Edited, memorised or added to reading queue

on 13-Dec-2017 (Wed)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1425592421644

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itMacroeconomics deals with aggregate economic quantities, such as national output and national income.

Original toplevel document

1. INTRODUCTIONIn a general sense, economics is the study of production, distribution, and consumption and can be divided into two broad areas of study: macroeconomics and microeconomics. Macroeconomics deals with aggregate economic quantities, such as national output and national income. Macroeconomics has its roots in microeconomics , which deals with markets and decision making of individual economic units, including consumers and businesses. Microeconomics is a logi

Flashcard 1426258267404

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIn general, producers are willing to sell their product for a price as long as that price is at least as high as the cost to produce an additional unit of the product.

Original toplevel document

3.3. The Supply Function and the Supply CurveThe willingness and ability to sell a good or service is called supply. In general, producers are willing to sell their product for a price as long as that price is at least as high as the cost to produce an additional unit of the product. It follows that the willingness to supply, called the supply function , depends on the price at which the good can be sold as well as the cost of production for an additional unit of t

Flashcard 1430334082316

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA change in a good’s own-price causes a movement along the demand curve, this is referred to as a change in quantity demanded, A change in the value of any other variable will shift the entire demand curve. This is referred to as a <span>change in demand.<span><body><html>

Original toplevel document

Open itbut the intercepts have both increased, resulting in an outward shift in the demand curve, as shown in Exhibit 2. Exhibit 2. Household Demand Curve for Gasoline before and after Change in Income <span>In general, the only thing that can cause a movement along the demand curve is a change in a good’s own-price. A change in the value of any other variable will shift the entire demand curve. The former is referred to as a change in quantity demanded, and the latter is referred to as a change in demand. More importantly, the shift in demand was both a vertical shift upward and a horizontal shift to the right. That is to say, for any given quantity, the household is now wil

Flashcard 1432888675596

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itMéxico debe fortalecer su posición negociadora acercándose a la otra superpotencia comercial: China.

Original toplevel document

Trump y el efecto de “huevo revuelto”rimiendo cómo conseguir aumentar la competitividad de América del Norte, en particular en el contexto de un dólar fortalecido que le ha restado competitividad a su industria. Sin embargo, como le hemos comentado en otras ocasiones, <span>México debe fortalecer su posición negociadora acercándose a la otra superpotencia comercial: China. El arribo de la empresa petrolera china CNOOC, que invertirá cerca de 8 mil millones de dólares en el Golfo de México, multiplicará por 40 veces la inversión china acumulada

Flashcard 1433029709068

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLa mejor contribución que hace la política monetaria al crecimiento económico es mantener la inflación baja, que se traduce en un ambiente de mayor confianza

Original toplevel document

Carstens fue muy importante, pero el Banxico va a seguirmi salida. En ese contexto, puede destacarse en estos años una mayor apertura. Banxico ha publicado una serie de documentos que reflejan una mayor transparencia, en particular las minutas de las reuniones de política monetaria. <span>La mejor contribución que hace la política monetaria al crecimiento económico es mantener la inflación baja, que se traduce en un ambiente de mayor confianza También podemos hacer muy bien nuestro trabajo fortaleciendo la institución o hacerlo muy mal, debilitando la institución Son una pieza de informa

Flashcard 1435564641548

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFinance experts frequently reconcile profitability and risk objectives by stating that the objective of the firm is, or should be, shareholder wealth maximization (i.e., to maximize the market value of shareholders’ equity)

Original toplevel document

2. OBJECTIVES OF THE FIRMen be classified as focused on profitability (e.g., maximizing profits, increasing market share) or on controlling risk (e.g., survival, stable earnings growth); and c) managers in different countries may have different emphases. <span>Finance experts frequently reconcile profitability and risk objectives by stating that the objective of the firm is, or should be, shareholder wealth maximization (i.e., to maximize the market value of shareholders’ equity). This theory states that firms try, or should try, to increase the wealth of their owners (shareholders) and that market prices balance returns against risk. However, complex corporate

Flashcard 1435622837516

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itWe can define a term, economic cost , equal to the sum of total accounting costs and implicit opportunity costs.

Original toplevel document

2. OBJECTIVES OF THE FIRM00 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. <span>2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as accounting profit less the implicit opportunity costs not included in total accounting costs. Equation (3a) Economic profit = Accounting profit – Total implicit opportunity costs We can define a term, economic cost , equal to the sum of total accounting costs and implicit opportunity costs. Economic profit is therefore equivalently defined as: Equation (3b) Economic profit = Total revenue – Total economic costs For publicly traded corporations, the focus of investment analysts’ work, the cost of equity capital is the largest and most readily identified implicit opportunity cost omitted in calculating total accounting cost. Consequently, economic profit can be defined for publicly traded corporations as accounting profit less the required return on equity capital. Examples will make these concepts clearer. Consider the start-up company for which we calculated an accounting profit of €300,000 and suppose that the entrepreneurial executive who launched the start-up took a salary reduction of €100,000 per year relative to the job he left. That €100,000 is an opportunity cost of involving him in running the start-up. Besides labor, financial capital is a resource. Suppose that the executive, as sole owner, makes an investment of €1,500,000 to launch the enterprise and that he might otherwise expect to earn €200,000 per year on that amount in a similar risk investment. Total implicit opportunity costs are €100,000 + €200,000 = €300,000 per year and economic profit is zero: €300,000 – €300,000 = €0. For the publicly traded corporation, we consider the cost of equity capital as the only implicit opportunity cost identifiable. Suppose that equity investment is $18,750,000 and shareholders’ required rate of return is 8 percent so that the dollar cost of equity capital is $1,500,000. Economic profit for the publicly traded corporation is therefore $2,000,000 (accounting profit) less $1,500,000 (cost of equity capital) or $500,000. For the start-up company, economic profit was zero. Total economic costs were just covered by revenues and the company was not earning a euro more nor less than the amount that meets the opportunity costs of the resources used in the business. Economists would say the company was earning a normal profit (economic profit of zero). In simple terms, normal profit is the level of accounting profit needed to just cover the implicit opportunity costs ignored in accounting costs. For the publicly traded corporation, normal profit was $1,500,000: normal profit can be taken to be the cost of equity capital (in money terms) for such a company or the dollar return required on an equal investment by equity holders in an equivalently risky alternative investment opportunity. The publicly traded corporation actually earned $500,000 in excess of normal profit, which should be reflected in the common shares’ market price. Thus, the following expression links accounting profit to economic profit and normal profit: Equation (4) Accounting profit = Economic profit + Normal profit When accounting profit equals normal profit, economic profit is zero. Further, when accounting profit is greater than normal profit, economic profit is positive; and when accounting profit is less than normal profit, economic profit is negative (the firm has an economic loss ). Economic profit for a firm can originate from sources such as: competitive advantage; exceptional managerial efficiency or skill; difficult to copy technology or innovation (e.g., patents, trademarks, and copyrights); exclusive access to less-expensive inputs; fixed supply of an output, commodity, or resource; preferential treatment under governmental policy; large increases in demand where supply is unable to respond fully over time; exertion of monopoly power (price control) in the market; and market barriers to entry that limit competition. Any of the above factors may lead the firm to have positive net present value investment (NPV) opportunities. Access to positive NPV opportunities and therefore profit in excess of normal profits in the short run may or may not exist in the long run, depending on the potential strength of competition. In highly competitive market situations, firms tend to earn the normal profit level over time because ease of market entry allows for other competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. 2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical su

Flashcard 1436169145612

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itExpenses relating to advertising, supplies, utilities, inventory and equipment actually purchased are examples of explicit costs. Although the depreciation of an asset is not an activity that can be tangibly traced, depreciation expense is an <span>explicit cost because it relates to the cost of the underlying asset that the company owns. <span><body><html>

Original toplevel document

Explicit Cost Definition | InvestopediaAn explicit cost is an expense that has occurred and has a clearly defined dollar amount. These expenses are incurred during business operations and are actual out-of-pocket cash outlays. The objective dollar amounts are subject to reporting. <span>Examples of Explicit Costs Net income of a business reflects residual income remaining after all explicit costs have been paid. Explicit costs are the only costs necessary to calculate accounting profit. Expenses relating to advertising, supplies, utilities, inventory and equipment actually purchased are examples of explicit costs. Although the depreciation of an asset is not an activity that can be tangibly traced, depreciation expense is an explicit cost because it relates to the cost of the underlying asset that the company owns. Explicit Costs vs. Implicit Costs Explicit costs arise based on what has actually been purchased as opposed to implicit costs that arise based on what has actually been given up other t

Flashcard 1438140992780

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 1. Capital Budgeting: Introduction

ss of planning expenditures on assets (fixed assets) whose cash flows are expected to extend beyond one year. Managers analyze projects and decide which ones to include in the capital budget. "Capital" refers to <span>long-term assets. The "budget" is a plan which details projected cash inflows and outflows during a future period. The typical steps in the capital budgeting

ss of planning expenditures on assets (fixed assets) whose cash flows are expected to extend beyond one year. Managers analyze projects and decide which ones to include in the capital budget. "Capital" refers to <span>long-term assets. The "budget" is a plan which details projected cash inflows and outflows during a future period. The typical steps in the capital budgeting

Flashcard 1446745607436

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itties as sales promotion, advertising, and competitive positioning of the product that would take place under the market model of imperfect competition. Under perfect competition, however, total quantity in the market is influenced strictly by <span>price, while non-price factors are not important. Once consumer preferences are established in the market, price determines the quantity demanded by buyers. Together, price and quantity const

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITS(AR) Marginal Revenue (MR) 0 100 0 — — 1 100 100 100 100 2 100 200 100 100 3 100 300 100 100 4 100 400 100 100 5 100 500 100 100 6 100 600 100 100 7 100 700 100 100 8 100 800 100 100 9 100 900 100 100 10 100 1,000 100 100 <span>The quantity or quantity demanded variable is the amount of the product that consumers are willing and able to buy at each price level. The quantity sold can be affected by the business through such activities as sales promotion, advertising, and competitive positioning of the product that would take place under the market model of imperfect competition. Under perfect competition, however, total quantity in the market is influenced strictly by price, while non-price factors are not important. Once consumer preferences are established in the market, price determines the quantity demanded by buyers. Together, price and quantity constitute the firm’s demand curve, which becomes the basis for calculating the total, average, and marginal revenue. In Exhibit 4, price is the market price as established by the interactions of the market demand and supply factors. Since the firm is a price taker, price is fixed at 100

Flashcard 1446787288332

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe inputs in the production function are subject to the constraint that K ≥ 0 and L ≥ 0.

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1446821891340

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFactors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capi

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1446824250636

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFactors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physi

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1446827396364

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFactors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods a

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1446830542092

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open it; land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to <span>physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1446833949964

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itCapital goods are distinguished as inputs to production that are themselves produced goods; and

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1446836309260

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itontext refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to <span>any goods the business buys as inputs to its production process.<span><body><html>

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1446850989324

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThere are three approaches to calculate the point of profit maximization. Third approach compares the revenue generated by each resource unit with the cost of that unit. Profit contribution occurs when the revenue from an input unit exceeds its cost. The point of profit maximization is reached when reso

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSTotal variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) <span>3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a higher standard of living, and creates wealth for investors. Profit motivates businesses to use resources efficiently and to concentrate on activities in which they have a competitive advantage. Most economists believe that profit maximization promotes allocational efficiency—that resources flow into their highest valued uses. Overall, the functions of profit are as follows: Rewards entrepreneurs for risk taking when pursuing business ventures to satisfy consumer demand. Allocates resources to their most-efficient use; input factors flow from sectors with economic losses to sectors with economic profit, where profit reflects goods most desired by society. Spurs innovation and the development of new technology. Stimulates business investment and economic growth. There are three approaches to calculate the point of profit maximization. First, given that profit is the difference between total revenue and total costs, maximum profit occurs at the output level where this difference is the greatest. Second, maximum profit can also be calculated by comparing revenue and cost for each individual unit of output that is produced and sold. A business increases profit through greater sales as long as per-unit revenue exceeds per-unit cost on the next unit of output sold. Profit maximization takes place at the point where the last individual output unit breaks even. Beyond this point, total profit decreases because the per-unit cost is higher than the per-unit revenue from successive output units. A third approach compares the revenue generated by each resource unit with the cost of that unit. Profit contribution occurs when the revenue from an input unit exceeds its cost. The point of profit maximization is reached when resource units no longer contribute to profit. All three approaches yield the same profit-maximizing quantity of output. (These approaches will be explained in greater detail later.) Because profit is the difference between revenue and cost, an understanding of profit maximization requires that we examine both of those components. Revenue comes from the demand for the firm’s products, and cost comes from the acquisition and utilization of the firm’s inputs in the production of those products. 3.1.1. Total, Average, and Marginal Revenue This section briefly examines demand and revenue in preparation for addressing cost. Unless the firm is a pu

Flashcard 1446865407244

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itsfy consumer demand. Allocates resources to their most-efficient use; input factors flow from sectors with economic losses to sectors with economic profit, where profit reflects goods most desired by society. Spurs <span>innovation and the development of new technology. Stimulates business investment and economic growth.<span><body><html>

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSTotal variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) <span>3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a higher standard of living, and creates wealth for investors. Profit motivates businesses to use resources efficiently and to concentrate on activities in which they have a competitive advantage. Most economists believe that profit maximization promotes allocational efficiency—that resources flow into their highest valued uses. Overall, the functions of profit are as follows: Rewards entrepreneurs for risk taking when pursuing business ventures to satisfy consumer demand. Allocates resources to their most-efficient use; input factors flow from sectors with economic losses to sectors with economic profit, where profit reflects goods most desired by society. Spurs innovation and the development of new technology. Stimulates business investment and economic growth. There are three approaches to calculate the point of profit maximization. First, given that profit is the difference between total revenue and total costs, maximum profit occurs at the output level where this difference is the greatest. Second, maximum profit can also be calculated by comparing revenue and cost for each individual unit of output that is produced and sold. A business increases profit through greater sales as long as per-unit revenue exceeds per-unit cost on the next unit of output sold. Profit maximization takes place at the point where the last individual output unit breaks even. Beyond this point, total profit decreases because the per-unit cost is higher than the per-unit revenue from successive output units. A third approach compares the revenue generated by each resource unit with the cost of that unit. Profit contribution occurs when the revenue from an input unit exceeds its cost. The point of profit maximization is reached when resource units no longer contribute to profit. All three approaches yield the same profit-maximizing quantity of output. (These approaches will be explained in greater detail later.) Because profit is the difference between revenue and cost, an understanding of profit maximization requires that we examine both of those components. Revenue comes from the demand for the firm’s products, and cost comes from the acquisition and utilization of the firm’s inputs in the production of those products. 3.1.1. Total, Average, and Marginal Revenue This section briefly examines demand and revenue in preparation for addressing cost. Unless the firm is a pu

Flashcard 1448250313996

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

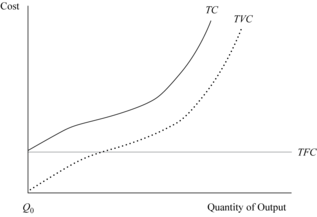

Exhibit 10 shows the graphical relationships among total costs, total fixed cost, and total variable cost. The curve for total costs is a parallel shift of the total variable cost curve and always lies above the total variable cost curve by the amount of total fixed cost. At zero production, total costs are equal to total fixed cost because total variable cost at this output level is zero

Flashcard 1448311131404

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe quantity or quantity demanded variable is the amount of the product that consumers are willing and able to buy at each price level.

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITS(AR) Marginal Revenue (MR) 0 100 0 — — 1 100 100 100 100 2 100 200 100 100 3 100 300 100 100 4 100 400 100 100 5 100 500 100 100 6 100 600 100 100 7 100 700 100 100 8 100 800 100 100 9 100 900 100 100 10 100 1,000 100 100 <span>The quantity or quantity demanded variable is the amount of the product that consumers are willing and able to buy at each price level. The quantity sold can be affected by the business through such activities as sales promotion, advertising, and competitive positioning of the product that would take place under the market model of imperfect competition. Under perfect competition, however, total quantity in the market is influenced strictly by price, while non-price factors are not important. Once consumer preferences are established in the market, price determines the quantity demanded by buyers. Together, price and quantity constitute the firm’s demand curve, which becomes the basis for calculating the total, average, and marginal revenue. In Exhibit 4, price is the market price as established by the interactions of the market demand and supply factors. Since the firm is a price taker, price is fixed at 100

Flashcard 1448677608716

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itontext refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to <span>any goods the business buys as inputs to its production process.<span><body><html>

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1448680754444

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itsfy consumer demand. Allocates resources to their most-efficient use; input factors flow from sectors with economic losses to sectors with economic profit, where profit reflects goods most desired by society. Spurs <span>innovation and the development of new technology. Stimulates business investment and economic growth.<span><body><html>

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSTotal variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) <span>3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a higher standard of living, and creates wealth for investors. Profit motivates businesses to use resources efficiently and to concentrate on activities in which they have a competitive advantage. Most economists believe that profit maximization promotes allocational efficiency—that resources flow into their highest valued uses. Overall, the functions of profit are as follows: Rewards entrepreneurs for risk taking when pursuing business ventures to satisfy consumer demand. Allocates resources to their most-efficient use; input factors flow from sectors with economic losses to sectors with economic profit, where profit reflects goods most desired by society. Spurs innovation and the development of new technology. Stimulates business investment and economic growth. There are three approaches to calculate the point of profit maximization. First, given that profit is the difference between total revenue and total costs, maximum profit occurs at the output level where this difference is the greatest. Second, maximum profit can also be calculated by comparing revenue and cost for each individual unit of output that is produced and sold. A business increases profit through greater sales as long as per-unit revenue exceeds per-unit cost on the next unit of output sold. Profit maximization takes place at the point where the last individual output unit breaks even. Beyond this point, total profit decreases because the per-unit cost is higher than the per-unit revenue from successive output units. A third approach compares the revenue generated by each resource unit with the cost of that unit. Profit contribution occurs when the revenue from an input unit exceeds its cost. The point of profit maximization is reached when resource units no longer contribute to profit. All three approaches yield the same profit-maximizing quantity of output. (These approaches will be explained in greater detail later.) Because profit is the difference between revenue and cost, an understanding of profit maximization requires that we examine both of those components. Revenue comes from the demand for the firm’s products, and cost comes from the acquisition and utilization of the firm’s inputs in the production of those products. 3.1.1. Total, Average, and Marginal Revenue This section briefly examines demand and revenue in preparation for addressing cost. Unless the firm is a pu

Flashcard 1448683900172

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itsfy consumer demand. Allocates resources to their most-efficient use; input factors flow from sectors with economic losses to sectors with economic profit, where profit reflects goods most desired by society. Spurs <span>innovation and the development of new technology. Stimulates business investment and economic growth.<span><body><html>

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSTotal variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) <span>3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a higher standard of living, and creates wealth for investors. Profit motivates businesses to use resources efficiently and to concentrate on activities in which they have a competitive advantage. Most economists believe that profit maximization promotes allocational efficiency—that resources flow into their highest valued uses. Overall, the functions of profit are as follows: Rewards entrepreneurs for risk taking when pursuing business ventures to satisfy consumer demand. Allocates resources to their most-efficient use; input factors flow from sectors with economic losses to sectors with economic profit, where profit reflects goods most desired by society. Spurs innovation and the development of new technology. Stimulates business investment and economic growth. There are three approaches to calculate the point of profit maximization. First, given that profit is the difference between total revenue and total costs, maximum profit occurs at the output level where this difference is the greatest. Second, maximum profit can also be calculated by comparing revenue and cost for each individual unit of output that is produced and sold. A business increases profit through greater sales as long as per-unit revenue exceeds per-unit cost on the next unit of output sold. Profit maximization takes place at the point where the last individual output unit breaks even. Beyond this point, total profit decreases because the per-unit cost is higher than the per-unit revenue from successive output units. A third approach compares the revenue generated by each resource unit with the cost of that unit. Profit contribution occurs when the revenue from an input unit exceeds its cost. The point of profit maximization is reached when resource units no longer contribute to profit. All three approaches yield the same profit-maximizing quantity of output. (These approaches will be explained in greater detail later.) Because profit is the difference between revenue and cost, an understanding of profit maximization requires that we examine both of those components. Revenue comes from the demand for the firm’s products, and cost comes from the acquisition and utilization of the firm’s inputs in the production of those products. 3.1.1. Total, Average, and Marginal Revenue This section briefly examines demand and revenue in preparation for addressing cost. Unless the firm is a pu

Flashcard 1448685735180

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itsfy consumer demand. Allocates resources to their most-efficient use; input factors flow from sectors with economic losses to sectors with economic profit, where profit reflects goods most desired by society. Spurs <span>innovation and the development of new technology. Stimulates business investment and economic growth.<span><body><html>

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSTotal variable cost divided by quantity; (TVC ÷ Q) Average total cost (ATC) Total cost divided by quantity; (TC ÷ Q) or (AFC + AVC) Marginal cost (MC) Change in total cost divided by change in quantity; (∆TC ÷ ∆Q) <span>3.1. Profit Maximization In free markets—and even in regulated market economies—profit maximization tends to promote economic welfare and a higher standard of living, and creates wealth for investors. Profit motivates businesses to use resources efficiently and to concentrate on activities in which they have a competitive advantage. Most economists believe that profit maximization promotes allocational efficiency—that resources flow into their highest valued uses. Overall, the functions of profit are as follows: Rewards entrepreneurs for risk taking when pursuing business ventures to satisfy consumer demand. Allocates resources to their most-efficient use; input factors flow from sectors with economic losses to sectors with economic profit, where profit reflects goods most desired by society. Spurs innovation and the development of new technology. Stimulates business investment and economic growth. There are three approaches to calculate the point of profit maximization. First, given that profit is the difference between total revenue and total costs, maximum profit occurs at the output level where this difference is the greatest. Second, maximum profit can also be calculated by comparing revenue and cost for each individual unit of output that is produced and sold. A business increases profit through greater sales as long as per-unit revenue exceeds per-unit cost on the next unit of output sold. Profit maximization takes place at the point where the last individual output unit breaks even. Beyond this point, total profit decreases because the per-unit cost is higher than the per-unit revenue from successive output units. A third approach compares the revenue generated by each resource unit with the cost of that unit. Profit contribution occurs when the revenue from an input unit exceeds its cost. The point of profit maximization is reached when resource units no longer contribute to profit. All three approaches yield the same profit-maximizing quantity of output. (These approaches will be explained in greater detail later.) Because profit is the difference between revenue and cost, an understanding of profit maximization requires that we examine both of those components. Revenue comes from the demand for the firm’s products, and cost comes from the acquisition and utilization of the firm’s inputs in the production of those products. 3.1.1. Total, Average, and Marginal Revenue This section briefly examines demand and revenue in preparation for addressing cost. Unless the firm is a pu

Flashcard 1448747863308

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

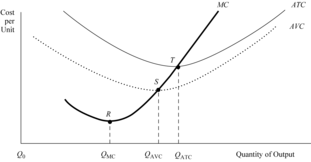

d MC in the short run. The marginal cost curve intersects both the ATC and AVC at their respective minimum points. This occurs at points S and T, which correspond to Q AVC and Q ATC , respectively. Mathematically, when <span>marginal cost is less than average variable cost, AVC will be decreasing . The opposite occurs when MC is greater than AVC. The same relationship holds true for MC and ATC . ATC declines when MC is less than ATC. ATC increases as MC exceeds ATC

Flashcard 1449951890700

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itmerger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the <span>creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. <span><body><html>

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISing, and financing decisions but do not necessarily rely on analysis of related financial statements. They have access to additional financial information that can be reported in whatever format is most useful to their decision.) <span>In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Evaluating an equity investment for inclusion in a portfolio. Evaluating a merger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. Extending credit to a customer. Examining compliance with debt covenants or other contractual arrangements. Assigning a debt rating to a company or bond issue. Valuing a security for making an investment recommendation to others. Forecasting future net income and cash flow. These decisions demonstrate certain themes in financial analysis. In general, analysts seek to examine the past and current performance and financial position of a

Flashcard 1450244181260

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTotal fixed cost (TFC) can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range.

Original toplevel document

Costsrate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. <span>Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi-fixed cost , although it remains categorized as part of TFC. Examples of fixed costs are debt service, real estate lease agreements, and rental contracts. Quasi-fixed cost examples would be certain utilities and administrative salaries that could be avoided or be lower when output is zero but would assume higher constant values over different production ranges. Normal profit is considered to be a fixed cost because it is a return required by investors on their equity capital regardless of output level. At zero output, total costs are always equal to the amount of total fixed cost that is incurred at this production point. In Exhibit 13, total fixed cost remains at 100 throughout the entire production range. Other fixed costs evolve primarily from investments in such fixed assets as real estate, production facilities, and equipment. As a firm grows in size, fixed asset expansion occurs along with a related increase in fixed cost. However, fixed cost cannot be arbitrarily cut when production declines. Regardless of the volume of output, an investment in a given level of fixed assets locks the firm into a certain amount of fixed cost that is used to finance the physical capital base, technology, and other capital assets. When a firm downsizes, the last expense to be cut is usually fixed cost. Total variable cost (TVC), which is the summation of all variable expenses, has a direct relationship with quantity. When quantity increases, total variable cost increases

Flashcard 1450634513676

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itHow is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth.

Original toplevel document