Edited, memorised or added to reading queue

on 17-Jan-2018 (Wed)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1431730785548

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

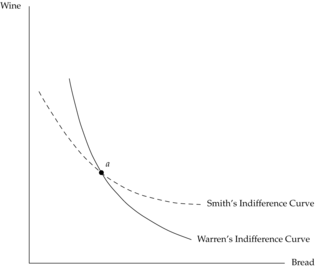

Note that because their indifference curves intersect at that point, their slopes are different.

Flashcard 1435637517580

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFor publicly traded corporations, the focus of investment analysts’ work, the cost of equity capital is the largest and most readily identified implicit opportunity cost omitted in calculating total accounting cost.

Original toplevel document

2. OBJECTIVES OF THE FIRM00 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. <span>2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as accounting profit less the implicit opportunity costs not included in total accounting costs. Equation (3a) Economic profit = Accounting profit – Total implicit opportunity costs We can define a term, economic cost , equal to the sum of total accounting costs and implicit opportunity costs. Economic profit is therefore equivalently defined as: Equation (3b) Economic profit = Total revenue – Total economic costs For publicly traded corporations, the focus of investment analysts’ work, the cost of equity capital is the largest and most readily identified implicit opportunity cost omitted in calculating total accounting cost. Consequently, economic profit can be defined for publicly traded corporations as accounting profit less the required return on equity capital. Examples will make these concepts clearer. Consider the start-up company for which we calculated an accounting profit of €300,000 and suppose that the entrepreneurial executive who launched the start-up took a salary reduction of €100,000 per year relative to the job he left. That €100,000 is an opportunity cost of involving him in running the start-up. Besides labor, financial capital is a resource. Suppose that the executive, as sole owner, makes an investment of €1,500,000 to launch the enterprise and that he might otherwise expect to earn €200,000 per year on that amount in a similar risk investment. Total implicit opportunity costs are €100,000 + €200,000 = €300,000 per year and economic profit is zero: €300,000 – €300,000 = €0. For the publicly traded corporation, we consider the cost of equity capital as the only implicit opportunity cost identifiable. Suppose that equity investment is $18,750,000 and shareholders’ required rate of return is 8 percent so that the dollar cost of equity capital is $1,500,000. Economic profit for the publicly traded corporation is therefore $2,000,000 (accounting profit) less $1,500,000 (cost of equity capital) or $500,000. For the start-up company, economic profit was zero. Total economic costs were just covered by revenues and the company was not earning a euro more nor less than the amount that meets the opportunity costs of the resources used in the business. Economists would say the company was earning a normal profit (economic profit of zero). In simple terms, normal profit is the level of accounting profit needed to just cover the implicit opportunity costs ignored in accounting costs. For the publicly traded corporation, normal profit was $1,500,000: normal profit can be taken to be the cost of equity capital (in money terms) for such a company or the dollar return required on an equal investment by equity holders in an equivalently risky alternative investment opportunity. The publicly traded corporation actually earned $500,000 in excess of normal profit, which should be reflected in the common shares’ market price. Thus, the following expression links accounting profit to economic profit and normal profit: Equation (4) Accounting profit = Economic profit + Normal profit When accounting profit equals normal profit, economic profit is zero. Further, when accounting profit is greater than normal profit, economic profit is positive; and when accounting profit is less than normal profit, economic profit is negative (the firm has an economic loss ). Economic profit for a firm can originate from sources such as: competitive advantage; exceptional managerial efficiency or skill; difficult to copy technology or innovation (e.g., patents, trademarks, and copyrights); exclusive access to less-expensive inputs; fixed supply of an output, commodity, or resource; preferential treatment under governmental policy; large increases in demand where supply is unable to respond fully over time; exertion of monopoly power (price control) in the market; and market barriers to entry that limit competition. Any of the above factors may lead the firm to have positive net present value investment (NPV) opportunities. Access to positive NPV opportunities and therefore profit in excess of normal profits in the short run may or may not exist in the long run, depending on the potential strength of competition. In highly competitive market situations, firms tend to earn the normal profit level over time because ease of market entry allows for other competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. 2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical su

Flashcard 1438180576524

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itreplace serviceable but obsolete equipment. These decisions are discretionary and a detailed analysis is usually required. The cash flows from the old asset must be considered in replacement decisions. Specifically, in a <span>replacement project, the cash flows from selling old assets should be used to offset the initial investment outlay. Analysts also need to compare revenue/cost/depreciation before and after the replacement

Original toplevel document

Subject 1. Capital Budgeting: Introductionood capital budgeting decisions can be made). Otherwise, you will have the GIGO (garbage in, garbage out) problem. Improve operations, thus making capital decisions well-implemented. <span>Project classifications: Replacement projects. There are two types of replacement decisions: Replacement decisions to maintain a business. The issue is twofold: should the existing operations be continued? If yes, should the same processes continue to be used? Maintenance decisions are usually made without detailed analysis. Replacement decisions to reduce costs. Cost reduction projects determine whether to replace serviceable but obsolete equipment. These decisions are discretionary and a detailed analysis is usually required. The cash flows from the old asset must be considered in replacement decisions. Specifically, in a replacement project, the cash flows from selling old assets should be used to offset the initial investment outlay. Analysts also need to compare revenue/cost/depreciation before and after the replacement to identify changes in these elements. Expansion projects. Projects concerning expansion into new products, services, or markets involve strategic decisions and explicit forecasts of future demand, and thus require detailed analysis. These projects are more complex than replacement projects. Regulatory, safety and environmental projects. These projects are mandatory investments, and are often non-revenue-producing. Others. Some projects need special considerations beyond traditional capital budgeting analysis (for example, a very risky research project in which cash flows cannot be reliably forecast). LOS a. describe the capital budgeting process and distinguish among the various categories of capital projects; <span><body><html>

Flashcard 1477056531724

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itHow can you develop an urge to get better at dealing with people? By constantly reminding yourself how important these principles are to you.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1478089903372

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itneral journal is the collection of all business transactions in an accounting system sorted by date. All accounting systems have a general journal to record all transactions. Some accounting systems also include special journals. For example, <span>there may be one journal for recording sales transactions and another for recording inventory purchases.<span><body><html>

Original toplevel document

Open itved and the corresponding liability to deliver newsletters) and, subsequently, 12 future adjusting entries, the first one of which was illustrated as Transaction 12. Each adjusting entry reduces the liability and records revenue. <span>In practice, a large amount of unearned revenue may cause some concern about a company’s ability to deliver on this future commitment. Conversely, a positive aspect is that increases in unearned revenue are an indicator of future revenues. For example, a large liability on the balance sheet of an airline relates to cash received for future airline travel. Revenue will be recognized as the travel occurs, so an increase in this liability is an indicator of future increases in revenue. <span><body><html>

Flashcard 1478157536524

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFinancial statements serve as a foundation for credit and equity analysis, including security valuation.

Original toplevel document

7. USING FINANCIAL STATEMENTS IN SECURITY ANALYSISFinancial statements serve as a foundation for credit and equity analysis, including security valuation. Analysts may need to make adjustments to reflect items not reported in the statements (certain assets/liabilities and future earnings). Analysts may also need to assess the reasonablene

Flashcard 1733044604172

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itCaracterísticas Básicas. Los servicios que TCP proporciona para la comunicación entre aplicaciones, pueden caracterizarse en los cuatro puntos siguientes: - Cuando dos aplicaciones transfieren grandes cantidades de datos, podemos pensar en esos datos como secuencias de octetos. El módulo TCP del nodo destino entrega las secuencias de octetos que recibe a la capa superior, tal y como la capa superior del nodo origen se la entregó a TCP. - Circuito virtual: TCP proporciona un servicio de comunicación orientado a la conexión. De esta forma TCP suministra un servicio fiable de transporte de datos de extremo a extremo. Entre otros servicios, TCP proporciona el establecimiento de la conexión, la transferencia de información y la desconexión. - Buffers de datos. Las aplicaciones transfieren sus datos en forma de cadenas de octetos al módulo TCP. Este agrupa o divide las cadenas de octetos recibidas en función del tamaño del paquete que puede transmitir. Para hacer más eficiente la transmisión y reducir el tráfico en la red, es necesario que el módulo TCP disponga de buffers donde acumular la información. Obviamente estos buffers pueden retrasar la transmisión de determinada información. Cuando es necesario realizar la transmisión inmediata de algunos datos, puede solicitarse a TCP que transmita dicha información (push), aún cuando su tamaño sea menor que el que proporciona mayor rendimiento. - Conexión full-duplex: |TCP/IP permite que las conexiones establecidas entre dos nodos sean concurrentes o simultáneas en ambos sentidos. Las aplicaciones ven este servicio como dos canales de transmisión (uno de entrada y otro de salida), sin interacción aparente.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1733129276684

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itHadoop está inspirado en el proyecto de Google File System(GFS) y en el paradigma de programación MapReduce, el cual consiste en dividir en dos tareas ( mapper – reducer ) para manipular los datos distribuidos a nodos de un clúster logrando un alto paralelismo en el procesamiento.[5] Hadoop está compuesto de tres piezas: Hadoop Distributed File System (HDFS), Hadoop MapReduce y Hadoop Common. Hadoop Distributed File System(HDFS) Los datos en el clúster de Hadoop son divididos en pequeñas piezas llamadas bloques y distribuidas a través del clúster; de esta manera, las funciones map y reduce pueden ser ejecutadas en pequeños subconjuntos y esto provee de la escalabilidad necesaria para el procesamiento de grandes volúmenes.

Original toplevel document

¿Qué es Big Data?n costo potencial al no descubrir el gran valor asociado. Desde luego, el ángulo correcto que actualmente tiene el liderazgo en términos de popularidad para analizar enormes cantidades de información es la plataforma de código abierto Hadoop. <span>Hadoop está inspirado en el proyecto de Google File System(GFS) y en el paradigma de programación MapReduce, el cual consiste en dividir en dos tareas ( mapper – reducer ) para manipular los datos distribuidos a nodos de un clúster logrando un alto paralelismo en el procesamiento.[5] Hadoop está compuesto de tres piezas: Hadoop Distributed File System (HDFS), Hadoop MapReduce y Hadoop Common. Hadoop Distributed File System(HDFS) Los datos en el clúster de Hadoop son divididos en pequeñas piezas llamadas bloques y distribuidas a través del clúster; de esta manera, las funciones map y reduce pueden ser ejecutadas en pequeños subconjuntos y esto provee de la escalabilidad necesaria para el procesamiento de grandes volúmenes. La siguiente figura ejemplifica como los bloques de datos son escritos hacia HDFS. Observe que cada bloque es almacenado tres veces y al menos un bloque se almacena en un diferente rack

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |