Edited, memorised or added to reading queue

on 18-Jan-2017 (Wed)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1429150240012

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe trivium, in itself a tool or a skill, has become associated with its most appropriate subject matter—the languages, oratory, literature, history, philosophy.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1429323255052

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itof number include not only music (here understood as musical principles, like those of harmony, which constitute t he liberal art of music and must be distinguished from applied instrumental music, which is a fine art) but also <span>physics, much of chemistry, and other forms of scientific measurement of discrete quantities. The theory of space includes analytic geometry and trigonometry. Applications of the theory of spa

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1432514596108

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itVoice is the sound uttered by an animal. The voice of irrational animals has meaning from nature, from the tone of the utterance. The human voice alone is symbolic, having a meaning imposed upon it by convention.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1432993008908

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itSegún estimaciones de la Cámara Nacional del Autotransporte de Carga, el precio del diesel subirá entre 15 y 20 por ciento para el siguiente año. Este aumento, considera la Cámara, podría ser trasladado al costo del flete, el cual podría subir entre 6 y 8 por ciento, pero eso dependerá

Original toplevel document

Encarecerá combustible mercancíasPara 2017 se espera que se encarezcan las mercancías por efecto del gasolinazo. Según estimaciones de la Cámara Nacional del Autotransporte de Carga, el precio del diesel subirá entre 15 y 20 por ciento para el siguiente año. Este aumento, considera la Cámara, podría ser trasladado al costo del flete, el cual podría subir entre 6 y 8 por ciento, pero eso dependerá de las negociaciones que cada transportista logre con sus clientes. Refugio Muñoz, vicepresidente ejecutivo de ese órgano empresarial, explicó que el combustible representa, en promedio, entre 30 y 35 por ciento de los costos operativos de lo

Flashcard 1439595105548

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open ite una empresa certificada denominada controladora y una o más sociedades controladas; Programa IMMEX Industrial, cuando se realice un proceso industrial de elaboración o transformación de mercancías destinadas a la exportación; Programa IMMEX <span>Servicios, cuando se realicen servicios a mercancías de exportación o se presten servicios de exportación, únicamente para el desarrollo de las actividades que la Secretaría determine, previa opi

Original toplevel document

Decreto IMMEXiladora de Exportación (Maquila) y el que Establece Programas de Importación Temporal para Producir Artículos de Exportación (PITEX), cuyas empresas representan en su conjunto el 85% de las exportaciones manufactureras de México. <span>ASPECTOS GENERALES Definición: El Programa IMMEX es un instrumento mediante el cual se permite importar temporalmente los bienes necesarios para ser utilizados en un proceso industrial o de servicio destinado a la elaboración, transformación o reparación de mercancías de procedencia extranjera importadas temporalmente para su exportación o a la prestación de servicios de exportación, sin cubrir el pago del impuesto general de importación, del impuesto al valor agregado y, en su caso, de las cuotas compensatorias Beneficiarios: La Secretaría de Economía (SE) podrá autorizar a las personas morales residentes en territorio nacional a que se refiere la fracción II del artículo 9 del Código Fiscal de la Federación, que tributen de conformidad con el Título II de la Ley del Impuesto sobre la Renta, un solo Programa IMMEX, que puede incluir las modalidades de controladora de empresas, industrial, servicios, albergue y terciarización, siempre que cumplan con los requisitos previstos en el Decreto para el Fomento de la Industria Manufacturera, Maquiladora y de Servicios de Exportación (Decreto IMMEX), publicado en el Diario Oficial e la Federación el 1 de noviembre de 2006. Beneficios: El Programa IMMEX brinda a sus titulares la posibilidad de importar temporalmente libre de impuestos a la importación y del IVA, los bienes necesarios para ser utilizados en un proceso industrial o de servicio destinado a la elaboración, transformación o reparación de mercancías de procedencia extranjera importadas temporalmente para su exportación o a la prestación de servicios de exportación. Estos bienes están agrupados bajo las siguientes categorías: Materias primas, partes y componentes que se vayan a destinar totalmente a integrar mercancías de exportación; combustibles, lubricantes y otros materiales que se vayan a consumir durante el proceso productivo de la mercancía de exportación; envases y empaques; etiquetas y folletos. Contenedores y cajas de trailers. Maquinaria, equipo, herramientas, instrumentos, moldes y refacciones destinadas al proceso productivo; equipos y aparatos para el control de la contaminación; para la investigación o capacitación, de seguridad industrial, de telecomunicación y cómputo, de laboratorio, de medición, de prueba de productos y control de calidad; así como aquéllos que intervengan en el manejo de materiales relacionados directamente con los bienes de exportación y otros vinculados con el proceso productivo; equipo para el desarrollo administrativo. Modalidades: Programa IMMEX Controladora de empresas, cuando en un mismo programa se integren las operaciones de manufactura de una empresa certificada denominada controladora y una o más sociedades controladas; Programa IMMEX Industrial, cuando se realice un proceso industrial de elaboración o transformación de mercancías destinadas a la exportación; Programa IMMEX Servicios, cuando se realicen servicios a mercancías de exportación o se presten servicios de exportación, únicamente para el desarrollo de las actividades que la Secretaría determine, previa opinión de la Secretaría de Hacienda y Crédito Público; Programa IMMEX Albergue, cuando una o varias empresas extranjeras le faciliten la tecnología y el material productivo, sin que estas últimas operen directamente el Programa, y Programa IMMEX Terciarización, cuando una empresa certificada que no cuente con instalaciones para realizar procesos productivos, realice las operaciones de manufactura a través de terceros que registre en su Programa. La SE podrá aprobar de manera simultánea un Programa de Promoción Sectorial, de acuerdo con el tipo de productos que fabrica o a los servicios de exportación que realice, debiendo cumplir con la normatividad aplicable a los mismos. Tratándose de una empresa bajo la modalidad de servicios, únicamente podrá importar al amparo del Programa de Promoción Sectorial las mercancías a que se refiere el artículo 4, fracción III del presente Decreto, siempre que corresponda al sector en que sea registrada. Vigencia: La vigencia de los Programas IMMEX estará sujeta mientras el titular de los mismos continúe cumpliendo con los requisitos previstos para su otorgamiento y con las obligaciones establecidas en el Decreto. Plazos de permanencia: Los bienes importados temporalmente al amparo de un Programa IMMEX, podrán permanecer en territorio nacional por los plazos establecidos en el artículo 108 de la Ley Aduanera. Para las mercancías comprendidas en los Anexos II y III del Decreto IMMEX, cuando se importen como materia prima, el plazo de permanencia será hasta por doce meses. Tratándose de las mercancías que se encuentran comprendidas en el Anexo III del Decreto IMMEX, cuando se importen como materia prima, únicamente cuando se destinen a actividades bajo la modalidad de servicios, el plazo de permanencia será de hasta seis meses. No podrán ser importadas al amparo del Programa las mercancías señaladas en el Anexo I del Decreto IMMEX. Compromisos: Para gozar de los beneficios de un Programa IMMEX se deberá dar cumplimiento a los términos establecidos en el Decreto en la materia. La autorización del Programa se otorgará bajo el compromiso de realizar anualmente ventas al exterior por un valor superior a 500,000 dólares de los Estados Unidos de América, o su equivalente en moneda nacional, o bien, facturar exportaciones, cuando menos por el 10% de su facturación total. Reportes: El titular de un Programa IMMEX deberá presentar un reporte anual de forma electrónica, respecto del total de las ventas y de las exportaciones, correspondientes al ejercicio fiscal inmediato anterior, a más tardar el último día hábil del mes de mayo, conforme al formato que mediante Reglas y Criterios de Carácter General en Materia de Comercio Exterior dé a conocer la Secretaría de Economía. Adicionalmente, la empresa con Programa IMMEX deberá presentar la información que, para efectos estadísticos, se determine, en los términos que establezca la SE mediante Reglas y Criterios de Carácter General en Materia de Comercio Exterior. Para mayor información sobre este programa comunicarse al 01 800 410 2000 disponible para todo el país ó al buzón de la Secretaría de Economía en www.economia.gob.mx; o al teléfono 52-29-61-00, ext. 34347, Lic. Sergio Manríquez Fernández, Subdirector de Devolución de Impuestos. TRÁMITES Operación: Los trámites relativos al Programa IMMEX son gratuitos y pueden ser realizados en las ventanillas de atención al público de las Repre

Flashcard 1442025704716

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe van der Waals radius is a measure of the size of an atom. The energy due to the van der Waals attraction between two atoms is optimal when they are separated from each other by the sum of their van der Waals radii. If they move closer, the energy increases sharply

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1446853348620

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFinancial analysis is the process of examining a company’s performance in the context of its industry and economic environment in order to arrive at a decision or recommendation.

Original toplevel document

1. INTRODUCTIONFinancial analysis is the process of examining a company’s performance in the context of its industry and economic environment in order to arrive at a decision or recommendation. Often, the decisions and recommendations addressed by financial analysts pertain to providing capital to companies—specifically, whether to invest in the company’s debt or equity securi

Flashcard 1446858591500

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itBasic financial statement analysis provides a foundation that enables the analyst to better understand information gathered from research beyond the financial reports.

Original toplevel document

1. INTRODUCTIONs with the information found in a company’s financial reports. These financial reports include audited financial statements, additional disclosures required by regulatory authorities, and any accompanying (unaudited) commentary by management. <span>Basic financial statement analysis—as presented in this reading—provides a foundation that enables the analyst to better understand information gathered from research beyond the financial reports. This reading is organized as follows: Section 2 discusses the scope of financial statement analysis. Section 3 describes the sources of information used in financial statem

Flashcard 1447262031116

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA particular or empirical description, such as the present store manager, this computer, the woman who made the flag, t he furniture in this house, the microbe now dividing in the petri dish, can symbolize the individual or

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1447490882828

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itEssence is that which makes the individual like other members of its class. Quantified matter is that which makes t he individual different from other individuals in its class because matter, extended by reason of its quantity, must be this or that matter, whi

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1447553010956

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itonstructs, for their definition adds to the simple concept human being certain accidents such as knowledge of law or physical agility, which are essential to the definition of lawyer or of athlete although not essential to the definition of a <span>construct.<span><body><html>

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1447753551116

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe logical dimension of language may be compared to the incandescent electrified wire in a transparent bulb; the wire is obvious and its limits are clearly defined. The psychological dimension may be compared to a frosted bulb, in which all the light, it is true, comes from the incandescent wire within, but the light is softened and diffused by the bulb, which gives it a more

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1447758269708

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLanguage with a purely logical dimension is desirable in legal document s and in scientific and philosophical treatises, where clarit y, precision, and singleness of meaning are requisite.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1448261061900

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

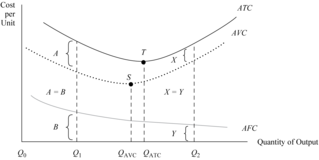

This shows the cost curve relationships among ATC, AVC, and AFC in the short run. The difference between ATC and AVC at any output quantity is exactly equal to the amount of AFC. Both ATC and AVC take on a bowl-shaped pattern in which each curv

Flashcard 1448267615500

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

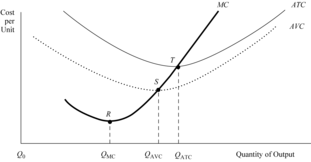

d MC in the short run. The marginal cost curve intersects both the ATC and AVC at their respective minimum points. This occurs at points S and T, which correspond to Q AVC and Q ATC , respectively. Mathematically, when <span>marginal cost is less than average variable cost, AVC will be decreasing . The opposite occurs when MC is greater than AVC. The same relationship holds true for MC and ATC . ATC declines when MC is less than ATC. ATC increases as MC exceeds ATC

Flashcard 1448315587852

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

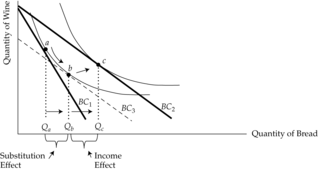

Open itMental exercise: Part of his response is because of the increase in real income . We remove that effect subtracting some income, while leaving the new lower price in place. That budget constraint shows the reduction in income that moves him back to his original indif

Original toplevel document

Substitution effect and income effectf bread falls, as indicated by the pivoting in budget constraints from BC 1 to BC 2 , Warren buys more bread, increasing his quantity from Q a to Q c . That is the net effect of both the substitution effect and the income effect. <span>Mental exercise: Part of his response is because of the increase in real income . We remove that effect subtracting some income, while leaving the new lower price in place. That budget constraint shows the reduction in income that moves him back to his original indifference curve. Notice that we are moving BC 2 inward, parallel to itself until it becomes just tangent to his original indifference curve at point b. The price decrease was a good thing for him. An offsetting bad thing would be an income reduction. If the income reduction is just sufficient to leave him no better or morse than before the price change, we have removed the real income effect of the decrease in price. What’s left of his response must be due to the substitution effect . So, we say that the substitution effect is shown by the move from point a to point b. If his

Flashcard 1448341802252

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open it2nd part In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Extending credit to a customer. Examining compliance with debt covenants or other contractual arrangements. Assigning a debt rating to a company or bond issue. Valuing a

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISing, and financing decisions but do not necessarily rely on analysis of related financial statements. They have access to additional financial information that can be reported in whatever format is most useful to their decision.) <span>In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Evaluating an equity investment for inclusion in a portfolio. Evaluating a merger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. Extending credit to a customer. Examining compliance with debt covenants or other contractual arrangements. Assigning a debt rating to a company or bond issue. Valuing a security for making an investment recommendation to others. Forecasting future net income and cash flow. These decisions demonstrate certain themes in financial analysis. In general, analysts seek to examine the past and current performance and financial position of a

Flashcard 1448346258700

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itmerger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the <span>creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. <span><body><html>

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISing, and financing decisions but do not necessarily rely on analysis of related financial statements. They have access to additional financial information that can be reported in whatever format is most useful to their decision.) <span>In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Evaluating an equity investment for inclusion in a portfolio. Evaluating a merger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. Extending credit to a customer. Examining compliance with debt covenants or other contractual arrangements. Assigning a debt rating to a company or bond issue. Valuing a security for making an investment recommendation to others. Forecasting future net income and cash flow. These decisions demonstrate certain themes in financial analysis. In general, analysts seek to examine the past and current performance and financial position of a

Flashcard 1448348617996

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThis reading is organized as follows: In Section 2, we introduce the cost of capital and its basic computation. Section 3 presents a selection of methods for estimating the costs of the various sources of capital. Section 4 discusses issues an analyst faces in using the cost of capital.

Original toplevel document

1. INTRODUCTIONr, is to estimate the cost of capital for the company as a whole and then adjust this overall corporate cost of capital upward or downward to reflect the risk of the contemplated project relative to the company’s average project. <span>This reading is organized as follows: In the next section, we introduce the cost of capital and its basic computation. Section 3 presents a selection of methods for estimating the costs of the various sources of capital. Section 4 discusses issues an analyst faces in using the cost of capital. A summary concludes the reading. <span><body><html>

Flashcard 1448422018316

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itRevenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases the factors of production, in order to produce a product that will be offered for sale to consum

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1448430931212

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFirst the external senses operate on an object present before us and produce a percept. The internal senses, primarily the imagination, produce a phantasm or mental image of the individual object

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1448434076940

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIrrational animals have the external and internal senses, which are sometimes keener than those of humans. But because they lack the rational powers (intellect, intellectual memory, and free will), they are incapable of progress or of culture.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1448450854156

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLawyer and athlete are constructs, for their definition adds to the simple concept human being certain accidents such as knowledge of law or physical agility, which are essential to the definition of lawyer or of athlete although not essential to the definition of a construct.</s

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1448524516620

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

Earnings are also frequently used by analysts in valuation. For example, an analyst may value shares of a company by comparing its price-to-earnings ratio (P/E) to the P/Es of peer companies and/or may use forecasted future earnings as direct or indirect inputs into discounted cash flow models of valuation.

Earnings are also frequently used by analysts in valuation. For example, an analyst may value shares of a company by comparing its price-to-earnings ratio (P/E) to the P/Es of peer companies and/or may use forecasted future earnings as direct or indirect inputs into discounted cash flow models of valuation.

Flashcard 1448570653964

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFinancial statements communicate financial information gathered and processed in the company's accounting system to parties outside the business.

Original toplevel document

Subject 2. Major Financial StatementsFinancial statements are the most important outcome of the accounting system. They communicate financial information gathered and processed in the company's accounting system to parties outside the business. The four principal financial statements are: Income statement (statement of earnings) Balance sheet (statement of financial position) Cash flow

Flashcard 1448609189132

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAssets - Liabilities = Stockholders' Equity =

Original toplevel document

Subject 2. Major Financial Statementsing operations is deemed not to be persistent, then recurring (pre-tax) income from continuing operations should be adjusted. The net income figure is used to prepare the statement of retained earnings. <span>Balance Sheet A balance sheet provides a "snapshot" of a company's financial condition. Think of the balance sheet as a photo of the business at a specific point in time. It reports major classes and amounts of assets, liabilities, stockholders' equity, and their interrelationships as of a specific date. Assets = Liabilities + Stockholders' Equity Assets are the economic resources controlled by the company. Liabilities are the financial obligations that the company must fulfill in the future. Liabilities are typically fulfilled by payment of cash. They represent the source of financing provided to the company by the creditors. Equity ownership is the owner's investments and the total earnings retained from the commencement of the company. Equity represents the source of financing provided to the company by the owners. Cash Flow Statement The primary purpose of the cash flow statement is to provide information about a company's cash receipts and

Flashcard 1448611548428

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLiabilities = Assets - Stockholders' Equity

Original toplevel document

Subject 2. Major Financial Statementsing operations is deemed not to be persistent, then recurring (pre-tax) income from continuing operations should be adjusted. The net income figure is used to prepare the statement of retained earnings. <span>Balance Sheet A balance sheet provides a "snapshot" of a company's financial condition. Think of the balance sheet as a photo of the business at a specific point in time. It reports major classes and amounts of assets, liabilities, stockholders' equity, and their interrelationships as of a specific date. Assets = Liabilities + Stockholders' Equity Assets are the economic resources controlled by the company. Liabilities are the financial obligations that the company must fulfill in the future. Liabilities are typically fulfilled by payment of cash. They represent the source of financing provided to the company by the creditors. Equity ownership is the owner's investments and the total earnings retained from the commencement of the company. Equity represents the source of financing provided to the company by the owners. Cash Flow Statement The primary purpose of the cash flow statement is to provide information about a company's cash receipts and

Flashcard 1448641432844

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe cashflow statement reports the cash receipts and cash outflows classified according to operating, investment, and financing activities

Original toplevel document

Subject 2. Major Financial Statementscreditors. Equity ownership is the owner's investments and the total earnings retained from the commencement of the company. Equity represents the source of financing provided to the company by the owners. <span>Cash Flow Statement The primary purpose of the cash flow statement is to provide information about a company's cash receipts and cash payments during a period. It reports the cash receipts and cash outflows classified according to operating, investment, and financing activities. The cash flow statement is useful because it provides answers to the following simple yet important questions: Where did the cash come from during the period? What was the cash used for during the period? What was the change in the cash balance during the period? The statement's value is that it helps users evaluate liquidity, solvency, and financial flexibility. Liquidity refers to the "nearness to cash" of assets and liabilities, or having enough cash available to pay debts when they are due. Solvency refers to the company's ability to pay its debts as they mature. Cash flows reflect the company's liquidity and long-term solvency. Financial flexibility refers to a company's ability to respond and adapt to financial adversity and unexpected needs and opportunities. For example, cash flow information can be used to evaluate the effects of major investment and financing decisions. The details of income statements, balance sheets and cash flow statements will be covered in Study Session 8. Statement of Changes in Owners' Equity This statement reports the amounts and sources of changes in equity from capital transactions with owners.

Flashcard 1448694910220

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itd><head>A general concept is a universal idea existing only in the mind but having its foundation outside the mind in the essence which exist s in the individual and makes it the kind of thing it is. Therefore, a concept is not arbitrary although the word is. Truth has an objective norm in the real.<html>

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1448738688268

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

This shows the cost curve relationships among ATC, AVC, and AFC in the short run. The difference between ATC and AVC at any output quantity is exactly equal to the amount of AFC. Both ATC and AVC take on a bowl-shaped pattern in which each curv

Flashcard 1448739998988

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

This shows the cost curve relationships among ATC, AVC, and AFC in the short run. The difference between ATC and AVC at any output quantity is exactly equal to the amount of AFC. Both ATC and AVC take on a bowl-shaped pattern in which each curv

Flashcard 1448744193292

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

d MC in the short run. The marginal cost curve intersects both the ATC and AVC at their respective minimum points. This occurs at points S and T, which correspond to Q AVC and Q ATC , respectively. Mathematically, when <span>marginal cost is less than average variable cost, AVC will be decreasing . The opposite occurs when MC is greater than AVC. The same relationship holds true for MC and ATC . ATC declines when MC is less than ATC. ATC increases as MC exceeds ATC

Flashcard 1448746028300

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

d MC in the short run. The marginal cost curve intersects both the ATC and AVC at their respective minimum points. This occurs at points S and T, which correspond to Q AVC and Q ATC , respectively. Mathematically, when <span>marginal cost is less than average variable cost, AVC will be decreasing . The opposite occurs when MC is greater than AVC. The same relationship holds true for MC and ATC . ATC declines when MC is less than ATC. ATC increases as MC exceeds ATC

Flashcard 1448747863308

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

d MC in the short run. The marginal cost curve intersects both the ATC and AVC at their respective minimum points. This occurs at points S and T, which correspond to Q AVC and Q ATC , respectively. Mathematically, when <span>marginal cost is less than average variable cost, AVC will be decreasing . The opposite occurs when MC is greater than AVC. The same relationship holds true for MC and ATC . ATC declines when MC is less than ATC. ATC increases as MC exceeds ATC

Flashcard 1448749698316

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

d MC in the short run. The marginal cost curve intersects both the ATC and AVC at their respective minimum points. This occurs at points S and T, which correspond to Q AVC and Q ATC , respectively. Mathematically, when <span>marginal cost is less than average variable cost, AVC will be decreasing . The opposite occurs when MC is greater than AVC. The same relationship holds true for MC and ATC . ATC declines when MC is less than ATC. ATC increases as MC exceeds ATC

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1449939045644

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Theoretical aspects of learning

ised figures (original text included additional figures related to the forgetting rate which has been significantly overestimated due to an error in the implementation of the simulation model) <span>This article should help you plan your learning and better understand your lifetime capacity for learning new things. Most of the figures and formulas have been theoretically derived. However, over the last ten years, these theoretical constructs have been confirmed many times by exact measurements taken during an actual learning process A simple simulation model makes it possible to predict the outcome of a long-term learning process based on spaced repetition. Probability of forgetting at each repetit

Flashcard 1449945337100

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Theoretical aspects of learning

ost of the figures and formulas have been theoretically derived. However, over the last ten years, these theoretical constructs have been confirmed many times by exact measurements taken during an actual learning process <span>A simple simulation model makes it possible to predict the outcome of a long-term learning process based on spaced repetition. Probability of forgetting at each repetition is determined by the forgetting index. By using a Spaced Repetition A

ost of the figures and formulas have been theoretically derived. However, over the last ten years, these theoretical constructs have been confirmed many times by exact measurements taken during an actual learning process <span>A simple simulation model makes it possible to predict the outcome of a long-term learning process based on spaced repetition. Probability of forgetting at each repetition is determined by the forgetting index. By using a Spaced Repetition A

Flashcard 1449951890700

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itmerger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the <span>creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. <span><body><html>

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISing, and financing decisions but do not necessarily rely on analysis of related financial statements. They have access to additional financial information that can be reported in whatever format is most useful to their decision.) <span>In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Evaluating an equity investment for inclusion in a portfolio. Evaluating a merger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. Extending credit to a customer. Examining compliance with debt covenants or other contractual arrangements. Assigning a debt rating to a company or bond issue. Valuing a security for making an investment recommendation to others. Forecasting future net income and cash flow. These decisions demonstrate certain themes in financial analysis. In general, analysts seek to examine the past and current performance and financial position of a

Flashcard 1449953725708

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itmerger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the <span>creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. <span><body><html>

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISing, and financing decisions but do not necessarily rely on analysis of related financial statements. They have access to additional financial information that can be reported in whatever format is most useful to their decision.) <span>In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Evaluating an equity investment for inclusion in a portfolio. Evaluating a merger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. Extending credit to a customer. Examining compliance with debt covenants or other contractual arrangements. Assigning a debt rating to a company or bond issue. Valuing a security for making an investment recommendation to others. Forecasting future net income and cash flow. These decisions demonstrate certain themes in financial analysis. In general, analysts seek to examine the past and current performance and financial position of a

Flashcard 1449965522188

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

Earnings are also frequently used by analysts in valuation. For example, an analyst may value shares of a company by comparing its price-to-earnings ratio (P/E) to the P/Es of peer companies and/or may use forecasted future earnings as direct or indirect inputs into discounted cash flow models of valuation.

Earnings are also frequently used by analysts in valuation. For example, an analyst may value shares of a company by comparing its price-to-earnings ratio (P/E) to the P/Es of peer companies and/or may use forecasted future earnings as direct or indirect inputs into discounted cash flow models of valuation.

Flashcard 1449987017996

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itEvidence of economic rent attracts additional capital funds to the economic endeavor.

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Article 1450228190476

Costs

#cfa-level-1 #microeconomics #reading-15-demand-and-supply-analysis-the-firm

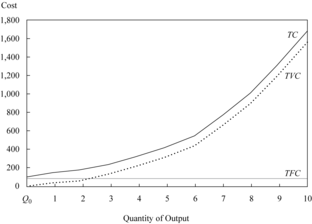

Total costs (TC) are the summation of all costs, where costs are classified according to fixed or variable. Total costs increase as the firm expands output and decrease when production is cut. The rate of increase in total costs declines up to a certain output level and, thereafter, accelerates as the firm gets closer to full utilization of capacity. The rate of change in total costs mirrors the rate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Costs

Total costs (TC) are the summation of all costs, where costs are classified according to fixed or variable. Total costs increase as the firm expands output and decrease when production is cut. The rate of increase in total costs declines up to a certain output level and, thereafter, accelerates as the firm gets closer to full utilization of capacity. The rate of change in total costs mirrors the rate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it

Flashcard 1450230549772

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTotal costs (TC) are the summation of all costs, where costs are classified according to fixed or variable. Total costs increase as the firm expands output and decrease when production is cut. The rate of increase in total costs declines up to a certain output level and, thereaft

Original toplevel document

CostsTotal costs (TC) are the summation of all costs, where costs are classified according to fixed or variable. Total costs increase as the firm expands output and decrease when production is cut. The rate of increase in total costs declines up to a certain output level and, thereafter, accelerates as the firm gets closer to full utilization of capacity. The rate of change in total costs mirrors the rate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it

Flashcard 1450232909068

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTotal costs (TC) are the summation of all costs, where costs are classified according to fixed or variable. Total costs increase as the firm expands output and decrease when production is cut. The rate of increase in total costs declines up to a certain output level and, thereafter, accelerates as the firm gets closer to full utilization o

Original toplevel document

CostsTotal costs (TC) are the summation of all costs, where costs are classified according to fixed or variable. Total costs increase as the firm expands output and decrease when production is cut. The rate of increase in total costs declines up to a certain output level and, thereafter, accelerates as the firm gets closer to full utilization of capacity. The rate of change in total costs mirrors the rate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it

Flashcard 1450236841228

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itead><head> The rate of increase in total costs declines up to a certain output level and, thereafter, accelerates as the firm gets closer to full utilization of capacity. The rate of change in total costs mirrors the rate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 10

Original toplevel document

CostsTotal costs (TC) are the summation of all costs, where costs are classified according to fixed or variable. Total costs increase as the firm expands output and decrease when production is cut. The rate of increase in total costs declines up to a certain output level and, thereafter, accelerates as the firm gets closer to full utilization of capacity. The rate of change in total costs mirrors the rate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Costs

rate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. <span>Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi-fixed cost , although it remains categorized as part of TFC. Examples of fixed costs are debt service, real estate lease agreements, and rental contracts. Quasi-fixed cost examples would be certain utilities and administrative salaries that could be avoided or be lower when output is zero but would assume higher constant values over different production ranges. Normal profit is considered to be a fixed cost because it is a return required by investors on their equity capital regardless of output level. At zero output, total costs are always equal to the amount of total fixed cost that is incurred at this production point. In Exhibit 13, total fixed cost remains at 100 throughout the entire production range. Other fixed costs evolve primarily from investments in such fixed assets as real estate, production facilities, and equipment. As a firm grows in size, fixed asset expansion occurs along with a related increase in fixed cost. However, fixed cost cannot be arbitrarily cut when production declines. Regardless of the volume of output, an investment in a given level of fixed assets locks the firm into a certain amount of fixed cost that is used to finance the physical capital base, technology, and other capital assets. When a firm downsizes, the last expense to be cut is usually fixed cost. Total variable cost (TVC), which is the summation of all variable expenses, has a direct relationship with quantity. When quantity increases, total variable cost increases

Flashcard 1450239462668

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTotal fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to

Original toplevel document

Costsrate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. <span>Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi-fixed cost , although it remains categorized as part of TFC. Examples of fixed costs are debt service, real estate lease agreements, and rental contracts. Quasi-fixed cost examples would be certain utilities and administrative salaries that could be avoided or be lower when output is zero but would assume higher constant values over different production ranges. Normal profit is considered to be a fixed cost because it is a return required by investors on their equity capital regardless of output level. At zero output, total costs are always equal to the amount of total fixed cost that is incurred at this production point. In Exhibit 13, total fixed cost remains at 100 throughout the entire production range. Other fixed costs evolve primarily from investments in such fixed assets as real estate, production facilities, and equipment. As a firm grows in size, fixed asset expansion occurs along with a related increase in fixed cost. However, fixed cost cannot be arbitrarily cut when production declines. Regardless of the volume of output, an investment in a given level of fixed assets locks the firm into a certain amount of fixed cost that is used to finance the physical capital base, technology, and other capital assets. When a firm downsizes, the last expense to be cut is usually fixed cost. Total variable cost (TVC), which is the summation of all variable expenses, has a direct relationship with quantity. When quantity increases, total variable cost increases

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itTotal fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi-fixed cost , although it remains categorized as part of TFC. Examples of fixed costs are debt service, real estate lease agreements, and rental cont

Original toplevel document

Costsrate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. <span>Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi-fixed cost , although it remains categorized as part of TFC. Examples of fixed costs are debt service, real estate lease agreements, and rental contracts. Quasi-fixed cost examples would be certain utilities and administrative salaries that could be avoided or be lower when output is zero but would assume higher constant values over different production ranges. Normal profit is considered to be a fixed cost because it is a return required by investors on their equity capital regardless of output level. At zero output, total costs are always equal to the amount of total fixed cost that is incurred at this production point. In Exhibit 13, total fixed cost remains at 100 throughout the entire production range. Other fixed costs evolve primarily from investments in such fixed assets as real estate, production facilities, and equipment. As a firm grows in size, fixed asset expansion occurs along with a related increase in fixed cost. However, fixed cost cannot be arbitrarily cut when production declines. Regardless of the volume of output, an investment in a given level of fixed assets locks the firm into a certain amount of fixed cost that is used to finance the physical capital base, technology, and other capital assets. When a firm downsizes, the last expense to be cut is usually fixed cost. Total variable cost (TVC), which is the summation of all variable expenses, has a direct relationship with quantity. When quantity increases, total variable cost increases

Flashcard 1450244181260

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itTotal fixed cost (TFC) can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range.

Original toplevel document

Costsrate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. <span>Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi-fixed cost , although it remains categorized as part of TFC. Examples of fixed costs are debt service, real estate lease agreements, and rental contracts. Quasi-fixed cost examples would be certain utilities and administrative salaries that could be avoided or be lower when output is zero but would assume higher constant values over different production ranges. Normal profit is considered to be a fixed cost because it is a return required by investors on their equity capital regardless of output level. At zero output, total costs are always equal to the amount of total fixed cost that is incurred at this production point. In Exhibit 13, total fixed cost remains at 100 throughout the entire production range. Other fixed costs evolve primarily from investments in such fixed assets as real estate, production facilities, and equipment. As a firm grows in size, fixed asset expansion occurs along with a related increase in fixed cost. However, fixed cost cannot be arbitrarily cut when production declines. Regardless of the volume of output, an investment in a given level of fixed assets locks the firm into a certain amount of fixed cost that is used to finance the physical capital base, technology, and other capital assets. When a firm downsizes, the last expense to be cut is usually fixed cost. Total variable cost (TVC), which is the summation of all variable expenses, has a direct relationship with quantity. When quantity increases, total variable cost increases

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation