Edited, memorised or added to reading queue

on 04-Dec-2018 (Tue)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1425590848780

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itMacroeconomics deals with aggregate economic quantities, such as national output and national income.

Original toplevel document

1. INTRODUCTIONIn a general sense, economics is the study of production, distribution, and consumption and can be divided into two broad areas of study: macroeconomics and microeconomics. Macroeconomics deals with aggregate economic quantities, such as national output and national income. Macroeconomics has its roots in microeconomics , which deals with markets and decision making of individual economic units, including consumers and businesses. Microeconomics is a logi

Flashcard 1428230114572

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itWhen something other than price changes, the demand curve or the supply curve will shift relative to the other curve. This shift is referred to as a change in demand or supply, as opposed to quantity demanded or quantity supplied. A new equilibrium generally will be obtained at a different price and a

Original toplevel document

SUMMARYs and households as sellers of land, labor, capital, and entrepreneurial risk-taking ability. Capital markets are used by firms to sell debt or equity to raise long-term capital to finance the production of goods and services. <span>Demand and supply curves are drawn on the assumption that everything except the price of the good itself is held constant (an assumption known as ceteris paribus or “holding all other things constant”). When something other than price changes, the demand curve or the supply curve will shift relative to the other curve. This shift is referred to as a change in demand or supply, as opposed to quantity demanded or quantity supplied. A new equilibrium generally will be obtained at a different price and a different quantity than before. The market mechanism is the ability of prices to adjust to eliminate any excess demand or supply resulting from a shift in one or the other curve. If, at a given price, the quantity demanded exceeds the quantity supplied, there is excess demand and price will rise. If, at a given price, the quantity supplied exceed

Flashcard 1430362656012

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAn externality is a case in which production costs or the consumption benefits of a good or service spill over onto those who are not producing or consuming the good or service; a spillover cost (e.g., pollution) is called a negative externality , a spillover benefit (e.g., literacy programs) is called a positive externality .)<html>

Original toplevel document

3.12. Markets Maximize Society’s Total Surplusof a good. Hence, it is society’s marginal value curve for that good. Additionally, the market supply curve represents the marginal cost to society to produce each additional unit of that good, assuming no positive or negative externalities. (<span>An externality is a case in which production costs or the consumption benefits of a good or service spill over onto those who are not producing or consuming the good or service; a spillover cost (e.g., pollution) is called a negative externality , a spillover benefit (e.g., literacy programs) is called a positive externality .) At equilibrium, where demand and supply curves intersect, the highest price that someone is willing to pay is just equal to the lowest price that a seller is willing to acc

Flashcard 1431536798988

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itArmed with the assumptions of completeness, transitivity, and non-satiation, we ask whether there might be a way for a given consumer to represent his own preferences in a consistent manner.

Original toplevel document

3. UTILITY THEORY: MODELING PREFERENCES AND TASTESifferent between the two. If she complies with this assumption, she must be able to compare these two baskets of goods. 3.2. Representing the Preference of a Consumer: The Utility Function <span>Armed with the assumptions of completeness, transitivity, and non-satiation, we ask whether there might be a way for a given consumer to represent his own preferences in a consistent manner. Let us consider presenting him with all possible bundles of all the possible goods and services he could consider. Now suppose we give him paper and pencil and ask him to assign a number to each of the bundles. (The assumption of completeness ensures that he, in fact, could do that.) All he must do is write a number on a paper and lay it on each of the bundles. The only restrictions are these: Comparing any two bundles, if he prefers one to the other, he must assign a higher number to the bundle he prefers. And if he is indifferent between them, he must assign the same number to both. Other than that, he is free to begin with any number he wants for the first bundle he considers. In this way, he is simply ordering the bundles according to his preferences over them. Of course, each of these possible bundles has a specific quantity of each of the goods and services. So, we have two sets of numbers. One set consists of the pieces of pape

Flashcard 1431576120588

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open ite same ranking, then the new set of numbers would be just as useful a utility function as the first in describing our consumer’s preferences. This characteristic of utility functions is called an ordinal, as contrasted to a cardinal, ranking. <span>Ordinal rankings are weaker measures than cardinal rankings because they do not allow the calculation and ranking of the differences between bundles.<span><body><html>

Original toplevel document

3. UTILITY THEORY: MODELING PREFERENCES AND TASTESead. The utility of a bundle containing 4 ounces of wine along with 2 slices of bread would equal 8 utils, and it would rank lower than a bundle containing 3 ounces of wine along with 3 slices of bread, which would yield 9 utils. <span>The important point to note is that the utility function is just a ranking of bundles of goods. If someone were to replace all those pieces of paper with new numbers that maintained the same ranking, then the new set of numbers would be just as useful a utility function as the first in describing our consumer’s preferences. This characteristic of utility functions is called an ordinal, as contrasted to a cardinal, ranking. Ordinal rankings are weaker measures than cardinal rankings because they do not allow the calculation and ranking of the differences between bundles. 3.3. Indifference Curves: The Graphical Portrayal of the Utility Function It will be convenient for us to represent our consumer’s preferences gr

Flashcard 1436152368396

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itExplicit Costs vs. Implicit Costs Explicit costs arise based on what has actually been purchased as opposed to implicit costs that arise based on what has actually been given up other than money. Explicit costs have a paper trail and provide audit documentation. Implicit costs are not traceable in a financial system. While management will utilize explicit costs when viewing bus

Original toplevel document

Explicit Cost Definition | Investopediahased are examples of explicit costs. Although the depreciation of an asset is not an activity that can be tangibly traced, depreciation expense is an explicit cost because it relates to the cost of the underlying asset that the company owns. <span>Explicit Costs vs. Implicit Costs Explicit costs arise based on what has actually been purchased as opposed to implicit costs that arise based on what has actually been given up other than money. Explicit costs have a paper trail and provide audit documentation. Implicit costs are not traceable in a financial system. While management will utilize explicit costs when viewing business operations, implicit costs are only utilized in decision-making or choosing between multiple alternatives. Opportunity Costs Explicit costs are used in the computation of opportunity costs. An opportunity cost is the total value of an item forgone. It is calculated by adding the explicit and

Flashcard 1436159708428

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itney. Explicit costs have a paper trail and provide audit documentation. Implicit costs are not traceable in a financial system. While management will utilize explicit costs when viewing business operations, implicit costs are only utilized in <span>decision-making or choosing between multiple alternatives. <span><body><html>

Original toplevel document

Explicit Cost Definition | Investopediahased are examples of explicit costs. Although the depreciation of an asset is not an activity that can be tangibly traced, depreciation expense is an explicit cost because it relates to the cost of the underlying asset that the company owns. <span>Explicit Costs vs. Implicit Costs Explicit costs arise based on what has actually been purchased as opposed to implicit costs that arise based on what has actually been given up other than money. Explicit costs have a paper trail and provide audit documentation. Implicit costs are not traceable in a financial system. While management will utilize explicit costs when viewing business operations, implicit costs are only utilized in decision-making or choosing between multiple alternatives. Opportunity Costs Explicit costs are used in the computation of opportunity costs. An opportunity cost is the total value of an item forgone. It is calculated by adding the explicit and

Flashcard 1438152002828

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe typical steps in the capital budgeting process: Generating good investment ideas to consider. Analyzing individual proposals (forecasting cash flows, evaluating profitability, etc.). Planning the capital budget. <span>How does the project fit within the company's overall strategies? What's the timeline and priority? Monitoring and post-auditing. The post-audit is a follow-up of capital budgeting decisions. It is a key element of capital budgeting. By comparing actual results with predicted results

Original toplevel document

Subject 1. Capital Budgeting: Introductioninclude in the capital budget. "Capital" refers to long-term assets. The "budget" is a plan which details projected cash inflows and outflows during a future period. <span>The typical steps in the capital budgeting process: Generating good investment ideas to consider. Analyzing individual proposals (forecasting cash flows, evaluating profitability, etc.). Planning the capital budget. How does the project fit within the company's overall strategies? What's the timeline and priority? Monitoring and post-auditing. The post-audit is a follow-up of capital budgeting decisions. It is a key element of capital budgeting. By comparing actual results with predicted results and then determining why differences occurred, decision-makers can: Improve forecasts (based on which good capital budgeting decisions can be made). Otherwise, you will have the GIGO (garbage in, garbage out) problem. Improve operations, thus making capital decisions well-implemented. Project classifications: Replacement projects. There are two types of replacement d

Flashcard 1438257122572

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itare relevant. Economic income is an investment's after-tax cash flow plus the change in the market value. Financing costs are ignored in computing economic income. Cash flow timing is critical because <span>money is worth more the sooner you get it. Also, firms must have adequate cash flow to meet maturing obligations. The opportunity cost should be charged against a project. Remember that just because something is

Original toplevel document

Subject 2. Basic Principles of Capital BudgetingCapital budgeting decisions are based on incremental after-tax cash flows discounted at the opportunity cost of capital. Assumptions of capital budgeting are: Capital budgeting decisions must be based on cash flows, not accounting income. Accounting profits only measure the return on the invested capital. Accounting income calculations reflect non-cash items and ignore the time value of money. They are important for some purposes, but for capital budgeting, cash flows are what are relevant. Economic income is an investment's after-tax cash flow plus the change in the market value. Financing costs are ignored in computing economic income. Cash flow timing is critical because money is worth more the sooner you get it. Also, firms must have adequate cash flow to meet maturing obligations. The opportunity cost should be charged against a project. Remember that just because something is on hand does not mean it's free. See below for the definition of opportunity cost. Expected future cash flows must be measured on an after-tax basis. The firm's wealth depends on its usable after-tax funds. Ignore how the project is financed. Interest payments should not be included in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which

Flashcard 1438285171980

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open ithow the project is financed. Interest payments should not be included in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on <span>business factors, not financing.<span><body><html>

Original toplevel document

Subject 2. Basic Principles of Capital BudgetingCapital budgeting decisions are based on incremental after-tax cash flows discounted at the opportunity cost of capital. Assumptions of capital budgeting are: Capital budgeting decisions must be based on cash flows, not accounting income. Accounting profits only measure the return on the invested capital. Accounting income calculations reflect non-cash items and ignore the time value of money. They are important for some purposes, but for capital budgeting, cash flows are what are relevant. Economic income is an investment's after-tax cash flow plus the change in the market value. Financing costs are ignored in computing economic income. Cash flow timing is critical because money is worth more the sooner you get it. Also, firms must have adequate cash flow to meet maturing obligations. The opportunity cost should be charged against a project. Remember that just because something is on hand does not mean it's free. See below for the definition of opportunity cost. Expected future cash flows must be measured on an after-tax basis. The firm's wealth depends on its usable after-tax funds. Ignore how the project is financed. Interest payments should not be included in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which

Flashcard 1438290939148

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itImportant capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which cannot be recovered regardless of whether a project is accepted or rejected. Since sunk costs are not increment costs, they should not be included in the capital budgeting ana

Original toplevel document

Subject 2. Basic Principles of Capital Budgetingd in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. <span>Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which cannot be recovered regardless of whether a project is accepted or rejected. Since sunk costs are not increment costs, they should not be included in the capital budgeting analysis. For example, a small bookstore is considering opening a coffee shop within its store, which will generate an annual net cash outflow of $10,000 from selling coffee. That is, the coffee shop will always be losing money. In the previous year, the bookstore spent $5,000 to hire a consultant to perform an analysis. This $5,000 consulting fee is a sunk cost; whether the coffee shop is opened or not, the $5,000 is spent. Incremental cash flow is the net cash flow attributable to an investment project. It represents the change in the firm's total cash flow that occurs as a direct result of accepting the project. Forget sunk costs. Subtract opportunity costs. Consider side effects on other parts of the firm: externalities and cannibalization. Recognize the investment and recovery of net working capital. Opportunity cost is the return on the best alternative use of an asset or the highest return that will not be earned if funds are invested in a particular project. For example, to continue with the bookstore example, the space to be occupied by the coffee shop is an opportunity cost - it could be used to sell books and generate a $5,000 annual net cash inflow. Externalities are the effects of a project on cash flows in other parts of a firm. Although they are difficult to quantify, they should be considered. Externalities can be either positive or negative: Positive externalities create benefits for other parts of the firm. For example, the coffee shop may generate some additional customers for the bookstore (who otherwise may not buy books there). Future cash flows generated by positive externalities occur with the project and do not occur without the project, so they are incremental. Negative externalities create costs for other parts of the firm. For example, if the bookstore is considering opening a branch two blocks away, some customers who buy books at the old store will switch to the new branch. The customers lost by the old store are a negative externality. The primary type of negative externality is cannibalization, which occurs when the introduction of a new product causes sales of existing products to decline. Future cash flows represented by negative externalities occur regardless of the project, so they are non-incremental. Such cash flows represent a transfer from existing projects to new projects, and thus should be subtracted from the new projects' cash flows. Conventional versus non-conventional cash flows. A conventional cash flow pattern is one with an initial outflow followed by a series of inflows. In a non-conventional cash flow pattern, the initial outflow can be followed by inflows and/or outflows. Some project interactions: Indepe

Flashcard 1438366174476

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itts that compete in some way for a company's resources - a firm can select one or another but not both. Independent projects, on the other hand, do not compete for the firm's resources. A company can select one or the other or both, so long as <span>minimum profitability thresholds are met. <span><body><html>

Original toplevel document

Subject 2. Basic Principles of Capital BudgetingIn a non-conventional cash flow pattern, the initial outflow can be followed by inflows and/or outflows. <span>Some project interactions: Independent versus mutually exclusive projects. Mutually exclusive projects are investments that compete in some way for a company's resources - a firm can select one or another but not both. Independent projects, on the other hand, do not compete for the firm's resources. A company can select one or the other or both, so long as minimum profitability thresholds are met. Project sequencing. How does one sequence multiple projects over time, since investing in project B may depend on the result of investing in project A? Unlimited funds versus capital rationing. Capital rationing occurs when management places a constraint on the size of the firm's capital budget during a particular period. In such situations, capital is scarce and should be allocated to the projects most likely to maximize the firm's aggregate NPV. The firm's capital budget and cost of capital must be determined simultaneously to best allocate the firm's capital. On the other hand, a firm can raise the funds it wants for all profitable projects simply by paying the required rate of return. Learning Outcome Statements b. describe the basic principles of capital budgeting; c. explain how the evaluat

Flashcard 1438952590604

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

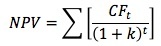

NPV formula explained

where CF t is the expected cash flow at period t, k is the project's cost of capital, and n is its life. Cash outflows are treated as negative cash flows since they represent expenditures of the company to fund the projec

Flashcard 1438977232140

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itdy>NPV measures the dollar benefit of the project to shareholders. However, it does not measure the rate of return of the project, and thus cannot provide "safety margin" information. Safety margin refers to how much the project return could fall in percentage terms before the invested capital is at risk.<body><html>

Original toplevel document

Subject 3. Investment Decision Criteriaon that capital. If a firm takes on a project with a positive NPV, the position of the stockholders is improved. Decision rules: The higher the NPV, the better. Reject if NPV is less than or equal to 0. <span>NPV measures the dollar benefit of the project to shareholders. However, it does not measure the rate of return of the project, and thus cannot provide "safety margin" information. Safety margin refers to how much the project return could fall in percentage terms before the invested capital is at risk. Assuming the cost of capital for the firm is 10%, calculate each cash flow by dividing the cash flow by (1 + k) t where k is the cost of capital and t is the year number.

Flashcard 1439256415500

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itInterest rates are negotiable, and are usually floating and lower than fixed rates.

Original toplevel document

Government-Assisted Foreign Buyer Financing (Eximbank USA)g may not be available in certain countries and certain terms for U.S. government policy reasons (for more information, see the Country Limitation Schedule posted on the Bank’s Web site, www.exim.gov, under the “Apply” section). <span>Key Features of Ex-Im Bank Loan Guarantees Loans are made by commercial banks and repayment of these loans is guaranteed by Ex-Im Bank. Guaranteed loans cover 100 percent of the principal and interest for 85 percent of the U.S. contract price. Interest rates are negotiable, and are usually floating and lower than fixed rates. Guaranteed loans are fully transferable, can be securitized and are available in certain foreign currencies. Guaranteed loans have a faster documentation process with the assistance of commercial banks. There are no U.S. vessel shipping requirements for amounts less than $20 million. Key Features of Ex-Im Bank Direct Loans Fixed-rate loans are provided directly to creditworthy foreign buyers. Direct loans supp

Flashcard 1441803144460

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe shorter the payback period, the greater the project's liquidity, the lower the risk, and the better the project.

Original toplevel document

Subject 3. Investment Decision Criteriay to recover the initial investment, not how much money you can make during the life of the project. It does not consider the time value of money. Therefore, the cost of capital is not reflected in the cash flows or calculations. <span>Discounted Payback Period This is similar to the regular payback method except that it discounts cash flows at the project's cost of capital. It considers the time value of money, but it ignores cash flows beyond the payback period. Again, assume the cost of capital for the firm is 10%: Discounted PaybackA = 2 + (1000 - 682 - 289)/113 = 2.26 years Discounted PaybackB = 3 + (1000 - 91 - 207 - 338)/512 = 3.71 years The payback provides an indication of a project's risk and liquidity because it shows how long the invested capital will be tied up in a project and "at risk." The shorter the payback period, the greater the project's liquidity, the lower the risk, and the better the project. The payback is often used as one indicator of a project's risk. Average Accounting Rate of Return (not required) This is a very simple rate of return: Its only advantage is that

Flashcard 1442165951756

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe payback provides an indication of a project's risk and liquidity because it shows how long the invested capital will be tied up in a project and "at risk."

Original toplevel document

Subject 3. Investment Decision Criteriay to recover the initial investment, not how much money you can make during the life of the project. It does not consider the time value of money. Therefore, the cost of capital is not reflected in the cash flows or calculations. <span>Discounted Payback Period This is similar to the regular payback method except that it discounts cash flows at the project's cost of capital. It considers the time value of money, but it ignores cash flows beyond the payback period. Again, assume the cost of capital for the firm is 10%: Discounted PaybackA = 2 + (1000 - 682 - 289)/113 = 2.26 years Discounted PaybackB = 3 + (1000 - 91 - 207 - 338)/512 = 3.71 years The payback provides an indication of a project's risk and liquidity because it shows how long the invested capital will be tied up in a project and "at risk." The shorter the payback period, the greater the project's liquidity, the lower the risk, and the better the project. The payback is often used as one indicator of a project's risk. Average Accounting Rate of Return (not required) This is a very simple rate of return: Its only advantage is that

Flashcard 1442680540428

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itPayback period is the expected number of years required to recover the original investment.

Original toplevel document

Subject 3. Investment Decision Criteria) 4 = 0 Since it is difficult to determine by hand, the use of a financial calculator is needed to solve for IRR. The IRR for Project A is 18.32% and for Project B is 15.03%. Payback Period <span>This is the expected number of years required to recover the original investment. Payback occurs when the cumulative net cash flow equals 0. Decision rules: The shorter the payback period, the better. A firm should establish a benchmark payb

Flashcard 1453118590220

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itHere are the steps. Open a book, find an article, consult your favorite poet. Find an excerpt about 400 words long, preferably with dialogue from different characters. The more exciting and emotional the excerpt the better. Read the excerpt out loud. Scream parts of it loudly, while exaggerating whispers in other parts. Use different and zany voices for different characters. Exaggerate any emotion you see in the excerpt tenfold – insane laughter, boiling rage, confusion, joy, etc.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1455394262284

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itHalf of your mastery of power comes from what you do not do, what you do not allow yourself to get dragged into. For this skill you must learn to judge all things by what they cost you. As Nietzsche wrote, “The value of a thing sometimes lies not in what one attains with it, but in what one pays for it —what it costs us.”

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1456855977228

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLove and affection are potentially destructive, in that they blind you to the often self-serving interests of those whom you least suspect of playing a power game.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1464682548492

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThere’s a simple reason to focus on the bookends – that’s where people get their impression of you.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1478478400780

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIn summary, gross profit is the amount of revenue available after subtracting the costs of delivering goods or services.

Original toplevel document

2. COMPONENTS AND FORMAT OF THE INCOME STATEMENTand merchandising companies, gross profit is a relevant item and is calculated as revenue minus the cost of the goods that were sold. For service companies, gross profit is calculated as revenue minus the cost of services that were provided. <span>In summary, gross profit is the amount of revenue available after subtracting the costs of delivering goods or services. Other expenses related to running the business are subtracted after gross profit. Another important subtotal which may be shown on the income statement is operating profit

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Backgrounds

;p>, and <div> elements have different background colors: Example h1 { background-color: green; } div { background-color: lightblue; } p { background-color: yellow; } Try it Yourself » <span>Background Image The background-image property specifies an image to use as the background of an element. By default, the image is repeated so it covers the entire element. The background image for a page can be set like this: Example body { background-image: url("paper.gif"); } Try it Yourself » Below is an example of a bad combination of text and background image. The text is hardly readable: Example body { background-image: url("bgdesert.jpg"); } Try it Your

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Backgrounds

} Try it Yourself » Below is an example of a bad combination of text and background image. The text is hardly readable: Example body { background-image: url("bgdesert.jpg"); } Try it Yourself » <span>Note: When using a background image, use an image that does not disturb the text. Background Image - Repeat Horizontally or Vertically By default, the background-image property repeats an image both horizontally and vertically. Some images should be repeated only hor

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Backgrounds

d image. The text is hardly readable: Example body { background-image: url("bgdesert.jpg"); } Try it Yourself » Note: When using a background image, use an image that does not disturb the text. <span>Background Image - Repeat Horizontally or Vertically By default, the background-image property repeats an image both horizontally and vertically. Some images should be repeated only horizontally or vertically, or they will look strange, like this: Example body { background-image: url("gradient_bg.png"); } Try it Yourself » If the image above is repeated only horizontally (background-repeat: repeat-x;), the background will look better: Example body { background-image: url("gradient_bg.png"); background-repeat: repeat-x; } Try it Yourself » Tip: To repeat an image vertically, set background-repeat: repeat-y; Background Image - Set position and no-repeat Showing the background image only once is also specified by the background-repeat property: Example body { background-image: url("img_tree.

Flashcard 3621696965900

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLiverpool Football Club was formed on 15 March 1892 following a disagreement between the directors of Everton Football Club and its president, John Houlding , who owned the club's ground, Anfield . A dispute over rent resulted in Everton

Original toplevel document

History of Liverpool F.C. (1892–1959) - Wikipediarpool Football Club from 1892 to 1959 covers the period from the club's foundation, through their first period of success from 1900 to the 1920s, to the appointment of Bill Shankly as manager . <span>Liverpool Football Club was formed on 15 March 1892 following a disagreement between the directors of Everton Football Club and its president, John Houlding , who owned the club's ground, Anfield . A dispute over rent resulted in Everton moving to Goodison Park , which left Houlding with an empty stadium. Thus, he founded Liverpool F.C., and they joined the Lancashire League . After winning the league title in their first season , Liverpool were accepted into the Football League for the 1893–94 season , following the resignations of Accrington and Bootle .

Flashcard 3621698014476

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLiverpool Football Club was formed on 15 March 1892 following a disagreement between the directors of Everton Football Club and its president, John Houlding , who owned the club's ground, Anfield . A dispute over rent resulted in Everton moving to Goodison Park , which left Houlding with an empty stadium. Thus, he founded Liverpool F.C., an

Original toplevel document

History of Liverpool F.C. (1892–1959) - Wikipediarpool Football Club from 1892 to 1959 covers the period from the club's foundation, through their first period of success from 1900 to the 1920s, to the appointment of Bill Shankly as manager . <span>Liverpool Football Club was formed on 15 March 1892 following a disagreement between the directors of Everton Football Club and its president, John Houlding , who owned the club's ground, Anfield . A dispute over rent resulted in Everton moving to Goodison Park , which left Houlding with an empty stadium. Thus, he founded Liverpool F.C., and they joined the Lancashire League . After winning the league title in their first season , Liverpool were accepted into the Football League for the 1893–94 season , following the resignations of Accrington and Bootle .

Flashcard 3621699063052

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open ited the club's ground, Anfield . A dispute over rent resulted in Everton moving to Goodison Park , which left Houlding with an empty stadium. Thus, he founded Liverpool F.C., and they joined the <span>Lancashire League <span>

Original toplevel document

History of Liverpool F.C. (1892–1959) - Wikipediarpool Football Club from 1892 to 1959 covers the period from the club's foundation, through their first period of success from 1900 to the 1920s, to the appointment of Bill Shankly as manager . <span>Liverpool Football Club was formed on 15 March 1892 following a disagreement between the directors of Everton Football Club and its president, John Houlding , who owned the club's ground, Anfield . A dispute over rent resulted in Everton moving to Goodison Park , which left Houlding with an empty stadium. Thus, he founded Liverpool F.C., and they joined the Lancashire League . After winning the league title in their first season , Liverpool were accepted into the Football League for the 1893–94 season , following the resignations of Accrington and Bootle .

Flashcard 3621700635916

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLiverpool were accepted into the Football League for the 1893–94 season ,

Original toplevel document

History of Liverpool F.C. (1892–1959) - Wikipediaing to Goodison Park , which left Houlding with an empty stadium. Thus, he founded Liverpool F.C., and they joined the Lancashire League . After winning the league title in their first season , <span>Liverpool were accepted into the Football League for the 1893–94 season , following the resignations of Accrington and Bootle . The appointment of Tom Watson as the club's manager in 1896 led to the club's first period of sustained success. Liverpool consolid

Flashcard 3621725015308

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Backgrounds

will look better: Example body { background-image: url("gradient_bg.png"); background-repeat: repeat-x; } Try it Yourself » Tip: To repeat an image vertically, set background-repeat: repeat-y; <span>Background Image - Set position and no-repeat Showing the background image only once is also specified by the background-repeat property: Example body { background-image: url("img_tree.png"); background-repeat: no-repeat; } Try it Yourself » In the example above, the background image is shown in the same place as the text. We want to change the position of the image, so that it does not disturb the text too much. The position of the image is specified by the background-position property: Example body { background-image: url("img_tree.png"); background-repeat: no-repeat; background-position: right top; } Try it Yourself » Background Image - Fixed position To specify that the background image should be fixed (will not scroll with the rest of the page), use the background-attachment prope

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Backgrounds

e image is specified by the background-position property: Example body { background-image: url("img_tree.png"); background-repeat: no-repeat; background-position: right top; } Try it Yourself » <span>Background Image - Fixed position To specify that the background image should be fixed (will not scroll with the rest of the page), use the background-attachment property: Example body { background-image: url("img_tree.png"); background-repeat: no-repeat; background-position: right top; background-attachment: fixed; } Try it Yourself » Background - Shorthand property To shorten the code, it is also possible to specify all the background properties in one single property. This is called a shorthand pr

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Backgrounds

ground-attachment property: Example body { background-image: url("img_tree.png"); background-repeat: no-repeat; background-position: right top; background-attachment: fixed; } Try it Yourself » <span>Background - Shorthand property To shorten the code, it is also possible to specify all the background properties in one single property. This is called a shorthand property. The shorthand property for background is background: Example body { background: #ffffff url("img_tree.png") no-repeat right top; } Try it Yourself » When using the shorthand property the order of the property values is: background-color background-image background-repeat background-attachment background-position It does not matter if one of the property values is missing, as long as the other ones are in this order. Test Yourself with Exercises! Exercise 1 » Exercise 2 » Exercise 3 » Exercise 4 » Exercise 5 » All CSS Background Properties Property Description background Sets all the background prop

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Borders

SS Functions CSS Reference Aural CSS Web Safe Fonts CSS Animatable CSS Units CSS PX-EM Converter CSS Colors CSS Color Values CSS Default Values CSS Browser Support CSS Borders ❮ Previous Next ❯ <span>CSS Border Properties The CSS border properties allow you to specify the style, width, and color of an element's border. I have borders on all sides. I have a red bottom border. I have rounded borders. I have a blue left border. Border Style The border-style property specifies what kind of border to displ

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Borders

r properties allow you to specify the style, width, and color of an element's border. I have borders on all sides. I have a red bottom border. I have rounded borders. I have a blue left border. <span>Border Style The border-style property specifies what kind of border to display. The following values are allowed: dotted - Defines a dotted border dashed - Defines a dashed border solid - Defines a solid border double - Defines a double border groove - Defines a 3D grooved border. The effect depends on the border-color value ridge - Defines a 3D ridged border. The effect depends on the border-color value inset - Defines a 3D inset border. The effect depends on the border-color value outset - Defines a 3D outset border. The effect depends on the border-color value none - Defines no border hidden - Defines a hidden border The border-style property can have from one to four values (for the top border, right border, bottom border, and the left border). Example p.dotted {border-style: dotted;} p.dashed {border-style: dashed;} p.solid {border-style: solid;} p.double {border-style: double;} p.groove {border-style: groove;} p.ridge {border-style: ridge;} p.inset {border-style: inset;} p.outset {border-style: outset;} p.none {border-style: none;} p.hidden {border-style: hidden;} p.mix {border-style: dotted dashed solid double;} Result: A dotted border. A dashed border. A solid border. A double border. A groove border. The effect depends on the border-color value. A ridge border. The effect depends on the borde

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Borders

lue. An inset border. The effect depends on the border-color value. An outset border. The effect depends on the border-color value. No border. A hidden border. A mixed border. Try it Yourself » <span>Note: None of the OTHER CSS border properties described below will have ANY effect unless the border-style property is set! Border Width The border-width property specifies the width of the four borders. The width can be set as a specific size (in px, pt, cm, em, etc) or by using one of the three pre-defined

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Borders

value. No border. A hidden border. A mixed border. Try it Yourself » Note: None of the OTHER CSS border properties described below will have ANY effect unless the border-style property is set! <span>Border Width The border-width property specifies the width of the four borders. The width can be set as a specific size (in px, pt, cm, em, etc) or by using one of the three pre-defined values: thin, medium, or thick. The border-width property can have from one to four values (for the top border, right border, bottom border, and the left border). 5px border-width Example p.one { border-style: solid; border-width: 5px; } p.two { border-style: solid; border-width: medium; } p.three { border-style: solid; border-width: 2px 10px 4px 20px; } Try it Yourself » Border Color The border-color property is used to set the color of the four borders. The color can be set by: name - specify a color name, like "red" Hex - specify a h

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Borders

xample p.one { border-style: solid; border-width: 5px; } p.two { border-style: solid; border-width: medium; } p.three { border-style: solid; border-width: 2px 10px 4px 20px; } Try it Yourself » <span>Border Color The border-color property is used to set the color of the four borders. The color can be set by: name - specify a color name, like "red" Hex - specify a hex value, like "#ff0000" RGB - specify a RGB value, like "rgb(255,0,0)" transparent The border-color property can have from one to four values (for the top border, right border, bottom border, and the left border). If border-color is not set, it inherits the color of the element. Red border Example p.one { border-style: solid; border-color: red; } p.two { border-style: solid; border-color: green; } p.three { border-style: solid; border-color: red green blue yellow; } Try it Yourself » Border - Individual Sides From the examples above you have seen that it is possible to specify a different border for each side. In CSS, there are also properties for

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Borders

ple p.one { border-style: solid; border-color: red; } p.two { border-style: solid; border-color: green; } p.three { border-style: solid; border-color: red green blue yellow; } Try it Yourself » <span>Border - Individual Sides From the examples above you have seen that it is possible to specify a different border for each side. In CSS, there are also properties for specifying each of the borders (top, right, bottom, and left): Different Border Styles Example p { border-top-style: dotted; border-right-style: solid; border-bottom-style: dotted; border-left-style: solid; } Try it Yourself » The example above gives the same result as this: Example p { border-style: dotted solid; } Try it Yourself » So, here is how it works: If the border-style property has four values: border-style: dotted solid double dashed; top border is dotted right border is solid bottom border is double left border is dashed If the border-style property has three values: border-style: dotted solid double; top border is dotted right and left borders are solid bottom border is double If the border-style property has two values: border-style: dotted solid; top and bottom borders are dotted right and left borders are solid If the border-style property has one value: border-style: dotted; all four borders are dotted The border-style property is used in the example above. However, it also works with border-width and border-color. Border - Shorthand Property As you can see from the examples above, there are many properties to consider when dealing with borders. To shorten the code, it is also possible to specify

Flashcard 3622192155916

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

CSS Borders

solid red; background-color: lightgrey; } Result: Some text Try it Yourself » Bottom Border p { border-bottom: 6px solid red; background-color: lightgrey; } Result: Some text Try it Yourself » <span>Rounded Borders The border-radius property is used to add rounded borders to an element: Normal border Round border Rounder border Roundest border Example p { border: 2px solid red; border-radius: 5px; } Try it Yourself » Note: The border-radius property is not supported in IE8 and earlier versions. More Examples All the top border properties in one declaration This example demonstrates a shorthand property for setting all of the properties for the top border in one declaration. Se

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |