Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

#cfa #cfa-level-1 #economics #has-images #microeconomics #reading-13-demand-and-supply-analysis-introduction

A Price Floor

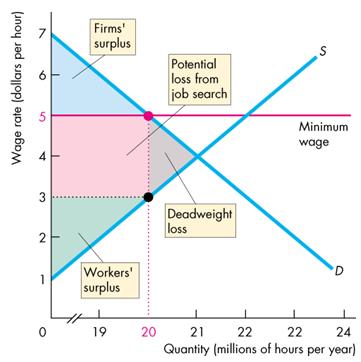

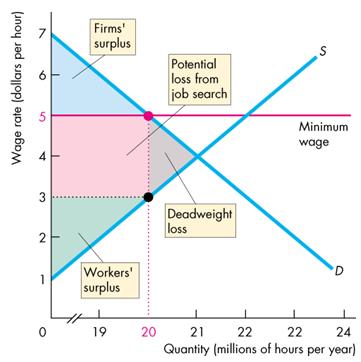

A price floor is a minimum price that can be legally charged. It usually fixes the price of a good or resource above the market equilibrium level. Price floors are usually imposed when the equilibrium price is considered too low to be fair. Agricultural price supports and minimum wage legislation are examples of price floors.

If a price floor is set above the equilibrium price, p0, for example, at p1, there is a reduction in quantity demanded from q0 to qd, whilst the quantity supplied increases from q0 to qs. The result is a surplus of qs-qd.

Example 1

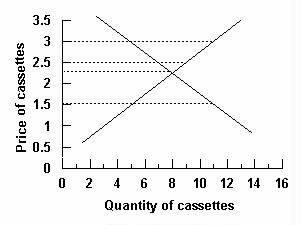

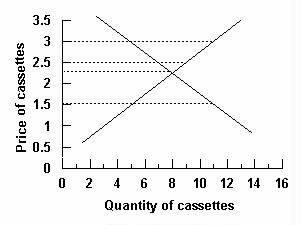

Refer to the graph below. A price floor set by the government would be binding and cause the greatest distortion in the market if it were established at what price?

Answer: $3.00.

Given the supply and demand curves in the graph, the equilibrium price is $2.25. A price floor will be binding only if it is above the equilibrium price. So a price floor of $1.50 would not distort the market. The higher the floor above equilibrium price, the greater the market distortion (surplus). A price floor at $3.00 would create a larger surplus than a price floor at $2.50.

It creates a deadweight loss.

Note that a surplus does not mean the good is no longer scarce: people just desire less of the good at the current price than sellers desire to bring to the market. A decline in price would eliminate the surplus but not the scarcity of the item.

If you want to change selection, open document below and click on "Move attachment"

Subject 6. Market Interference: The Negative Impact on Total Surplus

er surplus by using resources such as search activity, and creates a deadweight loss. It also transfers part of the producer surplus from producers to consumers. The consumer surplus becomes the green area + the pink area. <span>A Price Floor A price floor is a minimum price that can be legally charged. It usually fixes the price of a good or resource above the market equilibrium level. Price floors are usually imposed when the equilibrium price is considered too low to be fair. Agricultural price supports and minimum wage legislation are examples of price floors. If a price floor is set above the equilibrium price, p0, for example, at p1, there is a reduction in quantity demanded from q0 to qd, whilst the quantity supplied increases from q0 to qs. The result is a surplus of qs-qd. Example 1 Refer to the graph below. A price floor set by the government would be binding and cause the greatest distortion in the market if it were established at what price? Answer: $3.00. Given the supply and demand curves in the graph, the equilibrium price is $2.25. A price floor will be binding only if it is above the equilibrium price. So a price floor of $1.50 would not distort the market. The higher the floor above equilibrium price, the greater the market distortion (surplus). A price floor at $3.00 would create a larger surplus than a price floor at $2.50. It creates a deadweight loss. Note that a surplus does not mean the good is no longer scarce: people just desire less of the good at the current price than sellers desire to bring to the market. A decline in price would eliminate the surplus but not the scarcity of the item. Taxes When a tax is imposed, the government can make either the buyer or the seller legally responsible for payment of the tax. However, the pers

Subject 6. Market Interference: The Negative Impact on Total Surplus

er surplus by using resources such as search activity, and creates a deadweight loss. It also transfers part of the producer surplus from producers to consumers. The consumer surplus becomes the green area + the pink area. <span>A Price Floor A price floor is a minimum price that can be legally charged. It usually fixes the price of a good or resource above the market equilibrium level. Price floors are usually imposed when the equilibrium price is considered too low to be fair. Agricultural price supports and minimum wage legislation are examples of price floors. If a price floor is set above the equilibrium price, p0, for example, at p1, there is a reduction in quantity demanded from q0 to qd, whilst the quantity supplied increases from q0 to qs. The result is a surplus of qs-qd. Example 1 Refer to the graph below. A price floor set by the government would be binding and cause the greatest distortion in the market if it were established at what price? Answer: $3.00. Given the supply and demand curves in the graph, the equilibrium price is $2.25. A price floor will be binding only if it is above the equilibrium price. So a price floor of $1.50 would not distort the market. The higher the floor above equilibrium price, the greater the market distortion (surplus). A price floor at $3.00 would create a larger surplus than a price floor at $2.50. It creates a deadweight loss. Note that a surplus does not mean the good is no longer scarce: people just desire less of the good at the current price than sellers desire to bring to the market. A decline in price would eliminate the surplus but not the scarcity of the item. Taxes When a tax is imposed, the government can make either the buyer or the seller legally responsible for payment of the tax. However, the pers

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.