients' trades through a particular broker because an investment manager often has discretion over the selection of brokers. The broker may provide research services that provide a broad benefit to the manager. The manager has thus used "soft dollars" to purchase beneficial services through brokerage, which is an asset to the manager's clients. Since the manager would expect to purchase research services anyway, the soft dollar arrangement is not necessarily inappropriate. The manager must seek the best price and execution, and disclose any soft dollar arrangements. Procedures for compliance

Example 1 A client anxiously tells you that he needs to liquidate a bond portfolio immediately because he needs funds to pay for an operation for a relative. The bonds are highly liquid, but ... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 8. Standard III (B) Fair Dealing

#analyst-notes #guidance-for-standards-i-vii

III. DUTIES TO CLIENTS

B. Fair Dealing. Members and Candidates must deal fairly and objectively with all clients when providing investment analysis, making investment recommendations, taking investment action, or engaging in other professional activities. "Fairly" implies that members must not discriminate against or favor any clients. Fairness shall be maintained in quality and timing of services, and allocation of investment opportunities. The term "fairly," rather than "equally,", is used because it would be physically impossible to reach all customers at the same exact instant, and not all recommendations or investment actions are suitable for all clients. Members and candidates are NOT required to give the same level of services to all clients. For example, you can give more information and research to discretionary clients than to transaction-only clients. Members and candidates are required to adhere to the standard in:

Procedures for compliance

Members and their firms are required to take the following steps to ensure that adequate trade allocation practices are followed:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 9. Standard III (C) Suitability

#analyst-notes #guidance-for-standards-i-vii

III. DUTIES TO CLIENTS

C. Suitability. 1. When Members and Candidates are in an advisory relationship with a client, they must: a. Make a reasonable inquiry into a client or prospective client's investment experience, risk and return objectives, and financial constraints prior to making any investment recommendation or taking investment action and must re-assess and update this information regularly. b. Determine that an investment is suitable to the client's financial situation and consistent with the client's written objectives, mandates, and constraints prior to making an investment recommendation or taking investment action. c. Judge the suitability of investments in the context of the client's total portfolio. 2. When Members and Candidates are responsible for managing a portfolio to a specific mandate, strategy, or style, they must only make investment recommendations or take investment actions that are consistent with the stated objectives and constraints of the portfolio. Members must always consider the appropriateness and suitability of the client's investment action and match this up against the needs and circumstances of the particular client in order to determine the suitability of the investment for the client. In the event that a new client is obtained or an existing client's previous investment matures, the member need not immediately obtain client information if he or she first re-invests these funds in some form of cash equivalent. The member will then obtain the client's investment preferences. He or she will need to determine from the client the level of risk that the client is prepared to accept (in other words, the client's risk tolerance level). This needs to be ascertained before any investment action is taken. You are required to:

You are NOT required to change an existing client portfolio as soon as it comes under your discretion; it is best to take a bit of time, plan and implement actions in an organized way. Procedures for compliance A written investment policy statement should be developed.

The investor's objectives and constraints should be maintained and reviewed periodically to reflect any changes in the client's circumstances. Annual review is reasonable unless business or other reasons dictate more or less frequent review. Example 1 After a five-minute interview, you advise a client how to invest a substantial proportion of her wealth. You have violated the "Know your customer" rule. You do not have adequate basis to make a detailed recommendation. Example 2 An analyst tells a client about the upside potential, without discussing the downside risks. He violates the standard because he should discuss the downside risks as well. Example 3 When recomm... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 10. Standard III (D) Performance Presentation

#analyst-notes #guidance-for-standards-i-vii

III. DUTIES TO CLIENTS D. Performance Presentation. When communicating investment performance information, Members and Candidates must make reasonable efforts to make sure that this information is fair, accurate, and complete. In the past there have been several practices that have hindered performance presentation and comparability, such as:

A firm cannot claim that they are/were in compliance with CFA Institute's standards unless they comply in allmaterial respects with CFA Institute's standards. Procedures for compliance Misrepresentations about the investment performance of the firm can be avoided if the member maintains data about the firm's investments performance in written form and understands the classes of investments or accounts to which those data apply and the risks and limitations inherent in using such data. In analyzing information about the firm's investment performance, the member should ask the following questions:

Example Your bond fund has generated a below average performance for four of the past five years. You use this as the basis for expectations of an above-average performance for the upcoming year. If your average or expected performance is properly determined, you should have a 50% probability of meeting or exceeding that average. Thus, it is inappropriate to declare that because performance was below average last year it is likely to be above average next year. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 11. Standard III (E) Preservation of Confidentiality

#analyst-notes #guidance-for-standards-i-vii

III. DUTIES TO CLIENTS

E. Preservation of Confidentiality. Members and Candidates must keep information about current, former, and prospective clients confidential unless:

The analyst must preserve confidentiality when the following two criteria are met:

You are required to:

However, if the information concerns illegal activities by the client, the analyst may be required to consult with his supervisor and with legal counsel before deciding whether to report the activities to the appropriate governmental organization. Procedures for compliance The simplest, most conservative, and most effective way to comply with this standard is to avoid disclosing any information received from a client except to authorized fellow employees who are also working for the client. In some instances, however, a member may want to disclose information received from clients that is outside the scope of the confidential relationship and does not involve illegal activities. Before making such a disclosure, a member should ask the following questions:

Example 1 You work in the trust department of a large bank. A client tells you that she must sell a significant portion of her personal stock portfolio in order to generate cash to meet the payroll of her small business. Shortly after the meeting, a colleague in the commercial lending department of the bank mentions seeing you with the client. She has applied for a large business loan. He asks you if you have any information that could help the bank with the loan decision. You cannot disclose the content of your meeting with the client. If the colleague wants additional information, he should contact your client directly. Example 2 The employer of a client asks to meet with you. The employer suspects your client of embezzling funds from his place of work. You are aware that the client has made several substantial additions into his discretionary account during the past two months. It may be appropriate to provide information if it pertains to illegal activities. However, you are expected to preserve client confidentiality unless there is a clear indication of these activities. Contact your supervisor or legal counsel before providing information about your client. ... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 12. Standard IV (A) Loyalty

#analyst-notes #guidance-for-standards-i-vii

IV. DUTIES TO EMPLOYERS

A. Loyalty. In materials related to their employment, Members and Candidates must act for the benefit of their employer and not deprive their employer of the advantage of their skills and abilities, divulge confidential information, or otherwise cause harm to their employer. Independent practice Members shall not undertake any independent practice that could result in compensation or other benefit in competition with their employer unless they obtain written consent from their employer.

If members and candidates plan to engage in independent business while still employed, they must provide a written statement to their employer describing the types of services, the expected duration, and the compensation. Note: Members have to participate in the activities. They do not actually have to receive any remuneration for this standard to apply. Leaving an employer Until their resignation becomes effective, members and candidates must continue to act in the employer's best interest, and must not engage in any activities that would conflict with this duty. A member can make preparations (but not undertake competitive business) to begin a competitive business as a departing employee, provided that the preparations do not breach the employee's duty of loyalty. Examples of this would be finding office space to rent for a member's future business. Nature of employment You can be exempt from the standard if you are an independent contractor. Definition of employee: someone in the service of another who has the power to control and direct the employee in the details of how work is to be done. An employee is not a contractor (you cannot control the details of how a contractor does a job). Employment relationship does not require written or implied contract or actual receipt of monetary compensation. Violations

Example 1 You agree to serve as an investment advisor to a non-profit institution run by a friend. Your firm provides similar services, but you elect to do this on your own for a very modest fee. Even if no fee was involved, you are obliged to obtain written consent from your employer. Example 2 An independent investment advisor is hired by a brokerage firm. However, she wants to keep her existing clients for herself. In this case, she must get the employer's written consent. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 13. Standard IV (B) Additional Compensation Arrangements

#analyst-notes #guidance-for-standards-i-vii

IV. DUTIES TO EMPLOYERS

B. Additional Compensation Arrangements. Members and Candidates must not accept gifts, benefits, compensation, or consideration that competes with, or might reasonably be expected to create a conflict of interest with, their employer's interests unless they obtain written consent from all parties involved. Outside compensation/benefits may affect loyalties and objectivity and create potential conflicts of interest. These include direct compensations from clients and indirect compensations or other benefits from third parties. Note: Accepting gifts is allowed, but you must inform your employer in writing before accepting. Procedures for compliance Members should make an immediate written report to their employer specifying any compensation they receive or propose to receive for services in addition to compensation or benefits received from their primary employer. Disclosure in writing means any form of communication that can be documented (e.g., email). This written report should state the terms of any oral or written agreement under which a member will receive additional compensation. Terms include the following:

Example 1 In an attempt to increase portfolio performance, a firm's client offers the portfolio manager an incentive, such as a free vacation. A conflict of interest exists in this case and the portfolio manager must inform the firm beforeaccepting the arrangement. Example 2 One of your firm's clients manages a ski resort in Colorado. She has told you that as long as you are managing her assets, you are entitled to complimentary lift tickets at the resort. To be in compliance with this standard, you must report this in writing to your employer. The employer will want to ensure that this client receives no special consideration as a result of the arrangement. Example 3 Steve sits on the board of directors of ABC Inc. As a result, he obtains unlimited membership in ABC Inc.'s services. Steve does not disclose this relationship to his employer, because he does not receive monetary compensation. Steve has violated this standard by not disclosing the benefits he receives to his employer. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 14. Standard IV (C) Responsibilities of Supervisors

#analyst-notes #guidance-for-standards-i-vii

IV. DUTIES TO EMPLOYERS

C. Responsibilities of Supervisors. Members and Candidates must make reasonable efforts to detect and prevent violations of applicable laws, rules, regulations, and the Code and Standards by anyone subject to their supervision or authority. If you supervise large numbers of employees, you may not be able to evaluate the conduct of each employee. In this case, you may delegate supervisory duties; however, such delegation does not replace supervisory responsibilities. A supervisory member should rely on reasonable procedures to detect and prevent violations. The presence of a compliance policy manual and/or compliance department, however, does not remove his or her supervisory responsibilities. Procedures for compliance A supervisor complies with Standard IV (C) by identifying situations in which legal violations or violation of the Code and Standards are likely to occur, and establishing and enforcing compliance procedures to prevent such violations. If a firm does not have a compliance system, or the system is not adequate, members or candidates should decline in writing to accept supervisory responsibility until the firm adopts reasonable procedures to allow them to adequately exercise such responsibility. Adequate compliance procedures should:

Once a compliance program is in place, a supervisor should:

Once a violation is discovered, a supervisor should take the following actions:

If a supervisory member was unable to detect violations, he or she may not violate the standard if he or she takes steps to institute an effective compliance program AND adopts reasonable procedures to prevent and identify violations. Example 1 A supervisor in an investment management firm concludes that since all five equity analysts working for her are CFA charterholders, she can trust them to refrain from violations of laws, regulations, and the Code and Standards. While she can trust them to refrain from such violations, this does not constitute reasonable supervision. Example 2 You are offered a promotion to supervise all investment managers involved in discretionary trading. You are told that there have been instances of improper trading in some accounts and that at least one manager is likely performing additional investment services for several of his clients. However, the operation is highly profitable, so senior management has no immediate concern regarding these issues. You are responsible for prevention of violations of the Code and Standards. If there are known violations and little or no control over the investment process, you should decline ... |