Edited, memorised or added to reading queue

on 01-Feb-2018 (Thu)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1430838971660

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itrs, he replies, “I like them both, but sausages and a book by Shakespeare are so different that I cannot compare the two baskets.” Determine whether Bomber is obeying all the axioms of preference theory. Solution: <span>Smith is violating the assumption of complete preferences. <span><body><html>

Original toplevel document

3. UTILITY THEORY: MODELING PREFERENCES AND TASTESat analysis, we shall model the willingness of the investor to trade off between increased investment returns and increased certainty, which is the absence of risk. EXAMPLE 1 Axioms Concerning Preferences <span>Helen Smith enjoys, among other things, eating sausages. She also enjoys reading Marcel Proust. Smith is confronted with two baskets: Basket A, which contains several other goods and a package of sausages, and B, which contains identical quantities of the other goods as Basket A, but instead of the sausages, it contains a book by Proust. When asked which basket she prefers, she replies, “I like them both, but sausages and a book by Proust are so different that I simply cannot compare the two baskets.” Determine whether Smith is obeying all the axioms of preference theory. Solution: Smith is violating the assumption of complete preferences. This assumption states that a consumer must be able to compare any two baskets of goods, either preferring one to the other or being indifferent between the two. If she complies with th

Flashcard 1433091050764

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1435003653388

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itEl Signo de Raíz es v 7 llamado signo radical, y bajo este signo se co loca la cantidad a la cual se le extrae la raíz. Así, \T á equivale a raíz cuadrada de a, o sea, la cantidad que elevada al cuadrado reproduce la can tidad a; W

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1448341802252

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open it2nd part In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Extending credit to a customer. Examining compliance with debt covenants or other contractual arrangements. Assigning a debt rating to a company or bond issue. Valuing a

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISing, and financing decisions but do not necessarily rely on analysis of related financial statements. They have access to additional financial information that can be reported in whatever format is most useful to their decision.) <span>In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Evaluating an equity investment for inclusion in a portfolio. Evaluating a merger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. Extending credit to a customer. Examining compliance with debt covenants or other contractual arrangements. Assigning a debt rating to a company or bond issue. Valuing a security for making an investment recommendation to others. Forecasting future net income and cash flow. These decisions demonstrate certain themes in financial analysis. In general, analysts seek to examine the past and current performance and financial position of a

Flashcard 1448346258700

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itmerger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the <span>creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. <span><body><html>

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISing, and financing decisions but do not necessarily rely on analysis of related financial statements. They have access to additional financial information that can be reported in whatever format is most useful to their decision.) <span>In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Evaluating an equity investment for inclusion in a portfolio. Evaluating a merger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. Extending credit to a customer. Examining compliance with debt covenants or other contractual arrangements. Assigning a debt rating to a company or bond issue. Valuing a security for making an investment recommendation to others. Forecasting future net income and cash flow. These decisions demonstrate certain themes in financial analysis. In general, analysts seek to examine the past and current performance and financial position of a

Flashcard 1451171122444

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itConversation tactics are like the background music in a television scene. When they’re there, you don’t notice that everything is flowing smoothly. But when they’re gone, you notice (sometimes immediately)

Original toplevel document

Open itConversation tactics are like the background music in a television scene. When they’re there, you don’t notice that everything is flowing smoothly. But when they’re gone, you notice (sometimes immediately)

Flashcard 1465038802188

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itPART I: USE DECOYED OBJECTS OF DESIRE AND RED HERRINGS TO THROW PEOPLE OFF THE SCENT If at any point in the deception you practice people have the slightest suspicion as to your intentions, all is lost. Do not give them the

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1469137423628

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe most common way to estimate the average risk required rate of return is to calculate the marginal cost of each of the various sources of capital and then calculate a weighted average of these costs. This weighted average is referred to as the weighted average cost of capital (WACC).

Original toplevel document

2. COST OF CAPITALn the cost of capital for the entire company (later we will address how to adjust that for specific projects). The cost of capital of a company is the required rate of return that investors demand for the average-risk investment of a company. <span>The most common way to estimate this required rate of return is to calculate the marginal cost of each of the various sources of capital and then calculate a weighted average of these costs. This weighted average is referred to as the weighted average cost of capital (WACC). The WACC is also referred to as the marginal cost of capital (MCC) because it is the cost that a company incurs for additional capital. The weights in this weighted average are the prop

Flashcard 1474084867340

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itn the United States, the SEC requires listed companies to provide an MD&A and specifies the content.

Original toplevel document

3.1.6. Management Commentary or Management’s Discussion and Analysiscontent elements include 1) the nature of the business; 2) management’s objectives and strategies; 3) the company’s significant resources, risks, and relationships; 4) results of operations; and 5) critical performance measures. I<span>n the United States, the SEC requires listed companies to provide an MD&A and specifies the content.7 Management must highlight any favorable or unfavorable trends and identify significant events and uncertainties that affect the company’s liquidity, capital resources, and results of o

Flashcard 1477041065228

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itNothing is stable in the realm of power, and even the closest of friends can be transformed into the worst of enemies.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1478422039820

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itExpenses reflect outflows, depletions of assets, and incurrences of liabilities in the course of the activities of a business.

Original toplevel document

2. COMPONENTS AND FORMAT OF THE INCOME STATEMENThereas Kraft lists the years in decreasing order with the most recent year listed in the left-most column. Different orderings of chronological information are common. Differences in presentations of items, such as expenses, are also common. <span>Expenses reflect outflows, depletions of assets, and incurrences of liabilities in the course of the activities of a business. Expenses may be grouped and reported in different formats, subject to some specific requirements. For example, Danone reports research and development expenses as a separate line item w

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

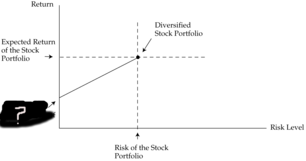

Reading 40 Risk Management: An Introduction Intro

Risk—and risk management—is an inescapable part of economic activity. People generally manage their affairs in order to be as happy and secure as their environment and resources will allow. But regardless of how carefully these affairs are managed, there is risk because the outcome, whether good or bad, is seldom predictable with complete certainty. There is risk inherent in nearly everything we do, but this reading will focus on economic and financial risk, particularly as it relates to investment management. All businesses and investors manage risk, whether consciously or not, in the choices they make. At its core, business and investing are about allocating resources and capital to chosen risks. In their decision process, within an environment of uncertainty, these entities may take steps to avoid some risks, pursue the risks that provide the highest rewards, and measure and mitigate their exposure to these risks as necessary. Risk management processes and tools make difficult business and financial problems easier to address in an uncertain world. Risk is not just a matter of fate; it is something that organizations can actively control with their decisions, within a risk management framework. Risk is an integral part of the business or investment process. Even in the earliest models of modern portfolio theory, such as mean–variance portfolio optimization and the capital asset pricing model, investment return is linked directly to risk but requires that risk be managed optimally. Proper identification and measurement of risk, and keeping risks aligned with the goals of the enterprise, are key factors in managing businesses and investments. Good risk management results in a higher chance of a preferred outcome—more value for the company or portfolio or more utility for the individual. Portfolio managers need to be familiar with risk management not only to improve the portfolio’s risk–return outcome, but also because of two other ways in which they use risk management at an enterprise level. First, they help to manage their own companies that have their own enterprise risk issues. Second, many portfolio assets are claims on companies that have risks. Portfolio managers need to evaluate the companies’ risks and how those companies are addressing them. This reading takes a broad approach that addresses both the risk management of enterprises in general and portfolio risk management. The principles underlying portfolio risk management are generally applicable to the risk management of financial and non-financial institutions as well. The concept of risk management is also relevant to individuals. Although many large entities formally practice risk management, most individuals practice it more informally and some practice it haphazardly, oftentimes responding to risk events after they occur. Although many individuals do take reasonable precautions against unwanted risks, these precautions are often against obvious risks, such as sticking a wet hand into an electrical socket or swallowing poison. The more subtle risks are often ignored. Many individuals simply do not view risk management as a formal, systematic process that would help them achieve not only their financial goals but also the ultimate end result of happiness, or maximum utility as economists like to call it, but they should. Although the primary focus of this reading is on institutions, we will also cover risk management as it applies to individuals. We will show that many common themes underlie risk management—themes that are applicable to both organizations and individuals. Although often viewed as defensive, risk management is a valuable offensive weapon in the manager’s arsenal. In the quest for preferred outcomes, such as higher profit, returns, or share price, management does not usually get to choose the outcomes but does choose the risks it takes in pursuit of those outcomes. The choice of which risks to undertake through the allocation of its scarce resources is the key tool available to management. An organization with a comprehensive risk management culture in place, in which risk is integral to every key strategy and decision, should perform better in the long-term, in good times and bad, as a result of better decision making. The fact that all businesses and investors engage in risky activities (i.e., activities with uncertain outcomes) raises a number of important questions. The questions that this reading will address include the following: What is risk management, and why is it important? What risks does an organization (or individual) face in pursuing its objectives? How are an entity’s goals affected by risk, and how does it make risk management decisions to produce better results? How does risk governance guide the risk management process and risk budgeting to integrate an organization’s goals with its activities? How does an organization measure and evaluate the risks it faces, and what tools does it have to address these risks? The answers to these questions collectively help to define the process of risk management. This reading is organized along the lines of these questions. Section 2 describes the risk management process, and Section 3 discusses risk governance and risk tolerance. Section 4 cove

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itms take up less than a megabyte of space and lack even a full-screen editor, whereas others require gigabytes of space and are based entirely on graphical windowing systems. A more common definition, and the one that we usually follow, is that <span>the operating system is the one program running at all times on the computer—usually called the kernel. (Along with the kernel, there are two other types of programs: system programs, which are associated with the operating system but are not necessarily part of the kernel, and application programs, which include all programs not associated with the operation of the system.) <span><body><html>

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itIdeally, we want the programs and data to reside in main memory permanently. This arrangement usually is not possible for the following two reasons: 1. Main memory is usually too small to store all needed programs and data permanently. 2. Main memory is a volatile storage device that loses its contents when power is turned off or otherwise lost. Thus, most computer systems provide secondary storage as an extension of main memory. The main requirement for secondary storage is that it be able to hold large quantities of data perm

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itre all needed programs and data permanently. 2. Main memory is a volatile storage device that loses its contents when power is turned off or otherwise lost. Thus, most computer systems provide secondary storage as an extension of main memory. <span>The main requirement for secondary storage is that it be able to hold large quantities of data permanently. The most common secondary-storage device is a magnetic disk, which provides storage for both programs and data. Most programs (system and application) are stored on a disk until they ar

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itension of main memory. The main requirement for secondary storage is that it be able to hold large quantities of data permanently. The most common secondary-storage device is a magnetic disk, which provides storage for both programs and data. <span>Most programs (system and application) are stored on a disk until they are loaded into memory. Many programs then use the disk as both the source and the destination of their processing. Hence, the proper management of disk storage is of central importance to a computer system, <span><body><html>

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1741521292556

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA general-purpose computer system consists of CPUs and multiple device controllers that are connected through a common bus. Each device controller is in charge of a specific type of device. Depending on the controller, more than one

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itA device controller maintains some local buffer storage and a set of special-purpose registers. The device controller is responsible for moving the data between the peripheral devices that it controls and its local buffer storage. Typically, operating systems have a device driver

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itA device controller maintains some local buffer storage and a set of special-purpose registers. The device controller is responsible for moving the data between the peripheral devices that it controls and its local buffer storage. Typically, operating systems have a device driver for each device controller. This device driver understands the device controller and provides the rest of the operating system with a

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1741529681164

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe device controller is responsible for moving data between the peripheral devices that it controls and its local buffer storage

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1741531254028

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itof special-purpose registers. The device controller is responsible for moving the data between the peripheral devices that it controls and its local buffer storage. Typically, operating systems have a device driver for each device controller. <span>This device driver understands the device controller and provides the rest of the operating system with a uniform interface to the device. To start an I/O operation, the device driver loads the appropriate registers within the device controller. The device controller, in turn, examines th

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itits local buffer storage. Typically, operating systems have a device driver for each device controller. This device driver understands the device controller and provides the rest of the operating system with a uniform interface to the device. <span>To start an I/O operation, the device driver loads the appropriate registers within the device controller. The device controller, in turn, examines the contents of these registers to determine what action to take (such as “read a character from the keyboard”). The controller starts the transfer of data from the device to its local buffer. Once the transfer of data is complete, the device controller informs the device driver via an interrupt that it has finished its operation. The device driver then returns control to the operating system, possibly returning the data or a pointer to the data if the operation was a read. For other operations, the device driver returns status information. This form of interrupt-driven I/O

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

igor in mathematics in the nineteenth century, mathematicians attempted to put integral calculus on a firm foundation. The Riemann integral—proposed by Bernhard Riemann (1826–1866)—is a broadly successful attempt to provide such a foundation. <span>Riemann's definition starts with the construction of a sequence of easily calculated areas that converge to the integral of a given function. This definition is successful in the sense that it gives the expected answer for many already-solved problems, and gives useful results for many other problems. However, Riemann integ

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

e of easily calculated areas that converge to the integral of a given function. This definition is successful in the sense that it gives the expected answer for many already-solved problems, and gives useful results for many other problems. <span>However, Riemann integration does not interact well with taking limits of sequences of functions, making such limiting processes difficult to analyze. This is important, for instance, in the study of Fourier series, Fourier transforms, and other topics. The Lebesgue integral is bet

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

. After I have taken all the money out of my pocket I order the bills and coins according to identical values and then I pay the several heaps one after the other to the creditor. This is my integral. — Source: (Siegmund-Schultze 2008) <span>The insight is that one should be able to rearrange the values of a function freely, while preserving the value of the integral. This process of rearrangement can convert a very pathological function into one that is "nice" from the point of view of integration, and thus let such pathological functions

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

es, Fourier transforms, and other topics. The Lebesgue integral is better able to describe how and when it is possible to take limits under the integral sign (via the powerful monotone convergence theorem and dominated convergence theorem). <span>While the Riemann integral considers the area under a curve as made out of vertical rectangles, the Lebesgue definition considers horizontal slabs that are not necessarily just rectangles, and so it is more flexible. For this reason, the Lebesgue definition makes it possible to calculate integrals for a broader class of functions. For example, the Dirichlet function, which is 0 where its argument is

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

a useful abstraction of the notion of length of subsets of the real line—and, more generally, area and volume of subsets of Euclidean spaces. In particular, it provided a systematic answer to the question of which subsets of ℝ have a length. <span>As later set theory developments showed (see non-measurable set), it is actually impossible to assign a length to all subsets of ℝ in a way that preserves some natural additivity and translation invariance properties. This suggests that picking out a suitable class of measurable subsets is an essential prerequisite. The Riemann integral uses the notion of length explicitly. Indeed, the element of calculation for the Riemann integral is the rectangle [a, b] × [c, d], whose area is calculated to be

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

∈ R . {\displaystyle \{x\,\mid \,f(x)>t\}\in X\quad \forall t\in \mathbb {R} .} We can show that this is equivalent to requiring that the pre-image of any Borel subset of ℝ be in X. <span>The set of measurable functions is closed under algebraic operations, but more importantly it is closed under various kinds of point-wise sequential limits: sup k ∈ N f

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Measurable function - Wikipedia

Measurable function - Wikipedia Measurable function From Wikipedia, the free encyclopedia Jump to: navigation, search In mathematics and in particular measure theory, a measurable function is a function between two measurable spaces such that the preimage of any measurable set is measurable, analogously to the definition that a function between topological spaces is continuous if the preimage of each open set is open. In real analysis, measurable functions are used in the

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

lly impossible to assign a length to all subsets of ℝ in a way that preserves some natural additivity and translation invariance properties. This suggests that picking out a suitable class of measurable subsets is an essential prerequisite. <span>The Riemann integral uses the notion of length explicitly. Indeed, the element of calculation for the Riemann integral is the rectangle [a, b] × [c, d], whose area is calculated to be (b − a)(d − c). The quantity b − a is the length of the base

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

. {\displaystyle \int \left(\sum _{k}a_{k}1_{S_{k}}\right)\,\mathrm {d} \mu =\sum _{k}a_{k}\int 1_{S_{k}}\,d\mu =\sum _{k}a_{k}\,\mu (S_{k}).} The convention 0 × ∞ = 0 must be used, and the result may be infinite. <span>Even if a simple function can be written in many ways as a linear combination of indicator functions, the integral is always the same. This can be shown using the additivity property of measures. Some care is needed when defining the integral of a real-valued simple function, to avoid the undefined expression ∞ − ∞: one assumes that the representation

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

| = f + + f − . {\displaystyle |f|=f^{+}+f^{-}.\quad } <span>We say that the Lebesgue integral of the measurable function f exists, or is defined if at least one of ∫ f + d μ {\displaystyle \int f^{+}\,\mathrm {d} \mu } and ∫ f − d μ {\displaystyle \int f^{-}\,\mathrm {d} \mu } is finite: min ( ∫ f +

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

μ < ∞ , {\displaystyle \int |f|\,\mathrm {d} \mu <\infty ,} we say that f is Lebesgue integrable. It turns out that this definition gives the desirable properties of the integral. <span>Complex valued functions can be similarly integrated, by considering the real part and the imaginary part separately. If h=f+ig for real-valued integrable functions f, g, then the integral of h is defined by ∫ h d μ

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Lebesgue integration - Wikipedia

1 ] ) = 0 , {\displaystyle \int _{[0,1]}1_{\mathbf {Q} }\,\mathrm {d} \mu =\mu (\mathbf {Q} \cap [0,1])=0,} because Q is countable. Domain of integration[edit source] <span>A technical issue in Lebesgue integration is that the domain of integration is defined as a set (a subset of a measure space), with no notion of orientation. In elementary calculus, one defines integration with respect to an orientation: ∫ b a

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itby the company’s actual economic activities and the resulting financial condition. The term “earnings quality” is commonly used in practice and will be used broadly to encompass the quality of earnings, cash flow, and/or balance sheet items. <span>High-quality earnings result from activities that a company will likely be able to sustain in the future and provide a sufficient return on the company’s investment. The concepts of earnings quality and financial reporting quality are interrelated because a correct assessment of earnings quality is possible only when there is some basic level of financial reporting quality. Beyond this basic level, as the quality of reporting increases, the ability of financial statement users to correctly assess earnings quality and to develop expectations for future performance arguably also increases. <span><body><html>

Original toplevel document

Reading 32 Financial Reporting Quality IntroductionIdeally, analysts would always have access to financial reports that are based on sound financial reporting standards, such as those from the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB), and are free from manipulation. But, in practice, the quality of financial reports can vary greatly. High-quality financial reporting provides information that is useful to analysts in assessing a company’s performance and prospects. Low-quality financial reporting contains inaccurate, misleading, or incomplete information. Extreme lapses in financial reporting quality have given rise to high-profile scandals that resulted not only in investor losses but also in reduced confidence in the financial system. Financial statement users who were able to accurately assess financial reporting quality were better positioned to avoid losses. These lapses illustrate the challenges analysts face as well as the potential costs of failing to recognize practices that result in misleading or inaccurate financial reports.1Examples of misreporting can provide an analyst with insight into various signals that may indicate poor-quality financial reports. It is important to be aware, however, that high-profile financial scandals reflect only those instances of misreporting that were identified. Although no one can know the extent of undetected misreporting, some research suggests that it is relatively widespread. An Ernst & Young 2013 survey of more than 3,000 board members, executives, managers, and other employees in 36 countries across Europe, the Middle East, India, and Africa indicates that 20% of the respondents had seen manipulation (such as overstated sales and understated costs) occurring in their own companies, and 42% of board directors and senior managers were aware of some type of irregular financial reporting in their own companies (Ernst & Young, 2013). Another survey of 169 chief financial officers of public US companies found that they believed, on average, that “in any given period, about 20% of companies manage earnings to misrepresent economic performance, and for such companies 10% of EPS [earnings per share] is typically managed” (Dichev, Graham, Harvey, and Rajgopal, 2013). This reading addresses financial reporting quality, which pertains to the quality of information in financial reports, including disclosures in notes. High-quality reporting provides decision-useful information, which is relevant and faithfully represents the economic reality of the company’s activities during the reporting period as well as the company’s financial condition at the end of the period. A separate but interrelated attribute of quality is quality of reported results or earnings quality, which pertains to the earnings and cash generated by the company’s actual economic activities and the resulting financial condition. The term “earnings quality” is commonly used in practice and will be used broadly to encompass the quality of earnings, cash flow, and/or balance sheet items. High-quality earnings result from activities that a company will likely be able to sustain in the future and provide a sufficient return on the company’s investment. The concepts of earnings quality and financial reporting quality are interrelated because a correct assessment of earnings quality is possible only when there is some basic level of financial reporting quality. Beyond this basic level, as the quality of reporting increases, the ability of financial statement users to correctly assess earnings quality and to develop expectations for future performance arguably also increases. Section 2 provides a conceptual overview of reporting quality. Section 3 discusses motivations that might cause, and conditions that might enable, management to issue finan

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

and

and  is finite:

is finite: