Edited, memorised or added to reading queue

on 26-Dec-2016 (Mon)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

How an immigrant motherfucker made munchery

r started delivering prepared lunches from its chefs to other tech startups to bring in some cash. Customers were fickle. When Munchery didn’t get the boss’s lean grilled chicken breast exactly right, it usually lost the account. <span>Eventually, Tran and Chu, by then his chief technology officer, realized catering was a distraction. They needed to get more production from their chefs, who were constrained by their primary jobs. So Munchery rented space at a shared kitchen and offered it to chefs with the promise that they’d sell their cuisine beyond the physical walls of conventional restaurants. Putting so many chefs together, each running his or her own business, turned out to be a problem. Tran had to break up constant fights over access to tables and equipment. During one confrontation, he remembers, a chef just stared at him while menacingly sharpening a knife. The company kept shifting strategies. It offered a subscription plan for a few meals each week, then pivoted to an a la carte model, where customers could schedule a delive

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

How an immigrant motherfucker made munchery

a few hours a day around din-nertime. The CEOs were “advocating for a way to make this fair for workers but to allow our businesses to operate,” he says. “Every presi-dential candidate is going to have to deal with this subject.” <span>Munchery’s high fixed costs pose one of the main drags on its business. Services such as GrubHub, which connect diners and restaurants online, don’t have significant fixed costs, because the restaurants make the food and in most cases deliver it to customers. Tran and his executives, naturally, pitch Munchery’s expensive infra structure as its biggest advantage. It enables the company to control all of its operating costs, so it

Flashcard 1429057965324

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe concept is classical, but the term liberal arts and the division of the arts into the trivium and the quadrivium date from the Middle Ages

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1429087587596

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itGrammar is an experiment al knowledge of the usages of languages as generally current among poets and prose writers. It is divided into six parts: (1) trained reading with due regard to prosody [versification]; (2) exposition, according to poetic figures [rhetoric]; (3) ready statement of dialectical peculiarities and allusion; (4) discovery of etymologies; (5) the accurate account of analogi

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itSpecial symbols are designed by experts to express with precision ideas in a special field of knowledge, for example: mathematics, chemistry, music. Such special languages are international and do not require translation, for t heir symbols are understood by people of all nationalities in their own language. The multiplication tabl

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1433096031500

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

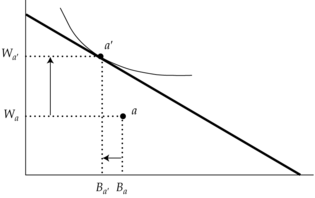

Open itThis is a constrained (by the resources available to pay for consumption) optimization problem that every consumer must solve: Choose the bundle of goods and services that gets us as high on our ranking as possible, while not exceeding our budget.

Original toplevel document

5. CONSUMER EQUILIBRIUM: MAXIMIZING UTILITY SUBJECT TO THE BUDGET CONSTRAINTerful if we could all consume as much of everything as we wanted, but unfortunately, most of us are constrained by income and prices. We now superimpose the budget constraint onto the preference map to model the actual choice of our consumer. <span>This is a constrained (by the resources available to pay for consumption) optimization problem that every consumer must solve: Choose the bundle of goods and services that gets us as high on our ranking as possible, while not exceeding our budget. 5.1. Determining the Consumer’s Equilibrium Bundle of Goods In general, the consumer’s constrained optimization problem consists of maximizing utility,

Flashcard 1434868911372

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1435507494156

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itInternal auditing is conducted in diverse legal and cultural environments; for organizations that vary in purpose, size, complexity, and structure; and by persons within or outside the organization. Wh

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1435509067020

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itInternal auditing is conducted in diverse legal and cultural environments; for organizations that vary in purpose, size, complexity, and structure; and by persons within or outside the organization. While differences may affect the practice of internal auditing in each environment, conformance with The IIA’s International Standards for the Professional Practice of Internal Auditing (Standards) is essential in meeting the responsibilities of internal auditors and the internal audit activity.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1435511426316

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itMunchery has served more than 3 million meals since Tran and a friend, Conrad Chu, delivered their first entrees in 2010. The company has raised more than $115 million in venture capital, and Tran says it’s now the largest single-kitchen pro-ducer of freshly prepared food in the cities where it operates.

Original toplevel document

How an immigrant motherfucker made muncheryture level. After they’re prepared, the dishes are chilled in refrigerated rooms, packed in compostable boxes, and loaded into cars for delivery. Customers heat them up for about two minutes in a microwave or 10 to 20 in an oven. <span>Munchery has served more than 3 million meals since Tran and a friend, Conrad Chu, delivered their first entrees in 2010. The company has raised more than $115 million in venture capital, and Tran says it’s now the largest single-kitchen pro-ducer of freshly prepared food in the cities where it operates. He hopes to open in at least 10 more markets in the next few years but is secretive about expansion plans. Like many other startups in the frenzied on-demand economy, Munchery isn’t yet

Article 1435513785612

LEARNING OUTCOMES

#cfa #cfa-level-1 #economics #lol #microeconomics #reading-15-demand-and-supply-analysis-the-firm

The candidate should be able to: calculate, interpret, and compare accounting profit, economic profit, normal profit, and economic rent; calculate and interpret and compare total, average, and marginal revenue; describe a firm’s factors of production; calculate and interpret total, average, marginal, fixed, and variable costs; determine and describe breakeven and shutdown points of production; describe approaches to determining the profit-maximizing level of output; describe how economies of scale and diseconomies of scale affect costs; distinguish between short-run and long-run profit maximization; distinguish among decreasing-cost, constant-cost, and increasing-cost industries and describe the long-run supply of each; calculate and interpret total, marginal, and average product of labor; describe the phenomenon of diminishing marginal returns and calculate and interpret the profit-maximizing utilization level of

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

LEARNING OUTCOMES

The candidate should be able to: calculate, interpret, and compare accounting profit, economic profit, normal profit, and economic rent; calculate and interpret and compare total, average, and marginal revenue; describe a firm’s factors of production; calculate and interpret total, average, marginal, fixed, and variable costs; determine and describe breakeven and shutdown points of production; describe approaches to determining the profit-maximizing level of output; describe how economies of scale and diseconomies of scale affect costs; distinguish between short-run and long-run profit maximization; distinguish among decreasing-cost, constant-cost, and increasing-cost industries and describe the long-run supply of each; calculate and interpret total, marginal, and average product of labor; describe the phenomenon of diminishing marginal returns and calculate and interpret the profit-maximizing utilization level of an input; determine the optimal combination of resources that minimizes cost.

Article 1435516669196

1. INTRODUCTION

#cfa #cfa-level-1 #economics #introduction #lol #microeconomics #reading-15-demand-and-supply-analysis-the-firm #study-session-4

In studying decision making by consumers and businesses, microeconomics gives rise to the theory of the consumer and theory of the firm as two branches of study. The theory of the consumer is the study of consumption—the demand for goods and services—by utility-maximizing individuals. The theory of the firm , the subject of this reading, is the study of the supply of goods and services by profit-maximizing firms. Conceptually, profit is the difference between revenue and costs. Revenue is a function of selling price and quantity sold, which are determined by the demand and supply behavior in the markets into which the firm sells/provides its goods or services. Costs are a function of the demand and supply interactions in resource markets, such as markets for labor and for physical inputs. The main focus of this reading is the cost side of the profit equation for companies competing in market economies under perfect competition. A subsequent reading will examine the different types of markets in

Flashcard 1435517979916

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

1. INTRODUCTION

In studying decision making by consumers and businesses, microeconomics gives rise to the theory of the consumer and theory of the firm as two branches of study. The theory of the consumer is the study of consumption—the demand for goods and services—by utility-maximizing individual

In studying decision making by consumers and businesses, microeconomics gives rise to the theory of the consumer and theory of the firm as two branches of study. The theory of the consumer is the study of consumption—the demand for goods and services—by utility-maximizing individual

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

1. INTRODUCTION

icroeconomics gives rise to the theory of the consumer and theory of the firm as two branches of study. The theory of the consumer is the study of consumption—the demand for goods and services—by utility-maximizing individuals. <span>The theory of the firm , the subject of this reading, is the study of the supply of goods and services by profit-maximizing firms. Conceptually, profit is the difference between revenue and costs. Revenue is a function of selling price and quantity sold, which are determined by the demand and supply behavior in the

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

1. INTRODUCTION

services—by utility-maximizing individuals. The theory of the firm , the subject of this reading, is the study of the supply of goods and services by profit-maximizing firms. Conceptually, profit is the difference between revenue and costs. <span>Revenue is a function of selling price and quantity sold, which are determined by the demand and supply behavior in the markets into which the firm sells/provides its goods or services. Costs are a function of the demand and supply interactions in resource markets, such as markets for labor and for physical inputs. The main focus of this reading is the cost side of the

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

1. INTRODUCTION

lly, profit is the difference between revenue and costs. Revenue is a function of selling price and quantity sold, which are determined by the demand and supply behavior in the markets into which the firm sells/provides its goods or services. <span>Costs are a function of the demand and supply interactions in resource markets, such as markets for labor and for physical inputs. The main focus of this reading is the cost side of the profit equation for companies competing in market economies under perfect competition. A subsequent reading will examine the diffe

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

1. INTRODUCTION

ined by the demand and supply behavior in the markets into which the firm sells/provides its goods or services. Costs are a function of the demand and supply interactions in resource markets, such as markets for labor and for physical inputs. <span>The main focus of this reading is the cost side of the profit equation for companies competing in market economies under perfect competition. A subsequent reading will examine the different types of markets into which a firm may sell its output. The study of the profit-maximizing firm in a single time period is t

Flashcard 1435524533516

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe theory of the firm , the subject of this reading, is the study of the supply of goods and services by profit-maximizing firms.

Original toplevel document

1. INTRODUCTIONicroeconomics gives rise to the theory of the consumer and theory of the firm as two branches of study. The theory of the consumer is the study of consumption—the demand for goods and services—by utility-maximizing individuals. <span>The theory of the firm , the subject of this reading, is the study of the supply of goods and services by profit-maximizing firms. Conceptually, profit is the difference between revenue and costs. Revenue is a function of selling price and quantity sold, which are determined by the demand and supply behavior in the

Flashcard 1435526892812

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itRevenue is a function of selling price and quantity sold, which are determined by the demand and supply behavior in the markets into which the firm sells/provides its goods or services.

Original toplevel document

1. INTRODUCTIONservices—by utility-maximizing individuals. The theory of the firm , the subject of this reading, is the study of the supply of goods and services by profit-maximizing firms. Conceptually, profit is the difference between revenue and costs. <span>Revenue is a function of selling price and quantity sold, which are determined by the demand and supply behavior in the markets into which the firm sells/provides its goods or services. Costs are a function of the demand and supply interactions in resource markets, such as markets for labor and for physical inputs. The main focus of this reading is the cost side of the

Flashcard 1435529252108

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itCosts are a function of the demand and supply interactions in resource markets, such as markets for labor and for physical inputs.

Original toplevel document

1. INTRODUCTIONlly, profit is the difference between revenue and costs. Revenue is a function of selling price and quantity sold, which are determined by the demand and supply behavior in the markets into which the firm sells/provides its goods or services. <span>Costs are a function of the demand and supply interactions in resource markets, such as markets for labor and for physical inputs. The main focus of this reading is the cost side of the profit equation for companies competing in market economies under perfect competition. A subsequent reading will examine the diffe

Flashcard 1435531611404

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe main focus of this reading is the cost side of the profit equation for companies competing in market economies under perfect competition.

Original toplevel document

1. INTRODUCTIONined by the demand and supply behavior in the markets into which the firm sells/provides its goods or services. Costs are a function of the demand and supply interactions in resource markets, such as markets for labor and for physical inputs. <span>The main focus of this reading is the cost side of the profit equation for companies competing in market economies under perfect competition. A subsequent reading will examine the different types of markets into which a firm may sell its output. The study of the profit-maximizing firm in a single time period is t

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

1. INTRODUCTION

f this reading is the cost side of the profit equation for companies competing in market economies under perfect competition. A subsequent reading will examine the different types of markets into which a firm may sell its output. <span>The study of the profit-maximizing firm in a single time period is the essential starting point for the analysis of the economics of corporate decision making. Furthermore, with the attention given to earnings by market participants, the insights gained by this study should be practically relevant. Among the questions this reading will address

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

1. INTRODUCTION

n? How are total, average, and marginal costs distinguished, and how is each related to the firm’s profit? What roles do marginal quantities (selling prices and costs) play in optimization? <span>This reading is organized as follows: Section 2 discusses the types of profit measures, including what they have in common, how they differ, and their uses and definitions. Section 3 covers the revenue and cost inputs of the profit equation and the related topics of breakeven analysis, shutdown point of operation, market entry and exit, cost structures, and scale effects. In addition, the economic outcomes related to a firm’s optimal supply behavior over the short run and long run are presented in this section. A summary and practice problems conclude the reading. <span><body><html>

Flashcard 1435536067852

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe study of the profit-maximizing firm in a single time period is the essential starting point for the analysis of the economics of corporate decision making.

Original toplevel document

1. INTRODUCTIONf this reading is the cost side of the profit equation for companies competing in market economies under perfect competition. A subsequent reading will examine the different types of markets into which a firm may sell its output. <span>The study of the profit-maximizing firm in a single time period is the essential starting point for the analysis of the economics of corporate decision making. Furthermore, with the attention given to earnings by market participants, the insights gained by this study should be practically relevant. Among the questions this reading will address

Flashcard 1435538427148

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThis reading is organized as follows: Section 2 discusses the types of profit measures, including what they have in common, how they differ, and their uses and definitions. Section 3 covers the revenue and cost inputs of the profit equation and the related to

Original toplevel document

1. INTRODUCTIONn? How are total, average, and marginal costs distinguished, and how is each related to the firm’s profit? What roles do marginal quantities (selling prices and costs) play in optimization? <span>This reading is organized as follows: Section 2 discusses the types of profit measures, including what they have in common, how they differ, and their uses and definitions. Section 3 covers the revenue and cost inputs of the profit equation and the related topics of breakeven analysis, shutdown point of operation, market entry and exit, cost structures, and scale effects. In addition, the economic outcomes related to a firm’s optimal supply behavior over the short run and long run are presented in this section. A summary and practice problems conclude the reading. <span><body><html>

Article 1435540000012

2. OBJECTIVES OF THE FIRM

#cfa #cfa-level-1 #economics #lol #microeconomics #reading-15-demand-and-supply-analysis-the-firm #section-2-objectives-of-the-firm #study-session-4

This reading assumes that the objective of the firm is to maximize profit over the period ahead. Such analysis provides both tools (e.g., optimization) and concepts (e.g., productivity) that can be adapted to more-complex cases and also provides a set of results that may offer useful approximations in practice. The price at which a given quantity of a good can be bought or sold is assumed to be known with certainty (i.e., the theory of the firm under conditions of certainty). The main contrast of this type of analysis is to the theory of the firm under conditions of uncertainty, where prices, and therefore profit, are uncertain. Under market uncertainty, a range of possible profit outcomes is associated with the firm’s decision to produce a given quantity of goods or services over a specific time period. Such complex theory typically makes simplifying assumptions. When managers of for-profit companies have been surveyed about the objectives of the companies they direct, researchers have often conclu

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

This reading assumes that the objective of the firm is to maximize profit over the period ahead. Such analysis provides both tools (e.g., optimization) and concepts (e.g., productivity) that can be adapted to more-complex cases and also provides a set of results that may offer use

Flashcard 1435542359308

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThis reading assumes that the objective of the firm is to maximize profit over the period ahead

Original toplevel document

2. OBJECTIVES OF THE FIRMThis reading assumes that the objective of the firm is to maximize profit over the period ahead. Such analysis provides both tools (e.g., optimization) and concepts (e.g., productivity) that can be adapted to more-complex cases and also provides a set of results that may offer use

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

fit over the period ahead. Such analysis provides both tools (e.g., optimization) and concepts (e.g., productivity) that can be adapted to more-complex cases and also provides a set of results that may offer useful approximations in practice. <span>The price at which a given quantity of a good can be bought or sold is assumed to be known with certainty (i.e., the theory of the firm under conditions of certainty). The main contrast of this type of analysis is to the theory of the firm under conditions of uncertainty, where prices, and therefore profit, are uncertain. Under market uncertainty, a

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

rovides a set of results that may offer useful approximations in practice. The price at which a given quantity of a good can be bought or sold is assumed to be known with certainty (i.e., the theory of the firm under conditions of certainty). <span>The main contrast of this type of analysis is to the theory of the firm under conditions of uncertainty, where prices, and therefore profit, are uncertain. Under market uncertainty, a range of possible profit outcomes is associated with the firm’s decision to produce a given quantity of goods or services over a specific time period. Such c

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

be known with certainty (i.e., the theory of the firm under conditions of certainty). The main contrast of this type of analysis is to the theory of the firm under conditions of uncertainty, where prices, and therefore profit, are uncertain. <span>Under market uncertainty, a range of possible profit outcomes is associated with the firm’s decision to produce a given quantity of goods or services over a specific time period. Such complex theory typically makes simplifying assumptions. When managers of for-profit companies have been surveyed about the objectives of the companies they direct, researchers have often concluded that a) companies frequently have multiple objectives; b) objectives can often be classified as focused on profitability (e.g., maximizing profits, increasing market share) or on controlling risk (e.g., survival, stable earnings growth); and c) managers in different countries may have different emphases. Finance experts frequently reconcile profitability and risk objectives by stating that the objective of the firm is, or should be, shareholder wealth maximization (i.e.,

Flashcard 1435547864332

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itUnder market uncertainty, a range of possible profit outcomes is associated with the firm’s decision to produce a given quantity of goods or services over a specific time period. Such complex theory typically makes simplifying assumptions.

Original toplevel document

2. OBJECTIVES OF THE FIRMbe known with certainty (i.e., the theory of the firm under conditions of certainty). The main contrast of this type of analysis is to the theory of the firm under conditions of uncertainty, where prices, and therefore profit, are uncertain. <span>Under market uncertainty, a range of possible profit outcomes is associated with the firm’s decision to produce a given quantity of goods or services over a specific time period. Such complex theory typically makes simplifying assumptions. When managers of for-profit companies have been surveyed about the objectives of the companies they direct, researchers have often concluded that a) companies frequently have multiple objectives; b) objectives can often be classified as focused on profitability (e.g., maximizing profits, increasing market share) or on controlling risk (e.g., survival, stable earnings growth); and c) managers in different countries may have different emphases. Finance experts frequently reconcile profitability and risk objectives by stating that the objective of the firm is, or should be, shareholder wealth maximization (i.e.,

Flashcard 1435551796492

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itWhen managers of for-profit companies have been surveyed about the objectives of the companies they direct, researchers have often concluded that a) companies frequently have multiple objectives; b) objectives can often be classified as focused on profitability (e.g., maximizing profits, increasing market share) or on controlling risk (e.g., survival, stable earnings

Original toplevel document

2. OBJECTIVES OF THE FIRMbe known with certainty (i.e., the theory of the firm under conditions of certainty). The main contrast of this type of analysis is to the theory of the firm under conditions of uncertainty, where prices, and therefore profit, are uncertain. <span>Under market uncertainty, a range of possible profit outcomes is associated with the firm’s decision to produce a given quantity of goods or services over a specific time period. Such complex theory typically makes simplifying assumptions. When managers of for-profit companies have been surveyed about the objectives of the companies they direct, researchers have often concluded that a) companies frequently have multiple objectives; b) objectives can often be classified as focused on profitability (e.g., maximizing profits, increasing market share) or on controlling risk (e.g., survival, stable earnings growth); and c) managers in different countries may have different emphases. Finance experts frequently reconcile profitability and risk objectives by stating that the objective of the firm is, or should be, shareholder wealth maximization (i.e.,

Flashcard 1435553369356

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe price at which a given quantity of a good can be bought or sold is assumed to be known with certainty (i.e., the theory of the firm under conditions of certainty)

Original toplevel document

2. OBJECTIVES OF THE FIRMfit over the period ahead. Such analysis provides both tools (e.g., optimization) and concepts (e.g., productivity) that can be adapted to more-complex cases and also provides a set of results that may offer useful approximations in practice. <span>The price at which a given quantity of a good can be bought or sold is assumed to be known with certainty (i.e., the theory of the firm under conditions of certainty). The main contrast of this type of analysis is to the theory of the firm under conditions of uncertainty, where prices, and therefore profit, are uncertain. Under market uncertainty, a

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

en be classified as focused on profitability (e.g., maximizing profits, increasing market share) or on controlling risk (e.g., survival, stable earnings growth); and c) managers in different countries may have different emphases. <span>Finance experts frequently reconcile profitability and risk objectives by stating that the objective of the firm is, or should be, shareholder wealth maximization (i.e., to maximize the market value of shareholders’ equity). This theory states that firms try, or should try, to increase the wealth of their owners (shareholders) and that market prices balance returns against risk. However, complex corporate

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

f shareholders’ equity). This theory states that firms try, or should try, to increase the wealth of their owners (shareholders) and that market prices balance returns against risk. However, complex corporate objectives may exist in practice. <span>Many analysts view profitability as the single most important measure of business performance. Without profit, the business eventually fails; with profit, the business can survive, compete, and prosper. The question is: What is profit? Economists, accountants, investors, financia

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

th of their owners (shareholders) and that market prices balance returns against risk. However, complex corporate objectives may exist in practice. Many analysts view profitability as the single most important measure of business performance. <span>Without profit, the business eventually fails; with profit, the business can survive, compete, and prosper. The question is: What is profit? Economists, accountants, investors, financial analysts, and regulators view profit from different perspectives. The starting point for anyone who is doing profit analysis is to have a solid grasp of how various forms of profit are defined and how to interpret the profit based on these different definitions. By defining profit in general terms as the difference between total revenue and total costs, profit maximization involves the following expression: Equation (1

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

fit from different perspectives. The starting point for anyone who is doing profit analysis is to have a solid grasp of how various forms of profit are defined and how to interpret the profit based on these different definitions. <span>By defining profit in general terms as the difference between total revenue and total costs, profit maximization involves the following expression: Equation (1) Π = TR – TC where Π is profit, TR is total revenue, and TC is total costs. TC can be defined as accounting costs or economic costs, depending on the objectives and requirements of the

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

ms as the difference between total revenue and total costs, profit maximization involves the following expression: Equation (1) Π = TR – TC where Π is profit, TR is total revenue, and TC is total costs. <span>TC can be defined as accounting costs or economic costs, depending on the objectives and requirements of the analyst for evaluating profit. The characteristics of the product market, where the firm sells its output or services, and of the resource market, where the firm purchases resources, play an important role in the det

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

Π = TR – TC where Π is profit, TR is total revenue, and TC is total costs. TC can be defined as accounting costs or economic costs, depending on the objectives and requirements of the analyst for evaluating profit. <span>The characteristics of the product market, where the firm sells its output or services, and of the resource market, where the firm purchases resources, play an important role in the determination of profit. Key variables that determine TC are the level of output, the firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource ma

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

the analyst for evaluating profit. The characteristics of the product market, where the firm sells its output or services, and of the resource market, where the firm purchases resources, play an important role in the determination of profit. <span>Key variables that determine TC are the level of output, the firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. 2.1. Types of Profit Measures The economics discipline has its

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

an important role in the determination of profit. Key variables that determine TC are the level of output, the firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. <span>TR is a function of output and product price as determined by the firm’s product market. 2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit.

Flashcard 1435564641548

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFinance experts frequently reconcile profitability and risk objectives by stating that the objective of the firm is, or should be, shareholder wealth maximization (i.e., to maximize the market value of shareholders’ equity)

Original toplevel document

2. OBJECTIVES OF THE FIRMen be classified as focused on profitability (e.g., maximizing profits, increasing market share) or on controlling risk (e.g., survival, stable earnings growth); and c) managers in different countries may have different emphases. <span>Finance experts frequently reconcile profitability and risk objectives by stating that the objective of the firm is, or should be, shareholder wealth maximization (i.e., to maximize the market value of shareholders’ equity). This theory states that firms try, or should try, to increase the wealth of their owners (shareholders) and that market prices balance returns against risk. However, complex corporate

Flashcard 1435566214412

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itMany analysts view profitability as the single most important measure of business performance.

Original toplevel document

2. OBJECTIVES OF THE FIRMf shareholders’ equity). This theory states that firms try, or should try, to increase the wealth of their owners (shareholders) and that market prices balance returns against risk. However, complex corporate objectives may exist in practice. <span>Many analysts view profitability as the single most important measure of business performance. Without profit, the business eventually fails; with profit, the business can survive, compete, and prosper. The question is: What is profit? Economists, accountants, investors, financia

Flashcard 1435567787276

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itBy defining profit in general terms as the difference between total revenue and total costs, profit maximization involves the following expression: Equation (1) Π = TR – TC

Original toplevel document

2. OBJECTIVES OF THE FIRMfit from different perspectives. The starting point for anyone who is doing profit analysis is to have a solid grasp of how various forms of profit are defined and how to interpret the profit based on these different definitions. <span>By defining profit in general terms as the difference between total revenue and total costs, profit maximization involves the following expression: Equation (1) Π = TR – TC where Π is profit, TR is total revenue, and TC is total costs. TC can be defined as accounting costs or economic costs, depending on the objectives and requirements of the

Flashcard 1435570146572

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTC can be defined as accounting costs or economic costs, depending on the objectives and requirements of the analyst for evaluating profit.

Original toplevel document

2. OBJECTIVES OF THE FIRMms as the difference between total revenue and total costs, profit maximization involves the following expression: Equation (1) Π = TR – TC where Π is profit, TR is total revenue, and TC is total costs. <span>TC can be defined as accounting costs or economic costs, depending on the objectives and requirements of the analyst for evaluating profit. The characteristics of the product market, where the firm sells its output or services, and of the resource market, where the firm purchases resources, play an important role in the det

Flashcard 1435572505868

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe characteristics of the product market, where the firm sells its output or services, and of the resource market, where the firm purchases resources, play an important role in the determination of profit.

Original toplevel document

2. OBJECTIVES OF THE FIRMΠ = TR – TC where Π is profit, TR is total revenue, and TC is total costs. TC can be defined as accounting costs or economic costs, depending on the objectives and requirements of the analyst for evaluating profit. <span>The characteristics of the product market, where the firm sells its output or services, and of the resource market, where the firm purchases resources, play an important role in the determination of profit. Key variables that determine TC are the level of output, the firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource ma

Flashcard 1435574865164

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itKey variables that determine TC are the level of output, the firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets.

Original toplevel document

2. OBJECTIVES OF THE FIRMthe analyst for evaluating profit. The characteristics of the product market, where the firm sells its output or services, and of the resource market, where the firm purchases resources, play an important role in the determination of profit. <span>Key variables that determine TC are the level of output, the firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. 2.1. Types of Profit Measures The economics discipline has its

Flashcard 1435577224460

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTR is a function of output and product price as determined by the firm’s product market.

Original toplevel document

2. OBJECTIVES OF THE FIRMan important role in the determination of profit. Key variables that determine TC are the level of output, the firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. <span>TR is a function of output and product price as determined by the firm’s product market. 2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit.

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. OBJECTIVES OF THE FIRM

he firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. <span>2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), accounting profit is what is left after paying all accounting costs—whether the expense is a cash outlay or not. When accounting profit is negative, it is called an accounting loss . Equation 2 summarizes the concept of accounting profit: Equation (2) Accounting profit = Total revenue – Total accounting costs When defining profit as accounting profit, the TC term in Equation 1 becomes total accounting costs, which include only the explicit costs of doing business. Let us consider two businesses: a start-up company and a publicly traded corporation. Suppose that for the start-up, total revenue in the business’s first year is €3,500,000 and total accounting costs are €3,200,000. Accounting profit is €3,500,000 – €3,200,000 = €300,000. The corresponding calculation for the publicly traded corporation, let us suppose, is $50,000,000 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. 2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as acc

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open it2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification r

Original toplevel document

2. OBJECTIVES OF THE FIRMhe firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. <span>2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), accounting profit is what is left after paying all accounting costs—whether the expense is a cash outlay or not. When accounting profit is negative, it is called an accounting loss . Equation 2 summarizes the concept of accounting profit: Equation (2) Accounting profit = Total revenue – Total accounting costs When defining profit as accounting profit, the TC term in Equation 1 becomes total accounting costs, which include only the explicit costs of doing business. Let us consider two businesses: a start-up company and a publicly traded corporation. Suppose that for the start-up, total revenue in the business’s first year is €3,500,000 and total accounting costs are €3,200,000. Accounting profit is €3,500,000 – €3,200,000 = €300,000. The corresponding calculation for the publicly traded corporation, let us suppose, is $50,000,000 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. 2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as acc

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itwhich differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. <span>In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private an

Original toplevel document

2. OBJECTIVES OF THE FIRMhe firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. <span>2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), accounting profit is what is left after paying all accounting costs—whether the expense is a cash outlay or not. When accounting profit is negative, it is called an accounting loss . Equation 2 summarizes the concept of accounting profit: Equation (2) Accounting profit = Total revenue – Total accounting costs When defining profit as accounting profit, the TC term in Equation 1 becomes total accounting costs, which include only the explicit costs of doing business. Let us consider two businesses: a start-up company and a publicly traded corporation. Suppose that for the start-up, total revenue in the business’s first year is €3,500,000 and total accounting costs are €3,200,000. Accounting profit is €3,500,000 – €3,200,000 = €300,000. The corresponding calculation for the publicly traded corporation, let us suppose, is $50,000,000 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. 2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as acc

Flashcard 1435584302348

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThere are thus two basic types of profit—accounting and economic

Original toplevel document

2. OBJECTIVES OF THE FIRMhe firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. <span>2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), accounting profit is what is left after paying all accounting costs—whether the expense is a cash outlay or not. When accounting profit is negative, it is called an accounting loss . Equation 2 summarizes the concept of accounting profit: Equation (2) Accounting profit = Total revenue – Total accounting costs When defining profit as accounting profit, the TC term in Equation 1 becomes total accounting costs, which include only the explicit costs of doing business. Let us consider two businesses: a start-up company and a publicly traded corporation. Suppose that for the start-up, total revenue in the business’s first year is €3,500,000 and total accounting costs are €3,200,000. Accounting profit is €3,500,000 – €3,200,000 = €300,000. The corresponding calculation for the publicly traded corporation, let us suppose, is $50,000,000 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. 2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as acc

Flashcard 1435585875212

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIn the theory of the firm, however, profit without further qualification refers to economic profit.

Original toplevel document

2. OBJECTIVES OF THE FIRMhe firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. <span>2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), accounting profit is what is left after paying all accounting costs—whether the expense is a cash outlay or not. When accounting profit is negative, it is called an accounting loss . Equation 2 summarizes the concept of accounting profit: Equation (2) Accounting profit = Total revenue – Total accounting costs When defining profit as accounting profit, the TC term in Equation 1 becomes total accounting costs, which include only the explicit costs of doing business. Let us consider two businesses: a start-up company and a publicly traded corporation. Suppose that for the start-up, total revenue in the business’s first year is €3,500,000 and total accounting costs are €3,200,000. Accounting profit is €3,500,000 – €3,200,000 = €300,000. The corresponding calculation for the publicly traded corporation, let us suppose, is $50,000,000 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. 2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as acc

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open ito be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit <span>Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Account

Original toplevel document

2. OBJECTIVES OF THE FIRMhe firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. <span>2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), accounting profit is what is left after paying all accounting costs—whether the expense is a cash outlay or not. When accounting profit is negative, it is called an accounting loss . Equation 2 summarizes the concept of accounting profit: Equation (2) Accounting profit = Total revenue – Total accounting costs When defining profit as accounting profit, the TC term in Equation 1 becomes total accounting costs, which include only the explicit costs of doing business. Let us consider two businesses: a start-up company and a publicly traded corporation. Suppose that for the start-up, total revenue in the business’s first year is €3,500,000 and total accounting costs are €3,200,000. Accounting profit is €3,500,000 – €3,200,000 = €300,000. The corresponding calculation for the publicly traded corporation, let us suppose, is $50,000,000 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. 2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as acc

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itng Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. <span>One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in

Original toplevel document

2. OBJECTIVES OF THE FIRMhe firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. <span>2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), accounting profit is what is left after paying all accounting costs—whether the expense is a cash outlay or not. When accounting profit is negative, it is called an accounting loss . Equation 2 summarizes the concept of accounting profit: Equation (2) Accounting profit = Total revenue – Total accounting costs When defining profit as accounting profit, the TC term in Equation 1 becomes total accounting costs, which include only the explicit costs of doing business. Let us consider two businesses: a start-up company and a publicly traded corporation. Suppose that for the start-up, total revenue in the business’s first year is €3,500,000 and total accounting costs are €3,200,000. Accounting profit is €3,500,000 – €3,200,000 = €300,000. The corresponding calculation for the publicly traded corporation, let us suppose, is $50,000,000 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. 2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as acc

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itersight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . <span>Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), accounting profit is what is left after paying all accounting costs—whether the expense is a cas

Original toplevel document

2. OBJECTIVES OF THE FIRMhe firm’s efficiency in producing that level of output when utilizing inputs, and resource prices as established by resource markets. TR is a function of output and product price as determined by the firm’s product market. <span>2.1. Types of Profit Measures The economics discipline has its own concept of profit, which differs substantially from what accountants consider profit. There are thus two basic types of profit—accounting and economic—and analysts need to be able to interpret each correctly and to understand how they are related to each other. In the theory of the firm, however, profit without further qualification refers to economic profit. 2.1.1. Accounting Profit Accounting profit is generally defined as net income reported on the income statement according to standards established by private and public financial oversight bodies that determine the rules for financial reporting. One widely accepted definition of accounting profit—also known as net profit, net income, or net earnings—states that it equals revenue less all accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), accounting profit is what is left after paying all accounting costs—whether the expense is a cash outlay or not. When accounting profit is negative, it is called an accounting loss . Equation 2 summarizes the concept of accounting profit: Equation (2) Accounting profit = Total revenue – Total accounting costs When defining profit as accounting profit, the TC term in Equation 1 becomes total accounting costs, which include only the explicit costs of doing business. Let us consider two businesses: a start-up company and a publicly traded corporation. Suppose that for the start-up, total revenue in the business’s first year is €3,500,000 and total accounting costs are €3,200,000. Accounting profit is €3,500,000 – €3,200,000 = €300,000. The corresponding calculation for the publicly traded corporation, let us suppose, is $50,000,000 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. 2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as acc

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itl accounting (or explicit) costs . Accounting or explicit costs are payments to non-owner parties for services or resources that they supply to the firm. Often referred to as the “bottom line” (the last income figure in the income statement), <span>accounting profit is what is left after paying all accounting costs—whether the expense is a cash outlay or not. When accounting profit is negative, it is called an accounting loss . Equation 2 summarizes the concept of accounting profit: Equation (2) Accounting profit =

Original toplevel document