Edited, memorised or added to reading queue

on 10-Jan-2017 (Tue)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1432387456268

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThis refers to the way in which verb forms change according to the person, tense or mood: (io) vado ‘I go’; (noi) andremo ‘we will go’; le ragazze sono andate ‘the girls went’; voleva che io andassi a casa sua ‘he wanted me to go to his house’; etc. The word conjugation is also used to mean

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1432544742668

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itRecipe and ingredient dinner kits : Blue Apron, Hello Fresh and Plated are the most established players and offer subscription boxes that include recipes and ingredients for three dinners per week for at least two people. Costs range from $10 –

Original toplevel document

The (almost) complete guide to food delivery services major-playerss with nutritional info and calorie counts. “No one product will own the entire market,” says Garg. “A lot of these companies are complementary with one another.” Here’s a rundown of the market and its major players: <span>Recipe and ingredient dinner kits : Blue Apron, Hello Fresh and Plated are the most established players and offer subscription boxes that include recipes and ingredients for three dinners per week for at least two people. Costs range from $10 – $15 per dinner, and the services offer varying degrees of customization. Smaller players such as Marley Spoon, PeachDish, Home Chef, Gobble offer a spin on the same model and may have more limited delivery areas. Restaurant takeout. Seamless and GrubHub, which merged in 2013, are essentially mobile platforms that connect consumers with local restaurants for takeout delivery. Restau

Flashcard 1435707247884

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA gerund is a verb form ending in -ando or -endo: parlando ‘speaking’; sorridendo ‘smiling’; finendo ‘finishing’. The gerund is most often used in Italian along with the verb stare to express a continuous action or event: sto finendo

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1435828882700

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open it(present, past) Verbs normally have a present participle and a past participle. Unlike other (finite) verb forms, the participle cannot be used on its own but is found together with other verb forms. The past participle is used with the verb avere or essere to form the passato prossimo tense: non abbiamo mangiato

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1438221470988

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Gasolinas, dólar y precios

emos entender por qué subieron los precios de las gasolinas y cuáles son las implicaciones que tendrá el aumento, así como los escenarios previsibles… algo más útil que echarse a perder el hígado. 1-¿Por qué subió la gasolina? <span>La razón es muy simple: porque cuesta más. En noviembre se vendieron 828 mil barriles diarios de gasolinas automotrices y se produjeron en el país 254 mil barriles de ese tipo de productos. Esto quiere decir que se importó alred

emos entender por qué subieron los precios de las gasolinas y cuáles son las implicaciones que tendrá el aumento, así como los escenarios previsibles… algo más útil que echarse a perder el hígado. 1-¿Por qué subió la gasolina? <span>La razón es muy simple: porque cuesta más. En noviembre se vendieron 828 mil barriles diarios de gasolinas automotrices y se produjeron en el país 254 mil barriles de ese tipo de productos. Esto quiere decir que se importó alred

Flashcard 1438223830284

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Gasolinas, dólar y precios

La razón es muy simple: porque cuesta más. En noviembre se vendieron 828 mil barriles diarios de gasolinas automotrices y se produjeron en el país 254 mil barriles de ese tipo de productos. Esto quiere decir que se importó alrededor del <span>70 por ciento de las gasolinas que se vendieron en el país. Y resulta, que la gasolina regular en la Costa del Golfo en Estados Unidos, de donde se importa la mayoría de la que se consume

La razón es muy simple: porque cuesta más. En noviembre se vendieron 828 mil barriles diarios de gasolinas automotrices y se produjeron en el país 254 mil barriles de ese tipo de productos. Esto quiere decir que se importó alrededor del <span>70 por ciento de las gasolinas que se vendieron en el país. Y resulta, que la gasolina regular en la Costa del Golfo en Estados Unidos, de donde se importa la mayoría de la que se consume

Flashcard 1439390371084

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itActive construction An active construction is a sentence in which the subject of the sentence is the person carrying out the action, or the event taking place (as opposed to a passive construction where the subject is the person affected by the action): mio marito fuma troppo ‘m

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. ANALYSIS OF MARKET STRUCTURES

yalty associated with soft drinks such as Coca-Cola. Many of Coca-Cola’s customers believe that their beverages are truly different from and better than all other soft drinks. The same is true for fashion creations and cosmetics. <span>The oligopoly market structure is based on a relatively small number of firms supplying the market. The small number of firms in the market means that each firm must consider what retaliatory strategies the other firms will pursue when prices and production levels change. Consider the pricing behavior of commercial airline companies. Pricing strategies and route scheduling are based on the expected reaction of the other carriers in similar markets. For any given route—say, from Paris, France, to Chennai, India—only a few carriers are in competition. If one of the carriers changes its pricing package, others will likely retaliate. Understanding the market structure of oligopoly markets can help in identifying a logical pattern of strategic price changes for the competing firms. Finally, the least competitive market structure is monopoly . In pure monopoly markets, there are no other good substitutes for the given product or service. There is a si

Flashcard 1439829200140

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open ity that makes it appear better than similar products from other firms. If a firm is successful in differentiating its product, the differentiation will provide pricing leverage. The more dissimilar the product appears, the more the market will <span>resemble the monopoly market structure. A firm can differentiate its product through aggressive advertising campaigns; frequent styling changes; the linking of its product with other, complementary products; or a host of oth

Original toplevel document

2. ANALYSIS OF MARKET STRUCTURESd monopoly is the local electrical power provider. In most cases, the monopoly power provider is allowed to earn a normal return on its investment and prices are set by the regulatory authority to allow that return. <span>2.2. Factors That Determine Market Structure Five factors determine market structure: The number and relative size of firms supplying the product; The degree of product differentiation; The power of the seller over pricing decisions; The relative strength of the barriers to market entry and exit; and The degree of non-price competition. The number and relative size of firms in a market influence market structure. If there are many firms, the degree of competition increases. With fewer firms supplying a good or service, consumers are limited in their market choices. One extreme case is the monopoly market structure, with only one firm supplying a unique good or service. Another extreme is perfect competition, with many firms supplying a similar product. Finally, an example of relative size is the automobile industry, in which a small number of large international producers (e.g., Ford and Toyota) are the leaders in the global market, and a number of small companies either have market power because they are niche players (e.g., Ferrari) or have little market power because of their narrow range of models or limited geographical presence (e.g., Škoda). In the case of monopolistic competition, there are many firms providing products to the market, as with perfect competition. However, one firm’s product is differentiated in some way that makes it appear better than similar products from other firms. If a firm is successful in differentiating its product, the differentiation will provide pricing leverage. The more dissimilar the product appears, the more the market will resemble the monopoly market structure. A firm can differentiate its product through aggressive advertising campaigns; frequent styling changes; the linking of its product with other, complementary products; or a host of other methods. When the market dictates the price based on aggregate supply and demand conditions, the individual firm has no control over pricing. The typical hog farmer in Nebraska and the milk producer in Bavaria are price takers . That is, they must accept whatever price the market dictates. This is the case under the market structure of perfect competition. In the case of monopolistic competition, the success of product differentiation determines the degree with which the firm can influence price. In the case of oligopoly, there are so few firms in the market that price control becomes possible. However, the small number of firms in an oligopoly market invites complex pricing strategies. Collusion, price leadership by dominant firms, and other pricing strategies can result. The degree to which one market structure can evolve into another and the difference between potential short-run outcomes and long-run equilibrium conditions depend on the strength of the barriers to entry and the possibility that firms fail to recoup their original costs or lose money for an extended period of time and are therefore forced to exit the market. Barriers to entry can result from very large capital investment requirements, as in the case of petroleum refining. Barriers may also result from patents, as in the case of some electronic products and drug formulas. Another entry consideration is the possibility of high exit costs. For example, plants that are specific to a special line of products, such as aluminum smelting plants, are non-redeployable, and exit costs would be high without a liquid market for the firm’s assets. High exit costs deter entry and are therefore also considered barriers to entry. In the case of farming, the barriers to entry are low. Production of corn, soybeans, wheat, tomatoes, and other produce is an easy process to replicate; therefore, those are highly competitive markets. Non-price competition dominates those market structures where product differentiation is critical. Therefore, monopolistic competition relies on competitive strategies that may not include pricing changes. An example of non-price competition is product differentiation through marketing. In other circumstances, non-price competition may occur because the few firms in the market feel dependent on each other. Each firm fears retaliatory price changes that would reduce total revenue for all of the firms in the market. Because oligopoly industries have so few firms, each firm feels dependent on the pricing strategies of the others. Therefore, non-price competition becomes a dominant strategy. Exhibit 1. Characteristics of Market Structure Market Structure Number of Sellers Degree of Product Differentiation Barriers to Entry Pricing Power of Firm Non-price Competition Perfect competition Many Homogeneous/ Standardized Very Low None None Monopolistic competition Many Differentiated Low Some Advertising and Product Differentiation Oligopoly Few Homogeneous/ Standardized High Some or Considerable Advertising and Product Differentiation Monopoly One Unique Product Very High Considerable Advertising From the perspective of the owners of the firm, the most desirable market structure is that with the most control over price, because this control can lead to large profits. Monopoly and oligopoly markets offer the greatest potential control over price; monopolistic competition offers less control. Firms operating under perfectly competitive market conditions have no control over price. From the consumers’ perspective, the most desirable market structure is that with the greatest degree of competition, because prices are generally lower. Thus, consumers would prefer as many goods and services as possible to be offered in competitive markets. As often happens in economics, there is a trade-off. While perfect competition gives the largest quantity of a good at the lowest price, other market forms may spur more innovation. Specifically, there may be high costs in researching a new product, and firms will incur such costs only if they expect to earn an attractive return on their research investment. This is the case often made for medical innovations, for example—the cost of clinical trials and experiments to create new medicines would bankrupt perfectly competitive firms but may be acceptable in an oligopoly market structure. Therefore, consumers can benefit from less-than-perfectly-competitive markets. PORTER’S FIVE FORCES AND MARKET STRUCTURE A financial analyst aiming to establish market conditions and consequent profitability of incumbent firms should start with the questions framed by Exhibit 1: How many sellers are there? Is the product differentiated? and so on. Moreover, in the case of monopolies and quasi monopolies, the analyst should evaluate the legislative and regulatory framework: Can the company set prices freely, or are there governmental controls? Finally, the analyst should consider the threat of competition from potential entrants. This analysis is often summarized by students of corporate strategy as “Porter’s five forces,” named after Harvard Business School professor Michael E. Porter. His book, Competitive Strategy, presented a systematic analysis of the practice of market strategy. Porter (2008) identified the five forces as: Threat of entry; Power of suppliers; Power of buyers (customers); Threat of substitutes; and Rivalry among existing competitors. It is easy to note the parallels between four of these five forces and the columns in Exhibit 1. The only “orphan” is the power of suppliers, which is not at the core of the theoretical economic analysis of competition, but which has substantial weight in the practical analysis of competition and profitability. Some stock analysts (e.g., Dorsey 2004) use the term “economic moat” to suggest that there are factors protecting the profitability of a firm that are similar to the moats (ditches full of water) that used to protect some medieval castles. A deep moat means that there is little or no threat of entry by invaders, i.e. competitors. It also means that customers are locked in because of high switching costs. <span><body><html>

Flashcard 1441835126028

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itSafety margin refers to how much the project return could fall in percentage terms before the invested capital is at risk.

Original toplevel document

Subject 3. Investment Decision Criteriaon that capital. If a firm takes on a project with a positive NPV, the position of the stockholders is improved. Decision rules: The higher the NPV, the better. Reject if NPV is less than or equal to 0. <span>NPV measures the dollar benefit of the project to shareholders. However, it does not measure the rate of return of the project, and thus cannot provide "safety margin" information. Safety margin refers to how much the project return could fall in percentage terms before the invested capital is at risk. Assuming the cost of capital for the firm is 10%, calculate each cash flow by dividing the cash flow by (1 + k) t where k is the cost of capital and t is the year number.

Flashcard 1442119552268

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFor the analyst seeking to evaluate a company’s investment program and its competitive position, an accurate estimate of a company’s cost of capital is important as well.

Original toplevel document

1. INTRODUCTION, the company is producing value today. But, how much value? The answer depends not only on the investments’ expected future cash flows but also on the cost of the funds. Borrowing is not costless. Neither is using owners’ funds. <span>The cost of this capital is an important ingredient in both investment decision making by the company’s management and the valuation of the company by investors. If a company invests in projects that produce a return in excess of the cost of capital, the company has created value; in contrast, if the company invests in projects whose returns are less than the cost of capital, the company has actually destroyed value. Therefore, the estimation of the cost of capital is a central issue in corporate financial management. For the analyst seeking to evaluate a company’s investment program and its competitive position, an accurate estimate of a company’s cost of capital is important as well. Cost of capital estimation is a challenging task. As we have already implied, the cost of capital is not observable but, rather, must be estimated. Arriving at a cost of ca

Flashcard 1442121911564

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThis reading is organized as follows: In Section 2, we introduce the cost of capital and its basic computation. Section 3 presents a selection of methods for estimating the costs of the various sources of capital. Section 4 discusses issues an anal

Original toplevel document

1. INTRODUCTIONr, is to estimate the cost of capital for the company as a whole and then adjust this overall corporate cost of capital upward or downward to reflect the risk of the contemplated project relative to the company’s average project. <span>This reading is organized as follows: In the next section, we introduce the cost of capital and its basic computation. Section 3 presents a selection of methods for estimating the costs of the various sources of capital. Section 4 discusses issues an analyst faces in using the cost of capital. A summary concludes the reading. <span><body><html>

Flashcard 1442125843724

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itnon-price competition may occur because the few firms in the market feel dependent on each other. Each firm fears retaliatory price changes that would reduce total revenue for all of the firms in the market. Because oligopoly industries have so few firms, each firm feels dependent

Original toplevel document

2. ANALYSIS OF MARKET STRUCTURESd monopoly is the local electrical power provider. In most cases, the monopoly power provider is allowed to earn a normal return on its investment and prices are set by the regulatory authority to allow that return. <span>2.2. Factors That Determine Market Structure Five factors determine market structure: The number and relative size of firms supplying the product; The degree of product differentiation; The power of the seller over pricing decisions; The relative strength of the barriers to market entry and exit; and The degree of non-price competition. The number and relative size of firms in a market influence market structure. If there are many firms, the degree of competition increases. With fewer firms supplying a good or service, consumers are limited in their market choices. One extreme case is the monopoly market structure, with only one firm supplying a unique good or service. Another extreme is perfect competition, with many firms supplying a similar product. Finally, an example of relative size is the automobile industry, in which a small number of large international producers (e.g., Ford and Toyota) are the leaders in the global market, and a number of small companies either have market power because they are niche players (e.g., Ferrari) or have little market power because of their narrow range of models or limited geographical presence (e.g., Škoda). In the case of monopolistic competition, there are many firms providing products to the market, as with perfect competition. However, one firm’s product is differentiated in some way that makes it appear better than similar products from other firms. If a firm is successful in differentiating its product, the differentiation will provide pricing leverage. The more dissimilar the product appears, the more the market will resemble the monopoly market structure. A firm can differentiate its product through aggressive advertising campaigns; frequent styling changes; the linking of its product with other, complementary products; or a host of other methods. When the market dictates the price based on aggregate supply and demand conditions, the individual firm has no control over pricing. The typical hog farmer in Nebraska and the milk producer in Bavaria are price takers . That is, they must accept whatever price the market dictates. This is the case under the market structure of perfect competition. In the case of monopolistic competition, the success of product differentiation determines the degree with which the firm can influence price. In the case of oligopoly, there are so few firms in the market that price control becomes possible. However, the small number of firms in an oligopoly market invites complex pricing strategies. Collusion, price leadership by dominant firms, and other pricing strategies can result. The degree to which one market structure can evolve into another and the difference between potential short-run outcomes and long-run equilibrium conditions depend on the strength of the barriers to entry and the possibility that firms fail to recoup their original costs or lose money for an extended period of time and are therefore forced to exit the market. Barriers to entry can result from very large capital investment requirements, as in the case of petroleum refining. Barriers may also result from patents, as in the case of some electronic products and drug formulas. Another entry consideration is the possibility of high exit costs. For example, plants that are specific to a special line of products, such as aluminum smelting plants, are non-redeployable, and exit costs would be high without a liquid market for the firm’s assets. High exit costs deter entry and are therefore also considered barriers to entry. In the case of farming, the barriers to entry are low. Production of corn, soybeans, wheat, tomatoes, and other produce is an easy process to replicate; therefore, those are highly competitive markets. Non-price competition dominates those market structures where product differentiation is critical. Therefore, monopolistic competition relies on competitive strategies that may not include pricing changes. An example of non-price competition is product differentiation through marketing. In other circumstances, non-price competition may occur because the few firms in the market feel dependent on each other. Each firm fears retaliatory price changes that would reduce total revenue for all of the firms in the market. Because oligopoly industries have so few firms, each firm feels dependent on the pricing strategies of the others. Therefore, non-price competition becomes a dominant strategy. Exhibit 1. Characteristics of Market Structure Market Structure Number of Sellers Degree of Product Differentiation Barriers to Entry Pricing Power of Firm Non-price Competition Perfect competition Many Homogeneous/ Standardized Very Low None None Monopolistic competition Many Differentiated Low Some Advertising and Product Differentiation Oligopoly Few Homogeneous/ Standardized High Some or Considerable Advertising and Product Differentiation Monopoly One Unique Product Very High Considerable Advertising From the perspective of the owners of the firm, the most desirable market structure is that with the most control over price, because this control can lead to large profits. Monopoly and oligopoly markets offer the greatest potential control over price; monopolistic competition offers less control. Firms operating under perfectly competitive market conditions have no control over price. From the consumers’ perspective, the most desirable market structure is that with the greatest degree of competition, because prices are generally lower. Thus, consumers would prefer as many goods and services as possible to be offered in competitive markets. As often happens in economics, there is a trade-off. While perfect competition gives the largest quantity of a good at the lowest price, other market forms may spur more innovation. Specifically, there may be high costs in researching a new product, and firms will incur such costs only if they expect to earn an attractive return on their research investment. This is the case often made for medical innovations, for example—the cost of clinical trials and experiments to create new medicines would bankrupt perfectly competitive firms but may be acceptable in an oligopoly market structure. Therefore, consumers can benefit from less-than-perfectly-competitive markets. PORTER’S FIVE FORCES AND MARKET STRUCTURE A financial analyst aiming to establish market conditions and consequent profitability of incumbent firms should start with the questions framed by Exhibit 1: How many sellers are there? Is the product differentiated? and so on. Moreover, in the case of monopolies and quasi monopolies, the analyst should evaluate the legislative and regulatory framework: Can the company set prices freely, or are there governmental controls? Finally, the analyst should consider the threat of competition from potential entrants. This analysis is often summarized by students of corporate strategy as “Porter’s five forces,” named after Harvard Business School professor Michael E. Porter. His book, Competitive Strategy, presented a systematic analysis of the practice of market strategy. Porter (2008) identified the five forces as: Threat of entry; Power of suppliers; Power of buyers (customers); Threat of substitutes; and Rivalry among existing competitors. It is easy to note the parallels between four of these five forces and the columns in Exhibit 1. The only “orphan” is the power of suppliers, which is not at the core of the theoretical economic analysis of competition, but which has substantial weight in the practical analysis of competition and profitability. Some stock analysts (e.g., Dorsey 2004) use the term “economic moat” to suggest that there are factors protecting the profitability of a firm that are similar to the moats (ditches full of water) that used to protect some medieval castles. A deep moat means that there is little or no threat of entry by invaders, i.e. competitors. It also means that customers are locked in because of high switching costs. <span><body><html>

Flashcard 1442128203020

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open ite few firms in the market feel dependent on each other. Each firm fears retaliatory price changes that would reduce total revenue for all of the firms in the market. Because oligopoly industries have so few firms, each firm feels dependent on <span>the pricing strategies of the others. Therefore, non-price competition becomes a dominant strategy.<span><body><html>

Original toplevel document

2. ANALYSIS OF MARKET STRUCTURESd monopoly is the local electrical power provider. In most cases, the monopoly power provider is allowed to earn a normal return on its investment and prices are set by the regulatory authority to allow that return. <span>2.2. Factors That Determine Market Structure Five factors determine market structure: The number and relative size of firms supplying the product; The degree of product differentiation; The power of the seller over pricing decisions; The relative strength of the barriers to market entry and exit; and The degree of non-price competition. The number and relative size of firms in a market influence market structure. If there are many firms, the degree of competition increases. With fewer firms supplying a good or service, consumers are limited in their market choices. One extreme case is the monopoly market structure, with only one firm supplying a unique good or service. Another extreme is perfect competition, with many firms supplying a similar product. Finally, an example of relative size is the automobile industry, in which a small number of large international producers (e.g., Ford and Toyota) are the leaders in the global market, and a number of small companies either have market power because they are niche players (e.g., Ferrari) or have little market power because of their narrow range of models or limited geographical presence (e.g., Škoda). In the case of monopolistic competition, there are many firms providing products to the market, as with perfect competition. However, one firm’s product is differentiated in some way that makes it appear better than similar products from other firms. If a firm is successful in differentiating its product, the differentiation will provide pricing leverage. The more dissimilar the product appears, the more the market will resemble the monopoly market structure. A firm can differentiate its product through aggressive advertising campaigns; frequent styling changes; the linking of its product with other, complementary products; or a host of other methods. When the market dictates the price based on aggregate supply and demand conditions, the individual firm has no control over pricing. The typical hog farmer in Nebraska and the milk producer in Bavaria are price takers . That is, they must accept whatever price the market dictates. This is the case under the market structure of perfect competition. In the case of monopolistic competition, the success of product differentiation determines the degree with which the firm can influence price. In the case of oligopoly, there are so few firms in the market that price control becomes possible. However, the small number of firms in an oligopoly market invites complex pricing strategies. Collusion, price leadership by dominant firms, and other pricing strategies can result. The degree to which one market structure can evolve into another and the difference between potential short-run outcomes and long-run equilibrium conditions depend on the strength of the barriers to entry and the possibility that firms fail to recoup their original costs or lose money for an extended period of time and are therefore forced to exit the market. Barriers to entry can result from very large capital investment requirements, as in the case of petroleum refining. Barriers may also result from patents, as in the case of some electronic products and drug formulas. Another entry consideration is the possibility of high exit costs. For example, plants that are specific to a special line of products, such as aluminum smelting plants, are non-redeployable, and exit costs would be high without a liquid market for the firm’s assets. High exit costs deter entry and are therefore also considered barriers to entry. In the case of farming, the barriers to entry are low. Production of corn, soybeans, wheat, tomatoes, and other produce is an easy process to replicate; therefore, those are highly competitive markets. Non-price competition dominates those market structures where product differentiation is critical. Therefore, monopolistic competition relies on competitive strategies that may not include pricing changes. An example of non-price competition is product differentiation through marketing. In other circumstances, non-price competition may occur because the few firms in the market feel dependent on each other. Each firm fears retaliatory price changes that would reduce total revenue for all of the firms in the market. Because oligopoly industries have so few firms, each firm feels dependent on the pricing strategies of the others. Therefore, non-price competition becomes a dominant strategy. Exhibit 1. Characteristics of Market Structure Market Structure Number of Sellers Degree of Product Differentiation Barriers to Entry Pricing Power of Firm Non-price Competition Perfect competition Many Homogeneous/ Standardized Very Low None None Monopolistic competition Many Differentiated Low Some Advertising and Product Differentiation Oligopoly Few Homogeneous/ Standardized High Some or Considerable Advertising and Product Differentiation Monopoly One Unique Product Very High Considerable Advertising From the perspective of the owners of the firm, the most desirable market structure is that with the most control over price, because this control can lead to large profits. Monopoly and oligopoly markets offer the greatest potential control over price; monopolistic competition offers less control. Firms operating under perfectly competitive market conditions have no control over price. From the consumers’ perspective, the most desirable market structure is that with the greatest degree of competition, because prices are generally lower. Thus, consumers would prefer as many goods and services as possible to be offered in competitive markets. As often happens in economics, there is a trade-off. While perfect competition gives the largest quantity of a good at the lowest price, other market forms may spur more innovation. Specifically, there may be high costs in researching a new product, and firms will incur such costs only if they expect to earn an attractive return on their research investment. This is the case often made for medical innovations, for example—the cost of clinical trials and experiments to create new medicines would bankrupt perfectly competitive firms but may be acceptable in an oligopoly market structure. Therefore, consumers can benefit from less-than-perfectly-competitive markets. PORTER’S FIVE FORCES AND MARKET STRUCTURE A financial analyst aiming to establish market conditions and consequent profitability of incumbent firms should start with the questions framed by Exhibit 1: How many sellers are there? Is the product differentiated? and so on. Moreover, in the case of monopolies and quasi monopolies, the analyst should evaluate the legislative and regulatory framework: Can the company set prices freely, or are there governmental controls? Finally, the analyst should consider the threat of competition from potential entrants. This analysis is often summarized by students of corporate strategy as “Porter’s five forces,” named after Harvard Business School professor Michael E. Porter. His book, Competitive Strategy, presented a systematic analysis of the practice of market strategy. Porter (2008) identified the five forces as: Threat of entry; Power of suppliers; Power of buyers (customers); Threat of substitutes; and Rivalry among existing competitors. It is easy to note the parallels between four of these five forces and the columns in Exhibit 1. The only “orphan” is the power of suppliers, which is not at the core of the theoretical economic analysis of competition, but which has substantial weight in the practical analysis of competition and profitability. Some stock analysts (e.g., Dorsey 2004) use the term “economic moat” to suggest that there are factors protecting the profitability of a firm that are similar to the moats (ditches full of water) that used to protect some medieval castles. A deep moat means that there is little or no threat of entry by invaders, i.e. competitors. It also means that customers are locked in because of high switching costs. <span><body><html>

Flashcard 1442133183756

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThis blended approach (Pre-learn, teaching -or getting tought- and TED talks and stuff afterwards) allows me to create three retrievals spaced with sleep, and it also starts to build the habits of the behaviors I am trying to cultivate.

Original toplevel document

Unknown titlebenefit seems to be better at three, so I focus on that number of retrievals in my own learning design. You can certainly build three retrievals into one learning event, but retention will be even more powerful if you add sleep to the mix. <span>Tip #5: Build in sleep between learning It turns out that the sleeping brain plays a large role in how long-term memories are formed. While we sleep, the brain pushes information that we learned that day from our short-term memory into our long-term memory. It's when we sleep that our brain adds the day's learning onto existing schemas, and physically builds and strengthens neural pathways. It also does a little housecleaning. Every day, we take in thousands of bits of information and it is during sleep that our brain chooses which of those bits is worthy of being retained. It even revisits items already in long-term memory and deletes the information that has not been activated in a while. The animated movie Inside Out does a great job of depicting this process. While Riley is sleeping, the minion-like workers in her brain decide to vacuum out most of the names of the U.S. presidents. So how can we use sleep to enhance our learning events? Flip the classroom and use blended learning. I now have learners do some pre-learning a few days prior, then we take a deeper dive in the classroom through hands-on application. I extend their learning with post-event opportunities and resources. For example, when I design leadership training, learners are asked to watch a corresponding online course at lynda.com. They can do this at their own pace and it frees me up from teaching some of that content so that I can use our in-person time for more focused work. When we come together, we do in-depth hands-on practice of the skills I want them to use. And after the event, I provide them with additional learning materials such as links to TED Talks, articles, and assignments to further hone their skills. This blended approach allows me to create three retrievals spaced with sleep, and it also starts to build the habits of the behaviors I am trying to cultivate. Tip #6: Be a habit designer Ultimately, the goal of most learning activities is behavior change. No matter the topic, we are trying to elicit new and better behaviors in the learner

Flashcard 1442135018764

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open italthough analysts have a vantage point outside the company, their interest in valuation coincides with the capital budgeting focus of maximizing shareholder value.

Original toplevel document

1. INTRODUCTIONsecurity analysts and portfolio managers are based on capital budgeting methods. Conversely, there have been innovations in security analysis and portfolio management that have also been adapted to capital budgeting. Finally, <span>although analysts have a vantage point outside the company, their interest in valuation coincides with the capital budgeting focus of maximizing shareholder value. Because capital budgeting information is not ordinarily available outside the company, the analyst may attempt to estimate the process, within reason, at least for companies that are not too complex. Further, analysts may be able to appraise the quality of the company’s capital budgeting process—for example, on the basis of whether the company has an accounting focus or an economic focus. This reading is organized as follows: Section 2 presents the steps in a typical capital budgeting process. After introducing the basic principles of capital budgeti

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Substitution effect and income effect

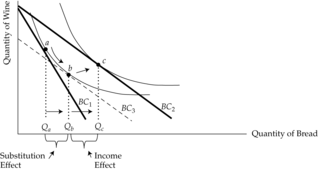

When the price of bread falls, as indicated by the pivoting in budget constraints from BC 1 to BC 2 , Warren buys more bread, increasing his quantity from Q a to Q c . That is the net effect of both the substitution effect and the income effect. Mental exercise: Part of his response is because of the increase in real income . We remove that effect subtracting some income, while leaving the new lower price in place.

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Substitution effect and income effect

f bread falls, as indicated by the pivoting in budget constraints from BC 1 to BC 2 , Warren buys more bread, increasing his quantity from Q a to Q c . That is the net effect of both the substitution effect and the income effect. <span>Mental exercise: Part of his response is because of the increase in real income . We remove that effect subtracting some income, while leaving the new lower price in place. That budget constraint shows the reduction in income that moves him back to his original indifference curve. Notice that we are moving BC 2 inward, parallel to itself until it becomes just tangent to his original indifference curve at point b. The price decrease was a good thing for him. An offsetting bad thing would be an income reduction. If the income reduction is just sufficient to leave him no better or morse than before the price change, we have removed the real income effect of the decrease in price. What’s left of his response must be due to the substitution effect . So, we say that the substitution effect is shown by the move from point a to point b. If his

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Substitution effect and income effect

him. An offsetting bad thing would be an income reduction. If the income reduction is just sufficient to leave him no better or morse than before the price change, we have removed the real income effect of the decrease in price. <span>What’s left of his response must be due to the substitution effect . So, we say that the substitution effect is shown by the move from point a to point b. If his income reduction were then restored, the resulting movement from point b to point c must be the income effect .<span><body><html>

Flashcard 1442141572364

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itwhen our eyes and ears attune to something that causes the hippocampus to begin recording. Richard Davidson, from the University of Wisconsin, calls this "phase locking" and it's the starting point of all

Original toplevel document

Unknown titler learning products. The brain structures that are involved in learning include the hippocampus, the amygdala, and the basal ganglia. To design the best learning experiences, we need to understand and respect the neuroscience of learning. <span>Tip #2: Focus is the starting point of learning The hippocampus is the part of the brain that takes in information and moves it to our memory. When it's damaged, people lose access to past memories and no longer can make new ones. The hippocampus acts like a recorder or data drive; like those devices, it has an "on" button. Physiologically, it's when our eyes and ears attune to something that causes the hippocampus to begin recording. Richard Davidson, from the University of Wisconsin, calls this "phase locking" and it's the starting point of all learning. As a result, we must design our learning environments to help people focus and we must bust the myth that you can multitask while learning. Research has proved that when we divide our attention, our focus switches back and forth between the two activities, also known as switch tasking. The hippocampus loses vital pieces of information for both of the things we were trying to attend to. I call this "Swiss tasking" because we end up with holes in the data the hippocampus was capturing and, therefore, holes in our learning that cannot be recovered. Here is the big shocker about the hippocampus: It can only hold so much information before it must be processed and pushed into short-term memory. Studies show that the maximum amount is about 20 minutes of information. Lecture-style sessions never have demonstrated good results for retention, and now we know why—it works against the brain's natural functioning. The good news is that many other learning activities can help. All the hippocampus needs is a few minutes of processing to push that data into short-term memory and it's ready again for more. I now build all my learning events in chunks of 15 min

Flashcard 1442143931660

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itis on hand does not mean it's free. See below for the definition of opportunity cost. Expected future cash flows must be measured on an after-tax basis. The firm's wealth depends on its usable after-tax funds. <span>Ignore how the project is financed. Interest payments should not be included in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existe

Original toplevel document

Subject 2. Basic Principles of Capital BudgetingCapital budgeting decisions are based on incremental after-tax cash flows discounted at the opportunity cost of capital. Assumptions of capital budgeting are: Capital budgeting decisions must be based on cash flows, not accounting income. Accounting profits only measure the return on the invested capital. Accounting income calculations reflect non-cash items and ignore the time value of money. They are important for some purposes, but for capital budgeting, cash flows are what are relevant. Economic income is an investment's after-tax cash flow plus the change in the market value. Financing costs are ignored in computing economic income. Cash flow timing is critical because money is worth more the sooner you get it. Also, firms must have adequate cash flow to meet maturing obligations. The opportunity cost should be charged against a project. Remember that just because something is on hand does not mean it's free. See below for the definition of opportunity cost. Expected future cash flows must be measured on an after-tax basis. The firm's wealth depends on its usable after-tax funds. Ignore how the project is financed. Interest payments should not be included in the estimated cash flows since the effects of debt financing are reflected in the cost of capital used to discount the cash flows. The existence of a project depends on business factors, not financing. Important capital budgeting concepts: A sunk cost is a cash outlay that has already been incurred and which

Flashcard 1442146553100

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itCash flows are based on opportunity costs. What are the incremental cash flows that occur with an investment compared to what they would have been without the investment?

Original toplevel document

3. BASIC PRINCIPLES OF CAPITAL BUDGETINGre often ignored because, if they are real, they should result in cash flows at some other time. Timing of cash flows is crucial. Analysts make an extraordinary effort to detail precisely when cash flows occur. <span>Cash flows are based on opportunity costs. What are the incremental cash flows that occur with an investment compared to what they would have been without the investment? Cash flows are analyzed on an after-tax basis. Taxes must be fully reflected in all capital budgeting decisions. Financing costs are ignored. This may se

Flashcard 1442148912396

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itintangible costs and benefits are often ignored because, if they are real, they should result in cash flows at some other time.

Original toplevel document

3. BASIC PRINCIPLES OF CAPITAL BUDGETINGting relies on just a few basic principles. Capital budgeting usually uses the following assumptions: Decisions are based on cash flows. The decisions are not based on accounting concepts, such as net income. Furthermore, <span>intangible costs and benefits are often ignored because, if they are real, they should result in cash flows at some other time. Timing of cash flows is crucial. Analysts make an extraordinary effort to detail precisely when cash flows occur. Cash flows are based on opportunity cos

Flashcard 1442150485260

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itCapital rationing exists when the company has a fixed amount of funds to invest. If the company has more profitable projects than it has funds for, it must allocate the funds to achieve the maximum shareholder value subject to the funding constraints.</sp

Original toplevel document

3. BASIC PRINCIPLES OF CAPITAL BUDGETINGin the second project. Unlimited funds versus capital rationing —An unlimited funds environment assumes that the company can raise the funds it wants for all profitable projects simply by paying the required rate of return. <span>Capital rationing exists when the company has a fixed amount of funds to invest. If the company has more profitable projects than it has funds for, it must allocate the funds to achieve the maximum shareholder value subject to the funding constraints. <span><body><html>

Flashcard 1442152844556

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itCapital rationing exists when the company has a fixed amount of funds to invest. If the company has more profitable projects than it has funds for, it must allocate the funds to achieve the maximum shareholder value subject to the funding constraints.

Original toplevel document

3. BASIC PRINCIPLES OF CAPITAL BUDGETINGin the second project. Unlimited funds versus capital rationing —An unlimited funds environment assumes that the company can raise the funds it wants for all profitable projects simply by paying the required rate of return. <span>Capital rationing exists when the company has a fixed amount of funds to invest. If the company has more profitable projects than it has funds for, it must allocate the funds to achieve the maximum shareholder value subject to the funding constraints. <span><body><html>

Flashcard 1442155203852

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIn highly competitive market situations, firms tend to earn the normal profit level over time because ease of market entry allows for other competing firms to compete away any economic profit over the long run.

Original toplevel document

2. OBJECTIVES OF THE FIRM00 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. <span>2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as accounting profit less the implicit opportunity costs not included in total accounting costs. Equation (3a) Economic profit = Accounting profit – Total implicit opportunity costs We can define a term, economic cost , equal to the sum of total accounting costs and implicit opportunity costs. Economic profit is therefore equivalently defined as: Equation (3b) Economic profit = Total revenue – Total economic costs For publicly traded corporations, the focus of investment analysts’ work, the cost of equity capital is the largest and most readily identified implicit opportunity cost omitted in calculating total accounting cost. Consequently, economic profit can be defined for publicly traded corporations as accounting profit less the required return on equity capital. Examples will make these concepts clearer. Consider the start-up company for which we calculated an accounting profit of €300,000 and suppose that the entrepreneurial executive who launched the start-up took a salary reduction of €100,000 per year relative to the job he left. That €100,000 is an opportunity cost of involving him in running the start-up. Besides labor, financial capital is a resource. Suppose that the executive, as sole owner, makes an investment of €1,500,000 to launch the enterprise and that he might otherwise expect to earn €200,000 per year on that amount in a similar risk investment. Total implicit opportunity costs are €100,000 + €200,000 = €300,000 per year and economic profit is zero: €300,000 – €300,000 = €0. For the publicly traded corporation, we consider the cost of equity capital as the only implicit opportunity cost identifiable. Suppose that equity investment is $18,750,000 and shareholders’ required rate of return is 8 percent so that the dollar cost of equity capital is $1,500,000. Economic profit for the publicly traded corporation is therefore $2,000,000 (accounting profit) less $1,500,000 (cost of equity capital) or $500,000. For the start-up company, economic profit was zero. Total economic costs were just covered by revenues and the company was not earning a euro more nor less than the amount that meets the opportunity costs of the resources used in the business. Economists would say the company was earning a normal profit (economic profit of zero). In simple terms, normal profit is the level of accounting profit needed to just cover the implicit opportunity costs ignored in accounting costs. For the publicly traded corporation, normal profit was $1,500,000: normal profit can be taken to be the cost of equity capital (in money terms) for such a company or the dollar return required on an equal investment by equity holders in an equivalently risky alternative investment opportunity. The publicly traded corporation actually earned $500,000 in excess of normal profit, which should be reflected in the common shares’ market price. Thus, the following expression links accounting profit to economic profit and normal profit: Equation (4) Accounting profit = Economic profit + Normal profit When accounting profit equals normal profit, economic profit is zero. Further, when accounting profit is greater than normal profit, economic profit is positive; and when accounting profit is less than normal profit, economic profit is negative (the firm has an economic loss ). Economic profit for a firm can originate from sources such as: competitive advantage; exceptional managerial efficiency or skill; difficult to copy technology or innovation (e.g., patents, trademarks, and copyrights); exclusive access to less-expensive inputs; fixed supply of an output, commodity, or resource; preferential treatment under governmental policy; large increases in demand where supply is unable to respond fully over time; exertion of monopoly power (price control) in the market; and market barriers to entry that limit competition. Any of the above factors may lead the firm to have positive net present value investment (NPV) opportunities. Access to positive NPV opportunities and therefore profit in excess of normal profits in the short run may or may not exist in the long run, depending on the potential strength of competition. In highly competitive market situations, firms tend to earn the normal profit level over time because ease of market entry allows for other competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. 2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical su

Flashcard 1442157038860

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThis type of financing provides direct loans to foreign buyers at a fixed interest rate or provides guarantees for term financing offered by commercial lenders.

Original toplevel document

Government-Assisted Foreign Buyer Financing (Eximbank USA)as their small business suppliers. Creditworthy foreign buyers can obtain loans needed for purchases of U.S. goods and services, especially high-value capital goods or services and exports to large-scale projects. <span>This type of financing provides direct loans to foreign buyers at a fixed interest rate or provides guarantees for term financing offered by commercial lenders. Financing is available for medium-term (up to 5 years) and long-term (generally up to 10 years) transactions. CHARACTERISTICS OF GOVERNMENT‑ASSISTED FORE

Flashcard 1442158873868

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itIt ignores cash flows beyond the payback period. Payback period is a type of "break-even" analysis: it indicates how quickly you can make enough money to recover the initial investment, not how much money

Original toplevel document

Subject 3. Investment Decision Criteriaestablish a benchmark payback period. Reject if payback is greater than benchmark. Payback A = 1 + (1000 - 750)/350 = 1.7 years Payback B = 3 + (1000 - 100 - 250 - 450)/750 = 3.27 years Drawbacks: <span>It ignores cash flows beyond the payback period. Payback period is a type of "break-even" analysis: it indicates how quickly you can make enough money to recover the initial investment, not how much money you can make during the life of the project. It does not consider the time value of money. Therefore, the cost of capital is not reflected in the cash flows or calculations. Discounted Payback Period This

Flashcard 1442163592460

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open it;break-even" analysis: it indicates how quickly you can make enough money to recover the initial investment, not how much money you can make during the life of the project. It does not consider the time value of money. Therefore, <span>the cost of capital is not reflected in the cash flows or calculations. <span><body><html>

Original toplevel document

Subject 3. Investment Decision Criteriaestablish a benchmark payback period. Reject if payback is greater than benchmark. Payback A = 1 + (1000 - 750)/350 = 1.7 years Payback B = 3 + (1000 - 100 - 250 - 450)/750 = 3.27 years Drawbacks: <span>It ignores cash flows beyond the payback period. Payback period is a type of "break-even" analysis: it indicates how quickly you can make enough money to recover the initial investment, not how much money you can make during the life of the project. It does not consider the time value of money. Therefore, the cost of capital is not reflected in the cash flows or calculations. Discounted Payback Period This

Flashcard 1442165951756

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe payback provides an indication of a project's risk and liquidity because it shows how long the invested capital will be tied up in a project and "at risk."

Original toplevel document

Subject 3. Investment Decision Criteriay to recover the initial investment, not how much money you can make during the life of the project. It does not consider the time value of money. Therefore, the cost of capital is not reflected in the cash flows or calculations. <span>Discounted Payback Period This is similar to the regular payback method except that it discounts cash flows at the project's cost of capital. It considers the time value of money, but it ignores cash flows beyond the payback period. Again, assume the cost of capital for the firm is 10%: Discounted PaybackA = 2 + (1000 - 682 - 289)/113 = 2.26 years Discounted PaybackB = 3 + (1000 - 91 - 207 - 338)/512 = 3.71 years The payback provides an indication of a project's risk and liquidity because it shows how long the invested capital will be tied up in a project and "at risk." The shorter the payback period, the greater the project's liquidity, the lower the risk, and the better the project. The payback is often used as one indicator of a project's risk. Average Accounting Rate of Return (not required) This is a very simple rate of return: Its only advantage is that

Flashcard 1442168311052

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe payback is often used as one indicator of a project's risk.

Original toplevel document

Subject 3. Investment Decision Criteriay to recover the initial investment, not how much money you can make during the life of the project. It does not consider the time value of money. Therefore, the cost of capital is not reflected in the cash flows or calculations. <span>Discounted Payback Period This is similar to the regular payback method except that it discounts cash flows at the project's cost of capital. It considers the time value of money, but it ignores cash flows beyond the payback period. Again, assume the cost of capital for the firm is 10%: Discounted PaybackA = 2 + (1000 - 682 - 289)/113 = 2.26 years Discounted PaybackB = 3 + (1000 - 91 - 207 - 338)/512 = 3.71 years The payback provides an indication of a project's risk and liquidity because it shows how long the invested capital will be tied up in a project and "at risk." The shorter the payback period, the greater the project's liquidity, the lower the risk, and the better the project. The payback is often used as one indicator of a project's risk. Average Accounting Rate of Return (not required) This is a very simple rate of return: Its only advantage is that

Flashcard 1442169883916

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe PI indicates the value you are receiving in exchange for one unit of currency invested.

Original toplevel document

Subject 3. Investment Decision Criteria#13; Drawbacks: It does not take into account the time value of money; the value of cash flows does not diminish with time, as is the case with NPV and IRR. ARR is based on numbers that include non-cash items. <span>Profitability Index (PI) This is an index used to evaluate proposals for which net present values have been determined. The profitability index is determined by dividing the present value of each proposal by its initial investment. The PI indicates the value you are receiving in exchange for one unit of currency invested. An index value greater than 1.0 is acceptable and the higher the number, the more financially attractive the proposal. A ratio of 1.0 is logically the lowest acceptable measure on the index. Any value lower than 1.0 would indicate that the project's PV is less than the initial investment. Learning Outcome Statements d. calculate and interpret net present value (NPV), internal rate of return (IRR), payback period, discounted payback period, and profita

Flashcard 1442171456780

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itpan>Knowledge can be relatively stable (basic math, anatomy, taxonomy, physical geography, etc.) and highly volatile (economic indicators, high-tech knowledge, personal statistics, etc.). It is important that you provide your items with time stamping or other tags indicating the degree of obsolescence.<span><body><html>

Original toplevel document

19. Provide date stampingKnowledge can be relatively stable (basic math, anatomy, taxonomy, physical geography, etc.) and highly volatile (economic indicators, high-tech knowledge, personal statistics, etc.). It is important that you provide your items with time stamping or other tags indicating the degree of obsolescence. In case of statistical figures, you might stamp them with the year they have been collected. When learning software applications, it is enough you stamp the item with the software versi

Flashcard 1442472660236

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itSome factors (monopoly, market barriers, trademarks etc.) may lead the firm to have positive net present value investment (NPV) opportunities. Access to positive NPV opportunities and therefore profit in excess of normal profits in the short run may or may not exist in the long run, depending on the potential strength of compe

Original toplevel document

2. OBJECTIVES OF THE FIRM00 – $48,000,000 = $2,000,000. Note that total accounting costs in either case include interest expense—which represents the return required by suppliers of debt capital—because interest expense is an explicit cost. <span>2.1.2. Economic Profit and Normal Profit Economic profit (also known as abnormal profit or supernormal profit ) may be defined broadly as accounting profit less the implicit opportunity costs not included in total accounting costs. Equation (3a) Economic profit = Accounting profit – Total implicit opportunity costs We can define a term, economic cost , equal to the sum of total accounting costs and implicit opportunity costs. Economic profit is therefore equivalently defined as: Equation (3b) Economic profit = Total revenue – Total economic costs For publicly traded corporations, the focus of investment analysts’ work, the cost of equity capital is the largest and most readily identified implicit opportunity cost omitted in calculating total accounting cost. Consequently, economic profit can be defined for publicly traded corporations as accounting profit less the required return on equity capital. Examples will make these concepts clearer. Consider the start-up company for which we calculated an accounting profit of €300,000 and suppose that the entrepreneurial executive who launched the start-up took a salary reduction of €100,000 per year relative to the job he left. That €100,000 is an opportunity cost of involving him in running the start-up. Besides labor, financial capital is a resource. Suppose that the executive, as sole owner, makes an investment of €1,500,000 to launch the enterprise and that he might otherwise expect to earn €200,000 per year on that amount in a similar risk investment. Total implicit opportunity costs are €100,000 + €200,000 = €300,000 per year and economic profit is zero: €300,000 – €300,000 = €0. For the publicly traded corporation, we consider the cost of equity capital as the only implicit opportunity cost identifiable. Suppose that equity investment is $18,750,000 and shareholders’ required rate of return is 8 percent so that the dollar cost of equity capital is $1,500,000. Economic profit for the publicly traded corporation is therefore $2,000,000 (accounting profit) less $1,500,000 (cost of equity capital) or $500,000. For the start-up company, economic profit was zero. Total economic costs were just covered by revenues and the company was not earning a euro more nor less than the amount that meets the opportunity costs of the resources used in the business. Economists would say the company was earning a normal profit (economic profit of zero). In simple terms, normal profit is the level of accounting profit needed to just cover the implicit opportunity costs ignored in accounting costs. For the publicly traded corporation, normal profit was $1,500,000: normal profit can be taken to be the cost of equity capital (in money terms) for such a company or the dollar return required on an equal investment by equity holders in an equivalently risky alternative investment opportunity. The publicly traded corporation actually earned $500,000 in excess of normal profit, which should be reflected in the common shares’ market price. Thus, the following expression links accounting profit to economic profit and normal profit: Equation (4) Accounting profit = Economic profit + Normal profit When accounting profit equals normal profit, economic profit is zero. Further, when accounting profit is greater than normal profit, economic profit is positive; and when accounting profit is less than normal profit, economic profit is negative (the firm has an economic loss ). Economic profit for a firm can originate from sources such as: competitive advantage; exceptional managerial efficiency or skill; difficult to copy technology or innovation (e.g., patents, trademarks, and copyrights); exclusive access to less-expensive inputs; fixed supply of an output, commodity, or resource; preferential treatment under governmental policy; large increases in demand where supply is unable to respond fully over time; exertion of monopoly power (price control) in the market; and market barriers to entry that limit competition. Any of the above factors may lead the firm to have positive net present value investment (NPV) opportunities. Access to positive NPV opportunities and therefore profit in excess of normal profits in the short run may or may not exist in the long run, depending on the potential strength of competition. In highly competitive market situations, firms tend to earn the normal profit level over time because ease of market entry allows for other competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. 2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical su

Flashcard 1442482883852

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itFive factors determine market structure: The number and relative size of firms supplying the product; The degree of product differentiation; The power of the seller over pricing decisions; The re

Original toplevel document