Edited, memorised or added to reading queue

on 22-Dec-2016 (Thu)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1427366087948

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itDe acuerdo con información de Bloomberg, tras el triunfo de Donald Trump, el bono referencial a 10 años del gobierno mexicano alcanzó un rendimiento de hasta 7.48 por ciento, un máximo desde 2011, para después recuperarse tras llamar la atención de algunos administradores. En promedio, la curva de rendimiento de México se elevó 113 puntos base en

Original toplevel document

Sube interés por bonos mexicanosnta para los administradores activos”, dijo Avi Hooper, quien administra fondos para Invesco Advisers. “Nos vimos frente a la oportunidad de comprar bonos a niveles que no habíamos visto desde principio de año”. <span>De acuerdo con información de Bloomberg, tras el triunfo de Donald Trump, el bono referencial a 10 años del gobierno mexicano alcanzó un rendimiento de hasta 7.48 por ciento, un máximo desde 2011, para después recuperarse tras llamar la atención de algunos administradores. En promedio, la curva de rendimiento de México se elevó 113 puntos base en las dos semanas posteriores a las elecciones y recuperaron 23puntos en las siguientes dos semanas. Esta es una pequeña victoria para los fondos mutuos tradicionales, quienes han luchado por los clientes contra ETFs de bajo costo, y que muestra el beneficio potencial de pag

Flashcard 1428084362508

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAristóteles destacó al derecho natural como la facultad o sentimiento de lo justo y lo injusto, reputándolo como una característica esencial y específica del ser humano que lo distinguía de las otras especies naturales

Original toplevel document

1.3.1 Leyes naturalesyes naturales son el Derecho natural, teóricamente es el conjunto de las normas que los hombres deducen de la intimidad, de su propia conciencia y que estiman como expresión de la justicia en un momento histórico determinado.5 <span>Aristóteles destacó al derecho natural como la facultad o sentimiento de lo justo y lo injusto, reputándolo como una característica esencial y específica del ser humano que lo distinguía de las otras especies naturales.6 La distinción del Derecho con el Derecho natural es que el primero es creado de acuerdo con el comportamiento del hombre y sancionado por el Estado, y el segundo es el d

Flashcard 1428100877580

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAutonomía: Estas normas son creadas por la conciencia misma del individuo que habrá de obedecerlas, con el fin de regular su propia conducta, por ejemplo: bañarse todos los días e ir al trabajo.

Original toplevel document

1.3.3.1 Clasificación de las normasxigido al individuo aún en contra de su voluntad e incluso con el uso de la fuerza, por ejemplo: si el padre niega dar alimento a sus hijos menores de edad, la norma jurídica lo sanciona y le ordena cumplir con esa obligación. <span>Autonomía: Estas normas son creadas por la conciencia misma del individuo que habrá de obedecerlas, con el fin de regular su propia conducta, por ejemplo: bañarse todos los días e ir al trabajo. Heteronomía: Son las reglas que enfrenta una persona, provienen del medio externo, es decir, son creadas por entidades distintas al destinatario de la norma, ejemplo:

Flashcard 1428199443724

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itSometimes markets really do use auctions to arrive at equilibrium price. Auctions can be categorized into two types depending on whether the value of the item being sold is the same for each bidder or is unique to each bidder.

Original toplevel document

3.8. Auctions as a Way to Find Equilibrium PriceSometimes markets really do use auctions to arrive at equilibrium price. Auctions can be categorized into two types depending on whether the value of the item being sold is the same for each bidder or is unique to each bidder. The first case is called a common value auction in which there is some actual common value that will ultimately be revealed after the auction is settled. Prior to the auction’s settle

Flashcard 1428870794508

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIniciativa, el derecho de iniciar leyes, conforme al artículo 71 de nuestra Constitución Política de los Estados Unidos Mexicanos, le compete al Presidente de la República, a los Diputados y Senadores, al Congreso de la Unión y a las Legislaturas de los Estados.

Original toplevel document

2.1 CLASIFICACIÓN DE LAS FUENTES DEL DERECHOso mediante el cual los órganos del Estado, (el Congreso de la Unión, que se conforma por la Cámara de Diputados y Cámara de Senadores), crean las normas jurídicas generales, abstractas y obligatorias que integrarán la ley. <span>En nuestro sistema mexicano existen seis etapas para la creación de una ley, a saber: iniciativa, discusión, aprobación, sanción, publicación e iniciación de la vigencia. Al hablar del proceso legislativo surge la idea de un procedimiento que ha de seguirse para la creación de las leyes federales o locales, acto que en nuestra Constitución se consigna en los artículos 71 y 72, que a continuación se explican: a) Iniciativa, el derecho de iniciar leyes, conforme al artículo 71 de nuestra Constitución Política de los Estados Unidos Mexicanos, le compete al Presidente de la República, a los Diputados y Senadores, al Congreso de la Unión y a las Legislaturas de los Estados. Las iniciativas presentadas por el Presidente de la República, por las Legislaturas de los Estados o por las Diputaciones de los mismos, pasarán desde luego a comisión. Las que presentaren los diputados o los senadores, se sujetarán a los trámites que designe el Reglamento de Debates. La iniciativa de ley es un proyecto que se presenta al Poder Legislativo para éste lo estudie, analice y, en su caso, siguiendo el proceso que señala la Constitución Política de los Estados Unidos Mexicanos, se convierta en ley; a la Cámara que primero recibe el proyecto de ley se le llama Cámara de Origen. b) Discusión es el acto por el cual las Cámaras deliberan acerca de las iniciativas, a fin de determinar si deben o no ser aprobadas,11 debaten sobre la proposición que se les ha hecho, exponiendo los puntos de vista que existan a favor o en contra de ella y formulando los puntos de vista que consideran pertinentes para el perfeccionamiento del proyecto. Una vez que la iniciativa de ley ha sido estudiada, discutida y revisada por la Cámara de Origen, si se considera que es prudente, se procede al siguiente paso del proceso legislativo: la aprobación. c) Aprobación, aquí los integrantes de la Cámara de Origen dan su autorización a la iniciativa para que ésta se convierta en ley, una vez aprobada la iniciativa, se envía a la otra Cámara, a cual se denomina Cámara Revisora, para que ésta también la discuta. La aprobación pude ser total o parcial, la primera de ellas se da cuando aceptan que la iniciativa, una vez discutida y analizada, fue autoriza por la Cámara de Origen para que se apruebe la ley; la segunda, se da cuando la iniciativa de ley tiene observaciones, por tal motivo elaborarán la propuesta de reformas o adiciones que se consideren pertinentes y sea discutida nuevamente. d) Sanción, una vez que la iniciativa de ley ha sido aprobada por las dos Cámaras, se debe enviar el Ejecutivo para que éste ordene su publicación, y es el acto por el cual el Presidente de la República manifiesta, mediante su firma, la aprobación del proyecto de ley que le envían las Cámaras, a este hecho se le llama sanción Sin embargo, el Presidente de la República puede hacer observaciones, y en este caso, la devolverá a la Cámara de Origen, en donde será discutido de nuevo, y su fuere confirmado por las dos terceras partes del número total de votos de la Cámara de Origen, y pasará otra vez a la Cámara Revisora, en la cual se analizarán las observaciones, y si la iniciativa también fuere confirmada por la misma mayoría, el proyecto se declarará y será enviado al Ejecutivo para su promulgación; así, en caso de que las observaciones sean aceptadas, el procedimiento será el mismo para el caso de la revisión. A la facultad que tiene el Presidente de la República para hacer observaciones o rechazar iniciativas de ley aprobadas por las Cámaras, se le denomina derecho de veto. El Ejecutivo dispone de un término de 10 días hábiles para ejercer el derecho de veto, pues se entiende que si pasado ese término sin que devuelva el proyecto de ley a su Cámara de Origen, éste ha sido aceptado por el Ejecutivo, si se da el caso de que en ese término concluyan o se suspendan las sesiones del Congreso, la devolución deberá hacerse el primer día hábil en que el Congreso reinicie sus sesiones. f) Promulgación, una vez que el proyecto de ley ha sido aceptado por el Poder Ejecutivo, se procede a la promulgación, que es la aprobación expresa del Ejecutivo, donde se manifiesta la orden de publicación y que se ejecute dicha ley. 32 g) Publicación, una vez que la ley fue promulgada, ésta debe ser puesta en conocimiento de la población. Se publica en el Diario Oficial de la Federación, que es el medio de comunicación que utilizan las autoridades federales para dar a conocer a la población las resoluciones administrativas, las leyes y otros avisos de importancia general. Respecto a la publicación de las leyes que emiten los Estados, éstas se realizan por medio de la Gaceta de Gobierno del Estado. h) Iniciación de la vigencia, aquí es donde la ley empieza a tener fuerza obligatoria para toda la población. En México, existen dos sistemas para que inicie la vigencia de una ley, a saber: El sucesivo consiste en que la ley entra en vigor tres días después de la publicación en el Diario Oficial de la Federación, en los lugares en los cuales no se publiquen el diario oficial, se dará un día más por cada 40 kilómetros o fracción que exceda la mitad de distancia entre el lugar de publicación y el sitio donde habrá de iniciarse la vigencia. Este sistema está considerado en el artículo 3 del Código Civil Federal, y es utilizada en el caso de que la ley no establezca la fecha en que entrará en vigor. El sincrónico es cuando la propia ley señala el día que iniciará su vigencia, en este caso, entrará en vigor en todos los lugares de su aplicación en la fecha establecida, esto lo señala el artículo 4 del Código Civil Federal. 2.1.3.2 La costumbre Es la regulación de la conducta surgida espontáneamente de un grupo social y de observancia voluntaria para quienes lo constituy

Flashcard 1429051411724

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itWords are categorized by their relationship to being and to each other.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1429150240012

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe trivium, in itself a tool or a skill, has become associated with its most appropriate subject matter—the languages, oratory, literature, history, philosophy.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1430501330188

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open ittwo goods whose cross-price elasticity of demand is negative are defined to be complements . Typically, these goods would tend to be consumed together as a pair, such as gasoline and automobiles or houses and furniture

Original toplevel document

4.4. Cross-price Elasticity of Demand: Substitutes and Complementseer. When the price of one of your favorite brands of beer rises, what would you do? You would probably buy less of that brand and more of a cheaper brand, so the cross-price elasticity of demand would be positive. Alternatively, <span>two goods whose cross-price elasticity of demand is negative are defined to be complements . Typically, these goods would tend to be consumed together as a pair, such as gasoline and automobiles or houses and furniture. When automobile prices fall, we might expect the quantity of autos demanded to rise, and thus we might expect to see a rise in the demand for gasoline. Ultimately, though, whether two

Flashcard 1430709472524

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

2. CONSUMER THEORY: FROM PREFERENCES TO DEMAND FUNCTIONS

consumer, also known as consumer choice theory. Consumer choice theory can be defined as the branch of microeconomics that relates consumer demand curves to consumer preferences. Consumer choice theory begins with a fundamental model of how <span>consumer preferences and tastes might be represented. It explores consumers’ willingness to trade off between two goods (or two baskets of goods), both of which the consumer finds beneficial. Consumer choice theory th

consumer, also known as consumer choice theory. Consumer choice theory can be defined as the branch of microeconomics that relates consumer demand curves to consumer preferences. Consumer choice theory begins with a fundamental model of how <span>consumer preferences and tastes might be represented. It explores consumers’ willingness to trade off between two goods (or two baskets of goods), both of which the consumer finds beneficial. Consumer choice theory th

Flashcard 1431900917004

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1432292297996

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itn>Bulk purchasing, portioned delivery . Blue Apron built its model on the idea of reducing food waste. At each fulfilment center, workers on assembly lines pack boxes with poultry, meat, vegetables and condiments to be delivered anywhere from <span>1-7 days later. Purchasing in bulk allows the company to negotiate prices with farmers, who are happy to receive a slightly lower price for a guaranteed volume. By only offering 6 recipes per we

Original toplevel document

Blue Apron: Fixing the Food Delivery Supply Chain – Technology and Operations Managementlity ingredients. On the recipe cards, they provide an information sheet that highlights the farms which provided the produce alongside information about how to cut and cook. Click here to view a video featuring Blue Apron’s Ghee Supplier. <span>Blue Apron aligns its operating model with its business model through: Control of the supply chain . Blue Apron’s model centers on delivering fresh ingredients. To maintain control of quality, the company manages its own distribution channel. The company sources farms differently for each of their three regional fulfilment centers, so the food is local and fresh and the delivery costs are low. The boxes are delivered in refrigerated boxes to maintain freshness, however, so delivery is outsourced to the cheapest partner for a given shipment. Bulk purchasing, portioned delivery . Blue Apron built its model on the idea of reducing food waste. At each fulfilment center, workers on assembly lines pack boxes with poultry, meat, vegetables and condiments to be delivered anywhere from 1-7 days later. Purchasing in bulk allows the company to negotiate prices with farmers, who are happy to receive a slightly lower price for a guaranteed volume. By only offering 6 recipes per week, Blue Apron can allocate the ingredients in a way that reduces food waste. Everything subscribers receive is pre-measured to the precise proportions the recipe requires, meaning less spending on unnecessary produce and less food waste. Data analytics . As a subscription business, Blue Apron collects data on its customers that allows for predictive modeling of demand. They built an internal suite of tools that manage the workflow of purchasing, fulfilment operations, ecommerce and order processing, shipping software, customer service software 6 . The software can estimate how many customers will cancel an order in any given week, for example, which allows the company to plan meals based on the expected availability and price of certain crops. Using this data helps create processes that improve operational efficiency and lower costs, supporting the $10 per meal price. Supporting Suppliers. There is a team at Blue Apron responsible for negotiating with farms to source ingredients, but they also work closely with farmers on crop rotation and management. This allows the company to work with farmers to plan production in a way that is more seasonal, more efficient and utilizes their resources better, all of which results in higher quality crops at lower prices for consumers. Additionally, by helping farmers to plan to rotate “heavy feeder” plants with less hungry plants like legumes, the farms use less pesticide and fertilize, resulting in healthier farms. Blue Apron focuses on bringing their customers an easy way to cook through a high quality food delivery service that has never bene available at scale before. Key operational decision

Flashcard 1432695475468

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itNouns referring to human beings or animals sometimes have the same grammatical gender as their natural gender, but not always (see below).

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1432841489676

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIntelligence may be narrowly defined as the capacity to acquire knowledge and understanding, and use it in different novel situations.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1432848043276

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAlthough it is difficult to define intelligence, indeed it appears to have no formal definition, there is, nevertheless, at least one particularly apposite definition: the capacity to learn and understand.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1432890248460

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itEn las pequeñas empresas el aumento fue mayor, de 1.65 puntos, al pasar de 8.6 a 10.25 y en las medianas pasó de 6.93 a 8.66 por ciento, 1.73 puntos más.

Original toplevel document

Impacta a Pymes alza en las tasasos de la Comisión Nacional Bancaria y de Valores (CNBV) muestran que entre octubre de 2015 y el mismo mes de este año las tasas de interés para las empresas grandes se elevaron de 5.64 a 7.14 por ciento en promedio, 1.5 puntos más. <span>En las pequeñas empresas el aumento fue mayor, de 1.65 puntos, al pasar de 8.6 a 10.25 y en las medianas pasó de 6.93 a 8.66 por ciento, 1.73 puntos más. “Hablamos de incentivos o apoyos en financiamientos que requieren las empresas para convertirse en proveedoras de las cadenas globales y de un programa adicional para el fina

Flashcard 1433023417612

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open iting to pay a price higher than some seller’s lowest acceptable price, but if the two cannot find one another, there will be no transaction, resulting in a deadweight loss. The costs of matching buyers with sellers are generally referred to as <span>search costs , and they arise because of frictions inherent in the matching process. When these costs are significant, an opportunity may arise for a third party to provide a valuable service by red

Original toplevel document

3.13. Market Interference: The Negative Impact on Total Surplusium price can cause imbalances as well. In the simple model of demand and supply, it is assumed that buyers and sellers can interact without cost. Often, however, there can be costs associated with finding a buyer’s or a seller’s counterpart. <span>There could be a buyer who is willing to pay a price higher than some seller’s lowest acceptable price, but if the two cannot find one another, there will be no transaction, resulting in a deadweight loss. The costs of matching buyers with sellers are generally referred to as search costs , and they arise because of frictions inherent in the matching process. When these costs are significant, an opportunity may arise for a third party to provide a valuable service by reducing those costs. This role is played by brokers. Brokers do not actually become owners of a good or service that is being bought, but they serve the role of locating buyers for sellers or sellers for buyers. (Dealers, however, actuall

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

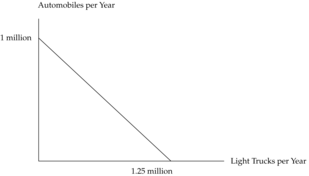

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICE

on the vertical axis, the slope is equal to –(P L /P C ) = –10/16 = –0.625. (Note: If we had chosen to measure quantity of lamb on the vertical axis, the slope would be inverted: –(P C /P L ) = −1.6.) <span>4.2. The Production Opportunity Set Companies face constraints on their production opportunities, just as consumers face limits on the bundles of goods that they can consume. Consider a company that produces two products using the same production capacity. For example, an automobile company might use the same factory to produce either automobiles or light trucks. If so, then the company is constrained by the limited capacity to produce vehicles. If it produces more trucks, it must reduce its production of automobiles; likewise, if it produces more automobiles, it must produce fewer trucks. The company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture. Such a frontier for the vehicle company might look something like that in Exhibit 9. Exhibit 9. The Production Opportunity Frontier Note: The production opportunity frontier for a vehicle manufacturer shows the maximum number of autos for any given level of truck production. In this example, the opportunity cost of a truck is 0.8 autos. There are two important things to notice about this example. First, if the company devoted its entire production facility to the manufacture of automobiles, it could produce 1 million in a year. Alternatively, if it devoted its entire plant to trucks, it could produce 1.25 million a year. Of course, it could devote only part of the year’s production to trucks, in which case it could produce automobiles during the remainder of the year. In this simple example, for every additional truck the company chooses to make, it would have to produce 0.8 fewer cars. That is, the opportunity cost of a truck is 0.8 cars, or the opportunity cost of a car is 1.25 trucks. The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. The other thing to notice about this exhibit is that it assumes the opportunity cost of a truck is independent of how many trucks (and cars) the company produces. The production opportunity frontier is linear with a constant slope. Perhaps a more realistic example would be to increase marginal opportunity cost. As more and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. 4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to exa

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itght trucks. If so, then the company is constrained by the limited capacity to produce vehicles. If it produces more trucks, it must reduce its production of automobiles; likewise, if it produces more automobiles, it must produce fewer trucks. <span>The company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture. Such a frontier for the vehicle company might look something like that in Exhibit 9. Exhibit 9. The Production Opportunity Frontier Note: The production op

Original toplevel document

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICEon the vertical axis, the slope is equal to –(P L /P C ) = –10/16 = –0.625. (Note: If we had chosen to measure quantity of lamb on the vertical axis, the slope would be inverted: –(P C /P L ) = −1.6.) <span>4.2. The Production Opportunity Set Companies face constraints on their production opportunities, just as consumers face limits on the bundles of goods that they can consume. Consider a company that produces two products using the same production capacity. For example, an automobile company might use the same factory to produce either automobiles or light trucks. If so, then the company is constrained by the limited capacity to produce vehicles. If it produces more trucks, it must reduce its production of automobiles; likewise, if it produces more automobiles, it must produce fewer trucks. The company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture. Such a frontier for the vehicle company might look something like that in Exhibit 9. Exhibit 9. The Production Opportunity Frontier Note: The production opportunity frontier for a vehicle manufacturer shows the maximum number of autos for any given level of truck production. In this example, the opportunity cost of a truck is 0.8 autos. There are two important things to notice about this example. First, if the company devoted its entire production facility to the manufacture of automobiles, it could produce 1 million in a year. Alternatively, if it devoted its entire plant to trucks, it could produce 1.25 million a year. Of course, it could devote only part of the year’s production to trucks, in which case it could produce automobiles during the remainder of the year. In this simple example, for every additional truck the company chooses to make, it would have to produce 0.8 fewer cars. That is, the opportunity cost of a truck is 0.8 cars, or the opportunity cost of a car is 1.25 trucks. The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. The other thing to notice about this exhibit is that it assumes the opportunity cost of a truck is independent of how many trucks (and cars) the company produces. The production opportunity frontier is linear with a constant slope. Perhaps a more realistic example would be to increase marginal opportunity cost. As more and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. 4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to exa

Flashcard 1433061952780

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture.

Original toplevel document

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICEon the vertical axis, the slope is equal to –(P L /P C ) = –10/16 = –0.625. (Note: If we had chosen to measure quantity of lamb on the vertical axis, the slope would be inverted: –(P C /P L ) = −1.6.) <span>4.2. The Production Opportunity Set Companies face constraints on their production opportunities, just as consumers face limits on the bundles of goods that they can consume. Consider a company that produces two products using the same production capacity. For example, an automobile company might use the same factory to produce either automobiles or light trucks. If so, then the company is constrained by the limited capacity to produce vehicles. If it produces more trucks, it must reduce its production of automobiles; likewise, if it produces more automobiles, it must produce fewer trucks. The company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture. Such a frontier for the vehicle company might look something like that in Exhibit 9. Exhibit 9. The Production Opportunity Frontier Note: The production opportunity frontier for a vehicle manufacturer shows the maximum number of autos for any given level of truck production. In this example, the opportunity cost of a truck is 0.8 autos. There are two important things to notice about this example. First, if the company devoted its entire production facility to the manufacture of automobiles, it could produce 1 million in a year. Alternatively, if it devoted its entire plant to trucks, it could produce 1.25 million a year. Of course, it could devote only part of the year’s production to trucks, in which case it could produce automobiles during the remainder of the year. In this simple example, for every additional truck the company chooses to make, it would have to produce 0.8 fewer cars. That is, the opportunity cost of a truck is 0.8 cars, or the opportunity cost of a car is 1.25 trucks. The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. The other thing to notice about this exhibit is that it assumes the opportunity cost of a truck is independent of how many trucks (and cars) the company produces. The production opportunity frontier is linear with a constant slope. Perhaps a more realistic example would be to increase marginal opportunity cost. As more and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. 4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to exa

Flashcard 1433068244236

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itinder of the year. In this simple example, for every additional truck the company chooses to make, it would have to produce 0.8 fewer cars. That is, the opportunity cost of a truck is 0.8 cars, or the opportunity cost of a car is 1.25 trucks. <span>The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. The other thing to notice about this exhibit is that it assumes the opp

Original toplevel document

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICEon the vertical axis, the slope is equal to –(P L /P C ) = –10/16 = –0.625. (Note: If we had chosen to measure quantity of lamb on the vertical axis, the slope would be inverted: –(P C /P L ) = −1.6.) <span>4.2. The Production Opportunity Set Companies face constraints on their production opportunities, just as consumers face limits on the bundles of goods that they can consume. Consider a company that produces two products using the same production capacity. For example, an automobile company might use the same factory to produce either automobiles or light trucks. If so, then the company is constrained by the limited capacity to produce vehicles. If it produces more trucks, it must reduce its production of automobiles; likewise, if it produces more automobiles, it must produce fewer trucks. The company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture. Such a frontier for the vehicle company might look something like that in Exhibit 9. Exhibit 9. The Production Opportunity Frontier Note: The production opportunity frontier for a vehicle manufacturer shows the maximum number of autos for any given level of truck production. In this example, the opportunity cost of a truck is 0.8 autos. There are two important things to notice about this example. First, if the company devoted its entire production facility to the manufacture of automobiles, it could produce 1 million in a year. Alternatively, if it devoted its entire plant to trucks, it could produce 1.25 million a year. Of course, it could devote only part of the year’s production to trucks, in which case it could produce automobiles during the remainder of the year. In this simple example, for every additional truck the company chooses to make, it would have to produce 0.8 fewer cars. That is, the opportunity cost of a truck is 0.8 cars, or the opportunity cost of a car is 1.25 trucks. The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. The other thing to notice about this exhibit is that it assumes the opportunity cost of a truck is independent of how many trucks (and cars) the company produces. The production opportunity frontier is linear with a constant slope. Perhaps a more realistic example would be to increase marginal opportunity cost. As more and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. 4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to exa

Flashcard 1433071127820

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe opportunity cost of trucks is the negative of the slope of the production opportunity frontier

Original toplevel document

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICEon the vertical axis, the slope is equal to –(P L /P C ) = –10/16 = –0.625. (Note: If we had chosen to measure quantity of lamb on the vertical axis, the slope would be inverted: –(P C /P L ) = −1.6.) <span>4.2. The Production Opportunity Set Companies face constraints on their production opportunities, just as consumers face limits on the bundles of goods that they can consume. Consider a company that produces two products using the same production capacity. For example, an automobile company might use the same factory to produce either automobiles or light trucks. If so, then the company is constrained by the limited capacity to produce vehicles. If it produces more trucks, it must reduce its production of automobiles; likewise, if it produces more automobiles, it must produce fewer trucks. The company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture. Such a frontier for the vehicle company might look something like that in Exhibit 9. Exhibit 9. The Production Opportunity Frontier Note: The production opportunity frontier for a vehicle manufacturer shows the maximum number of autos for any given level of truck production. In this example, the opportunity cost of a truck is 0.8 autos. There are two important things to notice about this example. First, if the company devoted its entire production facility to the manufacture of automobiles, it could produce 1 million in a year. Alternatively, if it devoted its entire plant to trucks, it could produce 1.25 million a year. Of course, it could devote only part of the year’s production to trucks, in which case it could produce automobiles during the remainder of the year. In this simple example, for every additional truck the company chooses to make, it would have to produce 0.8 fewer cars. That is, the opportunity cost of a truck is 0.8 cars, or the opportunity cost of a car is 1.25 trucks. The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. The other thing to notice about this exhibit is that it assumes the opportunity cost of a truck is independent of how many trucks (and cars) the company produces. The production opportunity frontier is linear with a constant slope. Perhaps a more realistic example would be to increase marginal opportunity cost. As more and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. 4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to exa

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itcost of a car is 1.25 trucks. The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. <span>The other thing to notice about this exhibit is that it assumes the opportunity cost of a truck is independent of how many trucks (and cars) the company produces. The production opportunity frontier is linear with a constant slope. Perhaps a more realistic example would be to increase marginal opportunity cost. As more and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that wou

Original toplevel document

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICEon the vertical axis, the slope is equal to –(P L /P C ) = –10/16 = –0.625. (Note: If we had chosen to measure quantity of lamb on the vertical axis, the slope would be inverted: –(P C /P L ) = −1.6.) <span>4.2. The Production Opportunity Set Companies face constraints on their production opportunities, just as consumers face limits on the bundles of goods that they can consume. Consider a company that produces two products using the same production capacity. For example, an automobile company might use the same factory to produce either automobiles or light trucks. If so, then the company is constrained by the limited capacity to produce vehicles. If it produces more trucks, it must reduce its production of automobiles; likewise, if it produces more automobiles, it must produce fewer trucks. The company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture. Such a frontier for the vehicle company might look something like that in Exhibit 9. Exhibit 9. The Production Opportunity Frontier Note: The production opportunity frontier for a vehicle manufacturer shows the maximum number of autos for any given level of truck production. In this example, the opportunity cost of a truck is 0.8 autos. There are two important things to notice about this example. First, if the company devoted its entire production facility to the manufacture of automobiles, it could produce 1 million in a year. Alternatively, if it devoted its entire plant to trucks, it could produce 1.25 million a year. Of course, it could devote only part of the year’s production to trucks, in which case it could produce automobiles during the remainder of the year. In this simple example, for every additional truck the company chooses to make, it would have to produce 0.8 fewer cars. That is, the opportunity cost of a truck is 0.8 cars, or the opportunity cost of a car is 1.25 trucks. The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. The other thing to notice about this exhibit is that it assumes the opportunity cost of a truck is independent of how many trucks (and cars) the company produces. The production opportunity frontier is linear with a constant slope. Perhaps a more realistic example would be to increase marginal opportunity cost. As more and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. 4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to exa

Flashcard 1433074273548

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itore and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. <span>In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. <span><body><html>

Original toplevel document

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICEon the vertical axis, the slope is equal to –(P L /P C ) = –10/16 = –0.625. (Note: If we had chosen to measure quantity of lamb on the vertical axis, the slope would be inverted: –(P C /P L ) = −1.6.) <span>4.2. The Production Opportunity Set Companies face constraints on their production opportunities, just as consumers face limits on the bundles of goods that they can consume. Consider a company that produces two products using the same production capacity. For example, an automobile company might use the same factory to produce either automobiles or light trucks. If so, then the company is constrained by the limited capacity to produce vehicles. If it produces more trucks, it must reduce its production of automobiles; likewise, if it produces more automobiles, it must produce fewer trucks. The company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture. Such a frontier for the vehicle company might look something like that in Exhibit 9. Exhibit 9. The Production Opportunity Frontier Note: The production opportunity frontier for a vehicle manufacturer shows the maximum number of autos for any given level of truck production. In this example, the opportunity cost of a truck is 0.8 autos. There are two important things to notice about this example. First, if the company devoted its entire production facility to the manufacture of automobiles, it could produce 1 million in a year. Alternatively, if it devoted its entire plant to trucks, it could produce 1.25 million a year. Of course, it could devote only part of the year’s production to trucks, in which case it could produce automobiles during the remainder of the year. In this simple example, for every additional truck the company chooses to make, it would have to produce 0.8 fewer cars. That is, the opportunity cost of a truck is 0.8 cars, or the opportunity cost of a car is 1.25 trucks. The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. The other thing to notice about this exhibit is that it assumes the opportunity cost of a truck is independent of how many trucks (and cars) the company produces. The production opportunity frontier is linear with a constant slope. Perhaps a more realistic example would be to increase marginal opportunity cost. As more and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. 4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to exa

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

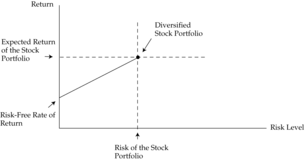

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICE

ent, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. <span>4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to examine it briefly here because we are learning about constraints on behavior. Consider possible investments in which one option might be to invest in an essentially risk-free asset, such as a US Treasury bill. There is virtually no possibility that the US government would default on a 90-day obligation to pay back an investor’s purchase price, plus interest. Alternatively, an investor could put her money into a broadly diversified index of common shares. This investment will necessarily be more risky because of the fact that share prices fluctuate. If investors inherently find risk distasteful, then they will be reluctant to invest in a risky asset unless they expect to receive, on average, a higher rate of return. Hence, it is reasonable to expect that a broadly diversified index of common shares will have an expected return that exceeds that of the risk-free asset, or else no one would hold that portfolio. Our hypothetical investor could choose to put some of her funds in the risk-free asset and the rest in the common shares index. For each additional dollar invested in the common shares index, she can expect to receive a higher return, though not with certainty; so, she is exposing herself to more risk in the pursuit of a higher return. We can structure her investment opportunities as a frontier that shows the highest expected return consistent with any given level of risk, as shown in Exhibit 10. The investor’s choice of a portfolio on the frontier will depend on her level of risk aversion. Exhibit 10. The Investment Opportunity Frontier Note: The investment opportunity frontier shows that as the investor chooses to invest a greater proportion of assets in the market portfolio, she can expect a higher return but also higher risk. <span><body><html>

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itody>4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to examine it briefly here because we are learning about constraints on behavior. Consider possible investments in which one option might be to invest in an essentially risk-free asset, such as a US Treasury bill. There is virtually no possibility that the US government would default on a 90-day obligation to pay back an investor’s purchase price, plus interest. Alternatively, an investor could put her money into a broadly diversified index of common shares. This investment will necessarily be more risky because of the fact that share prices fluctuate. If investors inherently find risk distasteful, then they will be reluctant to invest in a risky asset unless they expect to receive, on average, a higher rate of return. Hence, it is reasonable to expect that a broadly diversified index of common shares will have an expected return that exceeds that of the risk-free asset, or else no one would hold that portfolio. Our hypothetical investor could choose to put some of her funds in the risk-free asset and the rest in the common shares index. For each additional dollar invested in the c

Original toplevel document

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICEent, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. <span>4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to examine it briefly here because we are learning about constraints on behavior. Consider possible investments in which one option might be to invest in an essentially risk-free asset, such as a US Treasury bill. There is virtually no possibility that the US government would default on a 90-day obligation to pay back an investor’s purchase price, plus interest. Alternatively, an investor could put her money into a broadly diversified index of common shares. This investment will necessarily be more risky because of the fact that share prices fluctuate. If investors inherently find risk distasteful, then they will be reluctant to invest in a risky asset unless they expect to receive, on average, a higher rate of return. Hence, it is reasonable to expect that a broadly diversified index of common shares will have an expected return that exceeds that of the risk-free asset, or else no one would hold that portfolio. Our hypothetical investor could choose to put some of her funds in the risk-free asset and the rest in the common shares index. For each additional dollar invested in the common shares index, she can expect to receive a higher return, though not with certainty; so, she is exposing herself to more risk in the pursuit of a higher return. We can structure her investment opportunities as a frontier that shows the highest expected return consistent with any given level of risk, as shown in Exhibit 10. The investor’s choice of a portfolio on the frontier will depend on her level of risk aversion. Exhibit 10. The Investment Opportunity Frontier Note: The investment opportunity frontier shows that as the investor chooses to invest a greater proportion of assets in the market portfolio, she can expect a higher return but also higher risk. <span><body><html>

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1433091050764

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Article 1433092885772

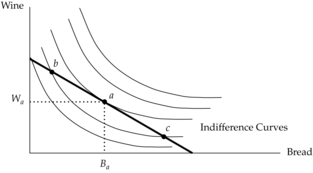

5. CONSUMER EQUILIBRIUM: MAXIMIZING UTILITY SUBJECT TO THE BUDGET CONSTRAINT

#4-3-the-investment-opportunity-set #cfa #cfa-level-1 #economics #microeconomics #reading-14-demand-and-supply-analysis-consumer-demand #section-5-consumer-equilibrium #study-session-4

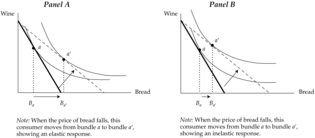

It would be wonderful if we could all consume as much of everything as we wanted, but unfortunately, most of us are constrained by income and prices. We now superimpose the budget constraint onto the preference map to model the actual choice of our consumer. This is a constrained (by the resources available to pay for consumption) optimization problem that every consumer must solve: Choose the bundle of goods and services that gets us as high on our ranking as possible, while not exceeding our budget. 5.1. Determining the Consumer’s Equilibrium Bundle of Goods In general, the consumer’s constrained optimization problem consists of maximizing utility, subject to the budget constraint. If, for simplicity, we assume there are only two goods, wine and bread, then the problem appears graphically as in Exhibit 11. Exhibit 11. Consumer Equilibrium Note: Consumer equilibrium is achieved at point a, where the highest indifference curve is attained while not violating the budget c

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

5. CONSUMER EQUILIBRIUM: MAXIMIZING UTILITY SUBJECT TO THE BUDGET CONSTRAINT

erful if we could all consume as much of everything as we wanted, but unfortunately, most of us are constrained by income and prices. We now superimpose the budget constraint onto the preference map to model the actual choice of our consumer. <span>This is a constrained (by the resources available to pay for consumption) optimization problem that every consumer must solve: Choose the bundle of goods and services that gets us as high on our ranking as possible, while not exceeding our budget. 5.1. Determining the Consumer’s Equilibrium Bundle of Goods In general, the consumer’s constrained optimization problem consists of maximizing utility,

Flashcard 1433096031500

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThis is a constrained (by the resources available to pay for consumption) optimization problem that every consumer must solve: Choose the bundle of goods and services that gets us as high on our ranking as possible, while not exceeding our budget.

Original toplevel document

5. CONSUMER EQUILIBRIUM: MAXIMIZING UTILITY SUBJECT TO THE BUDGET CONSTRAINTerful if we could all consume as much of everything as we wanted, but unfortunately, most of us are constrained by income and prices. We now superimpose the budget constraint onto the preference map to model the actual choice of our consumer. <span>This is a constrained (by the resources available to pay for consumption) optimization problem that every consumer must solve: Choose the bundle of goods and services that gets us as high on our ranking as possible, while not exceeding our budget. 5.1. Determining the Consumer’s Equilibrium Bundle of Goods In general, the consumer’s constrained optimization problem consists of maximizing utility,

Flashcard 1433101274380

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1433103109388

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

5. CONSUMER EQUILIBRIUM: MAXIMIZING UTILITY SUBJECT TO THE BUDGET CONSTRAINT

Exhibit 11. Consumer Equilibrium Note: Consumer equilibrium is achieved at point a, where the highest indifference curve is attained while not violating the budget constraint. <span>The consumer desires to reach the indifference curve that is farthest from the origin, while not violating the budget constraint. In this case, that pursuit ends at point a, where she is purchasing W a ounces of wine along with B a slices of bread per month. It is important to note that this equilibrium point re

Flashcard 1433108352268

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

5. CONSUMER EQUILIBRIUM: MAXIMIZING UTILITY SUBJECT TO THE BUDGET CONSTRAINT

on is less than the price ratio—meaning that the price for that additional unit is above her willingness to pay. Even though she could afford bundle c, it would not be the best use of her income. EXAMPLE 5 <span>Consumer Equilibrium Currently, a consumer is buying both sorbet and gelato each week. His MRS GS [marginal rate of substitution of gelato (G) for sorbet (S)] equals 0.75. The price of gelato is €1 per scoop, and the price of sorbet is €1.25 per scoop. Determine whether the consumer is currently optimizing his budget over these two desserts. Justify your answer. Explain whether the consumer should buy more sorbet or more gelato, given that he is not currently optimizing his budget. Solution to 1: In this example, the condition for consumer equilibrium is MRS GS = P G /P S . Because P G /P S = 0.8 and MRS GS = 0.75, the consumer is clearly not allocating his budget in a way that maximizes his utility, subject to his budget constraint. Solution to 2: The MRS GS is the rate at which the consumer is willing to give up sorbet to gain a small additional amount of gelato, which is 0.75 scoops of sorbet to gain one scoop of gelato. The price ratio, P G /P S (0.8), is the rate at which he must give up sorbet to gain an additional small amount of gelato. In this case, the consumer would be better off spending a little less on gelato and a little more on sorbet. 5.2. Consumer Response to Changes in Income: Normal and Inferior Goods The consumer’s behavior is constrained by his income a

Flashcard 1433116478732

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itConsumer Equilibrium Currently, a consumer is buying both sorbet and gelato each week. His MRS GS [marginal rate of substitution of gelato (G) for sorbet (S)] equals 0.75. The price of gelato is €1 per scoop, and the price of sorbet is €1.25 per scoop. Determine whether the consumer is currently optimizing his budget over these two desserts. Justify your answer. Explain whether the consumer should buy more sorbet or more gelato, given that he is not currently optimizing his budget. Solution to 1: In this example, the

Original toplevel document

5. CONSUMER EQUILIBRIUM: MAXIMIZING UTILITY SUBJECT TO THE BUDGET CONSTRAINTon is less than the price ratio—meaning that the price for that additional unit is above her willingness to pay. Even though she could afford bundle c, it would not be the best use of her income. EXAMPLE 5 <span>Consumer Equilibrium Currently, a consumer is buying both sorbet and gelato each week. His MRS GS [marginal rate of substitution of gelato (G) for sorbet (S)] equals 0.75. The price of gelato is €1 per scoop, and the price of sorbet is €1.25 per scoop. Determine whether the consumer is currently optimizing his budget over these two desserts. Justify your answer. Explain whether the consumer should buy more sorbet or more gelato, given that he is not currently optimizing his budget. Solution to 1: In this example, the condition for consumer equilibrium is MRS GS = P G /P S . Because P G /P S = 0.8 and MRS GS = 0.75, the consumer is clearly not allocating his budget in a way that maximizes his utility, subject to his budget constraint. Solution to 2: The MRS GS is the rate at which the consumer is willing to give up sorbet to gain a small additional amount of gelato, which is 0.75 scoops of sorbet to gain one scoop of gelato. The price ratio, P G /P S (0.8), is the rate at which he must give up sorbet to gain an additional small amount of gelato. In this case, the consumer would be better off spending a little less on gelato and a little more on sorbet. 5.2. Consumer Response to Changes in Income: Normal and Inferior Goods The consumer’s behavior is constrained by his income a

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1433120935180

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itMasculine nouns ending in -co or -go in the singular normally form the plural as -chi and -ghi, with the hard c, g sound, if the stress falls on the penulti- mate syllable: fuoco fuochi fire ago aghi needle buco buchi hole albèrgo albèrghi hotel

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1433123556620

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itMasculine nouns ending in -co or -go in the singular normally form the plural as -chi and -ghi, with the hard c, g sound, if the stress falls on the penulti- mate syllable: fuoco fuochi fire ago aghi needle buco buchi hole albèrgo albèrghi hotel

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1433127226636

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFeminine nouns ending in -ca, -ga form their plural in -che, -ghe, with the hard c, g sound: amica amiche friend lega leghe league

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1433130896652

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itNouns ending in -ca, -ga, which refer to either men or women, normally form their plural in -chi, -ghi for male and -che, -ghe for female (and see 1.2.4 below): collega colleague colleghi (m.) colleghe (f.) But note: belga Belgian belgi (m.) belghe (f.)

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1433135877388

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFeminine nouns ending in -cia, -gia form their plural as follows: • in -cie, -gie when the stress falls on the i , and when the last syllable is preceded by a vowel: farmacìa farmacìe pharmacy bugìa

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1433907367180

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFeminine nouns ending in -cia, -gia form their plural as follows: in -ce, -ge when the ending is preceded by a consonant: arància arànce orange spiàggia spiàgge beach provìncia

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1434793413900

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itand three endogenous variables: P x , Qdx , and Qsx . Hence, we have a system of two equations and three unknowns. We need another equation to solve this system. That equation is called the equilibrium condition , and it is simply <span>Qdx=Qsx .<span><body><html>

Original toplevel document

3.6. Market Equilibriume of the demand and supply model of this particular market. Because of that, they are called exogenous variables . Price and quantity, however, are determined within the model for this particular market and are called endogenous variables . <span>In our simple example, there are three exogenous variables (I, P y , and W) and three endogenous variables: P x , Qdx , and Qsx . Hence, we have a system of two equations and three unknowns. We need another equation to solve this system. That equation is called the equilibrium condition , and it is simply Qdx=Qsx . Continuing with our hypothetical examples, we could assume that income equals $50 (thousand, per year), the price of automobiles equals $20 (thousand, per automobile), and

Flashcard 1434812812556

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itthe seven fine arts (architecture, instrumental music, sculpture, painting, literature, t he drama, and the dance)

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1434834046220

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open iting to pay a price higher than some seller’s lowest acceptable price, but if the two cannot find one another, there will be no transaction, resulting in a deadweight loss. The costs of matching buyers with sellers are generally referred to as <span>search costs , and they arise because of frictions inherent in the matching process. When these costs are significant, an opportunity may arise for a third party to provide a valuable service by red

Original toplevel document

3.13. Market Interference: The Negative Impact on Total Surplusium price can cause imbalances as well. In the simple model of demand and supply, it is assumed that buyers and sellers can interact without cost. Often, however, there can be costs associated with finding a buyer’s or a seller’s counterpart. <span>There could be a buyer who is willing to pay a price higher than some seller’s lowest acceptable price, but if the two cannot find one another, there will be no transaction, resulting in a deadweight loss. The costs of matching buyers with sellers are generally referred to as search costs , and they arise because of frictions inherent in the matching process. When these costs are significant, an opportunity may arise for a third party to provide a valuable service by reducing those costs. This role is played by brokers. Brokers do not actually become owners of a good or service that is being bought, but they serve the role of locating buyers for sellers or sellers for buyers. (Dealers, however, actuall

Flashcard 1434843483404

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itConsumer Equilibrium Currently, a consumer is buying both sorbet and gelato each week. His MRS GS [marginal rate of substitution of gelato (G) for sorbet (S)] equals 0.75. The price of gelato is €1 per scoop, and the price of sorbet is €1.25 per scoop. Determine whether the consumer is currently optimizing his budget over these two desserts. Justify your answer. Explain whether the consumer should buy more sorbet or more gelato, given that he is not currently optimizing his budget. Solution to 1: In this example, the

Original toplevel document