Edited, memorised or added to reading queue

on 23-Oct-2017 (Mon)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1441821756684

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIf the company can invest elsewhere and earn a return of r, or if the company can repay its sources of capital and save a cost of r, then r is the company’s opportunity cost of funds.

Original toplevel document

3. BASIC PRINCIPLES OF CAPITAL BUDGETINGhe “required rate of return.” The required rate of return is the discount rate that investors should require given the riskiness of the project. This discount rate is frequently called the “opportunity cost of funds” or the “cost of capital.” <span>If the company can invest elsewhere and earn a return of r, or if the company can repay its sources of capital and save a cost of r, then r is the company’s opportunity cost of funds. If the company cannot earn more than its opportunity cost of funds on an investment, it should not undertake that investment. Unless an investment earns more than the cost of funds from

Flashcard 1446783094028

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor.

Original toplevel document

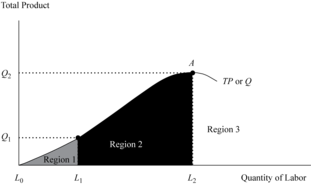

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1446908661004

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe firm would want to avoid Region 3 because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”.

Original toplevel document

Open itrate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. <span>The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. <span><body><html>

Flashcard 1448307199244

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA company that generates positive cash flow from operations has more flexibility in funding needed for investments and taking advantage of attractive business opportunities than an otherwise comparable company without positive operating cash flow.

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISd to earn that income. Overall, profit (or loss) equals income minus expenses, and its recognition is mostly independent from when cash is received or paid. Example 1 illustrates the distinction between profit and cash flow. <span>EXAMPLE 1 Profit versus Cash Flow Sennett Designs (SD) sells furniture on a retail basis. SD began operations during December 2009 and sold furniture for €250,000 in cash. The furniture sold by SD was purchased on credit for €150,000 and delivered by the supplier during December. The credit terms granted by the supplier required SD to pay the €150,000 in January for the furniture it received during December. In addition to the purchase and sale of furniture, in December, SD paid €20,000 in cash for rent and salaries. How much is SD’s profit for December 2009 if no other transactions occurred? How much is SD’s cash flow for December 2009? If SD purchases and sells exactly the same amount in January 2010 as it did in December and under the same terms (receiving cash for the sales and making purchases on credit that will be due in February), how much will the company’s profit and cash flow be for the month of January? Solution to 1: SD’s profit for December 2009 is the excess of the sales price (€250,000) over the cost of the goods that were sold (€150,000) and rent and salaries (€20,000), or €80,000. Solution to 2: The December 2009 cash flow is €230,000, the amount of cash received from the customer (€250,000) less the cash paid for rent and salaries (€20,000). Solution to 3: SD’s profit for January 2010 will be identical to its profit in December: €80,000, calculated as the sales price (€250,000) minus the cost of the goods that were sold (€150,000) and minus rent and salaries (€20,000). SD’s cash flow in January 2010 will also equal €80,000, calculated as the amount of cash received from the customer (€250,000) minus the cash paid for rent and salaries (€20,000) and minus the €150,000 that SD owes for the goods it had purchased on credit in the prior month. Although profitability is important, so is a company’s ability to generate positive cash flow. Cash flow is important because, ultimately, the company needs cash to pay employees, suppliers, and others in order to continue as a going concern. A company that generates positive cash flow from operations has more flexibility in funding needed for investments and taking advantage of attractive business opportunities than an otherwise comparable company without positive operating cash flow. Additionally, a company needs cash to pay returns (interest and dividends) to providers of debt and equity capital. Therefore, the expected magnitude of future cash flows is important in valuing corporate securities and in determining the company’s ability to meet its obligations. The ability to meet short-term obligations is generally referred to as liquidity , and the ability to meet long-term obligations is generally referred to as solvency . Cash flow in any given period is not, however, a complete measure of performance for that period because, as shown in Example 1, a company may be obligated to make future cash payments as a result of a transaction that generates positive cash flow in the current period. Profits may provide useful information about cash flows, past and future. If the transaction of Example 1 were repeated month after month, the long-term average monthly cas

Flashcard 1448650607884

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLiquidity refers to the "nearness to cash" of assets and liabilities, or having enough cash available to pay debts when they are due.

Original toplevel document

Subject 2. Major Financial Statementscreditors. Equity ownership is the owner's investments and the total earnings retained from the commencement of the company. Equity represents the source of financing provided to the company by the owners. <span>Cash Flow Statement The primary purpose of the cash flow statement is to provide information about a company's cash receipts and cash payments during a period. It reports the cash receipts and cash outflows classified according to operating, investment, and financing activities. The cash flow statement is useful because it provides answers to the following simple yet important questions: Where did the cash come from during the period? What was the cash used for during the period? What was the change in the cash balance during the period? The statement's value is that it helps users evaluate liquidity, solvency, and financial flexibility. Liquidity refers to the "nearness to cash" of assets and liabilities, or having enough cash available to pay debts when they are due. Solvency refers to the company's ability to pay its debts as they mature. Cash flows reflect the company's liquidity and long-term solvency. Financial flexibility refers to a company's ability to respond and adapt to financial adversity and unexpected needs and opportunities. For example, cash flow information can be used to evaluate the effects of major investment and financing decisions. The details of income statements, balance sheets and cash flow statements will be covered in Study Session 8. Statement of Changes in Owners' Equity This statement reports the amounts and sources of changes in equity from capital transactions with owners.

Flashcard 1450723380492

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

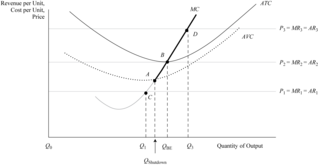

Open itIn the short run, a business is capable of operating in a loss situation as long as it covers its variable costs even though it is not earning sufficient revenue to cover all fixed cost obligations.

Original toplevel document

Open itiable cost (any output below Q shutdown ), which corresponds to point A in Exhibit 17. Shutdown is defined as a situation in which the firm stops production but still confronts the payment of fixed costs in the short run as a business entity. <span>In the short run, a business is capable of operating in a loss situation as long as it covers its variable costs even though it is not earning sufficient revenue to cover all fixed cost obligations. If variable costs cannot be covered in the short run (P < AVC), the firm will shut down operations and simply absorb the unavoidable fixed costs. This problem occurs at output Q 1 ,

Flashcard 1451615718668

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1474349108492

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itReading and evaluating financial statements includes reading the notes and understanding what operating decisions have been made that affect reported financial statements (for example, leasing versus purchasing equipment).

Original toplevel document

4.3. Process Datag statistical analyses, such as regressions or Monte Carlo simulations; performing equity valuation; performing sensitivity analyses; or using any other analytical tools or combination of tools that are available and appropriate for the task. <span>A comprehensive financial analysis at this stage would include the following: Reading and evaluating financial statements for each company being analyzed. This includes reading the notes and understanding what accounting standards have been used (for example, IFRS or US GAAP), what accounting choices have been made (for example, when to report revenue on the income statement), and what operating decisions have been made that affect reported financial statements (for example, leasing versus purchasing equipment). Making any needed adjustments to the financial statements to facilitate comparison when the unadjusted statements of the subject companies reflect differences in accounting standards, accounting choices, or operating decisions. Note that commonly used databases do not make such analyst adjustments. Preparing or collecting common-size financial statement data (which scale data to directly reflect percentages [e.g., of sales] or changes [e.g., from the prior year]) and financial ratios (which are measures of various aspects of corporate performance based on financial statement elements). On the basis of common-size financial statements and financial ratios, analysts can evaluate a company’s relative profitability, liquidity, leverage, efficiency, and valuation in relation to past results and/or peers’ results. <span><body><html>

Flashcard 1602979499276

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 1. Components and Format of the Balance Sheet

le column. Balance Sheet Components Current Assets These are cash and other assets expected to be converted into cash, sold, or consumed either in one year or in the operating cycle, whichever is longer. <span>The operating cycle is the average time between the acquisition of materials and supplies and the realization of cash through sales of the product for which the materials and supplies were acquired. The cycle operates from cash through inventory, production, and receivables back to cash. Where there are several operating cycles within one year, the one-year period is used. If the o

le column. Balance Sheet Components Current Assets These are cash and other assets expected to be converted into cash, sold, or consumed either in one year or in the operating cycle, whichever is longer. <span>The operating cycle is the average time between the acquisition of materials and supplies and the realization of cash through sales of the product for which the materials and supplies were acquired. The cycle operates from cash through inventory, production, and receivables back to cash. Where there are several operating cycles within one year, the one-year period is used. If the o

Flashcard 1619929206028

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Percentage of completion steps to report

Step 1: Current Cost= Divides el costo acumulado en ese año y lo divides entre el costo estimado total y lo multiplicas por 100. Ese porcentaje lo multiplicas por el costo estimado Step 2: Current Revenue: divides el costo acumulado en ese año, lo divides entre el costo estimado total y lo multiplicas por el precio del contrato. Step 3:Profit=current revenue-Current cost

Flashcard 1706272623884

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe role of financial reporting is to provide information about a company's financial position and performance for use by parties both internal and external to the company.

Original toplevel document

Subject 1. The Roles of Financial Reporting and Financial Statement AnalysisThe role of financial reporting is to provide information about a company's financial position and performance for use by parties both internal and external to the company. Financial statements are issued by management, who is responsible for their form and content. The role of financial statement analysis, on the other hand, is to take these

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1706416540940

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIf the company can invest elsewhere and earn a return of r, or if the company can repay its sources of capital and save a cost of r, then r is the company’s opportunity cost of funds.

Original toplevel document

3. BASIC PRINCIPLES OF CAPITAL BUDGETINGhe “required rate of return.” The required rate of return is the discount rate that investors should require given the riskiness of the project. This discount rate is frequently called the “opportunity cost of funds” or the “cost of capital.” <span>If the company can invest elsewhere and earn a return of r, or if the company can repay its sources of capital and save a cost of r, then r is the company’s opportunity cost of funds. If the company cannot earn more than its opportunity cost of funds on an investment, it should not undertake that investment. Unless an investment earns more than the cost of funds from

Flashcard 1706419424524

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFinancial statements are issued by management, who is responsible for their form and content.

Original toplevel document

Subject 1. The Roles of Financial Reporting and Financial Statement AnalysisThe role of financial reporting is to provide information about a company's financial position and performance for use by parties both internal and external to the company. Financial statements are issued by management, who is responsible for their form and content. The role of financial statement analysis, on the other hand, is to take these financial statements and other information to evaluate the company's past, current, and prosp

Flashcard 1706423094540

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLiquidity refers to the "nearness to cash" of assets and liabilities, or having enough cash available to pay debts when they are due.

Original toplevel document

Subject 2. Major Financial Statementscreditors. Equity ownership is the owner's investments and the total earnings retained from the commencement of the company. Equity represents the source of financing provided to the company by the owners. <span>Cash Flow Statement The primary purpose of the cash flow statement is to provide information about a company's cash receipts and cash payments during a period. It reports the cash receipts and cash outflows classified according to operating, investment, and financing activities. The cash flow statement is useful because it provides answers to the following simple yet important questions: Where did the cash come from during the period? What was the cash used for during the period? What was the change in the cash balance during the period? The statement's value is that it helps users evaluate liquidity, solvency, and financial flexibility. Liquidity refers to the "nearness to cash" of assets and liabilities, or having enough cash available to pay debts when they are due. Solvency refers to the company's ability to pay its debts as they mature. Cash flows reflect the company's liquidity and long-term solvency. Financial flexibility refers to a company's ability to respond and adapt to financial adversity and unexpected needs and opportunities. For example, cash flow information can be used to evaluate the effects of major investment and financing decisions. The details of income statements, balance sheets and cash flow statements will be covered in Study Session 8. Statement of Changes in Owners' Equity This statement reports the amounts and sources of changes in equity from capital transactions with owners.

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

O Pensador – Wikipédia, a enciclopédia livre

, conforme o livro de estilo. Encontre fontes: Google (notícias, livros e acadêmico) O Pensador Le Penseur [imagelink] Autor Auguste Rodin Data 1904 Técnica Escultura em bronze Altura 186 Localização Museu Rodin, Paris, França <span>O Pensador (francês: Le Penseur) é uma das mais famosas esculturas de bronze do escultor francês Auguste Rodin. Retrata um homem em meditação soberba, lutando com uma poderosa força interna. Originalmente chamado de O Poeta, a peça era parte de uma comissão do Museu de Arte Decorativa em Paris para criar um portal monumental baseada na Divina Comédia, de Dante Alighieri.

Flashcard 1706526641420

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itO Pensador é uma das mais famosas esculturas de bronze do escultor francês Auguste Rodin. Retrata um homem em meditação soberba, lutando com uma poderosa força interna.

Original toplevel document

O Pensador – Wikipédia, a enciclopédia livre, conforme o livro de estilo. Encontre fontes: Google (notícias, livros e acadêmico) O Pensador Le Penseur [imagelink] Autor Auguste Rodin Data 1904 Técnica Escultura em bronze Altura 186 Localização Museu Rodin, Paris, França <span>O Pensador (francês: Le Penseur) é uma das mais famosas esculturas de bronze do escultor francês Auguste Rodin. Retrata um homem em meditação soberba, lutando com uma poderosa força interna. Originalmente chamado de O Poeta, a peça era parte de uma comissão do Museu de Arte Decorativa em Paris para criar um portal monumental baseada na Divina Comédia, de Dante Alighieri.

Flashcard 1706529000716

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itO Pensador é uma das mais famosas esculturas de bronze do escultor francês Auguste Rodin. Retrata um homem em meditação soberba, lutando com uma poderosa força interna.

Original toplevel document

O Pensador – Wikipédia, a enciclopédia livre, conforme o livro de estilo. Encontre fontes: Google (notícias, livros e acadêmico) O Pensador Le Penseur [imagelink] Autor Auguste Rodin Data 1904 Técnica Escultura em bronze Altura 186 Localização Museu Rodin, Paris, França <span>O Pensador (francês: Le Penseur) é uma das mais famosas esculturas de bronze do escultor francês Auguste Rodin. Retrata um homem em meditação soberba, lutando com uma poderosa força interna. Originalmente chamado de O Poeta, a peça era parte de uma comissão do Museu de Arte Decorativa em Paris para criar um portal monumental baseada na Divina Comédia, de Dante Alighieri.

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Diotima de Mantineia – Wikipédia, a enciclopédia livre

ção, pesquisa Diotima de Mantineia Pré-socráticos Nome completo Διοτίμα Data de nascimento: Não disponível Local: Não disponível Trabalhos notáveis Papel relevante no 'Banquete (Symposion) de Platão. Foi influenciado: Platão <span>Diotima de Mantinea (em grego antigo: Διοτίμα) é uma filósofa e sacerdotisa grega com um papel importante no Banquete (Symposion) de Platão. A filosofia de Diotima está na origem do conceito platônico de amor. A única fonte sobre ela é o próprio Platão e por isso não é possível assegurar se era uma personagem ou alguém que de fato tenha existido. Entretanto, praticamente todos os personagens

Flashcard 1706536078604

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itDiotima de Mantinea é uma filósofa e sacerdotisa grega com um papel importante no Banquete de Platão. A filosofia de Diotima está na origem do conceito platônico de amor. </s

Original toplevel document

Diotima de Mantineia – Wikipédia, a enciclopédia livreção, pesquisa Diotima de Mantineia Pré-socráticos Nome completo Διοτίμα Data de nascimento: Não disponível Local: Não disponível Trabalhos notáveis Papel relevante no 'Banquete (Symposion) de Platão. Foi influenciado: Platão <span>Diotima de Mantinea (em grego antigo: Διοτίμα) é uma filósofa e sacerdotisa grega com um papel importante no Banquete (Symposion) de Platão. A filosofia de Diotima está na origem do conceito platônico de amor. A única fonte sobre ela é o próprio Platão e por isso não é possível assegurar se era uma personagem ou alguém que de fato tenha existido. Entretanto, praticamente todos os personagens

Flashcard 1706538437900

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itDiotima de Mantinea é uma filósofa e sacerdotisa grega com um papel importante no Banquete de Platão. A filosofia de Diotima está na origem do conceito platônico de amor.

Original toplevel document

Diotima de Mantineia – Wikipédia, a enciclopédia livreção, pesquisa Diotima de Mantineia Pré-socráticos Nome completo Διοτίμα Data de nascimento: Não disponível Local: Não disponível Trabalhos notáveis Papel relevante no 'Banquete (Symposion) de Platão. Foi influenciado: Platão <span>Diotima de Mantinea (em grego antigo: Διοτίμα) é uma filósofa e sacerdotisa grega com um papel importante no Banquete (Symposion) de Platão. A filosofia de Diotima está na origem do conceito platônico de amor. A única fonte sobre ela é o próprio Platão e por isso não é possível assegurar se era uma personagem ou alguém que de fato tenha existido. Entretanto, praticamente todos os personagens

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |