Edited, memorised or added to reading queue

on 28-Dec-2016 (Wed)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1425563061516

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itReading 14 covers the theory of the consumer, which addresses the demand for goods and services by individuals who make decisions to maximize the satisfaction they receive from present and future consumption.

Original toplevel document

Study Session 4cribe the marketplace behavior of consumers and firms. Reading 13 explains the concepts and tools of demand and supply analysis—the study of how buyers and sellers interact to determine transaction prices and quantities. <span>Reading 14 covers the theory of the consumer, which addresses the demand for goods and services by individuals who make decisions to maximize the satisfaction they receive from present and future consumption. Reading 15 deals with the theory of the firm, focusing on the supply of goods and services by profit-maximizing firms. That reading provides the basis for understanding the c

Flashcard 1429151812876

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLogic prescribes how to combine concepts into judgments and judgments into syllogisms and chains of reasoning so as to achieve truth.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1429243825420

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFor normal goods, a rise in income would shift the entire demand curve upward and to the right, resulting in an increase in demand. If the good were inferior, however, a rise in income would result in a downward and leftward shift in the entire demand curve.<

Original toplevel document

4.3. Income Elasticity of Demand: Normal and Inferior Goodsall other things constant” when we plotted the relationship between price and quantity demanded. One of the variables we held constant was consumer income. If income were to change, obviously the whole curve would shift one way or the other. <span>For normal goods, a rise in income would shift the entire demand curve upward and to the right, resulting in an increase in demand. If the good were inferior, however, a rise in income would result in a downward and leftward shift in the entire demand curve. <span><body><html>

Flashcard 1429323255052

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itof number include not only music (here understood as musical principles, like those of harmony, which constitute t he liberal art of music and must be distinguished from applied instrumental music, which is a fine art) but also <span>physics, much of chemistry, and other forms of scientific measurement of discrete quantities. The theory of space includes analytic geometry and trigonometry. Applications of the theory of spa

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1430302100748

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itBased on algebraic sign and magnitude of the various elasticities, goods can be classified into groups. If own-price elasticity of demand is less than one in absolute value, demand is called “inelastic”; it is called “elastic” if own-price elasticity of demand is greater than one in absolute value. Goods with positive income elasticity of demand are called normal goods, and those with

Original toplevel document

SUMMARYhe dependent variable to the percentage change in the independent variable of interest. Important specific elasticities include own-price elasticity of demand, income elasticity of demand, and cross-price elasticity of demand. <span>Based on algebraic sign and magnitude of the various elasticities, goods can be classified into groups. If own-price elasticity of demand is less than one in absolute value, demand is called “inelastic”; it is called “elastic” if own-price elasticity of demand is greater than one in absolute value. Goods with positive income elasticity of demand are called normal goods, and those with negative income elasticity of demand are called inferior goods. Two goods with negative cross-price elasticity of demand—a drop in the price of one good causes an increase in demand for the other good—are called complements. Goods with positive cross-price elasticity of demand—a drop in the price of one good causes a decrease in demand for the other—are called substitutes. The relationship among own-price elasticity of demand, changes in price, and changes in total expenditure is as follows: If demand is elastic, a reduction in price resul

Flashcard 1430319402252

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itEquation (1) Qdx=f(Px,I,Py,...) Qdx = the quantity demanded of some good X (e.g. per household demand for gasoline in gallons per week), P x = Price of good X I = consumers’ income P y is the price of another good, Y. It may be read, “Quantity demanded of good X depends on (is a function of) the price of g

Original toplevel document

3.1. The Demand Function and the Demand Curvedemand function . (In general, a function is a relationship that assigns a unique value to a dependent variable for any given set of values of a group of independent variables.) We represent such a demand function in Equation 1: <span>Equation (1) Qdx=f(Px,I,Py,...) where Qdx represents the quantity demanded of some good X (such as per household demand for gasoline in gallons per week), P x is the price per unit of good X (such as $ per gallon), I is consumers’ income (as in $1,000s per household annually), and P y is the price of another good, Y. (There can be many other goods, not just one, and they can be complements or substitutes.) Equation 1 may be read, “Quantity demanded of good X depends on (is a function of) the price of good X, consumers’ income, the price of good Y, and so on.” Often, economists use simple linear equations to approximate real-world demand and supply functions in relevant ranges. A hypothetical example of a specific demand function

Flashcard 1431897771276

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itthe seven fine arts (architecture, instrumental music, sculpture, painting, literature, t he drama, and the dance)

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1432505158924

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe form of words is their meaning, and it is treated in semantics.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1432945560844

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itHorse is the species or class t o which Bucephalus and every other horse belong because t he essence or nature of horse is common to all horses.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1432959454476

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFlower is the genus to which rose, violet, tulip, and every species of flower belong because the essence or nature of flower is the same in all of them.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1434914000140

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

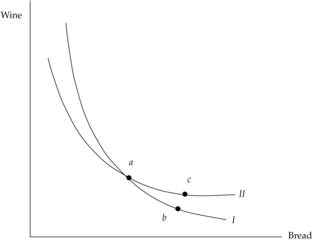

Open itA demand curve for bread is derived from the indifference curve map and a set of budget constraints representing different prices of bread.

Original toplevel document

6. REVISITING THE CONSUMER’S DEMAND FUNCTIONupper exhibit, we have rotated the budget constraint rightward, indicating successively lower prices of bread, P1B , P2B , P3B , P4B , while holding income constant at I. Exhibit 15. Deriving a Demand Curve Note: <span>A demand curve for bread is derived from the indifference curve map and a set of budget constraints representing different prices of bread. This pair of diagrams deserves careful inspection. Notice first that the vertical axes are not the same. In the upper diagram, we represent the quantity of the other good,

Flashcard 1435081510156

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThis concept is captured in the following equation, which represents an individual seller’s supply function: Equation (7) Qsx=f(Px,W,…) where Qsx is the quantity supplied of some good X, such as gasoline, P x is the price per unit of good X, and W is the wage rate of labor in, say, dollars per hour. It wou

Original toplevel document

3.3. The Supply Function and the Supply Curvethat must be purchased in the labor market. The price of an hour of labor is the wage rate, or W. Hence, we can say that (for any given level of technology) the willingness to supply a good depends on the price of that good and the wage rate. <span>This concept is captured in the following equation, which represents an individual seller’s supply function: Equation (7) Qsx=f(Px,W,…) where Qsx is the quantity supplied of some good X, such as gasoline, P x is the price per unit of good X, and W is the wage rate of labor in, say, dollars per hour. It would be read, “The quantity supplied of good X depends on (is a function of) the price of X (its “own” price), the wage rate paid to labor, etc.” Just as with the demand function, we can consider a simple hypothetical example of a seller’s supply function. As mentioned earlier, economists often will simplify their an

Flashcard 1435097238796

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itHere is the big shocker about the hippocampus: It can only hold so much information before it must be processed and pushed into short-term memory. Studies show that the maximum amount is about 20 minutes of information.

Original toplevel document

Unknown titler learning products. The brain structures that are involved in learning include the hippocampus, the amygdala, and the basal ganglia. To design the best learning experiences, we need to understand and respect the neuroscience of learning. <span>Tip #2: Focus is the starting point of learning The hippocampus is the part of the brain that takes in information and moves it to our memory. When it's damaged, people lose access to past memories and no longer can make new ones. The hippocampus acts like a recorder or data drive; like those devices, it has an "on" button. Physiologically, it's when our eyes and ears attune to something that causes the hippocampus to begin recording. Richard Davidson, from the University of Wisconsin, calls this "phase locking" and it's the starting point of all learning. As a result, we must design our learning environments to help people focus and we must bust the myth that you can multitask while learning. Research has proved that when we divide our attention, our focus switches back and forth between the two activities, also known as switch tasking. The hippocampus loses vital pieces of information for both of the things we were trying to attend to. I call this "Swiss tasking" because we end up with holes in the data the hippocampus was capturing and, therefore, holes in our learning that cannot be recovered. Here is the big shocker about the hippocampus: It can only hold so much information before it must be processed and pushed into short-term memory. Studies show that the maximum amount is about 20 minutes of information. Lecture-style sessions never have demonstrated good results for retention, and now we know why—it works against the brain's natural functioning. The good news is that many other learning activities can help. All the hippocampus needs is a few minutes of processing to push that data into short-term memory and it's ready again for more. I now build all my learning events in chunks of 15 min

Flashcard 1435108773132

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFor example, I could teach you about neuroscience today. I can activate your schemas and you might even have an "aha moment." But if you don't have to retrieve that learning again, it eventually will get dumped from your brain.

Original toplevel document

Unknown titleult. This activates not only those specific memories, but also their individual schemas of change. When I pair this with hands-on activities for leading change effectively, the result is powerful and lasting. Advertisement <span>Tip #4: Aim for three retrievals One of the biggest insights from brain science has to do with how our memories are made. For conceptual learning, the evidence is clear that it's through the act of retrieval—having to recall something we have learned—that makes learning memorable for the long run. For example, I could teach you about neuroscience today (reading is certainly one of the ways we learn). I can activate your schemas and you might even have an "aha moment." But if you don't have to retrieve that learning again, it eventually will get dumped from your brain. Retrieval can occur through a variety of methods such as sharing what you learned with someone else, reflecting on how it relates to a past experience, doing an activity with hands-on application, quizzing yourself on your understanding, and a host of other learning activities. As instructional designers, we can easily build retrievals into our learning events and empower our learners to do that for themselves. This is what distinguishes great presenters from excellent instructors. Great presenters can create a feel-good experience that activates our schemas and that we thoroughly enjoy. And we will give those presenters or programs high ratings for satisfaction and raving reviews. But if no retrieval occurs, that learning will disappear in the following weeks and months. Sure, people will still say that they loved it, but they won't be able to remember much of what they learned, nor will their behavior change as a result. Research has shown that it is most effective to get to at least three retrievals. Memory studies have shown that three retrievals yield the best accuracy and retention. Although you can go on to more, the benefit seems to be better at three, so I focus on that number of retrievals in my own learning design. You can certainly build three retrievals into one learning event, but retention will be even more powerful if you add sleep to the mix. Tip #5: Build in sleep between learning It turns out that the sleeping brain plays a large role in how long-term memories are formed. While we sleep, the brain pushes information th

Flashcard 1435115851020

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itYou can certainly build three retrievals into one learning event, but retention will be even more powerful if you add sleep to the mix.

Original toplevel document

Unknown titleult. This activates not only those specific memories, but also their individual schemas of change. When I pair this with hands-on activities for leading change effectively, the result is powerful and lasting. Advertisement <span>Tip #4: Aim for three retrievals One of the biggest insights from brain science has to do with how our memories are made. For conceptual learning, the evidence is clear that it's through the act of retrieval—having to recall something we have learned—that makes learning memorable for the long run. For example, I could teach you about neuroscience today (reading is certainly one of the ways we learn). I can activate your schemas and you might even have an "aha moment." But if you don't have to retrieve that learning again, it eventually will get dumped from your brain. Retrieval can occur through a variety of methods such as sharing what you learned with someone else, reflecting on how it relates to a past experience, doing an activity with hands-on application, quizzing yourself on your understanding, and a host of other learning activities. As instructional designers, we can easily build retrievals into our learning events and empower our learners to do that for themselves. This is what distinguishes great presenters from excellent instructors. Great presenters can create a feel-good experience that activates our schemas and that we thoroughly enjoy. And we will give those presenters or programs high ratings for satisfaction and raving reviews. But if no retrieval occurs, that learning will disappear in the following weeks and months. Sure, people will still say that they loved it, but they won't be able to remember much of what they learned, nor will their behavior change as a result. Research has shown that it is most effective to get to at least three retrievals. Memory studies have shown that three retrievals yield the best accuracy and retention. Although you can go on to more, the benefit seems to be better at three, so I focus on that number of retrievals in my own learning design. You can certainly build three retrievals into one learning event, but retention will be even more powerful if you add sleep to the mix. Tip #5: Build in sleep between learning It turns out that the sleeping brain plays a large role in how long-term memories are formed. While we sleep, the brain pushes information th

Flashcard 1435511426316

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itMunchery has served more than 3 million meals since Tran and a friend, Conrad Chu, delivered their first entrees in 2010. The company has raised more than $115 million in venture capital, and Tran says it’s now the largest single-kitchen pro-ducer of freshly prepared food in the cities where it operates.

Original toplevel document

How an immigrant motherfucker made muncheryture level. After they’re prepared, the dishes are chilled in refrigerated rooms, packed in compostable boxes, and loaded into cars for delivery. Customers heat them up for about two minutes in a microwave or 10 to 20 in an oven. <span>Munchery has served more than 3 million meals since Tran and a friend, Conrad Chu, delivered their first entrees in 2010. The company has raised more than $115 million in venture capital, and Tran says it’s now the largest single-kitchen pro-ducer of freshly prepared food in the cities where it operates. He hopes to open in at least 10 more markets in the next few years but is secretive about expansion plans. Like many other startups in the frenzied on-demand economy, Munchery isn’t yet

Flashcard 1435584302348

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThere are thus two basic types of profit—accounting and economic

Original toplevel document

2. OBJECTIVES OF THE FIRMhe firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. <span>2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), accounting profit is what is left after paying all accounting costs—whether the expense is a cash outlay or not. When accounting profit is negative, it is called an accounting loss . Equation 2 summarizes the concept of accounting profit: Equation (2) Accounting profit = Total revenue – Total accounting costs When defining profit as accounting profit, the TC term in Equation 1 becomes total accounting costs, which include only the explicit costs of doing business. Let us consider two businesses: a start-up company and a publicly traded corporation. Suppose that for the start-up, total revenue in the business’s first year is €3,500,000 and total accounting costs are €3,200,000. Accounting profit is €3,500,000 – €3,200,000 = €300,000. The corresponding calculation for the publicly traded corporation, let us suppose, is $50,000,000 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. 2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as acc

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itrage revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit <span>(Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided b

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

Flashcard 1435774881036

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open it(Economic) profitTotal revenue minus total economic cost; (TR – TC)

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

Flashcard 1435778026764

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTo calculate a marginal term, take the change in the total and divide by the change in the quantity number.

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITScalculated with respect to the quantity produced and sold in a single period (as opposed to averaging a quantity over a number of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. <span>To calculate a marginal term, take the change in the total and divide by the change in the quantity number. Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that

Flashcard 1435779599628

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itRevenue and cost flows are calculated in terms of total, average, and marginal

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSTo fully comprehend the dimensions of profit maximization, one must have a detailed understanding of the revenue and cost variables that determine profit. Revenue and cost flows are calculated in terms of total, average, and marginal. A total is the summation of all individual components. For example, total cost is the summation of all costs that are incurred by the business. Total revenue is the sum of the revenues

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itifferent types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue <span>Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) S

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itTerm Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) <span>Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itminus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) <span>Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itor the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs <span>Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TV

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

Flashcard 1435786153228

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTotal fixed cost (TFC)Sum of all fixed expenses; here defined to include all opportunity costs

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

Flashcard 1435787726092

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itMarginal revenue (MR)Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q)

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

Flashcard 1435789298956

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAverage revenue (AR)Total revenue divided by quantity; (TR ÷ Q)

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

Flashcard 1435790871820

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTotal revenue (TR)Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i )

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open ite (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs <span>Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variab

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itn quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) <span>Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total co

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itxpenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) <span>Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itt (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) <span>Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q<span><body></h

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open it(per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) <span>Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q<span><body><html>

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) <span>Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q<span><body><html>

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

Flashcard 1435799522572

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTotal variable cost (TVC)Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q)

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

Flashcard 1435801881868

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTotal costs (TC)Total fixed cost plus total variable cost; (TFC + TVC)

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

Flashcard 1435803454732

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAverage fixed cost (AFC)Total fixed cost divided by quantity; (TFC ÷ Q)

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSumber of time periods). For example, average revenue is calculated by dividing total revenue by the number of items sold. To calculate a marginal term, take the change in the total and divide by the change in the quantity number. <span>Exhibit 3 shows a summary of the terminology and formulas pertaining to profit maximization, where profit is defined as total revenue minus total economic costs. Note that the definition of profit is the economic version, which recognizes that the implicit opportunity costs of equity capital, in addition to explicit accounting costs, are economic costs. The first main category consists of terms pertaining to the revenue side of the profit equation: total revenue, average revenue, and marginal revenue. Cost terms follow with an overview of the different types of costs—total, average, and marginal. Exhibit 3. Summary of Profit, Revenue, and Cost Terms Term Calculation Profit (Economic) profit Total revenue minus total economic cost; (TR – TC) Revenue Total revenue (TR) Price times quantity (P × Q), or the sum of individual units sold times their respective prices; ∑(P i × Q i ) Average revenue (AR) Total revenue divided by quantity; (TR ÷ Q) Marginal revenue (MR) Change in total revenue divided by change in quantity; (∆TR ÷ ∆Q) Costs Total fixed cost (TFC) Sum of all fixed expenses; here defined to include all opportunity costs Total variable cost (TVC) Sum of all variable expenses, or per unit variable cost times quantity; (per unit VC × Q) Total costs (TC) Total fixed cost plus total variable cost; (TFC + TVC) Average fixed cost (AFC) Total fixed cost divided by quantity; (TFC ÷ Q) Average variable cost (AVC) Total variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) 3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a hig

Flashcard 1435805027596

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |