Edited, memorised or added to reading queue

on 31-May-2017 (Wed)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1432235412748

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe introduction to demand and supply analysis in the previous reading basically assumed that the demand function exists, and focused on understanding its various characteristics and manifestations.

Original toplevel document

2. CONSUMER THEORY: FROM PREFERENCES TO DEMAND FUNCTIONSThe introduction to demand and supply analysis in the previous reading basically assumed that the demand function exists, and focused on understanding its various characteristics and manifestations. In this reading, we address the foundations of demand and supply analysis and seek to understand the sources of consumer demand through the theory of the consumer, also known as consume

Flashcard 1479939329292

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itBecause of better matching with the periods in which work is performed, the percentage-of-completion method is the preferred method of revenue recognition for long-term contracts and is required when the outcome can be measured reliably under both IFRS and US GAAP.

Original toplevel document

3.2.1. Long-Term Contractsimates and is thus not as objective as the completed contract method. However, an advantage of the percentage-of-completion method is that it results in better matching of revenue recognition with the accounting period in which it was earned. <span>Because of better matching with the periods in which work is performed, the percentage-of-completion method is the preferred method of revenue recognition for long-term contracts and is required when the outcome can be measured reliably under both IFRS and US GAAP. Under both IFRS and US GAAP, if a loss is expected on the contract, the loss is reported immediately, not upon completion of the contract, regardless of the method used (e.g., percentag

Flashcard 1603194719500

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 3. Financial Instruments: Financial Assets and Financial Liabilities

struments are contracts that give rise to both a financial asset of one company and a financial liability of another company. Financial instruments come in a variety of forms which include derivatives, hedges, and marketable securities. <span>Measured at fair market value: Financial assets: Financial assets held for trading. Available-for-sale financial assets. Derivatives (whether stand-alone or embedded in non-derivative instruments). Non-derivative instruments with fair value exposures hedged by derivatives. Financial liabilities: Derivatives. Financial liabilities held for trading. Non-derivative instruments with fair value exposures hedged by derivatives. &

struments are contracts that give rise to both a financial asset of one company and a financial liability of another company. Financial instruments come in a variety of forms which include derivatives, hedges, and marketable securities. <span>Measured at fair market value: Financial assets: Financial assets held for trading. Available-for-sale financial assets. Derivatives (whether stand-alone or embedded in non-derivative instruments). Non-derivative instruments with fair value exposures hedged by derivatives. Financial liabilities: Derivatives. Financial liabilities held for trading. Non-derivative instruments with fair value exposures hedged by derivatives. &

Flashcard 1603197078796

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 3. Financial Instruments: Financial Assets and Financial Liabilities

13; Financial assets held for trading. Available-for-sale financial assets. Derivatives (whether stand-alone or embedded in non-derivative instruments). Non-derivative instruments with fair value exposures hedged by derivatives. <span>Financial liabilities: Derivatives. Financial liabilities held for trading. Non-derivative instruments with fair value exposures hedged by derivatives. Measured at cost or amortized cost: Financial assets: Unlisted instruments (there is no reliable valuation measure). Held-to-maturity investments

13; Financial assets held for trading. Available-for-sale financial assets. Derivatives (whether stand-alone or embedded in non-derivative instruments). Non-derivative instruments with fair value exposures hedged by derivatives. <span>Financial liabilities: Derivatives. Financial liabilities held for trading. Non-derivative instruments with fair value exposures hedged by derivatives. Measured at cost or amortized cost: Financial assets: Unlisted instruments (there is no reliable valuation measure). Held-to-maturity investments

Article 1611234413836

Equity

Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: Contributed capital. The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded at par value with the remaining amount invested contained in additional paid-in capital. Minority interest. Retained earnings. These are the total earnings of the company since its inception less all dividends paid out. Treasury stock. This is a company's own stock that has Already been fully issued and was outstanding; Been reacquired by the company; and Not been retired. It decreases stockholder's equity and total shares outstanding. Accumulated comprehensive income. This includes items such as the minimum liability recognized for under-funded pension plans, market v

Flashcard 1611237297420

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: Contributed capital. The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded a

Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: Contributed capital. The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded a

Flashcard 1611239656716

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: <span>Contributed capital. The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded at par value with the remaining amo

Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: <span>Contributed capital. The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded at par value with the remaining amo

Flashcard 1611242802444

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: <span>Contributed capital. The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded at par value with the remaining amo

Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: <span>Contributed capital. The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded at par value with the remaining amo

Flashcard 1611245161740

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

sidual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: Contributed capital. <span>The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded at par value with the remaining amount invested contained in additional paid-in capital. Minority interest. Retained earnings. These are the total earnings of the company since its inception less all dividends paid out.

sidual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: Contributed capital. <span>The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded at par value with the remaining amount invested contained in additional paid-in capital. Minority interest. Retained earnings. These are the total earnings of the company since its inception less all dividends paid out.

Flashcard 1611247783180

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: <span>Contributed capital. The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded at par value with the remaining amount invested contained in additional paid-in capital.

Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet: <span>Contributed capital. The amount of money which has been invested in the business by the owners. This includes preferred stocks and common stocks. Common stock is recorded at par value with the remaining amount invested contained in additional paid-in capital.

Flashcard 1611250142476

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

ount invested contained in additional paid-in capital. Minority interest. Retained earnings. These are the total earnings of the company since its inception less all dividends paid out. <span>Treasury stock. This is a company's own stock that has Already been fully issued and was outstanding; Been reacquired by the company; and Not been retired. It decreases stockholder's equity and total shares outstanding. Accumulated comprehensive income. This includes items such as the minimum liability recogni

ount invested contained in additional paid-in capital. Minority interest. Retained earnings. These are the total earnings of the company since its inception less all dividends paid out. <span>Treasury stock. This is a company's own stock that has Already been fully issued and was outstanding; Been reacquired by the company; and Not been retired. It decreases stockholder's equity and total shares outstanding. Accumulated comprehensive income. This includes items such as the minimum liability recogni

Flashcard 1611252501772

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

ompany since its inception less all dividends paid out. Treasury stock. This is a company's own stock that has Already been fully issued and was outstanding; Been reacquired by the company; and Not been retired. <span>It decreases stockholder's equity and total shares outstanding. Accumulated comprehensive income. This includes items such as the minimum liability recognized for under-funded pension plans, market value changes in non-current

ompany since its inception less all dividends paid out. Treasury stock. This is a company's own stock that has Already been fully issued and was outstanding; Been reacquired by the company; and Not been retired. <span>It decreases stockholder's equity and total shares outstanding. Accumulated comprehensive income. This includes items such as the minimum liability recognized for under-funded pension plans, market value changes in non-current

Flashcard 1611254861068

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

. This is a company's own stock that has Already been fully issued and was outstanding; Been reacquired by the company; and Not been retired. It decreases stockholder's equity and total shares outstanding. <span>Accumulated comprehensive income. This includes items such as the minimum liability recognized for under-funded pension plans, market value changes in non-current investments, and the cumulative effect of foreign exchange rate changes. Refer to Reading 24 [Understanding the Income Statement] for details. Statement of Changes in Shareholders' Equity This statement reflects information about increases

. This is a company's own stock that has Already been fully issued and was outstanding; Been reacquired by the company; and Not been retired. It decreases stockholder's equity and total shares outstanding. <span>Accumulated comprehensive income. This includes items such as the minimum liability recognized for under-funded pension plans, market value changes in non-current investments, and the cumulative effect of foreign exchange rate changes. Refer to Reading 24 [Understanding the Income Statement] for details. Statement of Changes in Shareholders' Equity This statement reflects information about increases

Flashcard 1611257220364

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

imum liability recognized for under-funded pension plans, market value changes in non-current investments, and the cumulative effect of foreign exchange rate changes. Refer to Reading 24 [Understanding the Income Statement] for details. <span>Statement of Changes in Shareholders' Equity This statement reflects information about increases or decreases to a company's net assets or wealth. It reveals much more about the year's stockholders' equity transactions than the statement of retained earnings. The statement of shareholders' equity is a financial statem

imum liability recognized for under-funded pension plans, market value changes in non-current investments, and the cumulative effect of foreign exchange rate changes. Refer to Reading 24 [Understanding the Income Statement] for details. <span>Statement of Changes in Shareholders' Equity This statement reflects information about increases or decreases to a company's net assets or wealth. It reveals much more about the year's stockholders' equity transactions than the statement of retained earnings. The statement of shareholders' equity is a financial statem

Flashcard 1611259579660

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

hanges. Refer to Reading 24 [Understanding the Income Statement] for details. Statement of Changes in Shareholders' Equity This statement reflects information about increases or decreases to a company's net assets or wealth. <span>It reveals much more about the year's stockholders' equity transactions than the statement of retained earnings. The statement of shareholders' equity is a financial statement that summarizes changes that occurred during the accounting period in components of the stockholders' equity

hanges. Refer to Reading 24 [Understanding the Income Statement] for details. Statement of Changes in Shareholders' Equity This statement reflects information about increases or decreases to a company's net assets or wealth. <span>It reveals much more about the year's stockholders' equity transactions than the statement of retained earnings. The statement of shareholders' equity is a financial statement that summarizes changes that occurred during the accounting period in components of the stockholders' equity

Flashcard 1611261938956

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

d earnings. The statement of shareholders' equity is a financial statement that summarizes changes that occurred during the accounting period in components of the stockholders' equity section of the balance sheet. For example, it <span>includes capital transactions with owners (e.g., issuing shares) and distributions to owners (i.e., dividends). The shareholders' equity section of the balance sheet lists the items in contributed capital and retained earnings on the balance sheet date. <span><body><html>

d earnings. The statement of shareholders' equity is a financial statement that summarizes changes that occurred during the accounting period in components of the stockholders' equity section of the balance sheet. For example, it <span>includes capital transactions with owners (e.g., issuing shares) and distributions to owners (i.e., dividends). The shareholders' equity section of the balance sheet lists the items in contributed capital and retained earnings on the balance sheet date. <span><body><html>

Flashcard 1611264298252

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Equity

that occurred during the accounting period in components of the stockholders' equity section of the balance sheet. For example, it includes capital transactions with owners (e.g., issuing shares) and distributions to owners (i.e., dividends). <span>The shareholders' equity section of the balance sheet lists the items in contributed capital and retained earnings on the balance sheet date. <span><body><html>

that occurred during the accounting period in components of the stockholders' equity section of the balance sheet. For example, it includes capital transactions with owners (e.g., issuing shares) and distributions to owners (i.e., dividends). <span>The shareholders' equity section of the balance sheet lists the items in contributed capital and retained earnings on the balance sheet date. <span><body><html>

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Conversation Topics – Telegraph

lifetime, if they consider CDs to be expensive or what they think about downloading free MP3s from the internet. Be extra careful when talking about religion and politics, as people tend to get quite passionate about them. Have you ever ...? <span>Another way to start an interesting topic, is to ask the "Have you ever ...?" question. Here are some examples: Have you ever been on TV? Have you ever sung in public? Have you ever dyed your hair blond? Have you ever eaten frogs' legs? Have you ever received a present that you really hated? Have you ever walked into a lamppost? Have you ever cooked a meal by yourself for more than 15 people? Have you ever fallen or stumbled in front of others? Have you done volunteer work? Have you ever free-climbed a tree? Have you ever had a close relative who lived to over 100? Have you ever ridden a horse? Have you ever tried any extreme sports? Have you ever seen a car accident? Have you ever driven a sports car? have you ever been mugged? Have you ever broken a bone? Have you ever cheated on an exam? Have you ever fallen in love at first sight? Have you ever met a celebrity? Have you ever slept in a tent? Other topics Ordering food, describing a person, shopping, clothes and fashion, money, celebrities, gossip, food & eating, meeting people, sports, marriage, children, education, boo

Article 1611273473292

Subject 5. Uses and Analysis of the Balance Sheet

#has-images

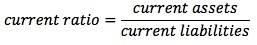

Balance Sheet Ratios Liquidity ratios measure the ability of a company to meet future short-term financial obligations from current assets and, more importantly, cash flows. Each of the following ratios takes a slightly different view of cash or near-cash items. Current Ratio is a measure of the number of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. A current ratio of less than 1 indicates the company has negative working capital. Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. Cash Ratio is the most conservative liquidity ratio, determined by eliminating receivables from the quick ratio. As with the elimination of inventory in the quick ratio, there is no guarantee that the

Flashcard 1611287366924

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

Balance Sheet Ratios Liquidity ratios measure the ability of a company to meet future short-term financial obligations from current assets and, more importantly, cash flows. Each of the following ratios takes a slightly different view of cash or near-cash items. Current Ratio is a measure of the number of dollars of current assets available to

Balance Sheet Ratios Liquidity ratios measure the ability of a company to meet future short-term financial obligations from current assets and, more importantly, cash flows. Each of the following ratios takes a slightly different view of cash or near-cash items. Current Ratio is a measure of the number of dollars of current assets available to

Flashcard 1611290512652

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

tios measure the ability of a company to meet future short-term financial obligations from current assets and, more importantly, cash flows. Each of the following ratios takes a slightly different view of cash or near-cash items. <span>Current Ratio is a measure of the number of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. A current ratio of less than 1 indicates the company has negative working capital. Quick Rati

tios measure the ability of a company to meet future short-term financial obligations from current assets and, more importantly, cash flows. Each of the following ratios takes a slightly different view of cash or near-cash items. <span>Current Ratio is a measure of the number of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. A current ratio of less than 1 indicates the company has negative working capital. Quick Rati

Flashcard 1611292871948

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

, more importantly, cash flows. Each of the following ratios takes a slightly different view of cash or near-cash items. Current Ratio is a measure of the number of dollars of current assets available to meet current obligations. <span>It is the best-known liquidity measure. A current ratio of less than 1 indicates the company has negative working capital. Quick Ratio (Acid-Test Ratio) eliminates less liqu

, more importantly, cash flows. Each of the following ratios takes a slightly different view of cash or near-cash items. Current Ratio is a measure of the number of dollars of current assets available to meet current obligations. <span>It is the best-known liquidity measure. A current ratio of less than 1 indicates the company has negative working capital. Quick Ratio (Acid-Test Ratio) eliminates less liqu

Flashcard 1611295231244

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

the following ratios takes a slightly different view of cash or near-cash items. Current Ratio is a measure of the number of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. <span>A current ratio of less than 1 indicates the company has negative working capital. Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. If inve

the following ratios takes a slightly different view of cash or near-cash items. Current Ratio is a measure of the number of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. <span>A current ratio of less than 1 indicates the company has negative working capital. Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. If inve

Flashcard 1611297590540

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

e following ratios takes a slightly different view of cash or near-cash items. Current Ratio is a measure of the number of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. A <span>current ratio of less than 1 indicates the company has negative working capital. Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. If inve

e following ratios takes a slightly different view of cash or near-cash items. Current Ratio is a measure of the number of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. A <span>current ratio of less than 1 indicates the company has negative working capital. Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. If inve

Flashcard 1611300736268

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

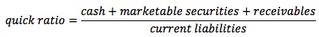

of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. A current ratio of less than 1 indicates the company has negative working capital. <span>Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. &

of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. A current ratio of less than 1 indicates the company has negative working capital. <span>Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. &

Flashcard 1611303095564

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

less than 1 indicates the company has negative working capital. Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. <span>If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. Cash Ratio is the most conservative liquidity ratio, determined by eliminating receivables from the quick ratio. As with the elimination of

less than 1 indicates the company has negative working capital. Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. <span>If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. Cash Ratio is the most conservative liquidity ratio, determined by eliminating receivables from the quick ratio. As with the elimination of

Flashcard 1611305454860

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. A current ratio of less than 1 indicates the company has negative working capital. <span>Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. Cash Ratio is the most conservative liquidity ratio, determined by eliminating receivables from the quick ratio. As with the elimination of

of dollars of current assets available to meet current obligations. It is the best-known liquidity measure. A current ratio of less than 1 indicates the company has negative working capital. <span>Quick Ratio (Acid-Test Ratio) eliminates less liquid assets, such as inventory and pre-paid expenses, from the current ratio. If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. Cash Ratio is the most conservative liquidity ratio, determined by eliminating receivables from the quick ratio. As with the elimination of

Flashcard 1611308600588

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

ory and pre-paid expenses, from the current ratio. If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. <span>Cash Ratio is the most conservative liquidity ratio, determined by eliminating receivables from the quick ratio. As with the elimination of inventory in the quick ratio, there is no guarantee that the receivables will be collected.

ory and pre-paid expenses, from the current ratio. If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. <span>Cash Ratio is the most conservative liquidity ratio, determined by eliminating receivables from the quick ratio. As with the elimination of inventory in the quick ratio, there is no guarantee that the receivables will be collected.

Flashcard 1611310959884

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

ory and pre-paid expenses, from the current ratio. If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. <span>Cash Ratio is the most conservative liquidity ratio, determined by eliminating receivables from the quick ratio. As with the elimination of inventory in the quick ratio, there is no guarantee that the receivables will be collected. Solvenc

ory and pre-paid expenses, from the current ratio. If inventory is not moving, the quick ratio is a better indicator of cash and near-cash items that will be available to meet current obligations. <span>Cash Ratio is the most conservative liquidity ratio, determined by eliminating receivables from the quick ratio. As with the elimination of inventory in the quick ratio, there is no guarantee that the receivables will be collected. Solvenc

Flashcard 1611313319180

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

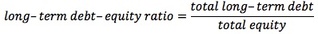

tio, determined by eliminating receivables from the quick ratio. As with the elimination of inventory in the quick ratio, there is no guarantee that the receivables will be collected. <span>Solvency ratios measure a company's ability to meet long-term and other obligations. Long-Term Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. Higher debt-equity ratio indicat

tio, determined by eliminating receivables from the quick ratio. As with the elimination of inventory in the quick ratio, there is no guarantee that the receivables will be collected. <span>Solvency ratios measure a company's ability to meet long-term and other obligations. Long-Term Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. Higher debt-equity ratio indicat

Flashcard 1611315678476

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

ory in the quick ratio, there is no guarantee that the receivables will be collected. Solvency ratios measure a company's ability to meet long-term and other obligations. <span>Long-Term Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. Higher debt-equity ratio indicates higher financial risk. Debt-Equity Ratio includes short-term debt in the numerator.

ory in the quick ratio, there is no guarantee that the receivables will be collected. Solvency ratios measure a company's ability to meet long-term and other obligations. <span>Long-Term Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. Higher debt-equity ratio indicates higher financial risk. Debt-Equity Ratio includes short-term debt in the numerator.

Flashcard 1611318037772

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

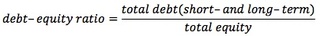

13; Solvency ratios measure a company's ability to meet long-term and other obligations. Long-Term Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. <span>Higher debt-equity ratio indicates higher financial risk. Debt-Equity Ratio includes short-term debt in the numerator. The total debt inclu

13; Solvency ratios measure a company's ability to meet long-term and other obligations. Long-Term Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. <span>Higher debt-equity ratio indicates higher financial risk. Debt-Equity Ratio includes short-term debt in the numerator. The total debt inclu

Flashcard 1611320397068

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

ory in the quick ratio, there is no guarantee that the receivables will be collected. Solvency ratios measure a company's ability to meet long-term and other obligations. <span>Long-Term Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. Higher debt-equity ratio indicates higher financial risk. Debt-Equity Ratio includes short-term debt in the numerator. The total debt inclu

ory in the quick ratio, there is no guarantee that the receivables will be collected. Solvency ratios measure a company's ability to meet long-term and other obligations. <span>Long-Term Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. Higher debt-equity ratio indicates higher financial risk. Debt-Equity Ratio includes short-term debt in the numerator. The total debt inclu

Flashcard 1611322756364

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

rm Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. Higher debt-equity ratio indicates higher financial risk. <span>Debt-Equity Ratio includes short-term debt in the numerator. The total debt includes all liabilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferre

rm Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. Higher debt-equity ratio indicates higher financial risk. <span>Debt-Equity Ratio includes short-term debt in the numerator. The total debt includes all liabilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferre

Flashcard 1611325115660

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

rm Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. Higher debt-equity ratio indicates higher financial risk. <span>Debt-Equity Ratio includes short-term debt in the numerator. The total debt includes all liabilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferre

rm Debt-Equity Ratio is an indicator of the degree of protection available to the creditors in the event of insolvency of a company. Higher debt-equity ratio indicates higher financial risk. <span>Debt-Equity Ratio includes short-term debt in the numerator. The total debt includes all liabilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferre

Flashcard 1611327474956

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

vency of a company. Higher debt-equity ratio indicates higher financial risk. Debt-Equity Ratio includes short-term debt in the numerator. <span>The total debt includes all liabilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferred taxes. This ratio is especially useful in analyzing a company with substantial financing from short-term borrowing. Total Debt Ratio = Financial Levera

vency of a company. Higher debt-equity ratio indicates higher financial risk. Debt-Equity Ratio includes short-term debt in the numerator. <span>The total debt includes all liabilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferred taxes. This ratio is especially useful in analyzing a company with substantial financing from short-term borrowing. Total Debt Ratio = Financial Levera

Flashcard 1611329834252

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

ilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferred taxes. This ratio is especially useful in analyzing a company with substantial financing from short-term borrowing. <span>Total Debt Ratio = Financial Leverage Ratio = Financial statement analysis aims to investigate a company's financial condition and operating performance. Using financial rati

ilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferred taxes. This ratio is especially useful in analyzing a company with substantial financing from short-term borrowing. <span>Total Debt Ratio = Financial Leverage Ratio = Financial statement analysis aims to investigate a company's financial condition and operating performance. Using financial rati

Flashcard 1611332193548

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

ing debt such as accounts payables, accrued expenses, and deferred taxes. This ratio is especially useful in analyzing a company with substantial financing from short-term borrowing. Total Debt Ratio = <span>Financial Leverage Ratio = Financial statement analysis aims to investigate a company's financial condition and operating performance. Using financial ratios helps to examine relationships among indi

ing debt such as accounts payables, accrued expenses, and deferred taxes. This ratio is especially useful in analyzing a company with substantial financing from short-term borrowing. Total Debt Ratio = <span>Financial Leverage Ratio = Financial statement analysis aims to investigate a company's financial condition and operating performance. Using financial ratios helps to examine relationships among indi