Edited, memorised or added to reading queue

on 19-Jan-2017 (Thu)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1432385096972

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThis refers to the way in which verb forms change according to the person, tense or mood: (io) vado ‘I go’; (noi) andremo ‘we will go’; le ragazze sono andate ‘the girls went’; voleva che io andassi a casa sua ‘he wanted me to go to his house’; etc. The word conjugation is

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1432412097804

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA noun is countable if it can normally be used in both singular and plural, and take the indefinite article un, una (etc.): un bicchiere ‘a glass’; una pizza ‘a pizza’. Whereas an uncountable noun is one which is not normally found in the plural (e.g. zucchero ‘sugar’) or an abstract noun (such as tristezza ‘sadness’).

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1435137346828

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itMunchery is one of dozens of technology startups around the world trying to solve the challenge of mealtime planning with the tap of an app. GrubHub in the U.S., Just Eat in Europe, and Ele.me in China, to name just a few, all connect Internet users with restaurants and their takeout menus.

Original toplevel document

How an immigrant motherfucker made muncheryd chief executive officer now. Four years ago he started Munchery, which delivers fully cooked meals to people’s homes, each day presenting an abundance of foods that stands in stark contrast to the deprivation of his early life. <span>Munchery is one of dozens of technology startups around the world trying to solve the challenge of mealtime planning with the tap of an app. GrubHub in the U.S., Just Eat in Europe, and Ele.me in China, to name just a few, all connect Internet users with restaurants and their takeout menus. Critics derisively call the proliferation of these businesses the “lazy food economy,” but Munchery is different. It cooks and delivers its own rela-tively healthy fare. Th

Flashcard 1436150009100

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itExplicit Costs vs. Implicit Costs Explicit costs arise based on what has actually been purchased as opposed to implicit costs that arise based on what has actually been given up other than money. Explicit costs have a paper trail and provide audit documentation. Implicit costs are not traceable in a financial system. While management will utilize explicit costs when viewing bus

Original toplevel document

Explicit Cost Definition | Investopediahased are examples of explicit costs. Although the depreciation of an asset is not an activity that can be tangibly traced, depreciation expense is an explicit cost because it relates to the cost of the underlying asset that the company owns. <span>Explicit Costs vs. Implicit Costs Explicit costs arise based on what has actually been purchased as opposed to implicit costs that arise based on what has actually been given up other than money. Explicit costs have a paper trail and provide audit documentation. Implicit costs are not traceable in a financial system. While management will utilize explicit costs when viewing business operations, implicit costs are only utilized in decision-making or choosing between multiple alternatives. Opportunity Costs Explicit costs are used in the computation of opportunity costs. An opportunity cost is the total value of an item forgone. It is calculated by adding the explicit and

Flashcard 1438298803468

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itspent. Incremental cash flow is the net cash flow attributable to an investment project. It represents the change in the firm's total cash flow that occurs as a direct result of accepting the project. <span>Forget sunk costs. Subtract opportunity costs. Consider side effects on other parts of the firm: externalities and cannibalization. Recognize the investment and recovery of net working capital. O

Original toplevel document

Subject 2. Basic Principles of Capital Budgetingd in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. <span>Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which cannot be recovered regardless of whether a project is accepted or rejected. Since sunk costs are not increment costs, they should not be included in the capital budgeting analysis. For example, a small bookstore is considering opening a coffee shop within its store, which will generate an annual net cash outflow of $10,000 from selling coffee. That is, the coffee shop will always be losing money. In the previous year, the bookstore spent $5,000 to hire a consultant to perform an analysis. This $5,000 consulting fee is a sunk cost; whether the coffee shop is opened or not, the $5,000 is spent. Incremental cash flow is the net cash flow attributable to an investment project. It represents the change in the firm's total cash flow that occurs as a direct result of accepting the project. Forget sunk costs. Subtract opportunity costs. Consider side effects on other parts of the firm: externalities and cannibalization. Recognize the investment and recovery of net working capital. Opportunity cost is the return on the best alternative use of an asset or the highest return that will not be earned if funds are invested in a particular project. For example, to continue with the bookstore example, the space to be occupied by the coffee shop is an opportunity cost - it could be used to sell books and generate a $5,000 annual net cash inflow. Externalities are the effects of a project on cash flows in other parts of a firm. Although they are difficult to quantify, they should be considered. Externalities can be either positive or negative: Positive externalities create benefits for other parts of the firm. For example, the coffee shop may generate some additional customers for the bookstore (who otherwise may not buy books there). Future cash flows generated by positive externalities occur with the project and do not occur without the project, so they are incremental. Negative externalities create costs for other parts of the firm. For example, if the bookstore is considering opening a branch two blocks away, some customers who buy books at the old store will switch to the new branch. The customers lost by the old store are a negative externality. The primary type of negative externality is cannibalization, which occurs when the introduction of a new product causes sales of existing products to decline. Future cash flows represented by negative externalities occur regardless of the project, so they are non-incremental. Such cash flows represent a transfer from existing projects to new projects, and thus should be subtracted from the new projects' cash flows. Conventional versus non-conventional cash flows. A conventional cash flow pattern is one with an initial outflow followed by a series of inflows. In a non-conventional cash flow pattern, the initial outflow can be followed by inflows and/or outflows. Some project interactions: Indepe

Flashcard 1438301162764

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itspent. Incremental cash flow is the net cash flow attributable to an investment project. It represents the change in the firm's total cash flow that occurs as a direct result of accepting the project. <span>Forget sunk costs. Subtract opportunity costs. Consider side effects on other parts of the firm: externalities and cannibalization. Recognize the investment and recovery of net working capital. O

Original toplevel document

Subject 2. Basic Principles of Capital Budgetingd in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. <span>Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which cannot be recovered regardless of whether a project is accepted or rejected. Since sunk costs are not increment costs, they should not be included in the capital budgeting analysis. For example, a small bookstore is considering opening a coffee shop within its store, which will generate an annual net cash outflow of $10,000 from selling coffee. That is, the coffee shop will always be losing money. In the previous year, the bookstore spent $5,000 to hire a consultant to perform an analysis. This $5,000 consulting fee is a sunk cost; whether the coffee shop is opened or not, the $5,000 is spent. Incremental cash flow is the net cash flow attributable to an investment project. It represents the change in the firm's total cash flow that occurs as a direct result of accepting the project. Forget sunk costs. Subtract opportunity costs. Consider side effects on other parts of the firm: externalities and cannibalization. Recognize the investment and recovery of net working capital. Opportunity cost is the return on the best alternative use of an asset or the highest return that will not be earned if funds are invested in a particular project. For example, to continue with the bookstore example, the space to be occupied by the coffee shop is an opportunity cost - it could be used to sell books and generate a $5,000 annual net cash inflow. Externalities are the effects of a project on cash flows in other parts of a firm. Although they are difficult to quantify, they should be considered. Externalities can be either positive or negative: Positive externalities create benefits for other parts of the firm. For example, the coffee shop may generate some additional customers for the bookstore (who otherwise may not buy books there). Future cash flows generated by positive externalities occur with the project and do not occur without the project, so they are incremental. Negative externalities create costs for other parts of the firm. For example, if the bookstore is considering opening a branch two blocks away, some customers who buy books at the old store will switch to the new branch. The customers lost by the old store are a negative externality. The primary type of negative externality is cannibalization, which occurs when the introduction of a new product causes sales of existing products to decline. Future cash flows represented by negative externalities occur regardless of the project, so they are non-incremental. Such cash flows represent a transfer from existing projects to new projects, and thus should be subtracted from the new projects' cash flows. Conventional versus non-conventional cash flows. A conventional cash flow pattern is one with an initial outflow followed by a series of inflows. In a non-conventional cash flow pattern, the initial outflow can be followed by inflows and/or outflows. Some project interactions: Indepe

Flashcard 1438397631756

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Subject 2. Basic Principles of Capital Budgeting

t allocate the firm's capital. On the other hand, a firm can raise the funds it wants for all profitable projects simply by paying the required rate of return. Learning Outcome Statements b. <span>describe the basic principles of capital budgeting; c. explain how the evaluation and selection of capital projects is affected by mutually exclusive projects, project sequencing, and capital rationing;

t allocate the firm's capital. On the other hand, a firm can raise the funds it wants for all profitable projects simply by paying the required rate of return. Learning Outcome Statements b. <span>describe the basic principles of capital budgeting; c. explain how the evaluation and selection of capital projects is affected by mutually exclusive projects, project sequencing, and capital rationing;

Flashcard 1438511664396

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itties create costs for other parts of the firm. For example, if the bookstore is considering opening a branch two blocks away, some customers who buy books at the old store will switch to the new branch. The customers lost by the old store are <span>a negative externality. The primary type of negative externality is cannibalization, which occurs when the introduction of a new product causes sales of existing products to decline.

Original toplevel document

Subject 2. Basic Principles of Capital Budgetingd in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. <span>Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which cannot be recovered regardless of whether a project is accepted or rejected. Since sunk costs are not increment costs, they should not be included in the capital budgeting analysis. For example, a small bookstore is considering opening a coffee shop within its store, which will generate an annual net cash outflow of $10,000 from selling coffee. That is, the coffee shop will always be losing money. In the previous year, the bookstore spent $5,000 to hire a consultant to perform an analysis. This $5,000 consulting fee is a sunk cost; whether the coffee shop is opened or not, the $5,000 is spent. Incremental cash flow is the net cash flow attributable to an investment project. It represents the change in the firm's total cash flow that occurs as a direct result of accepting the project. Forget sunk costs. Subtract opportunity costs. Consider side effects on other parts of the firm: externalities and cannibalization. Recognize the investment and recovery of net working capital. Opportunity cost is the return on the best alternative use of an asset or the highest return that will not be earned if funds are invested in a particular project. For example, to continue with the bookstore example, the space to be occupied by the coffee shop is an opportunity cost - it could be used to sell books and generate a $5,000 annual net cash inflow. Externalities are the effects of a project on cash flows in other parts of a firm. Although they are difficult to quantify, they should be considered. Externalities can be either positive or negative: Positive externalities create benefits for other parts of the firm. For example, the coffee shop may generate some additional customers for the bookstore (who otherwise may not buy books there). Future cash flows generated by positive externalities occur with the project and do not occur without the project, so they are incremental. Negative externalities create costs for other parts of the firm. For example, if the bookstore is considering opening a branch two blocks away, some customers who buy books at the old store will switch to the new branch. The customers lost by the old store are a negative externality. The primary type of negative externality is cannibalization, which occurs when the introduction of a new product causes sales of existing products to decline. Future cash flows represented by negative externalities occur regardless of the project, so they are non-incremental. Such cash flows represent a transfer from existing projects to new projects, and thus should be subtracted from the new projects' cash flows. Conventional versus non-conventional cash flows. A conventional cash flow pattern is one with an initial outflow followed by a series of inflows. In a non-conventional cash flow pattern, the initial outflow can be followed by inflows and/or outflows. Some project interactions: Indepe

Flashcard 1439597464844

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itrealicen servicios a mercancías de exportación o se presten servicios de exportación, únicamente para el desarrollo de las actividades que la Secretaría determine, previa opinión de la Secretaría de Hacienda y Crédito Público; Programa IMMEX <span>Albergue, cuando una o varias empresas extranjeras le faciliten la tecnología y el material productivo, sin que estas últimas operen directamente el Programa, y Programa IMMEX Terciarización, cu

Original toplevel document

Decreto IMMEXiladora de Exportación (Maquila) y el que Establece Programas de Importación Temporal para Producir Artículos de Exportación (PITEX), cuyas empresas representan en su conjunto el 85% de las exportaciones manufactureras de México. <span>ASPECTOS GENERALES Definición: El Programa IMMEX es un instrumento mediante el cual se permite importar temporalmente los bienes necesarios para ser utilizados en un proceso industrial o de servicio destinado a la elaboración, transformación o reparación de mercancías de procedencia extranjera importadas temporalmente para su exportación o a la prestación de servicios de exportación, sin cubrir el pago del impuesto general de importación, del impuesto al valor agregado y, en su caso, de las cuotas compensatorias Beneficiarios: La Secretaría de Economía (SE) podrá autorizar a las personas morales residentes en territorio nacional a que se refiere la fracción II del artículo 9 del Código Fiscal de la Federación, que tributen de conformidad con el Título II de la Ley del Impuesto sobre la Renta, un solo Programa IMMEX, que puede incluir las modalidades de controladora de empresas, industrial, servicios, albergue y terciarización, siempre que cumplan con los requisitos previstos en el Decreto para el Fomento de la Industria Manufacturera, Maquiladora y de Servicios de Exportación (Decreto IMMEX), publicado en el Diario Oficial e la Federación el 1 de noviembre de 2006. Beneficios: El Programa IMMEX brinda a sus titulares la posibilidad de importar temporalmente libre de impuestos a la importación y del IVA, los bienes necesarios para ser utilizados en un proceso industrial o de servicio destinado a la elaboración, transformación o reparación de mercancías de procedencia extranjera importadas temporalmente para su exportación o a la prestación de servicios de exportación. Estos bienes están agrupados bajo las siguientes categorías: Materias primas, partes y componentes que se vayan a destinar totalmente a integrar mercancías de exportación; combustibles, lubricantes y otros materiales que se vayan a consumir durante el proceso productivo de la mercancía de exportación; envases y empaques; etiquetas y folletos. Contenedores y cajas de trailers. Maquinaria, equipo, herramientas, instrumentos, moldes y refacciones destinadas al proceso productivo; equipos y aparatos para el control de la contaminación; para la investigación o capacitación, de seguridad industrial, de telecomunicación y cómputo, de laboratorio, de medición, de prueba de productos y control de calidad; así como aquéllos que intervengan en el manejo de materiales relacionados directamente con los bienes de exportación y otros vinculados con el proceso productivo; equipo para el desarrollo administrativo. Modalidades: Programa IMMEX Controladora de empresas, cuando en un mismo programa se integren las operaciones de manufactura de una empresa certificada denominada controladora y una o más sociedades controladas; Programa IMMEX Industrial, cuando se realice un proceso industrial de elaboración o transformación de mercancías destinadas a la exportación; Programa IMMEX Servicios, cuando se realicen servicios a mercancías de exportación o se presten servicios de exportación, únicamente para el desarrollo de las actividades que la Secretaría determine, previa opinión de la Secretaría de Hacienda y Crédito Público; Programa IMMEX Albergue, cuando una o varias empresas extranjeras le faciliten la tecnología y el material productivo, sin que estas últimas operen directamente el Programa, y Programa IMMEX Terciarización, cuando una empresa certificada que no cuente con instalaciones para realizar procesos productivos, realice las operaciones de manufactura a través de terceros que registre en su Programa. La SE podrá aprobar de manera simultánea un Programa de Promoción Sectorial, de acuerdo con el tipo de productos que fabrica o a los servicios de exportación que realice, debiendo cumplir con la normatividad aplicable a los mismos. Tratándose de una empresa bajo la modalidad de servicios, únicamente podrá importar al amparo del Programa de Promoción Sectorial las mercancías a que se refiere el artículo 4, fracción III del presente Decreto, siempre que corresponda al sector en que sea registrada. Vigencia: La vigencia de los Programas IMMEX estará sujeta mientras el titular de los mismos continúe cumpliendo con los requisitos previstos para su otorgamiento y con las obligaciones establecidas en el Decreto. Plazos de permanencia: Los bienes importados temporalmente al amparo de un Programa IMMEX, podrán permanecer en territorio nacional por los plazos establecidos en el artículo 108 de la Ley Aduanera. Para las mercancías comprendidas en los Anexos II y III del Decreto IMMEX, cuando se importen como materia prima, el plazo de permanencia será hasta por doce meses. Tratándose de las mercancías que se encuentran comprendidas en el Anexo III del Decreto IMMEX, cuando se importen como materia prima, únicamente cuando se destinen a actividades bajo la modalidad de servicios, el plazo de permanencia será de hasta seis meses. No podrán ser importadas al amparo del Programa las mercancías señaladas en el Anexo I del Decreto IMMEX. Compromisos: Para gozar de los beneficios de un Programa IMMEX se deberá dar cumplimiento a los términos establecidos en el Decreto en la materia. La autorización del Programa se otorgará bajo el compromiso de realizar anualmente ventas al exterior por un valor superior a 500,000 dólares de los Estados Unidos de América, o su equivalente en moneda nacional, o bien, facturar exportaciones, cuando menos por el 10% de su facturación total. Reportes: El titular de un Programa IMMEX deberá presentar un reporte anual de forma electrónica, respecto del total de las ventas y de las exportaciones, correspondientes al ejercicio fiscal inmediato anterior, a más tardar el último día hábil del mes de mayo, conforme al formato que mediante Reglas y Criterios de Carácter General en Materia de Comercio Exterior dé a conocer la Secretaría de Economía. Adicionalmente, la empresa con Programa IMMEX deberá presentar la información que, para efectos estadísticos, se determine, en los términos que establezca la SE mediante Reglas y Criterios de Carácter General en Materia de Comercio Exterior. Para mayor información sobre este programa comunicarse al 01 800 410 2000 disponible para todo el país ó al buzón de la Secretaría de Economía en www.economia.gob.mx; o al teléfono 52-29-61-00, ext. 34347, Lic. Sergio Manríquez Fernández, Subdirector de Devolución de Impuestos. TRÁMITES Operación: Los trámites relativos al Programa IMMEX son gratuitos y pueden ser realizados en las ventanillas de atención al público de las Repre

Flashcard 1439599824140

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itión de la Secretaría de Hacienda y Crédito Público; Programa IMMEX Albergue, cuando una o varias empresas extranjeras le faciliten la tecnología y el material productivo, sin que estas últimas operen directamente el Programa, y Programa IMMEX <span>Terciarización, cuando una empresa certificada que no cuente con instalaciones para realizar procesos productivos, realice las operaciones de manufactura a través de terceros que registre en su Progra

Original toplevel document

Decreto IMMEXiladora de Exportación (Maquila) y el que Establece Programas de Importación Temporal para Producir Artículos de Exportación (PITEX), cuyas empresas representan en su conjunto el 85% de las exportaciones manufactureras de México. <span>ASPECTOS GENERALES Definición: El Programa IMMEX es un instrumento mediante el cual se permite importar temporalmente los bienes necesarios para ser utilizados en un proceso industrial o de servicio destinado a la elaboración, transformación o reparación de mercancías de procedencia extranjera importadas temporalmente para su exportación o a la prestación de servicios de exportación, sin cubrir el pago del impuesto general de importación, del impuesto al valor agregado y, en su caso, de las cuotas compensatorias Beneficiarios: La Secretaría de Economía (SE) podrá autorizar a las personas morales residentes en territorio nacional a que se refiere la fracción II del artículo 9 del Código Fiscal de la Federación, que tributen de conformidad con el Título II de la Ley del Impuesto sobre la Renta, un solo Programa IMMEX, que puede incluir las modalidades de controladora de empresas, industrial, servicios, albergue y terciarización, siempre que cumplan con los requisitos previstos en el Decreto para el Fomento de la Industria Manufacturera, Maquiladora y de Servicios de Exportación (Decreto IMMEX), publicado en el Diario Oficial e la Federación el 1 de noviembre de 2006. Beneficios: El Programa IMMEX brinda a sus titulares la posibilidad de importar temporalmente libre de impuestos a la importación y del IVA, los bienes necesarios para ser utilizados en un proceso industrial o de servicio destinado a la elaboración, transformación o reparación de mercancías de procedencia extranjera importadas temporalmente para su exportación o a la prestación de servicios de exportación. Estos bienes están agrupados bajo las siguientes categorías: Materias primas, partes y componentes que se vayan a destinar totalmente a integrar mercancías de exportación; combustibles, lubricantes y otros materiales que se vayan a consumir durante el proceso productivo de la mercancía de exportación; envases y empaques; etiquetas y folletos. Contenedores y cajas de trailers. Maquinaria, equipo, herramientas, instrumentos, moldes y refacciones destinadas al proceso productivo; equipos y aparatos para el control de la contaminación; para la investigación o capacitación, de seguridad industrial, de telecomunicación y cómputo, de laboratorio, de medición, de prueba de productos y control de calidad; así como aquéllos que intervengan en el manejo de materiales relacionados directamente con los bienes de exportación y otros vinculados con el proceso productivo; equipo para el desarrollo administrativo. Modalidades: Programa IMMEX Controladora de empresas, cuando en un mismo programa se integren las operaciones de manufactura de una empresa certificada denominada controladora y una o más sociedades controladas; Programa IMMEX Industrial, cuando se realice un proceso industrial de elaboración o transformación de mercancías destinadas a la exportación; Programa IMMEX Servicios, cuando se realicen servicios a mercancías de exportación o se presten servicios de exportación, únicamente para el desarrollo de las actividades que la Secretaría determine, previa opinión de la Secretaría de Hacienda y Crédito Público; Programa IMMEX Albergue, cuando una o varias empresas extranjeras le faciliten la tecnología y el material productivo, sin que estas últimas operen directamente el Programa, y Programa IMMEX Terciarización, cuando una empresa certificada que no cuente con instalaciones para realizar procesos productivos, realice las operaciones de manufactura a través de terceros que registre en su Programa. La SE podrá aprobar de manera simultánea un Programa de Promoción Sectorial, de acuerdo con el tipo de productos que fabrica o a los servicios de exportación que realice, debiendo cumplir con la normatividad aplicable a los mismos. Tratándose de una empresa bajo la modalidad de servicios, únicamente podrá importar al amparo del Programa de Promoción Sectorial las mercancías a que se refiere el artículo 4, fracción III del presente Decreto, siempre que corresponda al sector en que sea registrada. Vigencia: La vigencia de los Programas IMMEX estará sujeta mientras el titular de los mismos continúe cumpliendo con los requisitos previstos para su otorgamiento y con las obligaciones establecidas en el Decreto. Plazos de permanencia: Los bienes importados temporalmente al amparo de un Programa IMMEX, podrán permanecer en territorio nacional por los plazos establecidos en el artículo 108 de la Ley Aduanera. Para las mercancías comprendidas en los Anexos II y III del Decreto IMMEX, cuando se importen como materia prima, el plazo de permanencia será hasta por doce meses. Tratándose de las mercancías que se encuentran comprendidas en el Anexo III del Decreto IMMEX, cuando se importen como materia prima, únicamente cuando se destinen a actividades bajo la modalidad de servicios, el plazo de permanencia será de hasta seis meses. No podrán ser importadas al amparo del Programa las mercancías señaladas en el Anexo I del Decreto IMMEX. Compromisos: Para gozar de los beneficios de un Programa IMMEX se deberá dar cumplimiento a los términos establecidos en el Decreto en la materia. La autorización del Programa se otorgará bajo el compromiso de realizar anualmente ventas al exterior por un valor superior a 500,000 dólares de los Estados Unidos de América, o su equivalente en moneda nacional, o bien, facturar exportaciones, cuando menos por el 10% de su facturación total. Reportes: El titular de un Programa IMMEX deberá presentar un reporte anual de forma electrónica, respecto del total de las ventas y de las exportaciones, correspondientes al ejercicio fiscal inmediato anterior, a más tardar el último día hábil del mes de mayo, conforme al formato que mediante Reglas y Criterios de Carácter General en Materia de Comercio Exterior dé a conocer la Secretaría de Economía. Adicionalmente, la empresa con Programa IMMEX deberá presentar la información que, para efectos estadísticos, se determine, en los términos que establezca la SE mediante Reglas y Criterios de Carácter General en Materia de Comercio Exterior. Para mayor información sobre este programa comunicarse al 01 800 410 2000 disponible para todo el país ó al buzón de la Secretaría de Economía en www.economia.gob.mx; o al teléfono 52-29-61-00, ext. 34347, Lic. Sergio Manríquez Fernández, Subdirector de Devolución de Impuestos. TRÁMITES Operación: Los trámites relativos al Programa IMMEX son gratuitos y pueden ser realizados en las ventanillas de atención al público de las Repre

Flashcard 1439734304012

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itSection 2 introduces the analysis of market structures. The section addresses questions such as: What determines the degree of competition associated with each market structure? Given the degree of competition associated with each market structure, what decisions are left to the management team developing corporate strategy? How does

Original toplevel document

1. INTRODUCTIONts are possible even in the long run; in the short run, any outcome is possible. Therefore, understanding the forces behind the market structure will aid the financial analyst in determining firms’ short- and long-term prospects. <span>Section 2 introduces the analysis of market structures. The section addresses questions such as: What determines the degree of competition associated with each market structure? Given the degree of competition associated with each market structure, what decisions are left to the management team developing corporate strategy? How does a chosen pricing and output strategy evolve into specific decisions that affect the profitability of the firm? The answers to these questions are related to the forces of the market structure within which the firm operates. Sections 3, 4, 5, and 6 analyze demand, supply, optimal price and output, and factors affecting long-run equilibrium for perfect competition, monopolistic competition, olig

Flashcard 1439736663308

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itof market structures. The section addresses questions such as: What determines the degree of competition associated with each market structure? Given the degree of competition associated with each market structure, what decisions are left to <span>the management team developing corporate strategy? How does a chosen pricing and output strategy evolve into specific decisions that affect the profitability of the firm? The answers to these questions are related to the forces of the

Original toplevel document

1. INTRODUCTIONts are possible even in the long run; in the short run, any outcome is possible. Therefore, understanding the forces behind the market structure will aid the financial analyst in determining firms’ short- and long-term prospects. <span>Section 2 introduces the analysis of market structures. The section addresses questions such as: What determines the degree of competition associated with each market structure? Given the degree of competition associated with each market structure, what decisions are left to the management team developing corporate strategy? How does a chosen pricing and output strategy evolve into specific decisions that affect the profitability of the firm? The answers to these questions are related to the forces of the market structure within which the firm operates. Sections 3, 4, 5, and 6 analyze demand, supply, optimal price and output, and factors affecting long-run equilibrium for perfect competition, monopolistic competition, olig

Flashcard 1442904673548

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLa morfología se ocupa de la estructura interna de las palabras. Su unidad de análisis es el morfema, la unidad significativa mínima. Una palabra como libro no es segmentable en partes que preserven la dualidad entre sonido y significado: es una pa

Original toplevel document

Open itEn un sentido estrecho, la gramática sólo estudia las unidades significativas y su combinatoria. Comprende dos partes: la morfología y la sintaxis. La [16] primera se ocupa de la estructura interna de las palabras. Su unidad de análisis es el morfema, la unidad significativa mínima. Una palabra como libro no es segmentable en partes que preserven la dualidad entre sonido y significado: es una palabra simple. En cambio, libro-s, libr-ero, libr-ito contienen cada una dos formantes. La morfología detiene su análisis al llegar a la palabra. La sintaxis, a su vez, estudia la combinatoria de las palabras en el marco de la oración, su unidad máxima. Entre el morfema y la oración, unidades mínima y máxima, respectivamente

Flashcard 1447234243852

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThese are truly symbols because they express something conceivable: a mermaid, a purple cow, an inhabitant of another planet, a regular polygon with one hundred sides, an elephant, a rose. So also are the symbols given above as examples of the essence,

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1447291129100

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itan aggregate is a particular group of individuals that may or may not have the same essence or class nature; but in either case, the aggregate does not include all the members that have that nat ure

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1447427443980

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open iteasure and determine its place, for example: on a bench, beside the lake. 9 Posture is the relative position which the parts of a substance have toward each other, for example: sitting, leaning forward. 10 <span>Habiliment consists of clothing, ornaments, or weapons with which human beings by their art complement their nature in order to conserve t heir own being or that of the community (the other self)

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1447699811596

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open iteasure and determine its place, for example: on a bench, beside the lake. 9 Posture is the relative position which the parts of a substance have toward each other, for example: sitting, leaning forward. 10 <span>Habiliment consists of clothing, ornaments, or weapons with which human beings by their art complement their nature in order to conserve t heir own being or that of the community (the other self)

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1447737822476

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itObjectively, the definition (the logical dimension) of house and home are similar and may be represented by the lines ab; but subjectively, home is a much richer word, for to its logical content is added an emotional content (

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1448304053516

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itProfit (or loss) includes other income (such as investing income or income from the sale of items other than goods and services) minus the expenses incurred to earn that income.

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISof cash disbursements). Profit and cash flow are not equivalent. Profit (or loss) represents the difference between the prices at which goods or services are provided to customers and the expenses incurred to provide those goods and services. <span>In addition, profit (or loss) includes other income (such as investing income or income from the sale of items other than goods and services) minus the expenses incurred to earn that income. Overall, profit (or loss) equals income minus expenses, and its recognition is mostly independent from when cash is received or paid. Example 1 illustrates the distinction between profi

Flashcard 1450236841228

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

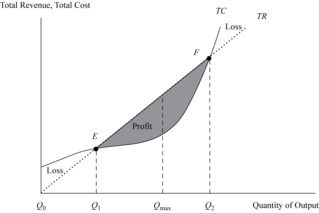

Open itead><head> The rate of increase in total costs declines up to a certain output level and, thereafter, accelerates as the firm gets closer to full utilization of capacity. The rate of change in total costs mirrors the rate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 10

Original toplevel document

CostsTotal costs (TC) are the summation of all costs, where costs are classified according to fixed or variable. Total costs increase as the firm expands output and decrease when production is cut. The rate of increase in total costs declines up to a certain output level and, thereafter, accelerates as the firm gets closer to full utilization of capacity. The rate of change in total costs mirrors the rate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it

Flashcard 1450632154380

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itUnder any form of imperfect competition, the individual seller confronts a negatively sloped demand curve, where price and the quantity demanded by consumers are inversely related.

Original toplevel document

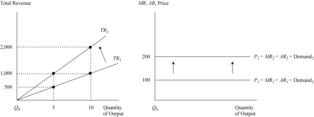

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSzation requires that we examine both of those components. Revenue comes from the demand for the firm’s products, and cost comes from the acquisition and utilization of the firm’s inputs in the production of those products. <span>3.1.1. Total, Average, and Marginal Revenue This section briefly examines demand and revenue in preparation for addressing cost. Unless the firm is a pure monopolist (i.e., the only seller in its market), there is a difference between market demand and the demand facing an individual firm. A later reading will devote much more time to understanding the various competitive environments (perfect competition, monopolistic competition, oligopoly, and monopoly), known as market structure . To keep the analysis simple at this point, we will note that competition could be either perfect or imperfect. In perfect competition , the individual firm has virtually no impact on market price, because it is assumed to be a very small seller among a very large number of firms selling essentially identical products. Such a firm is called a price taker . In the second case, the firm does have at least some control over the price at which it sells its product because it must lower its price to sell more units. Exhibit 4 presents total, average, and marginal revenue data for a firm under the assumption that the firm is price taker at each relevant level of quantity of goods sold. Consequently, the individual seller faces a horizontal demand curve over relevant output ranges at the price level established by the market (see Exhibit 5). The seller can offer any quantity at this set market price without affecting price. In contrast, imperfect competition is where an individual firm has enough share of the market (or can control a certain segment of the market) and is therefore able to exert some influence over price. Instead of a large number of competing firms, imperfect competition involves a smaller number of firms in the market relative to perfect competition and in the extreme case only one firm (i.e., monopoly). Under any form of imperfect competition, the individual seller confronts a negatively sloped demand curve, where price and the quantity demanded by consumers are inversely related. In this case, price to the firm declines when a greater quantity is offered to the market; price to the firm increases when a lower quantity is offered to the market. This is shown in Exhibits 6 and 7. Exhibit 4. Total, Average, and Marginal Revenue under Perfect Competition Quantity Sold (Q) Price (P) Total Revenue (TR) Average Re

Flashcard 1450634513676

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itHow is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth.

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

Flashcard 1450636872972

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAny commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itAny commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in dema

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itonsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. <span>When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent.<span><body><html>

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

Flashcard 1450642377996

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itUnder any form of imperfect competition, price to the firm declines when a greater quantity is offered to the market; price to the firm increases when a lower quantity is offered to the market.

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSzation requires that we examine both of those components. Revenue comes from the demand for the firm’s products, and cost comes from the acquisition and utilization of the firm’s inputs in the production of those products. <span>3.1.1. Total, Average, and Marginal Revenue This section briefly examines demand and revenue in preparation for addressing cost. Unless the firm is a pure monopolist (i.e., the only seller in its market), there is a difference between market demand and the demand facing an individual firm. A later reading will devote much more time to understanding the various competitive environments (perfect competition, monopolistic competition, oligopoly, and monopoly), known as market structure . To keep the analysis simple at this point, we will note that competition could be either perfect or imperfect. In perfect competition , the individual firm has virtually no impact on market price, because it is assumed to be a very small seller among a very large number of firms selling essentially identical products. Such a firm is called a price taker . In the second case, the firm does have at least some control over the price at which it sells its product because it must lower its price to sell more units. Exhibit 4 presents total, average, and marginal revenue data for a firm under the assumption that the firm is price taker at each relevant level of quantity of goods sold. Consequently, the individual seller faces a horizontal demand curve over relevant output ranges at the price level established by the market (see Exhibit 5). The seller can offer any quantity at this set market price without affecting price. In contrast, imperfect competition is where an individual firm has enough share of the market (or can control a certain segment of the market) and is therefore able to exert some influence over price. Instead of a large number of competing firms, imperfect competition involves a smaller number of firms in the market relative to perfect competition and in the extreme case only one firm (i.e., monopoly). Under any form of imperfect competition, the individual seller confronts a negatively sloped demand curve, where price and the quantity demanded by consumers are inversely related. In this case, price to the firm declines when a greater quantity is offered to the market; price to the firm increases when a lower quantity is offered to the market. This is shown in Exhibits 6 and 7. Exhibit 4. Total, Average, and Marginal Revenue under Perfect Competition Quantity Sold (Q) Price (P) Total Revenue (TR) Average Re

Flashcard 1450644999436

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itBecause price is fixed to the individual seller, the firm’s demand curve is a horizontal line at the point where the market sets the price.

Original toplevel document

Exhibit 5. Total Revenue, Average Revenue, and Marginal Revenue under Perfect CompetitionExhibit 5 graphically displays the revenue data from perfect competition. For an individual firm operating in a market setting of perfect competition, MR equals AR and both are equal to a price that stays the same across all levels of output. <span>Because price is fixed to the individual seller, the firm’s demand curve is a horizontal line at the point where the market sets the price. In Exhibit 5, at a price of 100, P 1 = MR 1 = AR 1 = Demand 1 . Marginal revenue, average revenue, and the firm’s price remain constant until market demand and supply factors cause a

Flashcard 1450646572300

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itWhen a firm downsizes, the last expense to be cut is usually fixed cost.

Original toplevel document

Costsrate of change in total variable cost. In Exhibit 13, TC at 5 units is 400—of which 300 is variable cost and 100 is fixed cost. At 10 units, total costs are 1,650, which is the sum of 1,550 in variable cost and 100 in fixed cost. <span>Total fixed cost (TFC) is the summation of all expenses that do not change when production varies. It can be a sunk or unavoidable cost that a firm has to cover whether it produces anything or not, or it can be a cost that stays the same over a range of production but can change to another constant level when production moves outside of that range. The latter is referred to as a quasi-fixed cost , although it remains categorized as part of TFC. Examples of fixed costs are debt service, real estate lease agreements, and rental contracts. Quasi-fixed cost examples would be certain utilities and administrative salaries that could be avoided or be lower when output is zero but would assume higher constant values over different production ranges. Normal profit is considered to be a fixed cost because it is a return required by investors on their equity capital regardless of output level. At zero output, total costs are always equal to the amount of total fixed cost that is incurred at this production point. In Exhibit 13, total fixed cost remains at 100 throughout the entire production range. Other fixed costs evolve primarily from investments in such fixed assets as real estate, production facilities, and equipment. As a firm grows in size, fixed asset expansion occurs along with a related increase in fixed cost. However, fixed cost cannot be arbitrarily cut when production declines. Regardless of the volume of output, an investment in a given level of fixed assets locks the firm into a certain amount of fixed cost that is used to finance the physical capital base, technology, and other capital assets. When a firm downsizes, the last expense to be cut is usually fixed cost. Total variable cost (TVC), which is the summation of all variable expenses, has a direct relationship with quantity. When quantity increases, total variable cost increases

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1450654698764

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

Dividing total fixed cost by quantity yields average fixed cost (AFC), which decreases throughout the production span. A declining average fixed cost reflects spreading a constant cost over more and more production units. At high production volumes, AFC may be so low that it is a small proportion of average total cost. In Exhibit 13, AFC declines from 100 at 1 unit, t

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Open it

>Dividing total fixed cost by quantity yields average fixed cost (AFC), which decreases throughout the production span. A declining average fixed cost reflects spreading a constant cost over more and more production units. At high production volumes, AFC may be so low that it is a small proportion of average total cost. In Exhibit 13, AFC declines from 100 at 1 unit, to 20 at 5 units, and then to 10 at an output level of 10 units. <html>

Article 1450658893068

#cfa #cfa-level-1 #economics #reading-15-demand-and-supply-analysis-the-firm #section-3-analysis-of-revenue-costs-and-profit

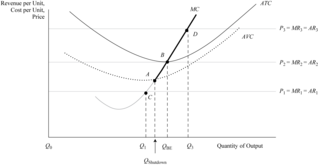

Average variable cost (AVC) is derived by dividing total variable cost by quantity. For example, average variable cost at 5 units is (300 ÷ 5) or 60. Over an initial range of production, average variable cost declines and then reaches a minimum point. Thereafter, cost increases as the firm utilizes more of its production capacity. This higher cost results primarily from production constraints imposed by the fixed assets at higher volume levels. The minimum point on the AVC coincides with the lowest average variable cost. However, the minimum point on the AVC does not correspond to the least-cost quantity for average total cost. In Exhibit 13, average variable cost is minimized at 2 units, whereas average total cost is the lowest at 3 units. Average total cost (ATC) is calculated by dividing total costs by quantity or by summing average fixed cost and average variable cost. For instance, in Exhibit 13, at 8 units ATC is 125 [calculated as (1,000 ÷ 8) or (AFC + AVC = 12.5 + 112.5)]. Average total cost is

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Open it

Average variable cost (AVC) is derived by dividing total variable cost by quantity. For example, average variable cost at 5 units is (300 ÷ 5) or 60. Over an initial range of production, average variable cost declines and then reaches a minimum point. Thereafter, cost increases as the firm utilizes more of its production capacity. This higher cost results primarily from production constraints imposed by the fixed assets at higher volume levels. The minimum point on the AVC coincides with the lowest average variable cost. However, the minimum point on the AVC does not correspond to the least-cost quantity for average total cost. In Exhibit 13, average variable cost is minimized at 2 units, whereas average total cost is the lowest at 3 units. Average total cost (ATC) is calculated by dividing total costs by quantity or by summing average fixed cost and average variable cost. For instance, in Exhibit 13, at 8 un

Flashcard 1450662300940

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itOver an initial range of production, average variable cost declines and then reaches a minimum point. Thereafter, cost increases as the firm utilizes more of its production capacity. This higher cost results primarily from production constraints imposed by the fixed assets at higher vo

Original toplevel document