Edited, memorised or added to reading queue

on 16-Oct-2017 (Mon)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1425522953484

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itGDP is more widely used as a measure of economic activity occurring within the country, which, in turn, affects employment, growth, and the investment environment.

Original toplevel document

2.1. Basic Terminologyf citizens who work abroad (for example, Pakistan and Portugal), and/or pay more for the use of foreign-owned capital in domestic production than they earn on the capital they own abroad (for example, Brazil and Canada). Therefore, <span>GDP is more widely used as a measure of economic activity occurring within the country, which, in turn, affects employment, growth, and the investment environment. Imports are goods and services that a domestic economy (i.e., households, firms, and government) purchases from other countries. For example, the US economy imports (purch

Flashcard 1425602120972

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itDemand and supply analysis is the study of how buyers and sellers interact to determine transaction prices and quantities.

Original toplevel document

1. INTRODUCTIONf individual economic units, including consumers and businesses. Microeconomics is a logical starting point for the study of economics. This reading focuses on a fundamental subject in microeconomics: demand and supply analysis. <span>Demand and supply analysis is the study of how buyers and sellers interact to determine transaction prices and quantities. As we will see, prices simultaneously reflect both the value to the buyer of the next (or marginal) unit and the cost to the seller of that unit. In private enterprise market economies,

Flashcard 1425616538892

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itllows. Section 2 explains how economists classify markets. Section 3 covers the basic principles and concepts of demand and supply analysis of markets. Section 4 introduces measures of sensitivity of demand to <span>changes in prices and income. <span><body><html>

Original toplevel document

1. INTRODUCTIONs to converge to an equilibrium price? What are the conditions that would make that equilibrium stable or unstable in response to external shocks? How do different types of auctions affect price discovery? <span>This reading is organized as follows. Section 2 explains how economists classify markets. Section 3 covers the basic principles and concepts of demand and supply analysis of markets. Section 4 introduces measures of sensitivity of demand to changes in prices and income. A summary and practice problems conclude the reading. <span><body><html>

Flashcard 1430341684492

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itand three endogenous variables: P x , Qdx , and Qsx . Hence, we have a system of two equations and three unknowns. We need another equation to solve this system. That equation is called the equilibrium condition , and it is simply <span>Qdx=Qsx .<span><body><html>

Original toplevel document

3.6. Market Equilibriume of the demand and supply model of this particular market. Because of that, they are called exogenous variables . Price and quantity, however, are determined within the model for this particular market and are called endogenous variables . <span>In our simple example, there are three exogenous variables (I, P y , and W) and three endogenous variables: P x , Qdx , and Qsx . Hence, we have a system of two equations and three unknowns. We need another equation to solve this system. That equation is called the equilibrium condition , and it is simply Qdx=Qsx . Continuing with our hypothetical examples, we could assume that income equals $50 (thousand, per year), the price of automobiles equals $20 (thousand, per automobile), and

Flashcard 1432236985612

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itConsumer theory explores consumers’ willingness to trade off between two goods (or two baskets of goods), both of which the consumer finds beneficial.

Original toplevel document

2. CONSUMER THEORY: FROM PREFERENCES TO DEMAND FUNCTIONSmer choice theory can be defined as the branch of microeconomics that relates consumer demand curves to consumer preferences. Consumer choice theory begins with a fundamental model of how consumer preferences and tastes might be represented. <span>It explores consumers’ willingness to trade off between two goods (or two baskets of goods), both of which the consumer finds beneficial. Consumer choice theory then recognizes that to consume a set of goods and services, consumers must purchase them at given market prices and with a limited income. In effect, consumer ch

Flashcard 1435011517708

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFor most goods and services, the long-run demand is much more elastic than the short-run demand. The reason is that if price were to change for, say, gasoline, we probably would not be able to respond quickly with a significant reduct

Original toplevel document

4.1. Own-Price Elasticity of Demandthe price of housing were to rise significantly, however, most households would try to find a way to reduce the quantity they buy, at least in the long run. This example leads to another characteristic regarding price elasticity. <span>For most goods and services, the long-run demand is much more elastic than the short-run demand. The reason is that if price were to change for, say, gasoline, we probably would not be able to respond quickly with a significant reduction in the quantity we consume. In the short run, we tend to be locked into modes of transportation, housing and employment location, and so on. The longer the adjustment time, however, the greater the degree to which a household could adjust to the change in price. Hence, for most goods, long-run elasticity of demand is greater than short-run elasticity. Durable goods, however, tend to behave in the opposite way. If the price of washing machines were to fall, people might react quickly because they have an old machine that they know will need to be replaced fairly soon anyway. So when price falls, they might decide to go ahead and make the purchase. If the price of washing machines were to stay low forever, however, it is unlikely that a typical consumer would buy all that many more machines over a lifetime. Certainly, whether the good or service is seen to be non-discretionary or discretionary would help determine its sensitivity to a price change. Faced with the same percenta

Flashcard 1438445079820

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIndependent versus mutually exclusive projects. Mutually exclusive projects are investments that compete in some way for a company's resources - a firm can select one or another but not both. Independent projects, on the other hand, do not compete for the firm's resources. A company can select one or the other or both, so long

Original toplevel document

Subject 2. Basic Principles of Capital BudgetingIn a non-conventional cash flow pattern, the initial outflow can be followed by inflows and/or outflows. <span>Some project interactions: Independent versus mutually exclusive projects. Mutually exclusive projects are investments that compete in some way for a company's resources - a firm can select one or another but not both. Independent projects, on the other hand, do not compete for the firm's resources. A company can select one or the other or both, so long as minimum profitability thresholds are met. Project sequencing. How does one sequence multiple projects over time, since investing in project B may depend on the result of investing in project A? Unlimited funds versus capital rationing. Capital rationing occurs when management places a constraint on the size of the firm's capital budget during a particular period. In such situations, capital is scarce and should be allocated to the projects most likely to maximize the firm's aggregate NPV. The firm's capital budget and cost of capital must be determined simultaneously to best allocate the firm's capital. On the other hand, a firm can raise the funds it wants for all profitable projects simply by paying the required rate of return. Learning Outcome Statements b. describe the basic principles of capital budgeting; c. explain how the evaluat

Flashcard 1439244094732

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itDirect loan commitment: 0.5 percent per year on the undisbursed balance of the loan.

Original toplevel document

Government-Assisted Foreign Buyer Financing (Eximbank USA)disbursement of a loan to the foreign buyers. Generally, goods shipped by sea must be carried exclusively on U.S. vessels. Direct loans are best used when the buyer insists on a fixed rate. <span>Fees and Ex-Im Bank Contact Information Letter of interest: $50 for online application; $100 for paper application via mail and fax. Preliminary commitment: 0.1 of 1 percent of the financed amount up to $25,000. Guarantee commitment: 0.125 percent per year on the undisbursed balance of the loan. Direct loan commitment: 0.5 percent per year on the undisbursed balance of the loan. Exposure fee: varies, depending upon tenor, country risk, and buyer credit risk. For more information about loans from Ex-Im Bank, visit its Web site at www.exim.gov or call 1-800-565-EXIM (3946). <span><body><html>

Flashcard 1441768017164

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itusiness School professor Michael E. Porter. His book, Competitive Strategy, presented a systematic analysis of the practice of market strategy. Porter (2008) identified the five forces as: Threat of entry; <span>Power of suppliers; Power of buyers (customers); Threat of substitutes; and Rivalry among existing competitors. It is easy to note the p

Original toplevel document

2. ANALYSIS OF MARKET STRUCTURESd monopoly is the local electrical power provider. In most cases, the monopoly power provider is allowed to earn a normal return on its investment and prices are set by the regulatory authority to allow that return. <span>2.2. Factors That Determine Market Structure Five factors determine market structure: The number and relative size of firms supplying the product; The degree of product differentiation; The power of the seller over pricing decisions; The relative strength of the barriers to market entry and exit; and The degree of non-price competition. The number and relative size of firms in a market influence market structure. If there are many firms, the degree of competition increases. With fewer firms supplying a good or service, consumers are limited in their market choices. One extreme case is the monopoly market structure, with only one firm supplying a unique good or service. Another extreme is perfect competition, with many firms supplying a similar product. Finally, an example of relative size is the automobile industry, in which a small number of large international producers (e.g., Ford and Toyota) are the leaders in the global market, and a number of small companies either have market power because they are niche players (e.g., Ferrari) or have little market power because of their narrow range of models or limited geographical presence (e.g., Škoda). In the case of monopolistic competition, there are many firms providing products to the market, as with perfect competition. However, one firm’s product is differentiated in some way that makes it appear better than similar products from other firms. If a firm is successful in differentiating its product, the differentiation will provide pricing leverage. The more dissimilar the product appears, the more the market will resemble the monopoly market structure. A firm can differentiate its product through aggressive advertising campaigns; frequent styling changes; the linking of its product with other, complementary products; or a host of other methods. When the market dictates the price based on aggregate supply and demand conditions, the individual firm has no control over pricing. The typical hog farmer in Nebraska and the milk producer in Bavaria are price takers . That is, they must accept whatever price the market dictates. This is the case under the market structure of perfect competition. In the case of monopolistic competition, the success of product differentiation determines the degree with which the firm can influence price. In the case of oligopoly, there are so few firms in the market that price control becomes possible. However, the small number of firms in an oligopoly market invites complex pricing strategies. Collusion, price leadership by dominant firms, and other pricing strategies can result. The degree to which one market structure can evolve into another and the difference between potential short-run outcomes and long-run equilibrium conditions depend on the strength of the barriers to entry and the possibility that firms fail to recoup their original costs or lose money for an extended period of time and are therefore forced to exit the market. Barriers to entry can result from very large capital investment requirements, as in the case of petroleum refining. Barriers may also result from patents, as in the case of some electronic products and drug formulas. Another entry consideration is the possibility of high exit costs. For example, plants that are specific to a special line of products, such as aluminum smelting plants, are non-redeployable, and exit costs would be high without a liquid market for the firm’s assets. High exit costs deter entry and are therefore also considered barriers to entry. In the case of farming, the barriers to entry are low. Production of corn, soybeans, wheat, tomatoes, and other produce is an easy process to replicate; therefore, those are highly competitive markets. Non-price competition dominates those market structures where product differentiation is critical. Therefore, monopolistic competition relies on competitive strategies that may not include pricing changes. An example of non-price competition is product differentiation through marketing. In other circumstances, non-price competition may occur because the few firms in the market feel dependent on each other. Each firm fears retaliatory price changes that would reduce total revenue for all of the firms in the market. Because oligopoly industries have so few firms, each firm feels dependent on the pricing strategies of the others. Therefore, non-price competition becomes a dominant strategy. Exhibit 1. Characteristics of Market Structure Market Structure Number of Sellers Degree of Product Differentiation Barriers to Entry Pricing Power of Firm Non-price Competition Perfect competition Many Homogeneous/ Standardized Very Low None None Monopolistic competition Many Differentiated Low Some Advertising and Product Differentiation Oligopoly Few Homogeneous/ Standardized High Some or Considerable Advertising and Product Differentiation Monopoly One Unique Product Very High Considerable Advertising From the perspective of the owners of the firm, the most desirable market structure is that with the most control over price, because this control can lead to large profits. Monopoly and oligopoly markets offer the greatest potential control over price; monopolistic competition offers less control. Firms operating under perfectly competitive market conditions have no control over price. From the consumers’ perspective, the most desirable market structure is that with the greatest degree of competition, because prices are generally lower. Thus, consumers would prefer as many goods and services as possible to be offered in competitive markets. As often happens in economics, there is a trade-off. While perfect competition gives the largest quantity of a good at the lowest price, other market forms may spur more innovation. Specifically, there may be high costs in researching a new product, and firms will incur such costs only if they expect to earn an attractive return on their research investment. This is the case often made for medical innovations, for example—the cost of clinical trials and experiments to create new medicines would bankrupt perfectly competitive firms but may be acceptable in an oligopoly market structure. Therefore, consumers can benefit from less-than-perfectly-competitive markets. PORTER’S FIVE FORCES AND MARKET STRUCTURE A financial analyst aiming to establish market conditions and consequent profitability of incumbent firms should start with the questions framed by Exhibit 1: How many sellers are there? Is the product differentiated? and so on. Moreover, in the case of monopolies and quasi monopolies, the analyst should evaluate the legislative and regulatory framework: Can the company set prices freely, or are there governmental controls? Finally, the analyst should consider the threat of competition from potential entrants. This analysis is often summarized by students of corporate strategy as “Porter’s five forces,” named after Harvard Business School professor Michael E. Porter. His book, Competitive Strategy, presented a systematic analysis of the practice of market strategy. Porter (2008) identified the five forces as: Threat of entry; Power of suppliers; Power of buyers (customers); Threat of substitutes; and Rivalry among existing competitors. It is easy to note the parallels between four of these five forces and the columns in Exhibit 1. The only “orphan” is the power of suppliers, which is not at the core of the theoretical economic analysis of competition, but which has substantial weight in the practical analysis of competition and profitability. Some stock analysts (e.g., Dorsey 2004) use the term “economic moat” to suggest that there are factors protecting the profitability of a firm that are similar to the moats (ditches full of water) that used to protect some medieval castles. A deep moat means that there is little or no threat of entry by invaders, i.e. competitors. It also means that customers are locked in because of high switching costs. <span><body><html>

Flashcard 1442536099084

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itWhen managers of for-profit companies have been surveyed about the objectives of the companies they direct, researchers have often concluded that a) companies frequently have multiple objectives; b) objectives can often be classified as focused on profitability (e.g., maximizing profits, increasing market share) or on controlling risk (e.g., survival, stable earnings

Original toplevel document

2. OBJECTIVES OF THE FIRMbe known with certainty (i.e., the theory of the firm under conditions of certainty). The main contrast of this type of analysis is to the theory of the firm under conditions of uncertainty, where prices, and therefore profit, are uncertain. <span>Under market uncertainty, a range of possible profit outcomes is associated with the firm’s decision to produce a given quantity of goods or services over a specific time period. Such complex theory typically makes simplifying assumptions. When managers of for-profit companies have been surveyed about the objectives of the companies they direct, researchers have often concluded that a) companies frequently have multiple objectives; b) objectives can often be classified as focused on profitability (e.g., maximizing profits, increasing market share) or on controlling risk (e.g., survival, stable earnings growth); and c) managers in different countries may have different emphases. Finance experts frequently reconcile profitability and risk objectives by stating that the objective of the firm is, or should be, shareholder wealth maximization (i.e.,

Flashcard 1442902314252

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itEn un sentido estrecho, la gramática sólo estudia las unidades significativas y su combinatoria. Comprende dos partes: la morfología y la sintaxis.

Original toplevel document

Open itEn un sentido estrecho, la gramática sólo estudia las unidades significativas y su combinatoria. Comprende dos partes: la morfología y la sintaxis. La [16] primera se ocupa de la estructura interna de las palabras. Su unidad de análisis es el morfema, la unidad significativa mínima. Una palabra como libro no es segmentable en par

Flashcard 1446738791692

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1450274327820

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itOther fixed costs evolve primarily from investments in such fixed assets as real estate, production facilities, and equipment. As a firm grows in size, fixed asset expansion occurs along with a related increase in fixed cost. However, fixed cost cannot be arbitrarily cut when production declines. Regardless of the volume of output, an investment in a given

Original toplevel document

Costsrate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. <span>Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi-fixed cost , although it remains categorized as part of TFC. Examples of fixed costs are debt service, real estate lease agreements, and rental contracts. Quasi-fixed cost examples would be certain utilities and administrative salaries that could be avoided or be lower when output is zero but would assume higher constant values over different production ranges. Normal profit is considered to be a fixed cost because it is a return required by investors on their equity capital regardless of output level. At zero output, total costs are always equal to the amount of total fixed cost that is incurred at this production point. In Exhibit 13, total fixed cost remains at 100 throughout the entire production range. Other fixed costs evolve primarily from investments in such fixed assets as real estate, production facilities, and equipment. As a firm grows in size, fixed asset expansion occurs along with a related increase in fixed cost. However, fixed cost cannot be arbitrarily cut when production declines. Regardless of the volume of output, an investment in a given level of fixed assets locks the firm into a certain amount of fixed cost that is used to finance the physical capital base, technology, and other capital assets. When a firm downsizes, the last expense to be cut is usually fixed cost. Total variable cost (TVC), which is the summation of all variable expenses, has a direct relationship with quantity. When quantity increases, total variable cost increases

Flashcard 1450312076556

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itPer unit variable cost is the cost of producing each unit exclusive of any fixed cost allocation to production units.

Original toplevel document

Costsof fixed assets locks the firm into a certain amount of fixed cost that is used to finance the physical capital base, technology, and other capital assets. When a firm downsizes, the last expense to be cut is usually fixed cost. <span>Total variable cost (TVC), which is the summation of all variable expenses, has a direct relationship with quantity. When quantity increases, total variable cost increases; total variable cost declines when quantity decreases. At zero production, total variable cost is always zero. Variable cost examples are payments for labor, raw materials, and supplies. As indicated above, total costs mirror total variable cost, with the difference being a constant fixed cost. The change in total variable cost (which defines marginal cost) declines up to a certain output point and then increases as production approaches capacity limits. In Exhibit 13, total variable cost increases with an increase in quantity. However, the change from 1 to 2 units is 25, calculated as (75 – 50); the change from 9 to 10 units is 350, calculated as (1,550 – 1,200). Another approach to calculating total variable cost is to determine the variable cost per unit of output and multiply this cost figure by the number of production units. Per unit variable cost is the cost of producing each unit exclusive of any fixed cost allocation to production units. One can assign variable cost individually to units or derive an average variable cost per unit. Whenever a firm initiates a downsizing, retrenchment, or defensive strategy, variable cost is the first to be considered for reduction given its variability with output. However, variable cost is reducible only so far because all firms have to maintain a minimum amount of labor and other variable resources to function effectively. <span><body><html>

Flashcard 1450632154380

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itUnder any form of imperfect competition, the individual seller confronts a negatively sloped demand curve, where price and the quantity demanded by consumers are inversely related.

Original toplevel document

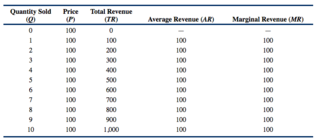

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSzation requires that we examine both of those components. Revenue comes from the demand for the firm’s products, and cost comes from the acquisition and utilization of the firm’s inputs in the production of those products. <span>3.1.1. Total, Average, and Marginal Revenue This section briefly examines demand and revenue in preparation for addressing cost. Unless the firm is a pure monopolist (i.e., the only seller in its market), there is a difference between market demand and the demand facing an individual firm. A later reading will devote much more time to understanding the various competitive environments (perfect competition, monopolistic competition, oligopoly, and monopoly), known as market structure . To keep the analysis simple at this point, we will note that competition could be either perfect or imperfect. In perfect competition , the individual firm has virtually no impact on market price, because it is assumed to be a very small seller among a very large number of firms selling essentially identical products. Such a firm is called a price taker . In the second case, the firm does have at least some control over the price at which it sells its product because it must lower its price to sell more units. Exhibit 4 presents total, average, and marginal revenue data for a firm under the assumption that the firm is price taker at each relevant level of quantity of goods sold. Consequently, the individual seller faces a horizontal demand curve over relevant output ranges at the price level established by the market (see Exhibit 5). The seller can offer any quantity at this set market price without affecting price. In contrast, imperfect competition is where an individual firm has enough share of the market (or can control a certain segment of the market) and is therefore able to exert some influence over price. Instead of a large number of competing firms, imperfect competition involves a smaller number of firms in the market relative to perfect competition and in the extreme case only one firm (i.e., monopoly). Under any form of imperfect competition, the individual seller confronts a negatively sloped demand curve, where price and the quantity demanded by consumers are inversely related. In this case, price to the firm declines when a greater quantity is offered to the market; price to the firm increases when a lower quantity is offered to the market. This is shown in Exhibits 6 and 7. Exhibit 4. Total, Average, and Marginal Revenue under Perfect Competition Quantity Sold (Q) Price (P) Total Revenue (TR) Average Re

Flashcard 1450662300940

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

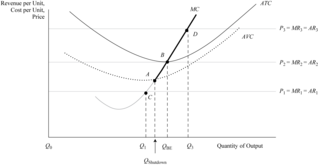

Open itOver an initial range of production, average variable cost declines and then reaches a minimum point. Thereafter, cost increases as the firm utilizes more of its production capacity. This higher cost results primarily from production constraints imposed by the fixed assets at higher vo

Original toplevel document

Open itAverage variable cost (AVC) is derived by dividing total variable cost by quantity. For example, average variable cost at 5 units is (300 ÷ 5) or 60. Over an initial range of production, average variable cost declines and then reaches a minimum point. Thereafter, cost increases as the firm utilizes more of its production capacity. This higher cost results primarily from production constraints imposed by the fixed assets at higher volume levels. The minimum point on the AVC coincides with the lowest average variable cost. However, the minimum point on the AVC does not correspond to the least-cost quantity for average total cost. In Exhibit 13, average variable cost is minimized at 2 units, whereas average total cost is the lowest at 3 units. Average total cost (ATC) is calculated by dividing total costs by quantity or by summing average fixed cost and average variable cost. For instance, in Exhibit 13, at 8 un

Flashcard 1450710535436

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIn the long run, however, the firm is not able to survive if fixed costs are not completely covered. Any operating point above point B (the minimum point on ATC), such as point D, generates an economic profit.

Original toplevel document

Open itd A), it shuts down because of its inability to cover variable costs in full. Between points A and B, the firm can operate in the short run because it is meeting variable cost payments even though it is unable to cover all of its fixed costs. <span>In the long run, however, the firm is not able to survive if fixed costs are not completely covered. Any operating point above point B (the minimum point on ATC), such as point D, generates an economic profit. A firm’s shutdown point occurs when average revenue is less than average variable cost (any output below Q shutdown ), which corresponds to point A in Exhibit 17. Shutdow

Flashcard 1450823519500

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itde negocios es la forma en que un negocio compite en un sector particular. Las decisiones estratégicas adoptadas a nivel negocio tienen que ver con asuntos tales como la fijación de precios y la eficacia en la fabricación y la publicidad. La <span>estrategia de negocios se basa principalmente en la obtención de una ventaja competitiva en el mercado . <span><body><html>

Original toplevel document

Estrategia de negocios y corporativarespecto a la dirección de la organización en su conjunto. Esta estrategia se refiere a los asuntos que afectan a la empresa en general, tales como decidir el tamaño y la composición del portafolio de negocios. <span>Estrategia de negocios La estrategia de negocios es la forma en que un negocio compite en un sector particular. Las decisiones estratégicas adoptadas a nivel negocio tienen que ver con asuntos tales como la fijación de precios y la eficacia en la fabricación y la publicidad. La estrategia de negocios se basa principalmente en la obtención de una ventaja competitiva en el mercado . <span><body><html>

Flashcard 1454937869580

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLouis XIV, the Sun King, was a proud and arrogant man who wanted to be the center of attention at all times; he could not countenance being outdone in lavishness by anyone, and certainly not his finance minister. To succeed Fouquet, Louis chose Jean-Baptiste Colbert, a man famous for his parsimony and for giving the dullest parties in Paris. Colbert made sure that any money liberated from the tr

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1478086757644

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itr (chronological order). The general journal is the collection of all business transactions in an accounting system sorted by date. All accounting systems have a general journal to record all transactions. Some accounting systems also include <span>special journals. For example, there may be one journal for recording sales transactions and another for recording inventory purchases.<span><body><html>

Original toplevel document

Open itved and the corresponding liability to deliver newsletters) and, subsequently, 12 future adjusting entries, the first one of which was illustrated as Transaction 12. Each adjusting entry reduces the liability and records revenue. <span>In practice, a large amount of unearned revenue may cause some concern about a company’s ability to deliver on this future commitment. Conversely, a positive aspect is that increases in unearned revenue are an indicator of future revenues. For example, a large liability on the balance sheet of an airline relates to cash received for future airline travel. Revenue will be recognized as the travel occurs, so an increase in this liability is an indicator of future increases in revenue. <span><body><html>

Flashcard 1478171954444

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAn important first step in analyzing financial statements is identifying the types of accruals and valuation entries in an entity’s financial statements. Most of these items will be noted in the critical accounting policies/estimates section of management’s discussion and analysi

Original toplevel document

7. USING FINANCIAL STATEMENTS IN SECURITY ANALYSISions of balance sheet accounts. Accruals and valuation entries require considerable judgment and thus create many of the limitations of the accounting model. Judgments could prove wrong or, worse, be used for deliberate earnings manipulation. <span>An important first step in analyzing financial statements is identifying the types of accruals and valuation entries in an entity’s financial statements. Most of these items will be noted in the critical accounting policies/estimates section of management’s discussion and analysis (MD&A) and in the significant accounting policies footnote, both found in the annual report. Analysts should use this disclosure to identify the key accruals and valuations for a company. The analyst needs to be aware, as Example 4 shows, that the manipulation of earnings and a

Flashcard 1611327474956

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 5. Uses and Analysis of the Balance Sheet

vency of a company. Higher debt-equity ratio indicates higher financial risk. Debt-Equity Ratio includes short-term debt in the numerator. <span>The total debt includes all liabilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferred taxes. This ratio is especially useful in analyzing a company with substantial financing from short-term borrowing. Total Debt Ratio = Financial Levera

vency of a company. Higher debt-equity ratio indicates higher financial risk. Debt-Equity Ratio includes short-term debt in the numerator. <span>The total debt includes all liabilities, including non-interest-bearing debt such as accounts payables, accrued expenses, and deferred taxes. This ratio is especially useful in analyzing a company with substantial financing from short-term borrowing. Total Debt Ratio = Financial Levera

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705363508492

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itO sistema muito útil para a geração de relatórios, que emprega os dados do SIAFI, é o Tesouro Gerencial, que conheceremos no final desta unidade.

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705369275660

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAs demonstrações contábeis das entidades definidas no campo da Contabilidade Aplicada ao Setor Público são: (a) Balanço Patrimonial; (b) Balanço Orçamentário; (c) Balanço Financeiro; (d) Demonstração das Variações Patrimoniais; (e) Demonstração dos Fluxos de Caixa; (f) Demonstração das Mutaç

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705370848524

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAs demonstrações contábeis das entidades definidas no campo da Contabilidade Aplicada ao Setor Público são: (a) Balanço Patrimonial; (b) Balanço Orçamentário; (c) Balanço Financeiro; (d) Demonstração das Variações Patrimoniais; (e) Demonstração dos Fluxos de Caixa; (f) Demonstração das Mutações do Patrimônio Líquido;

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705372421388

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAs demonstrações contábeis das entidades definidas no campo da Contabilidade Aplicada ao Setor Público são: (a) Balanço Patrimonial; (b) Balanço Orçamentário; (c) Balanço Financeiro; (d) Demonstração das Variações Patrimoniais; (e) Demonstração dos Fluxos de Caixa; (f) Demonstração das Mutações do Patrimônio Líquido; (g) Notas Explicativas. (NBC

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705373994252

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open it>As demonstrações contábeis das entidades definidas no campo da Contabilidade Aplicada ao Setor Público são: (a) Balanço Patrimonial; (b) Balanço Orçamentário; (c) Balanço Financeiro; (d) Demonstração das Variações Patrimoniais; (e) Demonstração dos Fluxos de Caixa; (f) Demonstração das Mutações do Patrimônio Líquido; (g) Notas Explicativas. (NBC T 16.6)<html>

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705375567116

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itentidades definidas no campo da Contabilidade Aplicada ao Setor Público são: (a) Balanço Patrimonial; (b) Balanço Orçamentário; (c) Balanço Financeiro; (d) Demonstração das Variações Patrimoniais; (e) Demonstração dos <span>Fluxos de Caixa; (f) Demonstração das Mutações do Patrimônio Líquido; (g) Notas Explicativas. (NBC T 16.6)<span><body><html>

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705377139980

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itde Aplicada ao Setor Público são: (a) Balanço Patrimonial; (b) Balanço Orçamentário; (c) Balanço Financeiro; (d) Demonstração das Variações Patrimoniais; (e) Demonstração dos Fluxos de Caixa; (f) Demonstração das <span>Mutações do Patrimônio Líquido; (g) Notas Explicativas. (NBC T 16.6)<span><body><html>

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705379499276

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itnço Patrimonial; (b) Balanço Orçamentário; (c) Balanço Financeiro; (d) Demonstração das Variações Patrimoniais; (e) Demonstração dos Fluxos de Caixa; (f) Demonstração das Mutações do Patrimônio Líquido; (g) Notas <span>Explicativas. (NBC T 16.6)<span><body><html>

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705387101452

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itOs ativos devem ser classificados como “circulante” quando houver a expectativa de realizá-lo até o término do exercício seguinte, e o restante dos ativos deve ser classificado como não circulante.

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705392868620

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itOs passivos devem ser classificados como “circulante” quando forem exigíveis até o término do exercício seguinte. Os demais passivos são classificados como não circulante. As contas do ativo devem ser dispostas em ordem decrescente de grau de conversibilida

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705395227916

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itOs passivos devem ser classificados como “circulante” quando forem exigíveis até o término do exercício seguinte. Os demais passivos são classificados como não circulante. As contas do ativo devem ser dispostas em ordem decrescente de grau de conversibilidade; as contas do passivo, em ordem decrescente de grau de exigibilidade.<html>

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705397587212

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itssivos devem ser classificados como “circulante” quando forem exigíveis até o término do exercício seguinte. Os demais passivos são classificados como não circulante. As contas do ativo devem ser dispostas em ordem decrescente de grau de <span>conversibilidade; as contas do passivo, em ordem decrescente de grau de exigibilidade.<span><body><html>

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705403354380

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itd>Em geral, um resultado financeiro positivo é um indicador de equilíbrio financeiro. Mas, variação Positiva não é sinônimo, necessariamente, de bom desempenho da gestão financeira, pode decorrer, por exemplo, da elevação do endividamento público, e variação Negativa não significa, necessariamente, mau desempenho, pode decorrer de redução no endividamento. Análise deve ser feita com o Balanço Patrimonial, considerando de

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705405713676

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itmpenho da gestão financeira, pode decorrer, por exemplo, da elevação do endividamento público, e variação Negativa não significa, necessariamente, mau desempenho, pode decorrer de redução no endividamento. Análise deve ser feita com o Balanço <span>Patrimonial, considerando demais variáveis orçamentárias e extraorçamentárias<span><body><html>

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705409121548

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA Demonstração dos Fluxos de Caixa (DFC) apresenta as entradas e saídas de caixa e as classifica em fluxos operacional, de investimento e de financiamento

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705411480844

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA Demonstração dos Fluxos de Caixa (DFC) apresenta as entradas e saídas de caixa e as classifica em fluxos operacional, de investimento e de financiamento

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705418034444

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAinda na LRF, foram estabelecidos os Anexo de Metas Fiscais e Anexo de Riscos Fiscais que devem compor a LDO.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705420393740

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705425898764

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705431141644

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLRF estabeleceu que ao final de cada quadrimestre os titulares de Poderes e órgãos emitirão Relatório de Gestão Fiscal (STN, 2017b), que deverá ser publicado e disponibilizado ao acesso público, inclusive em meios eletrônicos, até trinta dias após o encerramento do período a que corresponder</spa

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705434287372

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itúltimo quadrimestre, o RGF deverá conter, também, o demonstrativo do montante da Disponibilidade de Caixa e dos Restos a Pagar referente às despesas liquidadas, às empenhadas e não liquidadas, inscritas até o limite do saldo da disponibilidade de caixa e às não inscritas por falta

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705444510988

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1705448967436

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705453161740

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itÍndice de Restos a Pagar (IRPDC) indica quanto a entidade possui de disponibilidade de caixa para pagar cada unidade de restos a pagar. Apurado pela seguinte equação: IRPDC = Restos a Pagar/ Disponibilidade de Caixa.</

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705457356044

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itÍndice de Liquidez Corrente (LC) determina quanto a instituição possui de disponibilidade e créditos para cada unidade de obrigações exigíveis.

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705460501772

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itÍndice de Liquidez Imediata (LI) determina a relação de quanto a instituição possui de disponibilidade imediata ou de alta liquidez para cada unidade de obrigação exigível no passivo financeiro.<

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705462074636

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itÍndice de Liquidez Imediata (LI) determina a relação de quanto a instituição possui de disponibilidade imediata ou de alta liquidez para cada unidade de obrigação exigível no passivo financeiro.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705470725388

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705475181836

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itO Tesouro Gerencial é um sistema da Secretaria do Tesouro Nacional para consulta de informações do SIAFI, construído em uma plataforma de business intelligence. A partir de 2015, esse sistema substituiu o

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1705476754700

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itO Tesouro Gerencial é um sistema da Secretaria do Tesouro Nacional para consulta de informações do SIAFI, construído em uma plataforma de business intelligence. A partir de 2015, esse sistema substituiu o SIAFI Gerencial para consulta da execução orçamentária e financeira do Governo Federa

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1705480949004

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itEmbora tenha surgido para ocupar lacunas e resolver problemas, o SIAFI Gerencial não é utilizado para a execução orçamentária ou financeira, prestando-se apenas para a emissão de relatórios com a utilização do banco de dados que é executado pelo SIAFI Operacional.</

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Sofista (diálogo) – Wikipédia, a enciclopédia livre

ta (diálogo) – Wikipédia, a enciclopédia livre Sofista (diálogo) Origem: Wikipédia, a enciclopédia livre. Ir para: navegação, pesquisa <span>Sofista (em grego antigo: Σοφιστής, em latim: Sophista [1] ) é um diálogo platônico que ocupa-se com os conceitos de sofista, homem político e filósofo. Além disso, o diálogo aborda a questão do não-ser. Nesta obra encontra-se uma posição de Platão sobre o conhecimento e também uma explicitação detalhada do método da investigação filosófica. [2] Referências Ir para cima ↑ Henri Es

Flashcard 1705499561228

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itSofista é um diálogo platônico que ocupa-se com os conceitos de sofista, homem político e filósofo. Aborda também a questão do não-ser.

Original toplevel document

Sofista (diálogo) – Wikipédia, a enciclopédia livreta (diálogo) – Wikipédia, a enciclopédia livre Sofista (diálogo) Origem: Wikipédia, a enciclopédia livre. Ir para: navegação, pesquisa <span>Sofista (em grego antigo: Σοφιστής, em latim: Sophista [1] ) é um diálogo platônico que ocupa-se com os conceitos de sofista, homem político e filósofo. Além disso, o diálogo aborda a questão do não-ser. Nesta obra encontra-se uma posição de Platão sobre o conhecimento e também uma explicitação detalhada do método da investigação filosófica. [2] Referências Ir para cima ↑ Henri Es

Flashcard 1705501920524

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itSofista é um diálogo platônico que ocupa-se com os conceitos de sofista, homem político e filósofo. Aborda também a questão do não-ser.

Original toplevel document

Sofista (diálogo) – Wikipédia, a enciclopédia livreta (diálogo) – Wikipédia, a enciclopédia livre Sofista (diálogo) Origem: Wikipédia, a enciclopédia livre. Ir para: navegação, pesquisa <span>Sofista (em grego antigo: Σοφιστής, em latim: Sophista [1] ) é um diálogo platônico que ocupa-se com os conceitos de sofista, homem político e filósofo. Além disso, o diálogo aborda a questão do não-ser. Nesta obra encontra-se uma posição de Platão sobre o conhecimento e também uma explicitação detalhada do método da investigação filosófica. [2] Referências Ir para cima ↑ Henri Es

Flashcard 1705504279820

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itSofista é um diálogo platônico que ocupa-se com os conceitos de sofista, homem político e filósofo. Aborda também a questão do não-ser.

Original toplevel document

Sofista (diálogo) – Wikipédia, a enciclopédia livreta (diálogo) – Wikipédia, a enciclopédia livre Sofista (diálogo) Origem: Wikipédia, a enciclopédia livre. Ir para: navegação, pesquisa <span>Sofista (em grego antigo: Σοφιστής, em latim: Sophista [1] ) é um diálogo platônico que ocupa-se com os conceitos de sofista, homem político e filósofo. Além disso, o diálogo aborda a questão do não-ser. Nesta obra encontra-se uma posição de Platão sobre o conhecimento e também uma explicitação detalhada do método da investigação filosófica. [2] Referências Ir para cima ↑ Henri Es