Edited, memorised or added to reading queue

on 11-Nov-2017 (Sat)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1428162481420

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itsimplest level, production of a good consists of transforming inputs, or factors of production (such as land, labor, capital, and materials) into finished goods and services. Economists refer to the “rules” that govern this transformation as <span>the technology of production . Because producers have to purchase inputs in factor markets, the cost of production depends on both the technology and the price of those factors.<span><body><html>

Original toplevel document

3.3. The Supply Function and the Supply Curvebetween those two values, the greater is the willingness of producers to supply the good. In another reading, we will explore the cost of production in greater detail. At this point, we need to understand only the basics of cost. <span>At its simplest level, production of a good consists of transforming inputs, or factors of production (such as land, labor, capital, and materials) into finished goods and services. Economists refer to the “rules” that govern this transformation as the technology of production . Because producers have to purchase inputs in factor markets, the cost of production depends on both the technology and the price of those factors. Clearly, willingness to supply is dependent on not only the price of a producer’s output, but also additionally on the prices (i.e., costs) of the inputs necessary to produce it. For si

Flashcard 1430507883788

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itOften, economists use simple linear equations to approximate real-world demand and supply functions in relevant ranges.

Original toplevel document

3.1. The Demand Function and the Demand Curvey other goods, not just one, and they can be complements or substitutes.) Equation 1 may be read, “Quantity demanded of good X depends on (is a function of) the price of good X, consumers’ income, the price of good Y, and so on.” <span>Often, economists use simple linear equations to approximate real-world demand and supply functions in relevant ranges. A hypothetical example of a specific demand function could be the following linear equation for a small town’s per-household gasoline consumption per week, where P y might be the average price of an automobile in $1,000s: Equation (2) Qdx=8.4−0.4Px+0.06I−0.01Py The signs of the coefficients on gasoline price (negative) and consumer’s income (positive) are intuitive, reflecting, respectively, an inverse and a positive relationship between those variables and quantity of gasoline consumed. The negative sign on average automobile price may indicate that if automobiles go up in price, fewer will be purchased and driven; hence less gasoline will be consumed. As will be discussed later, such a relationship would indicate that gasoline and automobiles have a negative cross-price elasticity of demand and are thus complements. To continue our example, suppose that the price of gasoline (P x ) is $3 per gallon, per household income (I) is $50,000, and the price of the average automobile (P y ) is

Flashcard 1430517583116

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itrkets that are tangentially involved with this one. At other times, however, we need explicitly to take account of all the feedback mechanisms that are going on in all markets simultaneously. When we do that, we are engaging in what is called <span>general equilibrium analysis .<span><body><html>

Original toplevel document

3.6. Market Equilibriumso on, whereas the price and quantity of gasoline are being determined in the gasoline market. When we concentrate on one market, taking values of exogenous variables as given, we are engaging in what is called partial equilibrium analysis . <span>In many cases, we can gain sufficient insight into a market of interest without addressing feedback effects to and from all the other markets that are tangentially involved with this one. At other times, however, we need explicitly to take account of all the feedback mechanisms that are going on in all markets simultaneously. When we do that, we are engaging in what is called general equilibrium analysis .For example, in our hypothetical model of the local gasoline market, we recognize that the price of automobiles, a complementary product, has an impact on the demand for gasoline. If the

Flashcard 1433061952780

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture.

Original toplevel document

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICEon the vertical axis, the slope is equal to –(P L /P C ) = –10/16 = –0.625. (Note: If we had chosen to measure quantity of lamb on the vertical axis, the slope would be inverted: –(P C /P L ) = −1.6.) <span>4.2. The Production Opportunity Set Companies face constraints on their production opportunities, just as consumers face limits on the bundles of goods that they can consume. Consider a company that produces two products using the same production capacity. For example, an automobile company might use the same factory to produce either automobiles or light trucks. If so, then the company is constrained by the limited capacity to produce vehicles. If it produces more trucks, it must reduce its production of automobiles; likewise, if it produces more automobiles, it must produce fewer trucks. The company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture. Such a frontier for the vehicle company might look something like that in Exhibit 9. Exhibit 9. The Production Opportunity Frontier Note: The production opportunity frontier for a vehicle manufacturer shows the maximum number of autos for any given level of truck production. In this example, the opportunity cost of a truck is 0.8 autos. There are two important things to notice about this example. First, if the company devoted its entire production facility to the manufacture of automobiles, it could produce 1 million in a year. Alternatively, if it devoted its entire plant to trucks, it could produce 1.25 million a year. Of course, it could devote only part of the year’s production to trucks, in which case it could produce automobiles during the remainder of the year. In this simple example, for every additional truck the company chooses to make, it would have to produce 0.8 fewer cars. That is, the opportunity cost of a truck is 0.8 cars, or the opportunity cost of a car is 1.25 trucks. The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. The other thing to notice about this exhibit is that it assumes the opportunity cost of a truck is independent of how many trucks (and cars) the company produces. The production opportunity frontier is linear with a constant slope. Perhaps a more realistic example would be to increase marginal opportunity cost. As more and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. 4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to exa

Flashcard 1433071127820

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe opportunity cost of trucks is the negative of the slope of the production opportunity frontier

Original toplevel document

4. THE OPPORTUNITY SET: CONSUMPTION, PRODUCTION, AND INVESTMENT CHOICEon the vertical axis, the slope is equal to –(P L /P C ) = –10/16 = –0.625. (Note: If we had chosen to measure quantity of lamb on the vertical axis, the slope would be inverted: –(P C /P L ) = −1.6.) <span>4.2. The Production Opportunity Set Companies face constraints on their production opportunities, just as consumers face limits on the bundles of goods that they can consume. Consider a company that produces two products using the same production capacity. For example, an automobile company might use the same factory to produce either automobiles or light trucks. If so, then the company is constrained by the limited capacity to produce vehicles. If it produces more trucks, it must reduce its production of automobiles; likewise, if it produces more automobiles, it must produce fewer trucks. The company’s production opportunity frontier shows the maximum number of units of one good it can produce, for any given number of the other good that it chooses to manufacture. Such a frontier for the vehicle company might look something like that in Exhibit 9. Exhibit 9. The Production Opportunity Frontier Note: The production opportunity frontier for a vehicle manufacturer shows the maximum number of autos for any given level of truck production. In this example, the opportunity cost of a truck is 0.8 autos. There are two important things to notice about this example. First, if the company devoted its entire production facility to the manufacture of automobiles, it could produce 1 million in a year. Alternatively, if it devoted its entire plant to trucks, it could produce 1.25 million a year. Of course, it could devote only part of the year’s production to trucks, in which case it could produce automobiles during the remainder of the year. In this simple example, for every additional truck the company chooses to make, it would have to produce 0.8 fewer cars. That is, the opportunity cost of a truck is 0.8 cars, or the opportunity cost of a car is 1.25 trucks. The opportunity cost of trucks is the negative of the slope of the production opportunity frontier: 1/1.25. And of course, the opportunity cost of an automobile is the inverse of that ratio, or 1.25. The other thing to notice about this exhibit is that it assumes the opportunity cost of a truck is independent of how many trucks (and cars) the company produces. The production opportunity frontier is linear with a constant slope. Perhaps a more realistic example would be to increase marginal opportunity cost. As more and more trucks are produced, fewer inputs that are particularly well suited to producing truck inputs could be transferred to assist in their manufacture, causing the cost of trucks (in terms of cars) to rise as more trucks are produced. In this event, the production opportunity frontier would become steeper as the company moved its production point away from cars and toward more trucks, resulting in a frontier that would be concave as viewed from the origin. 4.3. The Investment Opportunity Set The investment opportunity set is examined in detail in readings on investments, but it is appropriate to exa

Flashcard 1434843483404

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itConsumer Equilibrium Currently, a consumer is buying both sorbet and gelato each week. His MRS GS [marginal rate of substitution of gelato (G) for sorbet (S)] equals 0.75. The price of gelato is €1 per scoop, and the price of sorbet is €1.25 per scoop. Determine whether the consumer is currently optimizing his budget over these two desserts. Justify your answer. Explain whether the consumer should buy more sorbet or more gelato, given that he is not currently optimizing his budget. Solution to 1: In this example, the

Original toplevel document

5. CONSUMER EQUILIBRIUM: MAXIMIZING UTILITY SUBJECT TO THE BUDGET CONSTRAINTon is less than the price ratio—meaning that the price for that additional unit is above her willingness to pay. Even though she could afford bundle c, it would not be the best use of her income. EXAMPLE 5 <span>Consumer Equilibrium Currently, a consumer is buying both sorbet and gelato each week. His MRS GS [marginal rate of substitution of gelato (G) for sorbet (S)] equals 0.75. The price of gelato is €1 per scoop, and the price of sorbet is €1.25 per scoop. Determine whether the consumer is currently optimizing his budget over these two desserts. Justify your answer. Explain whether the consumer should buy more sorbet or more gelato, given that he is not currently optimizing his budget. Solution to 1: In this example, the condition for consumer equilibrium is MRS GS = P G /P S . Because P G /P S = 0.8 and MRS GS = 0.75, the consumer is clearly not allocating his budget in a way that maximizes his utility, subject to his budget constraint. Solution to 2: The MRS GS is the rate at which the consumer is willing to give up sorbet to gain a small additional amount of gelato, which is 0.75 scoops of sorbet to gain one scoop of gelato. The price ratio, P G /P S (0.8), is the rate at which he must give up sorbet to gain an additional small amount of gelato. In this case, the consumer would be better off spending a little less on gelato and a little more on sorbet. 5.2. Consumer Response to Changes in Income: Normal and Inferior Goods The consumer’s behavior is constrained by his income a

Flashcard 1435624410380

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itEconomic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as accounting profit less the implicit opportunity costs not included in total accounting costs.

Original toplevel document

2. OBJECTIVES OF THE FIRM00 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. <span>2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as accounting profit less the implicit opportunity costs not included in total accounting costs. Equation (3a) Economic profit = Accounting profit – Total implicit opportunity costs We can define a term, economic cost , equal to the sum of total accounting costs and implicit opportunity costs. Economic profit is therefore equivalently defined as: Equation (3b) Economic profit = Total revenue – Total economic costs For publicly traded corporations, the focus of investment analysts’ work, the cost of equity capital is the largest and most readily identified implicit opportunity cost omitted in calculating total accounting cost. Consequently, economic profit can be defined for publicly traded corporations as accounting profit less the required return on equity capital. Examples will make these concepts clearer. Consider the start-up company for which we calculated an accounting profit of €300,000 and suppose that the entrepreneurial executive who launched the start-up took a salary reduction of €100,000 per year relative to the job he left. That €100,000 is an opportunity cost of involving him in running the start-up. Besides labor, financial capital is a resource. Suppose that the executive, as sole owner, makes an investment of €1,500,000 to launch the enterprise and that he might otherwise expect to earn €200,000 per year on that amount in a similar risk investment. Total implicit opportunity costs are €100,000 + €200,000 = €300,000 per year and economic profit is zero: €300,000 – €300,000 = €0. For the publicly traded corporation, we consider the cost of equity capital as the only implicit opportunity cost identifiable. Suppose that equity investment is $18,750,000 and shareholders’ required rate of return is 8 percent so that the dollar cost of equity capital is $1,500,000. Economic profit for the publicly traded corporation is therefore $2,000,000 (accounting profit) less $1,500,000 (cost of equity capital) or $500,000. For the start-up company, economic profit was zero. Total economic costs were just covered by revenues and the company was not earning a euro more nor less than the amount that meets the opportunity costs of the resources used in the business. Economists would say the company was earning a normal profit (economic profit of zero). In simple terms, normal profit is the level of accounting profit needed to just cover the implicit opportunity costs ignored in accounting costs. For the publicly traded corporation, normal profit was $1,500,000: normal profit can be taken to be the cost of equity capital (in money terms) for such a company or the dollar return required on an equal investment by equity holders in an equivalently risky alternative investment opportunity. The publicly traded corporation actually earned $500,000 in excess of normal profit, which should be reflected in the common shares’ market price. Thus, the following expression links accounting profit to economic profit and normal profit: Equation (4) Accounting profit = Economic profit + Normal profit When accounting profit equals normal profit, economic profit is zero. Further, when accounting profit is greater than normal profit, economic profit is positive; and when accounting profit is less than normal profit, economic profit is negative (the firm has an economic loss ). Economic profit for a firm can originate from sources such as: competitive advantage; exceptional managerial efficiency or skill; difficult to copy technology or innovation (e.g., patents, trademarks, and copyrights); exclusive access to less-expensive inputs; fixed supply of an output, commodity, or resource; preferential treatment under governmental policy; large increases in demand where supply is unable to respond fully over time; exertion of monopoly power (price control) in the market; and market barriers to entry that limit competition. Any of the above factors may lead the firm to have positive net present value investment (NPV) opportunities. Access to positive NPV opportunities and therefore profit in excess of normal profits in the short run may or may not exist in the long run, depending on the potential strength of competition. In highly competitive market situations, firms tend to earn the normal profit level over time because ease of market entry allows for other competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. 2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical su

Flashcard 1438143352076

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 1. Capital Budgeting: Introduction

ssets) whose cash flows are expected to extend beyond one year. Managers analyze projects and decide which ones to include in the capital budget. "Capital" refers to long-term assets. The "budget" is a <span>plan which details projected cash inflows and outflows during a future period. The typical steps in the capital budgeting process: Generating good investment ideas to consider. Analyzing individual pro

ssets) whose cash flows are expected to extend beyond one year. Managers analyze projects and decide which ones to include in the capital budget. "Capital" refers to long-term assets. The "budget" is a <span>plan which details projected cash inflows and outflows during a future period. The typical steps in the capital budgeting process: Generating good investment ideas to consider. Analyzing individual pro

Flashcard 1438187916556

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itments. Expansion projects. Projects concerning expansion into new products, services, or markets involve strategic decisions and explicit forecasts of future demand, and thus require detailed analysis. These projects are <span>more complex than replacement projects. Regulatory, safety and environmental projects. These projects are mandatory investments, and are often non-revenue-producing.

Original toplevel document

Subject 1. Capital Budgeting: Introductionood capital budgeting decisions can be made). Otherwise, you will have the GIGO (garbage in, garbage out) problem. Improve operations, thus making capital decisions well-implemented. <span>Project classifications: Replacement projects. There are two types of replacement decisions: Replacement decisions to maintain a business. The issue is twofold: should the existing operations be continued? If yes, should the same processes continue to be used? Maintenance decisions are usually made without detailed analysis. Replacement decisions to reduce costs. Cost reduction projects determine whether to replace serviceable but obsolete equipment. These decisions are discretionary and a detailed analysis is usually required. The cash flows from the old asset must be considered in replacement decisions. Specifically, in a replacement project, the cash flows from selling old assets should be used to offset the initial investment outlay. Analysts also need to compare revenue/cost/depreciation before and after the replacement to identify changes in these elements. Expansion projects. Projects concerning expansion into new products, services, or markets involve strategic decisions and explicit forecasts of future demand, and thus require detailed analysis. These projects are more complex than replacement projects. Regulatory, safety and environmental projects. These projects are mandatory investments, and are often non-revenue-producing. Others. Some projects need special considerations beyond traditional capital budgeting analysis (for example, a very risky research project in which cash flows cannot be reliably forecast). LOS a. describe the capital budgeting process and distinguish among the various categories of capital projects; <span><body><html>

Flashcard 1438252403980

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAssumptions of capital budgeting are: Capital budgeting decisions must be based on cash flows, not accounting income. Accounting profits only measure the return on the invested capital. Accounting income calculations reflect non-cash items and ignore the tim

Original toplevel document

Subject 2. Basic Principles of Capital BudgetingCapital budgeting decisions are based on incremental after-tax cash flows discounted at the opportunity cost of capital. Assumptions of capital budgeting are: Capital budgeting decisions must be based on cash flows, not accounting income. Accounting profits only measure the return on the invested capital. Accounting income calculations reflect non-cash items and ignore the time value of money. They are important for some purposes, but for capital budgeting, cash flows are what are relevant. Economic income is an investment's after-tax cash flow plus the change in the market value. Financing costs are ignored in computing economic income. Cash flow timing is critical because money is worth more the sooner you get it. Also, firms must have adequate cash flow to meet maturing obligations. The opportunity cost should be charged against a project. Remember that just because something is on hand does not mean it's free. See below for the definition of opportunity cost. Expected future cash flows must be measured on an after-tax basis. The firm's wealth depends on its usable after-tax funds. Ignore how the project is financed. Interest payments should not be included in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which

Flashcard 1438308502796

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itImportant capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which cannot be recovered regardless of whether a project is accepted or rejected. Since sunk costs are not increment costs, they sho

Original toplevel document

Subject 2. Basic Principles of Capital Budgetingd in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. <span>Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which cannot be recovered regardless of whether a project is accepted or rejected. Since sunk costs are not increment costs, they should not be included in the capital budgeting analysis. For example, a small bookstore is considering opening a coffee shop within its store, which will generate an annual net cash outflow of $10,000 from selling coffee. That is, the coffee shop will always be losing money. In the previous year, the bookstore spent $5,000 to hire a consultant to perform an analysis. This $5,000 consulting fee is a sunk cost; whether the coffee shop is opened or not, the $5,000 is spent. Incremental cash flow is the net cash flow attributable to an investment project. It represents the change in the firm's total cash flow that occurs as a direct result of accepting the project. Forget sunk costs. Subtract opportunity costs. Consider side effects on other parts of the firm: externalities and cannibalization. Recognize the investment and recovery of net working capital. Opportunity cost is the return on the best alternative use of an asset or the highest return that will not be earned if funds are invested in a particular project. For example, to continue with the bookstore example, the space to be occupied by the coffee shop is an opportunity cost - it could be used to sell books and generate a $5,000 annual net cash inflow. Externalities are the effects of a project on cash flows in other parts of a firm. Although they are difficult to quantify, they should be considered. Externalities can be either positive or negative: Positive externalities create benefits for other parts of the firm. For example, the coffee shop may generate some additional customers for the bookstore (who otherwise may not buy books there). Future cash flows generated by positive externalities occur with the project and do not occur without the project, so they are incremental. Negative externalities create costs for other parts of the firm. For example, if the bookstore is considering opening a branch two blocks away, some customers who buy books at the old store will switch to the new branch. The customers lost by the old store are a negative externality. The primary type of negative externality is cannibalization, which occurs when the introduction of a new product causes sales of existing products to decline. Future cash flows represented by negative externalities occur regardless of the project, so they are non-incremental. Such cash flows represent a transfer from existing projects to new projects, and thus should be subtracted from the new projects' cash flows. Conventional versus non-conventional cash flows. A conventional cash flow pattern is one with an initial outflow followed by a series of inflows. In a non-conventional cash flow pattern, the initial outflow can be followed by inflows and/or outflows. Some project interactions: Indepe

Flashcard 1438498032908

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itties create costs for other parts of the firm. For example, if the bookstore is considering opening a branch two blocks away, some customers who buy books at the old store will switch to the new branch. The customers lost by the old store are <span>a negative externality. The primary type of negative externality is cannibalization, which occurs when the introduction of a new product causes sales of existing products to decline.

Original toplevel document

Subject 2. Basic Principles of Capital Budgetingd in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. <span>Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which cannot be recovered regardless of whether a project is accepted or rejected. Since sunk costs are not increment costs, they should not be included in the capital budgeting analysis. For example, a small bookstore is considering opening a coffee shop within its store, which will generate an annual net cash outflow of $10,000 from selling coffee. That is, the coffee shop will always be losing money. In the previous year, the bookstore spent $5,000 to hire a consultant to perform an analysis. This $5,000 consulting fee is a sunk cost; whether the coffee shop is opened or not, the $5,000 is spent. Incremental cash flow is the net cash flow attributable to an investment project. It represents the change in the firm's total cash flow that occurs as a direct result of accepting the project. Forget sunk costs. Subtract opportunity costs. Consider side effects on other parts of the firm: externalities and cannibalization. Recognize the investment and recovery of net working capital. Opportunity cost is the return on the best alternative use of an asset or the highest return that will not be earned if funds are invested in a particular project. For example, to continue with the bookstore example, the space to be occupied by the coffee shop is an opportunity cost - it could be used to sell books and generate a $5,000 annual net cash inflow. Externalities are the effects of a project on cash flows in other parts of a firm. Although they are difficult to quantify, they should be considered. Externalities can be either positive or negative: Positive externalities create benefits for other parts of the firm. For example, the coffee shop may generate some additional customers for the bookstore (who otherwise may not buy books there). Future cash flows generated by positive externalities occur with the project and do not occur without the project, so they are incremental. Negative externalities create costs for other parts of the firm. For example, if the bookstore is considering opening a branch two blocks away, some customers who buy books at the old store will switch to the new branch. The customers lost by the old store are a negative externality. The primary type of negative externality is cannibalization, which occurs when the introduction of a new product causes sales of existing products to decline. Future cash flows represented by negative externalities occur regardless of the project, so they are non-incremental. Such cash flows represent a transfer from existing projects to new projects, and thus should be subtracted from the new projects' cash flows. Conventional versus non-conventional cash flows. A conventional cash flow pattern is one with an initial outflow followed by a series of inflows. In a non-conventional cash flow pattern, the initial outflow can be followed by inflows and/or outflows. Some project interactions: Indepe

Flashcard 1438506159372

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itties create costs for other parts of the firm. For example, if the bookstore is considering opening a branch two blocks away, some customers who buy books at the old store will switch to the new branch. The customers lost by the old store are <span>a negative externality. The primary type of negative externality is cannibalization, which occurs when the introduction of a new product causes sales of existing products to decline.

Original toplevel document

Subject 2. Basic Principles of Capital Budgetingd in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. <span>Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which cannot be recovered regardless of whether a project is accepted or rejected. Since sunk costs are not increment costs, they should not be included in the capital budgeting analysis. For example, a small bookstore is considering opening a coffee shop within its store, which will generate an annual net cash outflow of $10,000 from selling coffee. That is, the coffee shop will always be losing money. In the previous year, the bookstore spent $5,000 to hire a consultant to perform an analysis. This $5,000 consulting fee is a sunk cost; whether the coffee shop is opened or not, the $5,000 is spent. Incremental cash flow is the net cash flow attributable to an investment project. It represents the change in the firm's total cash flow that occurs as a direct result of accepting the project. Forget sunk costs. Subtract opportunity costs. Consider side effects on other parts of the firm: externalities and cannibalization. Recognize the investment and recovery of net working capital. Opportunity cost is the return on the best alternative use of an asset or the highest return that will not be earned if funds are invested in a particular project. For example, to continue with the bookstore example, the space to be occupied by the coffee shop is an opportunity cost - it could be used to sell books and generate a $5,000 annual net cash inflow. Externalities are the effects of a project on cash flows in other parts of a firm. Although they are difficult to quantify, they should be considered. Externalities can be either positive or negative: Positive externalities create benefits for other parts of the firm. For example, the coffee shop may generate some additional customers for the bookstore (who otherwise may not buy books there). Future cash flows generated by positive externalities occur with the project and do not occur without the project, so they are incremental. Negative externalities create costs for other parts of the firm. For example, if the bookstore is considering opening a branch two blocks away, some customers who buy books at the old store will switch to the new branch. The customers lost by the old store are a negative externality. The primary type of negative externality is cannibalization, which occurs when the introduction of a new product causes sales of existing products to decline. Future cash flows represented by negative externalities occur regardless of the project, so they are non-incremental. Such cash flows represent a transfer from existing projects to new projects, and thus should be subtracted from the new projects' cash flows. Conventional versus non-conventional cash flows. A conventional cash flow pattern is one with an initial outflow followed by a series of inflows. In a non-conventional cash flow pattern, the initial outflow can be followed by inflows and/or outflows. Some project interactions: Indepe

Flashcard 1438547840268

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1438902783244

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itBecause of the convexity assumption—that MRS BW must diminish as he moves toward more bread and less wine—the MRS BW is continuously changing as he moves along his indifference curve.

Original toplevel document

3. UTILITY THEORY: MODELING PREFERENCES AND TASTESe. If, at some point, the slope of the indifference curve had value –2.5, it means that, starting at that particular bundle, our consumer would be willing to sacrifice wine to obtain bread at the rate of 2.5 ounces of wine per slice of bread. <span>Because of the convexity assumption—that MRS BW must diminish as he moves toward more bread and less wine—the MRS BW is continuously changing as he moves along his indifference curve. EXAMPLE 2 Understanding the Marginal Rate of Substitution Tom Warren currently has 50 blueberries and 20 peanuts. His marginal rate of substitution

Flashcard 1439258774796

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itGuaranteed loans are fully transferable, can be securitized and are available in certain foreign currencies.

Original toplevel document

Government-Assisted Foreign Buyer Financing (Eximbank USA)g may not be available in certain countries and certain terms for U.S. government policy reasons (for more information, see the Country Limitation Schedule posted on the Bank’s Web site, www.exim.gov, under the “Apply” section). <span>Key Features of Ex-Im Bank Loan Guarantees Loans are made by commercial banks and repayment of these loans is guaranteed by Ex-Im Bank. Guaranteed loans cover 100 percent of the principal and interest for 85 percent of the U.S. contract price. Interest rates are negotiable, and are usually floating and lower than fixed rates. Guaranteed loans are fully transferable, can be securitized and are available in certain foreign currencies. Guaranteed loans have a faster documentation process with the assistance of commercial banks. There are no U.S. vessel shipping requirements for amounts less than $20 million. Key Features of Ex-Im Bank Direct Loans Fixed-rate loans are provided directly to creditworthy foreign buyers. Direct loans supp

Flashcard 1439283678476

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itSome factors (monopoly, market barriers, trademarks etc.) may lead the firm to have positive net present value investment (NPV) opportunities. Access to positive NPV opportunities and therefore profit in excess of normal profits in the short run may or may not exist in the long run, depending on the potential strength of competition.

Original toplevel document

2. OBJECTIVES OF THE FIRM00 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. <span>2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as accounting profit less the implicit opportunity costs not included in total accounting costs. Equation (3a) Economic profit = Accounting profit – Total implicit opportunity costs We can define a term, economic cost , equal to the sum of total accounting costs and implicit opportunity costs. Economic profit is therefore equivalently defined as: Equation (3b) Economic profit = Total revenue – Total economic costs For publicly traded corporations, the focus of investment analysts’ work, the cost of equity capital is the largest and most readily identified implicit opportunity cost omitted in calculating total accounting cost. Consequently, economic profit can be defined for publicly traded corporations as accounting profit less the required return on equity capital. Examples will make these concepts clearer. Consider the start-up company for which we calculated an accounting profit of €300,000 and suppose that the entrepreneurial executive who launched the start-up took a salary reduction of €100,000 per year relative to the job he left. That €100,000 is an opportunity cost of involving him in running the start-up. Besides labor, financial capital is a resource. Suppose that the executive, as sole owner, makes an investment of €1,500,000 to launch the enterprise and that he might otherwise expect to earn €200,000 per year on that amount in a similar risk investment. Total implicit opportunity costs are €100,000 + €200,000 = €300,000 per year and economic profit is zero: €300,000 – €300,000 = €0. For the publicly traded corporation, we consider the cost of equity capital as the only implicit opportunity cost identifiable. Suppose that equity investment is $18,750,000 and shareholders’ required rate of return is 8 percent so that the dollar cost of equity capital is $1,500,000. Economic profit for the publicly traded corporation is therefore $2,000,000 (accounting profit) less $1,500,000 (cost of equity capital) or $500,000. For the start-up company, economic profit was zero. Total economic costs were just covered by revenues and the company was not earning a euro more nor less than the amount that meets the opportunity costs of the resources used in the business. Economists would say the company was earning a normal profit (economic profit of zero). In simple terms, normal profit is the level of accounting profit needed to just cover the implicit opportunity costs ignored in accounting costs. For the publicly traded corporation, normal profit was $1,500,000: normal profit can be taken to be the cost of equity capital (in money terms) for such a company or the dollar return required on an equal investment by equity holders in an equivalently risky alternative investment opportunity. The publicly traded corporation actually earned $500,000 in excess of normal profit, which should be reflected in the common shares’ market price. Thus, the following expression links accounting profit to economic profit and normal profit: Equation (4) Accounting profit = Economic profit + Normal profit When accounting profit equals normal profit, economic profit is zero. Further, when accounting profit is greater than normal profit, economic profit is positive; and when accounting profit is less than normal profit, economic profit is negative (the firm has an economic loss ). Economic profit for a firm can originate from sources such as: competitive advantage; exceptional managerial efficiency or skill; difficult to copy technology or innovation (e.g., patents, trademarks, and copyrights); exclusive access to less-expensive inputs; fixed supply of an output, commodity, or resource; preferential treatment under governmental policy; large increases in demand where supply is unable to respond fully over time; exertion of monopoly power (price control) in the market; and market barriers to entry that limit competition. Any of the above factors may lead the firm to have positive net present value investment (NPV) opportunities. Access to positive NPV opportunities and therefore profit in excess of normal profits in the short run may or may not exist in the long run, depending on the potential strength of competition. In highly competitive market situations, firms tend to earn the normal profit level over time because ease of market entry allows for other competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. 2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical su

Flashcard 1442684472588

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itEconomists define a market as a group of buyers and sellers that are aware of each other and are able to agree on a price for the exchange of goods and services.

Original toplevel document

2. ANALYSIS OF MARKET STRUCTURESin more detail. Section 2.2 completes the introduction by providing and explaining the major points to evaluate in determining the structure to which a market belongs. 2.1. Economists’ Four Types of Structure <span>Economists define a market as a group of buyers and sellers that are aware of each other and are able to agree on a price for the exchange of goods and services. While the internet has extended a number of markets worldwide, certain markets are limited by geographic boundaries. For example, the internet search engine Google operates in a worldwi

Flashcard 1442974403852

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itEconomic profit is used extensively to determine whether a business should enter or exit a market or industry.

Original toplevel document

Explicit Cost Definition | Investopediaactually purchased. An implicit cost is the greatest benefit that could have resulted from the use of the funds. This cost could reflect a different vehicle that could have been purchased or the benefit gained from using the funds elsewhere. <span>Economic Profit Explicit costs are also utilized in the calculation of economic profit. Economic profit is the total return a company receives based on all costs incurred to attain that revenue. These costs include all explicit and implicit costs. Economic profit is utilized for long-term decision-making. Economic profit is used extensively to determine whether a business should enter or exit a market or industry.

Flashcard 1446848630028

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThere are three approaches to calculate the point of profit maximization. Second , maximum profit can also be calculated by comparing revenue and cost for each individual unit of output that is produced and sold. A business increases profit through greater sales as long as per-unit revenue exceeds per-unit cost on the next unit of output sold. Profit maximization takes place at th

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSTotal variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) <span>3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a higher standard of living, and creates wealth for investors. Profit motivates businesses to use resources efficiently and to concentrate on activities in which they have a competitive advantage. Most economists believe that profit maximization promotes allocational efficiency—that resources flow into their highest valued uses. Overall, the functions of profit are as follows: Rewards entrepreneurs for risk taking when pursuing business ventures to satisfy consumer demand. Allocates resources to their most-efficient use; input factors flow from sectors with economic losses to sectors with economic profit, where profit reflects goods most desired by society. Spurs innovation and the development of new technology. Stimulates business investment and economic growth. There are three approaches to calculate the point of profit maximization. First, given that profit is the difference between total revenue and total costs, maximum profit occurs at the output level where this difference is the greatest. Second, maximum profit can also be calculated by comparing revenue and cost for each individual unit of output that is produced and sold. A business increases profit through greater sales as long as per-unit revenue exceeds per-unit cost on the next unit of output sold. Profit maximization takes place at the point where the last individual output unit breaks even. Beyond this point, total profit decreases because the per-unit cost is higher than the per-unit revenue from successive output units. A third approach compares the revenue generated by each resource unit with the cost of that unit. Profit contribution occurs when the revenue from an input unit exceeds its cost. The point of profit maximization is reached when resource units no longer contribute to profit. All three approaches yield the same profit-maximizing quantity of output. (These approaches will be explained in greater detail later.) Because profit is the difference between revenue and cost, an understanding of profit maximization requires that we examine both of those components. Revenue comes from the demand for the firm’s products, and cost comes from the acquisition and utilization of the firm’s inputs in the production of those products. 3.1.1. Total, Average, and Marginal Revenue This section briefly examines demand and revenue in preparation for addressing cost. Unless the firm is a pu

Flashcard 1447151668492

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

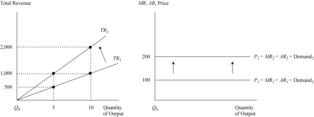

Exhibit 5. Total Revenue, Average Revenue, and Marginal Revenue under Perfect Competition

Exhibit 5 graphically displays the revenue data from perfect competition. For an individual firm operating in a market setting of perfect competition, MR equals AR and both are equal to a price that stays the same across all levels of output. Because price i

Flashcard 1449965522188

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

Earnings are also frequently used by analysts in valuation. For example, an analyst may value shares of a company by comparing its price-to-earnings ratio (P/E) to the P/Es of peer companies and/or may use forecasted future earnings as direct or indirect inputs into discounted cash flow models of valuation.

Earnings are also frequently used by analysts in valuation. For example, an analyst may value shares of a company by comparing its price-to-earnings ratio (P/E) to the P/Es of peer companies and/or may use forecasted future earnings as direct or indirect inputs into discounted cash flow models of valuation.

Flashcard 1450263842060

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itQuasi-fixed cost examples would be certain utilities and administrative salaries that could be avoided or be lower when output is zero but would assume higher constant values over different production ranges. Normal profit is considered to be a fixed cost because it

Original toplevel document

Costsrate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. <span>Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi-fixed cost , although it remains categorized as part of TFC. Examples of fixed costs are debt service, real estate lease agreements, and rental contracts. Quasi-fixed cost examples would be certain utilities and administrative salaries that could be avoided or be lower when output is zero but would assume higher constant values over different production ranges. Normal profit is considered to be a fixed cost because it is a return required by investors on their equity capital regardless of output level. At zero output, total costs are always equal to the amount of total fixed cost that is incurred at this production point. In Exhibit 13, total fixed cost remains at 100 throughout the entire production range. Other fixed costs evolve primarily from investments in such fixed assets as real estate, production facilities, and equipment. As a firm grows in size, fixed asset expansion occurs along with a related increase in fixed cost. However, fixed cost cannot be arbitrarily cut when production declines. Regardless of the volume of output, an investment in a given level of fixed assets locks the firm into a certain amount of fixed cost that is used to finance the physical capital base, technology, and other capital assets. When a firm downsizes, the last expense to be cut is usually fixed cost. Total variable cost (TVC), which is the summation of all variable expenses, has a direct relationship with quantity. When quantity increases, total variable cost increases

Flashcard 1450646572300

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itWhen a firm downsizes, the last expense to be cut is usually fixed cost.

Original toplevel document

Costsrate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. <span>Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi-fixed cost , although it remains categorized as part of TFC. Examples of fixed costs are debt service, real estate lease agreements, and rental contracts. Quasi-fixed cost examples would be certain utilities and administrative salaries that could be avoided or be lower when output is zero but would assume higher constant values over different production ranges. Normal profit is considered to be a fixed cost because it is a return required by investors on their equity capital regardless of output level. At zero output, total costs are always equal to the amount of total fixed cost that is incurred at this production point. In Exhibit 13, total fixed cost remains at 100 throughout the entire production range. Other fixed costs evolve primarily from investments in such fixed assets as real estate, production facilities, and equipment. As a firm grows in size, fixed asset expansion occurs along with a related increase in fixed cost. However, fixed cost cannot be arbitrarily cut when production declines. Regardless of the volume of output, an investment in a given level of fixed assets locks the firm into a certain amount of fixed cost that is used to finance the physical capital base, technology, and other capital assets. When a firm downsizes, the last expense to be cut is usually fixed cost. Total variable cost (TVC), which is the summation of all variable expenses, has a direct relationship with quantity. When quantity increases, total variable cost increases

Flashcard 1450677767436

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAverage total cost is often referenced as per-unit cost and is frequently called average cost. The minimum point on the average total cost curve defines the output level that has the least cost. The cost-minimizing behavior of the firm would

Original toplevel document

Open itcost. However, the minimum point on the AVC does not correspond to the least-cost quantity for average total cost. In Exhibit 13, average variable cost is minimized at 2 units, whereas average total cost is the lowest at 3 units. <span>Average total cost (ATC) is calculated by dividing total costs by quantity or by summing average fixed cost and average variable cost. For instance, in Exhibit 13, at 8 units ATC is 125 [calculated as (1,000 ÷ 8) or (AFC + AVC = 12.5 + 112.5)]. Average total cost is often referenced as per-unit cost and is frequently called average cost. The minimum point on the average total cost curve defines the output level that has the least cost. The cost-minimizing behavior of the firm would dictate operating at the minimum point on its ATC curve. However, the quantity that maximizes profit (such as Q 3 in Exhibit 17) may not correspond to the ATC-minimum point. The minimum point on the ATC curve is consistent with maximizing profit per-unit, but it is not necessarily consistent with maximizing total profit. In Exhibit 13, the least-cost point of production is 3 units; ATC is 75, derived as [(225 ÷ 3) or (33.3 + 41.7)]. Any other production level results in a higher ATC. Marginal cost (MC) is the change in total cost divided by the change in quantity. Marginal cost also can be calculated by taking the change in total variable cost and divi

Flashcard 1450703719692

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

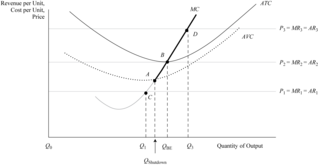

Open itpan>The firm’s short-run supply curve is the bold section of the marginal cost curve that lies above the minimum point (point A) on the average variable cost curve. If the firm operates below this point (for example between C and A), it shuts down because of its inability to cover variable costs in full.<span><body><html>

Original toplevel document

Open itExhibit 17 displays the firm’s supply curve, shutdown point, and breakeven level of operation under perfect competition in the short run. The firm’s short-run supply curve is the bold section of the marginal cost curve that lies above the minimum point (point A) on the average variable cost curve. If the firm operates below this point (for example between C and A), it shuts down because of its inability to cover variable costs in full. Between points A and B, the firm can operate in the short run because it is meeting variable cost payments even though it is unable to cover all of its fixed costs. In the long run, how

Flashcard 1450757983500

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open it(Keep in mind that normal profit as an implicit cost is included in ATC as a fixed cost.)

Original toplevel document

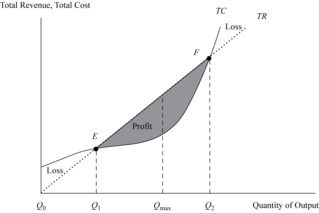

Open ites are first established, there is an initial period where losses occur at low quantity levels. In Exhibit 17, the breakeven quantity occurs at output Q BE , which corresponds to point B where price is tangent to the minimum point on the ATC. <span>(Keep in mind that normal profit as an implicit cost is included in ATC as a fixed cost.) Exhibit 18 shows the breakeven point under perfect competition using the total revenue–total cost approach. Actually, there are two breakeven points—lower (point E) and upp

Flashcard 1450781314316

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itBreakeven points, profit regions, and economic loss ranges are influenced by demand and supply conditions, which change frequently according to the market behavior of consumers and firms.

Original toplevel document

Open itgins to reach the limits of physical capacity, resulting in diminished productivity and an acceleration of costs. Obviously, the firm would not produce beyond Q max because it is the optimal production point that maximizes profit. <span>Breakeven points, profit regions, and economic loss ranges are influenced by demand and supply conditions, which change frequently according to the market behavior of consumers and firms. A high initial breakeven point is riskier than a low point because it takes a larger volume and, usually, a longer time to reach. However, at higher output levels it yields more return

Flashcard 1454991609100

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIn one stroke, Galileo gained more with his new strategy than he had in years of begging. The reason is simple: All masters want to appear more brilliant than other people. They do not care about science or empirical truth or the latest invention ; they care about their name and their glory. Galileo gave the Medicis infinitely more glory by linking their name with cosmic forces than he had by making them the patrons of some new scientific gadget or discovery. Sci

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1455309327628

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itWhat is 'Free Cash Flow - FCF' Free cash flow (FCF) is a measure of a company's financial performance, calculated as operating cash flow minus capital expenditures. FCF represents the cash that a company is able to generate after spending the money required to maintain or expand its asset base. FCF is important because i

Original toplevel document

Free Cash Flow - FCF Definition | Investopedia<span>What is 'Free Cash Flow - FCF' Free cash flow (FCF) is a measure of a company's financial performance, calculated as operating cash flow minus capital expenditures. FCF represents the cash that a company is able to generate after spending the money required to maintain or expand its asset base. FCF is important because it allows a company to pursue opportunities that enhance shareholder value. BREAKING DOWN 'Free Cash Flow - FCF' FCF is an assessment of the amount of cash a company generates after accounting for all capital expenditures, su

Flashcard 1461353319692

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAproach: the revenue value of the output from the last unit of input employed equals the cost of employing that input unit The third method compares the estimated cost of each unit of input to that input’s contribution with projected total revenue. If the increase in projected total revenue comi

Original toplevel document

3.1.4. Output Optimization and Maximization of Profitore units because each successive unit adds more to total revenue than it does to total costs. If MC is greater than MR, total profit is decreased when additional units are produced. The point of profit maximization occurs where MR equals MC. <span>The third method compares the estimated cost of each unit of input to that input’s contribution with projected total revenue. If the increase in projected total revenue coming from the input unit exceeds its cost, a contribution to total profit is evident. In turn, this justifies further employment of that input. On the other hand, if the increase in projected total revenue does not cover the input unit’s cost, total profit is diminished. Profit maximization based on the employment of inputs occurs where the next input unit for each type of resource used no longer makes any contribution to total profit. <span><body><html>

Flashcard 1474165345548

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itInterim reports are also provided by the company either semiannually or quarterly, depending on the applicable regulatory requirements.

Original toplevel document

3.2. Other Sources of Informationments. Public companies often provide this information in proxy statements, which are statements distributed to shareholders about matters that are to be put to a vote at the company’s annual (or special) meeting of shareholders. <span>Interim reports are also provided by the company either semiannually or quarterly, depending on the applicable regulatory requirements. Interim reports generally present the four basic financial statements and condensed notes but are not audited. These interim reports provide updated information on a company’s performan

Flashcard 1474534968588

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itings that provide meaningful summarization of voluminous data but retain enough detail to facilitate decision making and preparation of the financial statements. The actual accounts used in a company’s accounting system will be set forth in a <span>chart of accounts . Generally, the chart of accounts is far more detailed than the information presented in financial statements.<span><body><html>

Original toplevel document

3.1. Financial Statement Elements and Accountsount for each of its ovens, with the accounts named “Oven-1” and “Oven-2.” In its financial statements, these accounts would likely be grouped within long-term assets as a single line item called “Property, plant, and equipment.” <span>A company’s challenge is to establish accounts and account groupings that provide meaningful summarization of voluminous data but retain enough detail to facilitate decision making and preparation of the financial statements. The actual accounts used in a company’s accounting system will be set forth in a chart of accounts . Generally, the chart of accounts is far more detailed than the information presented in financial statements. Certain accounts are used to offset other accounts. For example, a common asset account is accounts receivable, also known as “trade accounts receivable” or “trade receivab

Flashcard 1477061250316

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itNobody, doesnt matter how bad they are, blame theirselves for anything.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1477997628684

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

ting recognition of revenue or expense, there are only a 2 possibilities. First, cash movement and accounting recognition can occur at the same time, in which case there is no need for accruals. Second, cash movement may <span>occur before or after accounting recognition, in which case accruals are required.<span><body><html>

Flashcard 1478143380748

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1478160157964

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itBecause analysts typically will not have access to the accounting system or individual entries, they will need to infer what transactions were recorded by examining the financial statements.

Original toplevel document

7. USING FINANCIAL STATEMENTS IN SECURITY ANALYSISysts may need to make adjustments to reflect items not reported in the statements (certain assets/liabilities and future earnings). Analysts may also need to assess the reasonableness of management judgment (e.g., in accruals and valuations). <span>Because analysts typically will not have access to the accounting system or individual entries, they will need to infer what transactions were recorded by examining the financial statements. 7.1. The Use of Judgment in Accounts and Entries Quite apart from deliberate misrepresentations, even efforts to faithfully represent the economic perfo

Flashcard 1478670552332

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itValuation adjustments are made to a company’s assets or liabilities—only where required by accounting standards—so that the accounting records reflect the current market value rather than the historical cost.

Original toplevel document

Open itved and the corresponding liability to deliver newsletters) and, subsequently, 12 future adjusting entries, the first one of which was illustrated as Transaction 12. Each adjusting entry reduces the liability and records revenue. <span>In practice, a large amount of unearned revenue may cause some concern about a company’s ability to deliver on this future commitment. Conversely, a positive aspect is that increases in unearned revenue are an indicator of future revenues. For example, a large liability on the balance sheet of an airline relates to cash received for future airline travel. Revenue will be recognized as the travel occurs, so an increase in this liability is an indicator of future increases in revenue. <span><body><html>

Flashcard 1481589525772

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

4.1. General Principles

goods sold in the same period as revenues from the sale of the goods. Period costs , expenditures that less directly match revenues, are reflected in the period when a company makes the expenditure or incurs the liability to pay. <span>Administrative expenses are an example of period costs. Other expenditures that also less directly match revenues relate more directly to future expected benefits; in this case, the expenditures are allocated systematically with the passage

goods sold in the same period as revenues from the sale of the goods. Period costs , expenditures that less directly match revenues, are reflected in the period when a company makes the expenditure or incurs the liability to pay. <span>Administrative expenses are an example of period costs. Other expenditures that also less directly match revenues relate more directly to future expected benefits; in this case, the expenditures are allocated systematically with the passage

Flashcard 1601903136012

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIf someone makes a joke at your expense, simply agree with them and exaggerate it to the 10 th degree.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1603695676684

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1614387481868

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||