Edited, memorised or added to reading queue

on 17-Jan-2017 (Tue)

Do you want BuboFlash to help you learning these things? Click here to log in or create user.

Flashcard 1428113984780

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itPara los importadores, el dólar caro ha sido costoso y creo que inevitablemente tendrá repercusión en la inflación.

Original toplevel document

Un dólar estable… e inciertocrudo, tras el acuerdo de reducción de producción que se obtuvo. Si los precios del crudo mantuvieran una tendencia hacia arriba, entonces, quizás habría otro factor que pudiera propiciar una paridad más fuerte del peso. <span>Para los importadores, el dólar caro ha sido costoso y creo que inevitablemente tendrá repercusión en la inflación. Pero para otros sectores se trata de una bendición. Este fin de año se pronostica como el mejor en una década para el turismo nacional, por la reducción de viajes al extranje

Flashcard 1429302021388

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe Trivium explains t hat logic is the art of deduction. As thinking beings, we know something and from that knowledge can deduce new knowledge.

Original toplevel document (pdf)

cannot see any pdfsFlashcard 1430541438220

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itwhen the magnitude(ignoring algebraic sign) of the own-price elasticity coefficient has a value less than one, demand is defined to be inelastic

Original toplevel document

4.1. Own-Price Elasticity of Demandded by only 0.12 percent. Actually, that is not too different from empirical estimates of the actual demand elasticity for gasoline in the United States. When demand is not very sensitive to price, we say demand is inelastic . To be precise, <span>when the magnitude(ignoring algebraic sign) of the own-price elasticity coefficient has a value less than one, demand is defined to be inelastic. When that magnitude is greater than one, demand is defined to be elastic . And when the elasticity coefficient is equal to negative one, demand is said to be unit elastic , or unita

Flashcard 1430546156812

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itions sell items that (generally) have a unique subjective value for each bidder. Ascending price auctions use an auctioneer to call out ever increasing prices until the last, highest bidder ultimately pays his/her bid price and buys the item. <span>Descending price, or Dutch, auctions begin at a very high price and then reduce that price until one bidder is willing to buy at that price. Second price sealed bid auctions are sometimes used to induce

Original toplevel document

SUMMARYven price, the quantity demanded exceeds the quantity supplied, there is excess demand and price will rise. If, at a given price, the quantity supplied exceeds the quantity demanded, there is excess supply and price will fall. <span>Sometimes auctions are used to seek equilibrium prices. Common value auctions sell items that have the same value to all bidders, but bidders can only estimate that value before the auction is completed. Overly optimistic bidders overestimate the true value and end up paying a price greater than that value. This result is known as the winner’s curse. Private value auctions sell items that (generally) have a unique subjective value for each bidder. Ascending price auctions use an auctioneer to call out ever increasing prices until the last, highest bidder ultimately pays his/her bid price and buys the item. Descending price, or Dutch, auctions begin at a very high price and then reduce that price until one bidder is willing to buy at that price. Second price sealed bid auctions are sometimes used to induce bidders to reveal their true reservation prices in private value auctions. Treasury notes and some other financial instruments are sold using a form of Dutch auction (called a single price auction) in which competitive and non-competitive bids are arrayed in descending price (increasing yield) order. The winning bidders all pay the same price, but marginal bidders might not be able to fill their entire order at the market clearing price. Markets that work freely can optimize society’s welfare, as measured by consumer surplus and producer surplus. Consumer surplus is the difference between the total value

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1432675814668

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itNouns, Adjectives and Articles together form a group of words called the noun group; two examples are shown below: una (article) grande (adjective) casa (noun) a big house la (article) ragazza (noun) inglese (adjective) the English girl</sp

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1438613900556

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open it¿La tasa de interés de los fondos federales será superior al 1.5 por ciento a finales de 2017? No. La respuesta depende de si el plan fiscal de Donald Trump puede lograr el crecimiento prometido del 3-4 por ciento. La Reserva Federal de EU proporcionará los tres incrementos que ha pronosticado, elevando la tasa al 1.5 por ciento, pero no necesitará elevarla más. (Michael MacKenzie)</

Original toplevel document

Predicciones mundiales para 2017leo, poniendo así fin a la afluencia de petrodólares y, por lo tanto, al ‘mecenazgo’ que le compra al gobierno corrupto su apoyo. Por lo tanto, la voluntad de Caracas de pagar sus deudas nunca está en duda. (John Paul Rathbone) 9. <span>¿La tasa de interés de los fondos federales será superior al 1.5 por ciento a finales de 2017? No. La respuesta depende de si el plan fiscal de Donald Trump puede lograr el crecimiento prometido del 3-4 por ciento. La Reserva Federal de EU proporcionará los tres incrementos que ha pronosticado, elevando la tasa al 1.5 por ciento, pero no necesitará elevarla más. (Michael MacKenzie) 10. ¿Finalizará el índice S&P 500 el año por encima de 2300 (aproximadamente su nivel actual)? ___No. Los inversionistas orientados hacia la valoración han sid

Flashcard 1439566531852

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itLa Secretaría de Economía (SE) podrá autorizar el decreto IMMEX a personas morales Las personas morales a las que se les autorice el decreto IMMEX deberán ser residentes en territorio nacional a que se refiere la fracción II del artículo 9 del Código Fiscal

Original toplevel document

Decreto IMMEXiladora de Exportación (Maquila) y el que Establece Programas de Importación Temporal para Producir Artículos de Exportación (PITEX), cuyas empresas representan en su conjunto el 85% de las exportaciones manufactureras de México. <span>ASPECTOS GENERALES Definición: El Programa IMMEX es un instrumento mediante el cual se permite importar temporalmente los bienes necesarios para ser utilizados en un proceso industrial o de servicio destinado a la elaboración, transformación o reparación de mercancías de procedencia extranjera importadas temporalmente para su exportación o a la prestación de servicios de exportación, sin cubrir el pago del impuesto general de importación, del impuesto al valor agregado y, en su caso, de las cuotas compensatorias Beneficiarios: La Secretaría de Economía (SE) podrá autorizar a las personas morales residentes en territorio nacional a que se refiere la fracción II del artículo 9 del Código Fiscal de la Federación, que tributen de conformidad con el Título II de la Ley del Impuesto sobre la Renta, un solo Programa IMMEX, que puede incluir las modalidades de controladora de empresas, industrial, servicios, albergue y terciarización, siempre que cumplan con los requisitos previstos en el Decreto para el Fomento de la Industria Manufacturera, Maquiladora y de Servicios de Exportación (Decreto IMMEX), publicado en el Diario Oficial e la Federación el 1 de noviembre de 2006. Beneficios: El Programa IMMEX brinda a sus titulares la posibilidad de importar temporalmente libre de impuestos a la importación y del IVA, los bienes necesarios para ser utilizados en un proceso industrial o de servicio destinado a la elaboración, transformación o reparación de mercancías de procedencia extranjera importadas temporalmente para su exportación o a la prestación de servicios de exportación. Estos bienes están agrupados bajo las siguientes categorías: Materias primas, partes y componentes que se vayan a destinar totalmente a integrar mercancías de exportación; combustibles, lubricantes y otros materiales que se vayan a consumir durante el proceso productivo de la mercancía de exportación; envases y empaques; etiquetas y folletos. Contenedores y cajas de trailers. Maquinaria, equipo, herramientas, instrumentos, moldes y refacciones destinadas al proceso productivo; equipos y aparatos para el control de la contaminación; para la investigación o capacitación, de seguridad industrial, de telecomunicación y cómputo, de laboratorio, de medición, de prueba de productos y control de calidad; así como aquéllos que intervengan en el manejo de materiales relacionados directamente con los bienes de exportación y otros vinculados con el proceso productivo; equipo para el desarrollo administrativo. Modalidades: Programa IMMEX Controladora de empresas, cuando en un mismo programa se integren las operaciones de manufactura de una empresa certificada denominada controladora y una o más sociedades controladas; Programa IMMEX Industrial, cuando se realice un proceso industrial de elaboración o transformación de mercancías destinadas a la exportación; Programa IMMEX Servicios, cuando se realicen servicios a mercancías de exportación o se presten servicios de exportación, únicamente para el desarrollo de las actividades que la Secretaría determine, previa opinión de la Secretaría de Hacienda y Crédito Público; Programa IMMEX Albergue, cuando una o varias empresas extranjeras le faciliten la tecnología y el material productivo, sin que estas últimas operen directamente el Programa, y Programa IMMEX Terciarización, cuando una empresa certificada que no cuente con instalaciones para realizar procesos productivos, realice las operaciones de manufactura a través de terceros que registre en su Programa. La SE podrá aprobar de manera simultánea un Programa de Promoción Sectorial, de acuerdo con el tipo de productos que fabrica o a los servicios de exportación que realice, debiendo cumplir con la normatividad aplicable a los mismos. Tratándose de una empresa bajo la modalidad de servicios, únicamente podrá importar al amparo del Programa de Promoción Sectorial las mercancías a que se refiere el artículo 4, fracción III del presente Decreto, siempre que corresponda al sector en que sea registrada. Vigencia: La vigencia de los Programas IMMEX estará sujeta mientras el titular de los mismos continúe cumpliendo con los requisitos previstos para su otorgamiento y con las obligaciones establecidas en el Decreto. Plazos de permanencia: Los bienes importados temporalmente al amparo de un Programa IMMEX, podrán permanecer en territorio nacional por los plazos establecidos en el artículo 108 de la Ley Aduanera. Para las mercancías comprendidas en los Anexos II y III del Decreto IMMEX, cuando se importen como materia prima, el plazo de permanencia será hasta por doce meses. Tratándose de las mercancías que se encuentran comprendidas en el Anexo III del Decreto IMMEX, cuando se importen como materia prima, únicamente cuando se destinen a actividades bajo la modalidad de servicios, el plazo de permanencia será de hasta seis meses. No podrán ser importadas al amparo del Programa las mercancías señaladas en el Anexo I del Decreto IMMEX. Compromisos: Para gozar de los beneficios de un Programa IMMEX se deberá dar cumplimiento a los términos establecidos en el Decreto en la materia. La autorización del Programa se otorgará bajo el compromiso de realizar anualmente ventas al exterior por un valor superior a 500,000 dólares de los Estados Unidos de América, o su equivalente en moneda nacional, o bien, facturar exportaciones, cuando menos por el 10% de su facturación total. Reportes: El titular de un Programa IMMEX deberá presentar un reporte anual de forma electrónica, respecto del total de las ventas y de las exportaciones, correspondientes al ejercicio fiscal inmediato anterior, a más tardar el último día hábil del mes de mayo, conforme al formato que mediante Reglas y Criterios de Carácter General en Materia de Comercio Exterior dé a conocer la Secretaría de Economía. Adicionalmente, la empresa con Programa IMMEX deberá presentar la información que, para efectos estadísticos, se determine, en los términos que establezca la SE mediante Reglas y Criterios de Carácter General en Materia de Comercio Exterior. Para mayor información sobre este programa comunicarse al 01 800 410 2000 disponible para todo el país ó al buzón de la Secretaría de Economía en www.economia.gob.mx; o al teléfono 52-29-61-00, ext. 34347, Lic. Sergio Manríquez Fernández, Subdirector de Devolución de Impuestos. TRÁMITES Operación: Los trámites relativos al Programa IMMEX son gratuitos y pueden ser realizados en las ventanillas de atención al público de las Repre

Flashcard 1439584619788

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itías de exportación; combustibles, lubricantes y otros materiales que se vayan a consumir durante el proceso productivo de la mercancía de exportación; envases y empaques; etiquetas y folletos. Contenedores y cajas de trailers. <span>Maquinaria, equipo, herramientas, instrumentos, moldes y refacciones destinadas al proceso productivo; equipos y aparatos para el control de la contaminación; para la investigación o capacitación,

Original toplevel document

Decreto IMMEXiladora de Exportación (Maquila) y el que Establece Programas de Importación Temporal para Producir Artículos de Exportación (PITEX), cuyas empresas representan en su conjunto el 85% de las exportaciones manufactureras de México. <span>ASPECTOS GENERALES Definición: El Programa IMMEX es un instrumento mediante el cual se permite importar temporalmente los bienes necesarios para ser utilizados en un proceso industrial o de servicio destinado a la elaboración, transformación o reparación de mercancías de procedencia extranjera importadas temporalmente para su exportación o a la prestación de servicios de exportación, sin cubrir el pago del impuesto general de importación, del impuesto al valor agregado y, en su caso, de las cuotas compensatorias Beneficiarios: La Secretaría de Economía (SE) podrá autorizar a las personas morales residentes en territorio nacional a que se refiere la fracción II del artículo 9 del Código Fiscal de la Federación, que tributen de conformidad con el Título II de la Ley del Impuesto sobre la Renta, un solo Programa IMMEX, que puede incluir las modalidades de controladora de empresas, industrial, servicios, albergue y terciarización, siempre que cumplan con los requisitos previstos en el Decreto para el Fomento de la Industria Manufacturera, Maquiladora y de Servicios de Exportación (Decreto IMMEX), publicado en el Diario Oficial e la Federación el 1 de noviembre de 2006. Beneficios: El Programa IMMEX brinda a sus titulares la posibilidad de importar temporalmente libre de impuestos a la importación y del IVA, los bienes necesarios para ser utilizados en un proceso industrial o de servicio destinado a la elaboración, transformación o reparación de mercancías de procedencia extranjera importadas temporalmente para su exportación o a la prestación de servicios de exportación. Estos bienes están agrupados bajo las siguientes categorías: Materias primas, partes y componentes que se vayan a destinar totalmente a integrar mercancías de exportación; combustibles, lubricantes y otros materiales que se vayan a consumir durante el proceso productivo de la mercancía de exportación; envases y empaques; etiquetas y folletos. Contenedores y cajas de trailers. Maquinaria, equipo, herramientas, instrumentos, moldes y refacciones destinadas al proceso productivo; equipos y aparatos para el control de la contaminación; para la investigación o capacitación, de seguridad industrial, de telecomunicación y cómputo, de laboratorio, de medición, de prueba de productos y control de calidad; así como aquéllos que intervengan en el manejo de materiales relacionados directamente con los bienes de exportación y otros vinculados con el proceso productivo; equipo para el desarrollo administrativo. Modalidades: Programa IMMEX Controladora de empresas, cuando en un mismo programa se integren las operaciones de manufactura de una empresa certificada denominada controladora y una o más sociedades controladas; Programa IMMEX Industrial, cuando se realice un proceso industrial de elaboración o transformación de mercancías destinadas a la exportación; Programa IMMEX Servicios, cuando se realicen servicios a mercancías de exportación o se presten servicios de exportación, únicamente para el desarrollo de las actividades que la Secretaría determine, previa opinión de la Secretaría de Hacienda y Crédito Público; Programa IMMEX Albergue, cuando una o varias empresas extranjeras le faciliten la tecnología y el material productivo, sin que estas últimas operen directamente el Programa, y Programa IMMEX Terciarización, cuando una empresa certificada que no cuente con instalaciones para realizar procesos productivos, realice las operaciones de manufactura a través de terceros que registre en su Programa. La SE podrá aprobar de manera simultánea un Programa de Promoción Sectorial, de acuerdo con el tipo de productos que fabrica o a los servicios de exportación que realice, debiendo cumplir con la normatividad aplicable a los mismos. Tratándose de una empresa bajo la modalidad de servicios, únicamente podrá importar al amparo del Programa de Promoción Sectorial las mercancías a que se refiere el artículo 4, fracción III del presente Decreto, siempre que corresponda al sector en que sea registrada. Vigencia: La vigencia de los Programas IMMEX estará sujeta mientras el titular de los mismos continúe cumpliendo con los requisitos previstos para su otorgamiento y con las obligaciones establecidas en el Decreto. Plazos de permanencia: Los bienes importados temporalmente al amparo de un Programa IMMEX, podrán permanecer en territorio nacional por los plazos establecidos en el artículo 108 de la Ley Aduanera. Para las mercancías comprendidas en los Anexos II y III del Decreto IMMEX, cuando se importen como materia prima, el plazo de permanencia será hasta por doce meses. Tratándose de las mercancías que se encuentran comprendidas en el Anexo III del Decreto IMMEX, cuando se importen como materia prima, únicamente cuando se destinen a actividades bajo la modalidad de servicios, el plazo de permanencia será de hasta seis meses. No podrán ser importadas al amparo del Programa las mercancías señaladas en el Anexo I del Decreto IMMEX. Compromisos: Para gozar de los beneficios de un Programa IMMEX se deberá dar cumplimiento a los términos establecidos en el Decreto en la materia. La autorización del Programa se otorgará bajo el compromiso de realizar anualmente ventas al exterior por un valor superior a 500,000 dólares de los Estados Unidos de América, o su equivalente en moneda nacional, o bien, facturar exportaciones, cuando menos por el 10% de su facturación total. Reportes: El titular de un Programa IMMEX deberá presentar un reporte anual de forma electrónica, respecto del total de las ventas y de las exportaciones, correspondientes al ejercicio fiscal inmediato anterior, a más tardar el último día hábil del mes de mayo, conforme al formato que mediante Reglas y Criterios de Carácter General en Materia de Comercio Exterior dé a conocer la Secretaría de Economía. Adicionalmente, la empresa con Programa IMMEX deberá presentar la información que, para efectos estadísticos, se determine, en los términos que establezca la SE mediante Reglas y Criterios de Carácter General en Materia de Comercio Exterior. Para mayor información sobre este programa comunicarse al 01 800 410 2000 disponible para todo el país ó al buzón de la Secretaría de Economía en www.economia.gob.mx; o al teléfono 52-29-61-00, ext. 34347, Lic. Sergio Manríquez Fernández, Subdirector de Devolución de Impuestos. TRÁMITES Operación: Los trámites relativos al Programa IMMEX son gratuitos y pueden ser realizados en las ventanillas de atención al público de las Repre

Flashcard 1442168311052

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe payback is often used as one indicator of a project's risk.

Original toplevel document

Subject 3. Investment Decision Criteriay to recover the initial investment, not how much money you can make during the life of the project. It does not consider the time value of money. Therefore, the cost of capital is not reflected in the cash flows or calculations. <span>Discounted Payback Period This is similar to the regular payback method except that it discounts cash flows at the project's cost of capital. It considers the time value of money, but it ignores cash flows beyond the payback period. Again, assume the cost of capital for the firm is 10%: Discounted PaybackA = 2 + (1000 - 682 - 289)/113 = 2.26 years Discounted PaybackB = 3 + (1000 - 91 - 207 - 338)/512 = 3.71 years The payback provides an indication of a project's risk and liquidity because it shows how long the invested capital will be tied up in a project and "at risk." The shorter the payback period, the greater the project's liquidity, the lower the risk, and the better the project. The payback is often used as one indicator of a project's risk. Average Accounting Rate of Return (not required) This is a very simple rate of return: Its only advantage is that

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

2. SCOPE OF FINANCIAL STATEMENT ANALYSIS

ing, and financing decisions but do not necessarily rely on analysis of related financial statements. They have access to additional financial information that can be reported in whatever format is most useful to their decision.) <span>In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Evaluating an equity investment for inclusion in a portfolio. Evaluating a merger or acquisition candidate. Evaluating a subsidiary or operating division of a parent company. Deciding whether to make a venture capital or other private equity investment. Determining the creditworthiness of a company in order to decide whether to extend a loan to the company and if so, what terms to offer. Extending credit to a customer. Examining compliance with debt covenants or other contractual arrangements. Assigning a debt rating to a company or bond issue. Valuing a security for making an investment recommendation to others. Forecasting future net income and cash flow. These decisions demonstrate certain themes in financial analysis. In general, analysts seek to examine the past and current performance and financial position of a

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1446776278284

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe types and quantities of resources used in production, their prices, and how efficiently they are employed in the production process determine the cost component of the profit equation.

Original toplevel document

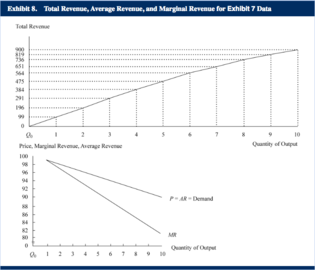

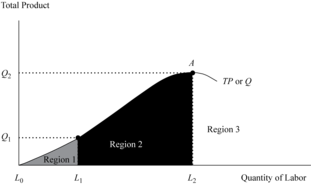

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data <span>3.1.2. Factors of Production Revenue generation occurs when output is sold in the market. However, costs are incurred before revenue generation takes place as the firm purchases resources, or what are commonly known as the factors of production, in order to produce a product or service that will be offered for sale to consumers. Factors of production, the inputs to the production of goods and services, include: land, as in the site location of the business; labor, which consists of the inputs of skilled and unskilled workers as well as the inputs of firms’ managers; capital, which in this context refers to physical capital—such tangible goods as equipment, tools, and buildings. Capital goods are distinguished as inputs to production that are themselves produced goods; and materials, which in this context refers to any goods the business buys as inputs to its production process.1 For example, a business that produces solid wood office desks needs to acquire lumber and hardware accessories as raw materials and hire workers to construct and assemble the desks using power tools and equipment. The factors of production are the inputs to the firm’s process of producing and selling a product or service where the goal of the firm is to maximize profit by satisfying the demand of consumers. The types and quantities of resources or factors used in production, their respective prices, and how efficiently they are employed in the production process determine the cost component of the profit equation. Clearly, in order to produce output, the firm needs to employ factors of production. While firms may use many different types of labor, capital, raw materials, and land, an analyst may find it more convenient to limit attention to a more simplified process in which only the two factors, capital and labor, are employed. The relationship between the flow of output and the two factors of production is called the production function , and it is represented generally as: Equation (5) Q = f (K, L) where Q is the quantity of output, K is capital, and L is labor. The inputs are subject to the constraint that K ≥ 0 and L ≥ 0. A more general production function is stated as: Equation (6) Q = f (x 1 , x 2 , … x n ) where x i represents the quantity of the ith input subject to x i ≥ 0 for n number of different inputs. Exhibit 9illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, typically because specialization allows laborers to become increasingly productive. In Region 2, however, (L 1 – L 2 ), TP is increasing at a decreasing rate because capital is fixed, and labor experiences diminishing marginal returns. The firm would want to avoid Region 3 if at all possible because total product or quantity would be declining rather than increasing with additional input: There is so little capital per unit of labor that additional laborers would possibly “get in each other’s way”. Point A is where TP is maximized. Exhibit 9. A Firm’s Production Function EXAMPLE 3 Factors of Production A group of business investor

Flashcard 1446984682764

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA simple statement is a single line that doesn't end in a colon.

Original toplevel document

1.5 Controlver, much of the interesting work of computation comes from evaluating expressions. Statements govern the relationship among different expressions in a program and what happens to their results. 1.5.2 Compound Statements In general, <span>Python code is a sequence of statements. A simple statement is a single line that doesn't end in a colon. A compound statement is so called because it is composed of other statements (simple and compound). Compound statements typically span multiple lines and start with a one-line header ending in a colon, which identifies the type of statement. Together, a header and an indented suite of statements is called a clause. A compound statement consists of one or more clauses: <span>

Flashcard 1447022693644

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA typical protein molecule is made from ~300 amino acids. Th e total number of different sequences possible for proteins of this length is 20^300 ≈ 10^390

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

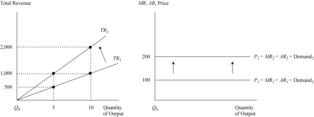

Exhibit 5. Total Revenue, Average Revenue, and Marginal Revenue under Perfect Competition

mpetition, MR equals AR and both are equal to a price that stays the same across all levels of output. Because price is fixed to the individual seller, the firm’s demand curve is a horizontal line at the point where the market sets the price. <span>In Exhibit 5, at a price of 100, P 1 = MR 1 = AR 1 = Demand 1 . Marginal revenue, average revenue, and the firm’s price remain constant until market demand and supply factors cause a change in price. For instance, if price increases to 200 because of an increase in market demand, the firm’s demand curve shifts from Demand 1 to Demand 2 with corresponding increases in MR and AR as well. Total revenue increases from TR 1 to TR 2 when price increases from 100 to 200. At a price of 100, total revenue at 10 units is 1,000; however, at a price of 200, total revenue would

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itOnly human beings have the power of intellectual abstraction; therefore, only human beings can form a general or universal concept. Irrational animals have the external and internal senses, which are sometimes keener than those of humans. But because they lack the rational powers (intellect, intellectual memory, and free will), they are incapable of progress or of culture. Despite their remarkable instinct, their productions, intricate though they may be, remain the same through the centuries, for example: beaver dams, bird nests, anthills, beehives.</spa

Original toplevel document (pdf)

cannot see any pdfs| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1448236682508

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

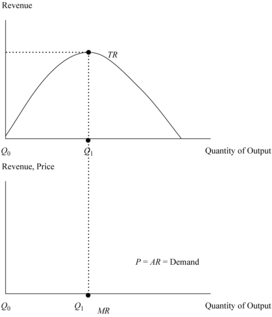

3. ANALYSIS OF REVENUE, COSTS, AND PROFITS

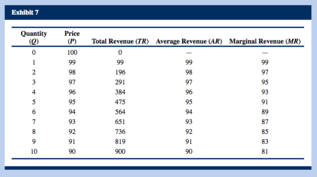

the price and AR lines. TR peaks when MR equals zero at point Q 1 . Exhibit 6. Total Revenue, Average Revenue, and Marginal Revenue under Imperfect Competition EXAMPLE 2 <span>Calculation and Interpretation of Total, Average, and Marginal Revenue under Imperfect Competition Given quantity and price data in the first two columns of Exhibit 7, total revenue, average revenue, and marginal revenue can be calculated for a firm that operates under imperfect competition. Exhibit 7 Quantity (Q) Price (P) Total Revenue (TR) Average Revenue (AR) Marginal Revenue (MR) 0 100 0 — — 1 99 99 99 99 2 98 196 98 97 3 97 291 97 95 4 96 384 96 93 5 95 475 95 91 6 94 564 94 89 7 93 651 93 87 8 92 736 92 85 9 91 819 91 83 10 90 900 90 81 Describe how total revenue, average revenue, and marginal revenue change as quantity sold increases from 0 to 10 units. Solution: Total revenue increases with a greater quantity, but the rate of increase in TR (as measured by marginal revenue) declines as quantity increases. Average revenue and marginal revenue decrease when output increases, with MR falling faster than price and AR. Average revenue is equal to price at each quantity level. Exhibit 8 shows the relationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data 3.1.2

Flashcard 1448242449676

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itQuantity (Q) Price (P) Total Revenue (TR) Average Revenue (AR) Marginal Revenue (MR) 0 100 0 — — 1 99 99 99 99 2 98 196 98 97 3 97 291 97 95 4 96 384 96 93 5 95 475 95 91 6 94 564 94 89 7 93 651 93 87 8 92 736 92 85 9 91 819 91 83 10 90 900 90 81 Describe how total revenue, average revenue, and marginal revenue change as quantity sold increases from 0 to 10 units. Solution: Total revenue increases with a greater quantity, but the rate of increase in TR (as measured by marginal revenue) declines as quantity increases. Average rev

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITSthe price and AR lines. TR peaks when MR equals zero at point Q 1 . Exhibit 6. Total Revenue, Average Revenue, and Marginal Revenue under Imperfect Competition EXAMPLE 2 <span>Calculation and Interpretation of Total, Average, and Marginal Revenue under Imperfect Competition Given quantity and price data in the first two columns of Exhibit 7, total revenue, average revenue, and marginal revenue can be calculated for a firm that operates under imperfect competition. Exhibit 7 Quantity (Q) Price (P) Total Revenue (TR) Average Revenue (AR) Marginal Revenue (MR) 0 100 0 — — 1 99 99 99 99 2 98 196 98 97 3 97 291 97 95 4 96 384 96 93 5 95 475 95 91 6 94 564 94 89 7 93 651 93 87 8 92 736 92 85 9 91 819 91 83 10 90 900 90 81 Describe how total revenue, average revenue, and marginal revenue change as quantity sold increases from 0 to 10 units. Solution: Total revenue increases with a greater quantity, but the rate of increase in TR (as measured by marginal revenue) declines as quantity increases. Average revenue and marginal revenue decrease when output increases, with MR falling faster than price and AR. Average revenue is equal to price at each quantity level. Exhibit 8 shows the relationships among the revenue variables presented in Exhibit 7. Exhibit 8. Total Revenue, Average Revenue, and Marginal Revenue for Exhibit 7 Data 3.1.2

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1448250313996

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

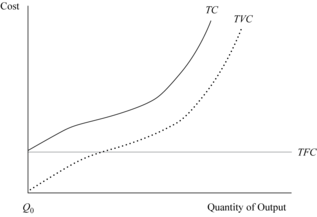

Exhibit 10 shows the graphical relationships among total costs, total fixed cost, and total variable cost. The curve for total costs is a parallel shift of the total variable cost curve and always lies above the total variable cost curve by the amount of total fixed cost. At zero production, total costs are equal to total fixed cost because total variable cost at this output level is zero

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1448257654028

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

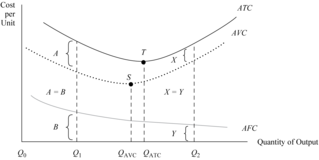

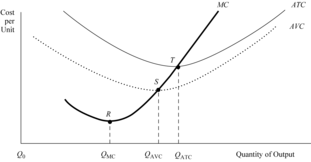

This shows the cost curve relationships among ATC, AVC, and AFC in the short run. (In the long run, the firm will have different ATC, AVC, and AFC cost curves when all inputs are variable, including technology, plant size, and physical capital.) The difference between ATC and AVC at any output quantity is the amount of AFC. For example, at Q 1 the distance between ATC a

Flashcard 1448261061900

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

This shows the cost curve relationships among ATC, AVC, and AFC in the short run. The difference between ATC and AVC at any output quantity is exactly equal to the amount of AFC. Both ATC and AVC take on a bowl-shaped pattern in which each curv

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1448267615500

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

d MC in the short run. The marginal cost curve intersects both the ATC and AVC at their respective minimum points. This occurs at points S and T, which correspond to Q AVC and Q ATC , respectively. Mathematically, when <span>marginal cost is less than average variable cost, AVC will be decreasing . The opposite occurs when MC is greater than AVC. The same relationship holds true for MC and ATC . ATC declines when MC is less than ATC. ATC increases as MC exceeds ATC

Flashcard 1448274955532

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itan>We assume that when comparing any three distinct bundles, A, B, and C, if A is preferred to B, and simultaneously B is preferred to C, then it must be true that A is preferred to C. This assumption is referred to as the assumption of transitive preferences , and it is assumed to hold for indifference as well as for strict preference.<span><body><html>

Original toplevel document

3. UTILITY THEORY: MODELING PREFERENCES AND TASTESthat about his two children. In effect, the father neither prefers one to the other nor is, in any meaningful sense, indifferent between the two. The assumption of complete preferences cannot accommodate such a response. Second, <span>we assume that when comparing any three distinct bundles, A, B, and C, if A is preferred to B, and simultaneously B is preferred to C, then it must be true that A is preferred to C. This assumption is referred to as the assumption of transitive preferences , and it is assumed to hold for indifference as well as for strict preference. This is a somewhat stronger assumption because it is essentially an assumption of rationality. We would say that if a consumer prefers a skiing holiday to a diving holiday and a diving

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1448300907788

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itManagers have access to additional financial information that can be reported in whatever format is most useful to their decision.

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISThe role of financial reporting by companies is to provide information about a company’s performance, financial position, and changes in financial position that is useful to a wide range of users in making economic decisions.1 The role of financial statement analysis is to use financial reports prepared by companies, combined with other information, to evaluate the past, current, and potential performance and financial position of a company for the purpose of making investment, credit, and other economic decisions. (Managers within a company perform financial analysis to make operating, investing, and financing decisions but do not necessarily rely on analysis of related financial statements. They have access to additional financial information that can be reported in whatever format is most useful to their decision.) In evaluating financial reports, analysts typically have a specific economic decision in mind. Examples of these decisions include the following: Evalu

Flashcard 1448302480652

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itAnalysts are concerned about factors that affect risks to a company’s future performance and financial position.

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISons demonstrate certain themes in financial analysis. In general, analysts seek to examine the past and current performance and financial position of a company in order to form expectations about its future performance and financial position. <span>Analysts are also concerned about factors that affect risks to a company’s future performance and financial position. An examination of performance can include an assessment of a company’s profitability (the ability to earn a profit from delivering goods and services) and its ability to generate positi

Flashcard 1448304053516

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itProfit (or loss) includes other income (such as investing income or income from the sale of items other than goods and services) minus the expenses incurred to earn that income.

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISof cash disbursements). Profit and cash flow are not equivalent. Profit (or loss) represents the difference between the prices at which goods or services are provided to customers and the expenses incurred to provide those goods and services. <span>In addition, profit (or loss) includes other income (such as investing income or income from the sale of items other than goods and services) minus the expenses incurred to earn that income. Overall, profit (or loss) equals income minus expenses, and its recognition is mostly independent from when cash is received or paid. Example 1 illustrates the distinction between profi

Flashcard 1448305626380

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itOverall, profit (or loss) equals income minus expenses, and its recognition is mostly independent from when cash is received or paid.

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISenses incurred to provide those goods and services. In addition, profit (or loss) includes other income (such as investing income or income from the sale of items other than goods and services) minus the expenses incurred to earn that income. <span>Overall, profit (or loss) equals income minus expenses, and its recognition is mostly independent from when cash is received or paid. Example 1 illustrates the distinction between profit and cash flow. EXAMPLE 1 Profit versus Cash Flow Sennett Designs (SD) sells furnit

Flashcard 1448307199244

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA company that generates positive cash flow from operations has more flexibility in funding needed for investments and taking advantage of attractive business opportunities than an otherwise comparable company without positive operating cash flow.

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISd to earn that income. Overall, profit (or loss) equals income minus expenses, and its recognition is mostly independent from when cash is received or paid. Example 1 illustrates the distinction between profit and cash flow. <span>EXAMPLE 1 Profit versus Cash Flow Sennett Designs (SD) sells furniture on a retail basis. SD began operations during December 2009 and sold furniture for €250,000 in cash. The furniture sold by SD was purchased on credit for €150,000 and delivered by the supplier during December. The credit terms granted by the supplier required SD to pay the €150,000 in January for the furniture it received during December. In addition to the purchase and sale of furniture, in December, SD paid €20,000 in cash for rent and salaries. How much is SD’s profit for December 2009 if no other transactions occurred? How much is SD’s cash flow for December 2009? If SD purchases and sells exactly the same amount in January 2010 as it did in December and under the same terms (receiving cash for the sales and making purchases on credit that will be due in February), how much will the company’s profit and cash flow be for the month of January? Solution to 1: SD’s profit for December 2009 is the excess of the sales price (€250,000) over the cost of the goods that were sold (€150,000) and rent and salaries (€20,000), or €80,000. Solution to 2: The December 2009 cash flow is €230,000, the amount of cash received from the customer (€250,000) less the cash paid for rent and salaries (€20,000). Solution to 3: SD’s profit for January 2010 will be identical to its profit in December: €80,000, calculated as the sales price (€250,000) minus the cost of the goods that were sold (€150,000) and minus rent and salaries (€20,000). SD’s cash flow in January 2010 will also equal €80,000, calculated as the amount of cash received from the customer (€250,000) minus the cash paid for rent and salaries (€20,000) and minus the €150,000 that SD owes for the goods it had purchased on credit in the prior month. Although profitability is important, so is a company’s ability to generate positive cash flow. Cash flow is important because, ultimately, the company needs cash to pay employees, suppliers, and others in order to continue as a going concern. A company that generates positive cash flow from operations has more flexibility in funding needed for investments and taking advantage of attractive business opportunities than an otherwise comparable company without positive operating cash flow. Additionally, a company needs cash to pay returns (interest and dividends) to providers of debt and equity capital. Therefore, the expected magnitude of future cash flows is important in valuing corporate securities and in determining the company’s ability to meet its obligations. The ability to meet short-term obligations is generally referred to as liquidity , and the ability to meet long-term obligations is generally referred to as solvency . Cash flow in any given period is not, however, a complete measure of performance for that period because, as shown in Example 1, a company may be obligated to make future cash payments as a result of a transaction that generates positive cash flow in the current period. Profits may provide useful information about cash flows, past and future. If the transaction of Example 1 were repeated month after month, the long-term average monthly cas

Flashcard 1448309558540

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itA company needs cash to pay returns (interest and dividends) to providers of debt and equity capital.

Original toplevel document

2. SCOPE OF FINANCIAL STATEMENT ANALYSISd to earn that income. Overall, profit (or loss) equals income minus expenses, and its recognition is mostly independent from when cash is received or paid. Example 1 illustrates the distinction between profit and cash flow. <span>EXAMPLE 1 Profit versus Cash Flow Sennett Designs (SD) sells furniture on a retail basis. SD began operations during December 2009 and sold furniture for €250,000 in cash. The furniture sold by SD was purchased on credit for €150,000 and delivered by the supplier during December. The credit terms granted by the supplier required SD to pay the €150,000 in January for the furniture it received during December. In addition to the purchase and sale of furniture, in December, SD paid €20,000 in cash for rent and salaries. How much is SD’s profit for December 2009 if no other transactions occurred? How much is SD’s cash flow for December 2009? If SD purchases and sells exactly the same amount in January 2010 as it did in December and under the same terms (receiving cash for the sales and making purchases on credit that will be due in February), how much will the company’s profit and cash flow be for the month of January? Solution to 1: SD’s profit for December 2009 is the excess of the sales price (€250,000) over the cost of the goods that were sold (€150,000) and rent and salaries (€20,000), or €80,000. Solution to 2: The December 2009 cash flow is €230,000, the amount of cash received from the customer (€250,000) less the cash paid for rent and salaries (€20,000). Solution to 3: SD’s profit for January 2010 will be identical to its profit in December: €80,000, calculated as the sales price (€250,000) minus the cost of the goods that were sold (€150,000) and minus rent and salaries (€20,000). SD’s cash flow in January 2010 will also equal €80,000, calculated as the amount of cash received from the customer (€250,000) minus the cash paid for rent and salaries (€20,000) and minus the €150,000 that SD owes for the goods it had purchased on credit in the prior month. Although profitability is important, so is a company’s ability to generate positive cash flow. Cash flow is important because, ultimately, the company needs cash to pay employees, suppliers, and others in order to continue as a going concern. A company that generates positive cash flow from operations has more flexibility in funding needed for investments and taking advantage of attractive business opportunities than an otherwise comparable company without positive operating cash flow. Additionally, a company needs cash to pay returns (interest and dividends) to providers of debt and equity capital. Therefore, the expected magnitude of future cash flows is important in valuing corporate securities and in determining the company’s ability to meet its obligations. The ability to meet short-term obligations is generally referred to as liquidity , and the ability to meet long-term obligations is generally referred to as solvency . Cash flow in any given period is not, however, a complete measure of performance for that period because, as shown in Example 1, a company may be obligated to make future cash payments as a result of a transaction that generates positive cash flow in the current period. Profits may provide useful information about cash flows, past and future. If the transaction of Example 1 were repeated month after month, the long-term average monthly cas

Flashcard 1448311131404

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe quantity or quantity demanded variable is the amount of the product that consumers are willing and able to buy at each price level.

Original toplevel document

3. ANALYSIS OF REVENUE, COSTS, AND PROFITS(AR) Marginal Revenue (MR) 0 100 0 — — 1 100 100 100 100 2 100 200 100 100 3 100 300 100 100 4 100 400 100 100 5 100 500 100 100 6 100 600 100 100 7 100 700 100 100 8 100 800 100 100 9 100 900 100 100 10 100 1,000 100 100 <span>The quantity or quantity demanded variable is the amount of the product that consumers are willing and able to buy at each price level. The quantity sold can be affected by the business through such activities as sales promotion, advertising, and competitive positioning of the product that would take place under the market model of imperfect competition. Under perfect competition, however, total quantity in the market is influenced strictly by price, while non-price factors are not important. Once consumer preferences are established in the market, price determines the quantity demanded by buyers. Together, price and quantity constitute the firm’s demand curve, which becomes the basis for calculating the total, average, and marginal revenue. In Exhibit 4, price is the market price as established by the interactions of the market demand and supply factors. Since the firm is a price taker, price is fixed at 100

Flashcard 1448312704268

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

Open itThe production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3.

Original toplevel document

Open itThis image illustrates the shape of a typical input–output relationship using labor (L) as the only variable input (all other input factors are held constant). The production function has three distinct regions where both the direction of change and the rate of change in total product (TP or Q, quantity of output) vary as production changes. Regions 1 and 2 have positive changes in TP as labor is added, but the change turns negative in Region 3. Moreover, in Region 1 (L 0 – L 1 ), TP is increasing at an increasing rate, ty

Flashcard 1448315587852

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Parent (intermediate) annotation

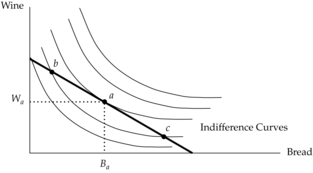

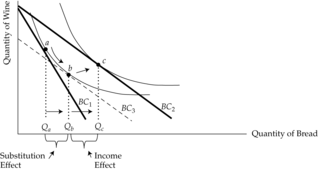

Open itMental exercise: Part of his response is because of the increase in real income . We remove that effect subtracting some income, while leaving the new lower price in place. That budget constraint shows the reduction in income that moves him back to his original indif

Original toplevel document

Substitution effect and income effectf bread falls, as indicated by the pivoting in budget constraints from BC 1 to BC 2 , Warren buys more bread, increasing his quantity from Q a to Q c . That is the net effect of both the substitution effect and the income effect. <span>Mental exercise: Part of his response is because of the increase in real income . We remove that effect subtracting some income, while leaving the new lower price in place. That budget constraint shows the reduction in income that moves him back to his original indifference curve. Notice that we are moving BC 2 inward, parallel to itself until it becomes just tangent to his original indifference curve at point b. The price decrease was a good thing for him. An offsetting bad thing would be an income reduction. If the income reduction is just sufficient to leave him no better or morse than before the price change, we have removed the real income effect of the decrease in price. What’s left of his response must be due to the substitution effect . So, we say that the substitution effect is shown by the move from point a to point b. If his

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itHow is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply ha

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itt useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. <span>Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply ha

Original toplevel document

2. OBJECTIVES OF THE FIRMer competing firms to compete away any economic profit over the long run. Economic profit that exists over the long run is usually found where competitive conditions persistently are less than perfect in the market. <span>2.1.3. Economic Rent The surplus value known as economic rent results when a particular resource or good is fixed in supply (with a vertical supply curve) and market price is higher than what is required to bring the resource or good onto the market and sustain its use. Essentially, demand determines the price level and the magnitude of economic rent that is forthcoming from the market. Exhibit 1 illustrates this concept, where P 1 is the price level that yields a normal profit return to the business that supplies the item. When demand increases from Demand 1 to Demand 2 , price rises to P 2 , where at this higher price level economic rent is created. The amount of this economic rent is calculated as (P 2 – P 1 ) × Q 1 . The firm has not done anything internally to merit this special reward: It benefits from an increase in demand in conjunction with a supply curve that does not fully adjust with an increase in quantity when price rises. Exhibit 1. Economic Rent Because of their limited availability in nature, certain resources—such as land and specialty commodities—possess highly inelastic supply curves in both the short run and long run (shown in Exhibit 1 as a vertical supply curve). When supply is relatively inelastic, a high degree of market demand can result in pricing that creates economic rent. This economic rent results from the fact that when price increases, the quantity supplied does not change or, at the most, increases only slightly. This is because of the fixation of supply by nature or by such artificial constraints as government policy. How is the concept of economic rent useful in financial analysis? Commodities or resources that command economic rent have the potential to reward equity investors more than what is required to attract their capital to that activity, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent. EXAMPLE 1 Economic Rent and Investment Decision Making The following market data show the global demand, global supply, and price on an annual basis for gold over the period 2006–2008. Based on the data, what observation can be made about market demand, supply, and economic rent? Year 2006 2007 2008 Percent Change 2006–2008 Supply (in metric tons) 3,569 3,475 3,508 –1.7 Demand (in metric tons) 3,423 3,552 3,805 +11.2 Average spot price (in US$) 603.92 695.39 871.65 +44.3 Source: GFMS and World Gold Council. Solution: The amount of total gold supplied to the world market over this period has actually declined slightly by 1.7 percent during a period when there was a double-digit increase of 11.2 percent in demand. As a consequence, the spot price has dramatically increased by 44.3 percent. Economic rent has resulted from this market relationship of a relatively fixed supply of gold and a rising demand for it. 2.2. Comparison of Profit Measures All three types of profit are interconnected because, according to Equation 4, acco

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Parent (intermediate) annotation

Open itty, resulting in greater shareholders’ wealth. Evidence of economic rent attracts additional capital funds to the economic endeavor. This new investment capital increases shareholders’ value as investors bid up share prices of existing firms. <span>Any commodity, resource, or good that is fixed or nearly fixed in supply has the potential to yield economic rent. From an analytical perspective, one can obtain industry supply data to calculate the elasticity of supply , which measures the sensitivity of quantity supplied to a change in price. If quantity supplied is relatively unresponsive ( inelastic ) to price changes, then a potential condition exists in the market for economic rent. A reliable forecast of changes in demand can indicate the degree of any economic rent that is forthcoming from the market in the future. When one is analyzing fixed or nearly fixed supply markets (e.g., gold), a fundamental comprehension of demand determinants is necessary to make rational financial decisions based on potential economic rent.<span><body><html>

Original toplevel document