Edited, memorised or added to reading queue

on 14-May-2017 (Sun)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1425526885644

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itNet exports is the difference between the value of a country’s exports and the value of its imports (i.e., value of exports minus imports). If the value of exports equals the value of imports, the

Original toplevel document

2.1. Basic Terminologye while those in Europe and the Middle East (which benefited from rising prices of their petroleum exports) experienced a substantial increase. Africa also experienced a small improvement in its terms of trade during this period. <span>Net exports is the difference between the value of a country’s exports and the value of its imports (i.e., value of exports minus imports). If the value of exports equals the value of imports, then trade is balanced. If the value of exports is greater (less) than the value of imports, then there is a trade surplus (deficit) . When a country has a trade surplus, it lends to foreigners or buys assets from foreigners reflecting the financing needed by foreigners running trade deficits with that country. Similarly, when a country has a trade deficit, it has to borrow from foreigners or sell some of its assets to foreigners. Section 4 on the balance of payments explains these relationships more fully. Autarky is a state in which a country does not trade with other countries. This means that all goods and services are produced and consumed domestically. The price of a go

Flashcard 1602839776524

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Wikinews, the free news source

ikinews The free news source you can write! Saturday, May 13, 2017, 2326 (UTC) Copy us • Newsroom • Mission statement • Report breaking news • Donate Audio Wikinews • Social networking • Chat • Best of Wikinews [imagelink] <span>Moon Jae-in becomes President of South Korea Moon Jae-in assumed the office of President of South Korea on Wednesday. He was announced the winner of Tuesday's election, with 41.1% of the vote, and sworn in on Wednesday at the Korean National Assembly. [ML] [ ± ] - Image credit - Read more... Latest news [imagelink] [imagelink] [imagelink] [imagelink] [imagelink] ± Changing position, President Trump says FBI Director Comey

ikinews The free news source you can write! Saturday, May 13, 2017, 2326 (UTC) Copy us • Newsroom • Mission statement • Report breaking news • Donate Audio Wikinews • Social networking • Chat • Best of Wikinews [imagelink] <span>Moon Jae-in becomes President of South Korea Moon Jae-in assumed the office of President of South Korea on Wednesday. He was announced the winner of Tuesday's election, with 41.1% of the vote, and sworn in on Wednesday at the Korean National Assembly. [ML] [ ± ] - Image credit - Read more... Latest news [imagelink] [imagelink] [imagelink] [imagelink] [imagelink] ± Changing position, President Trump says FBI Director Comey

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Wikinews, the free news source

sia thing" was among his reasons, mentioning Comey's repeated claims that he, Trump, was not being investigated. [ ± ] - Image credit - Read more... [imagelink] Cyberattack, not HBO comedian, caused website wipeout, says FCC <span>Although comedian John Oliver on his show Last Week Tonight had asked his viewers to inundate the FCC website with comments supporting Net Neutrality, the FCC said a DDoS cyberattack, not angry HBO fans, were responsible for their website becoming unresponsive shortly thereafter. [ ± ] - Image credit - Read more... [imagelink] Emmanuel Macron wins French presidential election race On Sunday, En Marche! candidate Emmanuel Macron won the second round

Flashcard 1602843708684

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAlthough comedian John Oliver on his show Last Week Tonight had asked his viewers to inundate the FCC website with comments supporting Net Neutrality, the FCC said a DDoS cyberattack, not angry HBO fans, were respon

Original toplevel document

Wikinews, the free news sourcesia thing" was among his reasons, mentioning Comey's repeated claims that he, Trump, was not being investigated. [ ± ] - Image credit - Read more... [imagelink] Cyberattack, not HBO comedian, caused website wipeout, says FCC <span>Although comedian John Oliver on his show Last Week Tonight had asked his viewers to inundate the FCC website with comments supporting Net Neutrality, the FCC said a DDoS cyberattack, not angry HBO fans, were responsible for their website becoming unresponsive shortly thereafter. [ ± ] - Image credit - Read more... [imagelink] Emmanuel Macron wins French presidential election race On Sunday, En Marche! candidate Emmanuel Macron won the second round

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Supreme Court of India begins hearing against triple talaq - Wikinews, the free news source

hacker 2 May 2017: Turkey blocks Wikipedia, alleging smear campaign 22 April 2017: 28-year-old suspect charged for attacking Borussia Dortmund's team bus [imagelink] Collaborate! Pillars of Wikinews writing Writing an article <span>The Indian Supreme Court yesterday formally began a hearing against triple talaq, an Islamic rule which allows men to divorce their wives instantly without the need of a judicial hearing. Activists and Muslim women have filed many petitions against Islamic practices — triple talaq, nikah halala, and polygamy — saying they are unconstitutional and demanding gender equality. [imagelink] We will also examine whether triple talaq is a part of enforceable fundamental right [imagelink] —Supreme Court A bench of five justices — Chief Justice Jagdish Sing

Flashcard 1602848951564

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe Indian Supreme Court yesterday formally began a hearing against triple talaq , an Islamic rule which allows men to divorce their wives instantly without the need of a judicial hearing. Activists and Muslim women have filed many petitions against Islamic practice

Original toplevel document

Supreme Court of India begins hearing against triple talaq - Wikinews, the free news sourcehacker 2 May 2017: Turkey blocks Wikipedia, alleging smear campaign 22 April 2017: 28-year-old suspect charged for attacking Borussia Dortmund's team bus [imagelink] Collaborate! Pillars of Wikinews writing Writing an article <span>The Indian Supreme Court yesterday formally began a hearing against triple talaq, an Islamic rule which allows men to divorce their wives instantly without the need of a judicial hearing. Activists and Muslim women have filed many petitions against Islamic practices — triple talaq, nikah halala, and polygamy — saying they are unconstitutional and demanding gender equality. [imagelink] We will also examine whether triple talaq is a part of enforceable fundamental right [imagelink] —Supreme Court A bench of five justices — Chief Justice Jagdish Sing

Flashcard 1602853670156

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itdiluted EPS. 6.3.1. Diluted EPS When a Company Has Convertible Preferred Stock Outstanding When a company has convertible preferred stock outstanding, diluted EPS is calculated using the if-converted method . <span>The if-converted method is based on what EPS would have been if the convertible preferred securities had been converted at the beginning of the period. In other words, the method calculates what the effect would have been if the convertible preferred shares converted at the beginning of the period. If the convertible shares had been co

Original toplevel document

Earnings Per Shareincome) from continuing operations.46 Similar presentation is required under US GAAP.47 This section outlines the calculations for EPS and explains how the calculation differs for a simple versus complex capital structure. <span>Simple versus Complex Capital Structure A company’s capital is composed of its equity and debt. Some types of equity have preference over others, and some debt (and other instruments) may be converted into equity. Under IFRS, the type of equity for which EPS is presented is referred to as ordinary. Ordinary shares are those equity shares that are subordinate to all other types of equity. The ordinary shareholders are basically the owners of the company—the equity holders who are paid last in a liquidation of the company and who benefit the most when the company does well. Under US GAAP, this ordinary equity is referred to as common stock or common shares , reflecting US language usage. The terms “ordinary shares,” “common stock,” and “common shares” are used interchangeably in the following discussion. When a company has issued any financial instruments that are potentially convertible into common stock, it is said to have a complex capital structure. Examples of financial instruments that are potentially convertible into common stock include convertible bonds, convertible preferred stock, employee stock options, and warrants.48 If a company’s capital structure does not include such potentially convertible financial instruments, it is said to have a simple capital structure. The distinction between simple versus complex capital structure is relevant to the calculation of EPS because financial instruments that are potentially convertible into common stock could, as a result of conversion or exercise, potentially dilute (i.e., decrease) EPS. Information about such a potential dilution is valuable to a company’s current and potential shareholders; therefore, accounting standards require companies to disclose what their EPS would be if all dilutive financial instruments were converted into common stock. The EPS that would result if all dilutive financial instruments were converted is called diluted EPS . In contrast, basic EPS is calculated using the reported earnings available to common shareholders of the parent company and the weighted average number of shares outstanding. Companies are required to report both basic and diluted EPS. For example, Danone reported basic EPS (“before dilution”) and diluted EPS (“after dilution”) of €2.57 for 2009, somewhat lower than 2008. Kraft reported basic EPS of $2.04 and diluted EPS of $2.03 for 2009, much higher than basic and diluted EPS (from continuing operations) of $1.22 and $1.21 for 2008. (The EPS information appears at the bottom of Danone’s and Kraft’s income statements.) An analyst would try to determine the causes underlying the changes in EPS, a topic we will address following an explanation of the calculations of both basic and diluted EPS. <span><body><html>

Flashcard 1602861534476

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itulation plus the additional shares of common stock that would be issued upon conversion of the preferred. Thus, the formula to calculate diluted EPS using the if-converted method for preferred stock is: Equation (2) <span>Diluted EPS Net income ___________________________________ (Weighted average number of shares outstanding + New common shares that would have been issued at conversion) A diluted EPS calculation using the if-converted method for preferred stock is provided in Example 15. <span><body><html>

Original toplevel document

Earnings Per Shareincome) from continuing operations.46 Similar presentation is required under US GAAP.47 This section outlines the calculations for EPS and explains how the calculation differs for a simple versus complex capital structure. <span>Simple versus Complex Capital Structure A company’s capital is composed of its equity and debt. Some types of equity have preference over others, and some debt (and other instruments) may be converted into equity. Under IFRS, the type of equity for which EPS is presented is referred to as ordinary. Ordinary shares are those equity shares that are subordinate to all other types of equity. The ordinary shareholders are basically the owners of the company—the equity holders who are paid last in a liquidation of the company and who benefit the most when the company does well. Under US GAAP, this ordinary equity is referred to as common stock or common shares , reflecting US language usage. The terms “ordinary shares,” “common stock,” and “common shares” are used interchangeably in the following discussion. When a company has issued any financial instruments that are potentially convertible into common stock, it is said to have a complex capital structure. Examples of financial instruments that are potentially convertible into common stock include convertible bonds, convertible preferred stock, employee stock options, and warrants.48 If a company’s capital structure does not include such potentially convertible financial instruments, it is said to have a simple capital structure. The distinction between simple versus complex capital structure is relevant to the calculation of EPS because financial instruments that are potentially convertible into common stock could, as a result of conversion or exercise, potentially dilute (i.e., decrease) EPS. Information about such a potential dilution is valuable to a company’s current and potential shareholders; therefore, accounting standards require companies to disclose what their EPS would be if all dilutive financial instruments were converted into common stock. The EPS that would result if all dilutive financial instruments were converted is called diluted EPS . In contrast, basic EPS is calculated using the reported earnings available to common shareholders of the parent company and the weighted average number of shares outstanding. Companies are required to report both basic and diluted EPS. For example, Danone reported basic EPS (“before dilution”) and diluted EPS (“after dilution”) of €2.57 for 2009, somewhat lower than 2008. Kraft reported basic EPS of $2.04 and diluted EPS of $2.03 for 2009, much higher than basic and diluted EPS (from continuing operations) of $1.22 and $1.21 for 2008. (The EPS information appears at the bottom of Danone’s and Kraft’s income statements.) An analyst would try to determine the causes underlying the changes in EPS, a topic we will address following an explanation of the calculations of both basic and diluted EPS. <span><body><html>

Article 1602870185228

6.3.3. Diluted EPS When a Company Has Stock Options, Warrants, or Their Equivalents Outstanding

#cfa-level-1 #fra-introduction #income-statement

When a company has stock options, warrants, or their equivalents49 outstanding, diluted EPS is calculated as if the financial instruments had been exercised and the company had used the proceeds from exercise to repurchase as many shares of common stock as possible at the average market price of common stock during the period. The weighted average number of shares outstanding for diluted EPS is thus increased by the number of shares that would be issued upon exercise minus the number of shares that would have been purchased with the proceeds. This method is called the treasury stock method under US GAAP because companies typically hold repurchased shares as treasury stock. The same method is used under IFRS but is not named. For the calculation of diluted EPS using this method, the assumed exercise of these financial instruments would have the following effects: The company is assumed to receive cash upon exercise and, in exchange, to issue shares. The company is assumed to use

Flashcard 1602871495948

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

6.3.2. Diluted EPS When a Company Has Convertible Debt Outstanding

reholders would increase by the after-tax amount of interest expense on the debt converted. Thus, the formula to calculate diluted EPS using the if-converted method for convertible debt is: Equation (3) <span>Diluted EPS= (Net income + After tax interest on convertible debt − Preferred dividends ) ________________________________________________________________________________________ (Weighted average number of shares outstanding + Additional common shares that would have been issued at conversion) <span><body><html>

reholders would increase by the after-tax amount of interest expense on the debt converted. Thus, the formula to calculate diluted EPS using the if-converted method for convertible debt is: Equation (3) <span>Diluted EPS= (Net income + After tax interest on convertible debt − Preferred dividends ) ________________________________________________________________________________________ (Weighted average number of shares outstanding + Additional common shares that would have been issued at conversion) <span><body><html>

Flashcard 1602875428108

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

6.3.3. Diluted EPS When a Company Has Stock Options, Warrants, or Their Equivalents Outstanding

Warrants, or Their Equivalents Outstanding = (Net income − Preferred dividends) ____________________________________ [Weighted average number of shares outstanding +( New shares that would have been issued at option exercise − <span>Shares that could have been purchased with cash received upon exercise ) × (Proportion of year during which the financial instruments were outstanding)] <span><body><html>

Warrants, or Their Equivalents Outstanding = (Net income − Preferred dividends) ____________________________________ [Weighted average number of shares outstanding +( New shares that would have been issued at option exercise − <span>Shares that could have been purchased with cash received upon exercise ) × (Proportion of year during which the financial instruments were outstanding)] <span><body><html>

Flashcard 1602877787404

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

6.3.3. Diluted EPS When a Company Has Stock Options, Warrants, or Their Equivalents Outstanding

When a company has stock options, warrants, or their equivalents49 outstanding, diluted EPS is calculated as if the financial instruments had been exercised and the company had used the proceeds from exercise to repu

When a company has stock options, warrants, or their equivalents49 outstanding, diluted EPS is calculated as if the financial instruments had been exercised and the company had used the proceeds from exercise to repu

Flashcard 1602880146700

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

6.3.3. Diluted EPS When a Company Has Stock Options, Warrants, or Their Equivalents Outstanding

ld have been purchased with the proceeds. This method is called the treasury stock method under US GAAP because companies typically hold repurchased shares as treasury stock. The same method is used under IFRS but is not named. <span>For the calculation of diluted EPS using this method, the assumed exercise of these financial instruments would have the following effects: The company is assumed to receive cash upon exercise and, in exchange, to issue shares. The company is assumed to use the cash proceeds to repurchase shares at the weighted average market price during the period. As a result of these two effects, the number of shares outstanding would increase by the incremental number of shares issued (the difference between the number of s

ld have been purchased with the proceeds. This method is called the treasury stock method under US GAAP because companies typically hold repurchased shares as treasury stock. The same method is used under IFRS but is not named. <span>For the calculation of diluted EPS using this method, the assumed exercise of these financial instruments would have the following effects: The company is assumed to receive cash upon exercise and, in exchange, to issue shares. The company is assumed to use the cash proceeds to repurchase shares at the weighted average market price during the period. As a result of these two effects, the number of shares outstanding would increase by the incremental number of shares issued (the difference between the number of s

Flashcard 1602881719564

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

6.3.3. Diluted EPS When a Company Has Stock Options, Warrants, or Their Equivalents Outstanding

ld have been purchased with the proceeds. This method is called the treasury stock method under US GAAP because companies typically hold repurchased shares as treasury stock. The same method is used under IFRS but is not named. <span>For the calculation of diluted EPS using this method, the assumed exercise of these financial instruments would have the following effects: The company is assumed to receive cash upon exercise and, in exchange, to issue shares. The company is assumed to use the cash proceeds to repurchase shares at the weighted average market price during the period. As a result of these two effects, the number of shares outstanding would increase by the incremental number of shares issued (the difference between the number of s

ld have been purchased with the proceeds. This method is called the treasury stock method under US GAAP because companies typically hold repurchased shares as treasury stock. The same method is used under IFRS but is not named. <span>For the calculation of diluted EPS using this method, the assumed exercise of these financial instruments would have the following effects: The company is assumed to receive cash upon exercise and, in exchange, to issue shares. The company is assumed to use the cash proceeds to repurchase shares at the weighted average market price during the period. As a result of these two effects, the number of shares outstanding would increase by the incremental number of shares issued (the difference between the number of s

Article 1602884603148

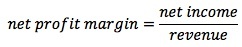

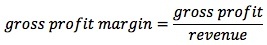

7. ANALYSIS OF THE INCOME STATEMENT

#cfa-level-1 #financial-reporting-and-analysis #has-images #income-statement

Common-Size Analysis of the Income Statement This topic will be discussed in detail in Reading 27 [Financial Analysis Techniques]. Income Statement Ratios The following operating profitability ratios measure the rates of profit on sales (profit margins). Net Profit Margin shows how much profit is generated on every dollar of sales. Net income is earnings after tax but before dividends (EBIT - interest - taxes). It should be based on earnings from the company's continuing operation because the analysis is to forecast the company's future performance. Thus analysts should not consider earnings from discontinued operations, gains or losses from the sale of discontinued operations, and non-recurring income or expenses. Gross Profit Margin equals percent of sales available after deducting cost of goods sold. This percentage is available to cover selling, general and administrative costs, and also earn a profit. It indicates the basic cost structure of

Flashcard 1602889059596

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

7. ANALYSIS OF THE INCOME STATEMENT

opic will be discussed in detail in Reading 27 [Financial Analysis Techniques]. Income Statement Ratios The following operating profitability ratios measure the rates of profit on sales (profit margins). <span>Net Profit Margin shows how much profit is generated on every dollar of sales. Net income is earnings after tax but before dividends (EBIT - interest - taxes). It should be based on earnings from the company's continuing o

opic will be discussed in detail in Reading 27 [Financial Analysis Techniques]. Income Statement Ratios The following operating profitability ratios measure the rates of profit on sales (profit margins). <span>Net Profit Margin shows how much profit is generated on every dollar of sales. Net income is earnings after tax but before dividends (EBIT - interest - taxes). It should be based on earnings from the company's continuing o

Flashcard 1602891418892

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

7. ANALYSIS OF THE INCOME STATEMENT

The following operating profitability ratios measure the rates of profit on sales (profit margins). Net Profit Margin shows how much profit is generated on every dollar of sales. <span>Net income is earnings after tax but before dividends (EBIT - interest - taxes). It should be based on earnings from the company's continuing operation because the analysis is to forecast the company's future performance. Thus analysts should not consider earnings from discontinued operations, gains or losses from the sale of discontinued operations, and non-recurring income or expenses. Gross Profit Margin equals percent of sales available after deducting cost of goods sold. This percentage is available to cov

The following operating profitability ratios measure the rates of profit on sales (profit margins). Net Profit Margin shows how much profit is generated on every dollar of sales. <span>Net income is earnings after tax but before dividends (EBIT - interest - taxes). It should be based on earnings from the company's continuing operation because the analysis is to forecast the company's future performance. Thus analysts should not consider earnings from discontinued operations, gains or losses from the sale of discontinued operations, and non-recurring income or expenses. Gross Profit Margin equals percent of sales available after deducting cost of goods sold. This percentage is available to cov

Flashcard 1602893778188

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

7. ANALYSIS OF THE INCOME STATEMENT

on sales (profit margins). Net Profit Margin shows how much profit is generated on every dollar of sales. Net income is earnings after tax but before dividends (EBIT - interest - taxes). <span>It should be based on earnings from the company's continuing operation because the analysis is to forecast the company's future performance. Thus analysts should not consider earnings from discontinued operations, gains or losses from the sale of discontinued operations, and non-recurring income or expenses.

on sales (profit margins). Net Profit Margin shows how much profit is generated on every dollar of sales. Net income is earnings after tax but before dividends (EBIT - interest - taxes). <span>It should be based on earnings from the company's continuing operation because the analysis is to forecast the company's future performance. Thus analysts should not consider earnings from discontinued operations, gains or losses from the sale of discontinued operations, and non-recurring income or expenses.

Flashcard 1602896137484

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

7. ANALYSIS OF THE INCOME STATEMENT

is to forecast the company's future performance. Thus analysts should not consider earnings from discontinued operations, gains or losses from the sale of discontinued operations, and non-recurring income or expenses. <span>Gross Profit Margin equals percent of sales available after deducting cost of goods sold. This percentage is available to cover selling, general and administrative costs, and also earn a profit. It indicates the basic cost structure of a c

is to forecast the company's future performance. Thus analysts should not consider earnings from discontinued operations, gains or losses from the sale of discontinued operations, and non-recurring income or expenses. <span>Gross Profit Margin equals percent of sales available after deducting cost of goods sold. This percentage is available to cover selling, general and administrative costs, and also earn a profit. It indicates the basic cost structure of a c

Flashcard 1602898496780

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

7. ANALYSIS OF THE INCOME STATEMENT

earnings from discontinued operations, gains or losses from the sale of discontinued operations, and non-recurring income or expenses. Gross Profit Margin equals percent of sales available after deducting cost of goods <span>sold. This percentage is available to cover selling, general and administrative costs, and also earn a profit. It indicates the basic cost structure of a c

earnings from discontinued operations, gains or losses from the sale of discontinued operations, and non-recurring income or expenses. Gross Profit Margin equals percent of sales available after deducting cost of goods <span>sold. This percentage is available to cover selling, general and administrative costs, and also earn a profit. It indicates the basic cost structure of a c

Flashcard 1602900856076

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

7. ANALYSIS OF THE INCOME STATEMENT

n a profit. It indicates the basic cost structure of a company and shows the company's cost-price position. Comparing this ratio with the industry average over time shows the company's relative profitability within the industry. <span>A declining gross profit may indicate increasing costs of production or declining prices. The ratio can be affected by changes in the company's product mix: a change toward items with higher (lower) margin raises (reduces) the gross profit margin. A small change in gross pro

n a profit. It indicates the basic cost structure of a company and shows the company's cost-price position. Comparing this ratio with the industry average over time shows the company's relative profitability within the industry. <span>A declining gross profit may indicate increasing costs of production or declining prices. The ratio can be affected by changes in the company's product mix: a change toward items with higher (lower) margin raises (reduces) the gross profit margin. A small change in gross pro

Flashcard 1602903215372

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

7. ANALYSIS OF THE INCOME STATEMENT

lining gross profit may indicate increasing costs of production or declining prices. The ratio can be affected by changes in the company's product mix: a change toward items with higher (lower) margin raises (reduces) the gross profit margin. <span>A small change in gross profit can result in a much larger change in profit margin if the company has high fixed costs. <span><body><html>

lining gross profit may indicate increasing costs of production or declining prices. The ratio can be affected by changes in the company's product mix: a change toward items with higher (lower) margin raises (reduces) the gross profit margin. <span>A small change in gross profit can result in a much larger change in profit margin if the company has high fixed costs. <span><body><html>

Article 1602905574668

Comprehensive income

#cfa #cfa-level-1 #financial-reporting-and-analysis #has-images #reading-24-understanding-income-statements

Comprehensive income includes both net income and other revenue and expense items that are excluded from the net income calculation. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding gain or loss from available-for-sale securities and foreign currency translation gains or losses. These items are not part of net income, yet are important enough to be included in comprehensive income, giving the user a bigger, more comprehensive picture of the organization as a whole. The following table is from the Statement of Stockholders' Equity section of the 3M's 2001 annual report. This section describes the composition of comprehensive income. It begins with net income and then includes those items affecting stockholders' equity that do not flow through the income statement. For 3M, these items include: Cumulative translation adjustment. Minimum pension liability a

Flashcard 1602908458252

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Comprehensive income

Comprehensive income includes both net income and other revenue and expense items that are excluded from the net income calculation. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding

Comprehensive income includes both net income and other revenue and expense items that are excluded from the net income calculation. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding

Flashcard 1602910817548

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Comprehensive income

Comprehensive income includes both net income and other revenue and expense items that are excluded from the net income calculation. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding gain or loss from available-for-sale securities and foreign currency translation gains or losses. These items are not part of net income, yet are important enough to be included in comprehensive income, giving the user a bigger, more comprehensive picture of the organization as a wh

Comprehensive income includes both net income and other revenue and expense items that are excluded from the net income calculation. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding gain or loss from available-for-sale securities and foreign currency translation gains or losses. These items are not part of net income, yet are important enough to be included in comprehensive income, giving the user a bigger, more comprehensive picture of the organization as a wh

Flashcard 1602913176844

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Comprehensive income

Comprehensive income includes both net income and other revenue and expense items that are excluded from the net income calculation. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding gain or loss from available-for-sale securities and foreign currency translation gains or losses. These items are not part of net income, yet are important enough to be included in comprehensive income, giving the user a bigger, more comprehensive picture of the organization as a wh

Comprehensive income includes both net income and other revenue and expense items that are excluded from the net income calculation. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding gain or loss from available-for-sale securities and foreign currency translation gains or losses. These items are not part of net income, yet are important enough to be included in comprehensive income, giving the user a bigger, more comprehensive picture of the organization as a wh

Flashcard 1602915011852

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Comprehensive income

sition of comprehensive income. It begins with net income and then includes those items affecting stockholders' equity that do not flow through the income statement. For 3M, these items include: Cumulative translation adjustment. <span>Minimum pension liability adjustment. Unrealized gains (losses) on available-for-sale investments. Unrealized gains (losses) on derivative investments. FASB has taken the position that income for a period shoul

sition of comprehensive income. It begins with net income and then includes those items affecting stockholders' equity that do not flow through the income statement. For 3M, these items include: Cumulative translation adjustment. <span>Minimum pension liability adjustment. Unrealized gains (losses) on available-for-sale investments. Unrealized gains (losses) on derivative investments. FASB has taken the position that income for a period shoul

Flashcard 1602917371148

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Comprehensive income

ins with net income and then includes those items affecting stockholders' equity that do not flow through the income statement. For 3M, these items include: Cumulative translation adjustment. Minimum pension liability adjustment. <span>Unrealized gains (losses) on available-for-sale investments. Unrealized gains (losses) on derivative investments. FASB has taken the position that income for a period should be all-inclusive comprehensive income. Comprehensive income may be reported on an income statement or separate s

ins with net income and then includes those items affecting stockholders' equity that do not flow through the income statement. For 3M, these items include: Cumulative translation adjustment. Minimum pension liability adjustment. <span>Unrealized gains (losses) on available-for-sale investments. Unrealized gains (losses) on derivative investments. FASB has taken the position that income for a period should be all-inclusive comprehensive income. Comprehensive income may be reported on an income statement or separate s

Flashcard 1602920516876

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Comprehensive income

lity adjustment. Unrealized gains (losses) on available-for-sale investments. Unrealized gains (losses) on derivative investments. FASB has taken the position that income for a period should be all-inclusive comprehensive income. <span>Comprehensive income may be reported on an income statement or separate statement, but is usually reported on a statement of stockholders' equity. <span><body><html>

lity adjustment. Unrealized gains (losses) on available-for-sale investments. Unrealized gains (losses) on derivative investments. FASB has taken the position that income for a period should be all-inclusive comprehensive income. <span>Comprehensive income may be reported on an income statement or separate statement, but is usually reported on a statement of stockholders' equity. <span><body><html>

Flashcard 1602930216204

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |