Edited, memorised or added to reading queue

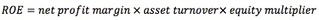

on 11-Nov-2016 (Fri)

|

Subject 3. Other Financial Information Sources

#cfa #cfa-level-1 #financial-reporting-and-analysis #introduction

Financial Notes and Supplementary Schedules

Financial footnotes are an integral part of financial statements. They provide information about the accounting methods, assumptions and estimates used by management to develop the data reported in the financial statements. They provide additional disclosure in such areas as fixed assets, inventory methods, income taxes, pensions, debt, contingencies such as lawsuits, sales to related parties, etc. They are designed to allow users to improve assessments of the amounts, timing, and uncertainty of the estimates reported in the financial statements. Supplementary Schedules: In some cases additional information about the assets and liabilities of a company is provided as supplementary data outside the financial statements. Examples include oil and gas reserves reported by oil and gas companies, the impact of changing prices, sales revenue, operating income, and other information for major business segments. Some of the supplementary data is unaudited. Management Discussion and Analysis (MD&A) This requires management to discuss specific issues on the financial statements, and to assess the company's current financial condition, liquidity, and its planned capital expenditure for the next year. An analyst should look for specific concise disclosure as well as consistency with footnote disclosure. Note that the MD&A section is not audited and is for public companies only. Auditor's Reports See next subject for details. Other Sources of Information

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 4. Auditor's Reports

#cfa #cfa-level-1 #financial-reporting-and-analysis #introduction

The auditor (an independent certified public accountant) is responsible for seeing that the financial statements issued comply with generally accepted accounting principles. In contrast, the company's management is responsible for the preparation of the financial statements. The auditor must agree that management's choice of accounting principles is appropriate and that any estimates are reasonable. The auditor also examines the company's accounting and internal control systems, confirms assets and liabilities, and generally tries to be sure that there are no material errors in the financial statements.

Though hired by the management, the auditor is supposed to be independent and to serve the stockholders and the other users of the financial statements. An auditor's report (also called the auditor's opinion) is issued as part of a company's audited financial report. It tells the end-user the following:

An auditor's report is considered an essential tool when reporting financial information to end-users, particularly in business. Since many third-party users prefer or even require financial information to be certified by an independent external auditor, many auditees rely on auditor reports to certify their information in order to attract investors, obtain loans, and improve public appearance. Some have even stated that financial information without an auditor's report is "essentially worthless" for investing purposes. The Types of Audit Reports There are four common types of auditor's reports, each one representing a different situation encountered during the auditor's work. The four reports are as follows:

Auditor's Report on In... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 5. Financial Statement Analysis Framework

#cfa #cfa-level-1 #financial-reporting-and-analysis #introduction

The financial statement analysis framework provides steps that can be followed in any financial statement analysis project, including the following:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. The Classification of Business Activities

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-mechanics

Business activities can be classified into three groups:

In Reading 27 [Understanding the Cash Flow Statement] a more detailed discussion of different business activities and their impact on cash flows will be provided. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 2. Financial Statement Elements and Accounts

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-mechanics

An account is a label used for recording and reporting a quantity of almost anything. It is the:

A chart of accounts is a list of all accounts tracked by a single accounting system, and should be designed to capture financial information to make good financial decisions. Each account in the Anglo-Saxon chart is classified into one of the five categories: Assets, Liabilities, Equity, Income, and Expenses. Assets Assets are economic resources controlled by a company that are expected to benefit future operations.

It is important to understand that in an accounting sense an asset is not the same as ownership. In accounting, ownership is described by the term "equity." Types of Assets

Liabilities Liabilities are the financial obligations that the company must fulfill in the future. They are typically fulfilled by cash payment. They represent the source of financing provided to a company by its creditors. Types of Liabilities

Owners' Equity Equity represents the source of financing provided to the company by the owners.

Owner's equity is the owners' investments and the total earnings retained from the commencement of the company.

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 3. Accounting Equations

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-mechanics #has-images

Assets reported on the balance sheet are either purchased by the company or generated through operations; they are financed, directly or indirectly, by the creditors and stockholders of the company. This fundamental accounting relationship provides the basis for recording all transactions in financial reporting and is expressed as the balance sheet equation:

This equation is the foundation for the double-entry bookkeeping system because there are two or more accounts affected by every transaction. If the equation is rearranged:

The above equation shows that the owners' equity is the residual claim of the owners. It is the amount left over after liabilities are deducted from assets. Owners' equity at a given date can be further classified by its origin: capital provided by owners, and earnings retained in the business up to that date.

Net income is equal to the income that a company has after subtracting costs and expenses from total revenue.

Net income is informally called the "bottom line" because it is typically found on the last line of a company's income statement. Balance sheets and income statements are interrelated through the retained earnings component of owners' equity.

The following expanded accounting equation, which is derived from the above equations, provides a combined representation of the balance sheet and income statement:

Because dividends and expenses are deductions from owners' equity, move them to the left side of the equation:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 4. Effects of Transactions on the Accounting Equation

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-mechanics

The following illustrates how the business transactions of ABC Realty are recorded in a simplified accounting system. 1. Owners' Investments - Invested $50,000 in business in exchange for 5,000 shares of $10 par value stock.

2. Purchase of Assets with Cash - Purchased a lot for $10,000 and a small building on a lot for $25,000.

3. Purchase of Assets by Incurring a Liability - Purchased office supplies for $500 on credit.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 5. Accruals and Valuation Adjustments

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-mechanics

Under strict cash basis accounting, revenue is recorded only when cash is received and expenses are recorded only when cash is paid. Net income is cash revenue minus cash expenses. The matching principle is ignored here, resulting inconformity with generally accepted accounting principles.

Most companies use accrual basis accounting, recognizing revenue when it is earned (the goods are sold or the services performed) and recognizing expenses in the period incurred without regard to the time of receipt or payment of cash. Net income is revenue earned minus expenses incurred. Although operating a business is a continuous process, there must be a cut-off point for periodic reports. Reports are prepared at the end of an accounting period.

Some transactions span more than one accounting period and they require adjustments. Adjustments are necessary for determining key profitability performance measures because they affect net income, assets, and liabilities. Adjustments, however, never affect the cash account in the current period. They provide information about future cash flow. For example, accounts receivable indicates expected future cash inflows. The four basic types of adjusting entries are:

In some cases valuation adjustments entries are required for assets. For example, trading securities are always recorded at their current market value, which can change from time to time.

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 6. Financial Statements

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-mechanics #has-images

Here are financial statements based on previous transactions for ABC Realty.

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 7. Flow of Information in an Accounting System

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-mechanics #has-images

It is important for an analyst to understand the flow of information through a financial reporting system.

1. Journal entries and adjusting entries Journalizing is the process of chronologically recording transactions.

2. General ledger and T-accounts The items entered in a general journal must be transferred to the general ledger. This procedure, posting, is part of the summarizing and classifying process. The general ledger contains all the same entries as those posted to the general journal; the only difference is that the data are sorted by date in the journal and by account in the ledger. There is a separate T-account for each item in the ledger. A T-account appears as follows:

3. Trial balance and adjusted trial balance A trial balance is a list of all open accounts in the general ledger and their balances.

Since certain accounts may not be accurately stated, adjusting entries may be required to prepare an adjusted trial balance. 4. Finance statements The financial statements can be prepared from the adjusted trial balance. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 8. Using Financial Statements in Security Analysis

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-mechanics

Financial statements are the primary information that firms publish about themselves, and investors and creditors are the primary users of financial statements. Analysts, who work for investors and creditors, may need to make adjustments to reflect items not reported in the statements or assess the reasonableness of managements' judgments. For example, an important first step in analyzing financial statements is identifying the types of accruals and valuation entries in a company's financial statements.

Company management can manipulate financial statements, and a perceptive analyst can use his or her understanding of financial statements to detect misrepresentations. For example, companies may improperly record costs as assets rather than as expenses and amortize the assets over future periods. The goal is to impress shareholders and bankers with higher profits. Consider advertising expenses, which should be charged against income immediately. Certain companies, particularly those selling memberships to customers (e.g., health clubs and Internet access providers), aggressively capitalize these costs and spread them over several periods. Companies may amortize long-term assets too slowly. Slow depreciation or amortization keeps assets on the balance sheet longer, resulting in a higher net worth. With slow amortization, expenses are lower and profits are higher. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. The Objective of Financial Reporting

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-standards

An awareness of the reporting framework underlying financial reports can assist in security valuation and other financial analysis. This framework describes the objectives of financial reporting, desirable characteristics for financial reports, the elements of financial reports, and the underlying assumptions and constraints of financial reporting. An understanding of the framework that is broader than knowledge of a particular set of rules offers an analyst a basis from which to infer the proper financial reporting, and thus security valuation implications, of any financial statement element transaction.

The objective of financial reporting:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 2. Financial Reporting Standard-Setting Bodies and Regulatory Authorities

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-standards

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 3. The International Financial Reporting Standards Framework

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-standards

The IFRS Framework sets forth the concepts that underlie the preparation and presentation of financial statements for external end-users, provides further guidance on the elements from which financial statements are constructed, and discusses the concepts of capital and capital maintenance.

Objectives of Financial Statements The Framework identifies the central objective of financial statements as providing information about a company that is useful in making economic decisions. Financial statements prepared for this purpose will meet the needs of most end-users. Users generally want information about a company's financial performance, financial position, cash flows, and ability to adapt to changes in the economic environment in which it operates. The Framework identifies end-users as investors and potential investors, employees, lenders, suppliers, creditors, customers, governments, and the public at large. Qualitative Characteristics of Financial Statements The Framework prescribes a number of qualitative characteristics of financial statements. The key characteristics are relevance and reliability. Preparers can face a dilemma in satisfying both criteria at once. For example, information about the outcome of a lawsuit may be relevant, but the financial impact cannot be measured reliably. Financial information is relevant if it has the capacity to influence an end-user's economic decisions. Relevant information will help users evaluate the past, present, and most importantly, future events in a company. To be reliable, financial information must represent faithfully the effects of the transactions and events that it reflects. The true impact of transactions and events can be compromised by the difficulty of measuring transactions reliably.

Financial information must be easily understandable in addition to being relevant and reliable. Preparers should assume that end-users have a reasonable knowledge of business and economic activities, and an ability to comprehend complex financial matters. End-users must be able to compare a company's financial statements through time in order to identify trends in financial performance (comparability). Hence, policies on recognition, measurement, and disclosure must be applied consistently over time. Where a company changes its accounting for the recognition or measurement of transactions, it should disclose the change in the Basis of Accounting section of its financial statements and follow the guidance set out in IFRS. The application of qualitative characteristics and accounting standards usually results in financial statements that show a true and fair view, or fairly present a company's financial position and performance. The Elements of Financial Statements The Framework outlines definition and recognition criteria fo... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1418088025356

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

|

Subject 4. General Requirements for Financial Statements

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-standards

The objective of IAS No. 1 is to prescribe the basis for the presentation of general-purpose financial statements, to ensure comparability both with the company's financial statements of previous periods and with the financial statements of other entities. To achieve this objective, this Standard sets out overall requirements for the presentation of financial statements, guidelines for their structure, and minimum requirements for their content.

Components of Financial Statements A complete set of financial statements comprises:

Fundamental Principles Underlying the Preparation of Financial Statements A company whose financial statements comply with IFRS shall make an explicit and unreserved statement of such compliance in the notes. Financial statements shall not be described as complying with IFRS unless they comply with all the requirements of IFRS. Underlying principles:

Presentation requirements:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1418091695372

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418094841100

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

|

Subject 5. Comparison of IFRS with Alternative Reporting Systems

#cfa #cfa-level-1 #financial-reporting-and-analysis #financial-reporting-standards

A significant number of the world's listed companies report under either IFRS or U.S. GAAP. Although these standards are moving toward convergence, there are still significant differences in the framework and individual standards. Frequently, companies provide reconciliations and disclosures regarding the significant differences between reporting bases. These reconciliations can be reviewed to identify significant items that could affect security valuation. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. Components and Format of the Income Statement

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-income-statement

The income statement presents information on the financial results of a company's activities over a period of time. The format of the income statement is not specified by U.S. GAAP and the actual format varies across companies. Here are common components:

The... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1418099035404

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418100870412

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418104016140

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

|

Subject 2. Revenue Recognition

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-income-statement

There are two revenue and expense recognition issues when accrual accounting is used to prepare financial statements:

Revenue is generally recognized when it is (1) realized or realizable, and (2) earned. The general rule for revenue recognition includes the "concept of realization." Two conditions must be met for revenue recognition to take place: 1. Completion of the earnings process The company must have provided all or virtually all the goods or services for which it is to be paid, and it must be possible to measure the total expected cost of providing the goods or services. No remaining significant contingent obligation should exist. This condition is not met if the company has the obligation to provide future services (such as warranty protection) but cannot estimate the associated expenses. 2. Assurance of payment The quantification of cash or assets expected to be received for the goods or services provided must be reliable. These conditions are typically met at the time of sale, but there are many exceptions, which will be discussed next. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 3. Revenue Recognition in Special Cases

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-income-statement

In limited circumstances, specific revenue recognition methods may be applicable.

Long-term Contracts A long-term contract is one that spans multiple accounting periods. How should a company apportion the revenue earned under a long-term contract to each accounting period?

Percentage-of-completion Revenues and expenses are recognized each period in proportion to the work completed. This is used for a long-term project if all of the following conditions are met:

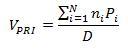

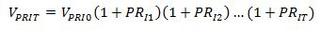

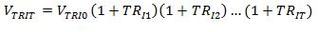

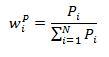

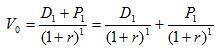

It recognizes profit corresponding to the percentage of cost incurred to total estimated costs associated with long-term construction contracts. It is the preferred method because it provides a better measure of operating activities and a more informative disclosure of the status of incomplete contracts. It also facilitates the forecast of future performance and cash flows. This method highlights the relationship among the income statement (revenues), the balance sheet (resulting receivables), and the cash flow statement (current collections). The percentage-of-completion is equal to actual cost/estimated total cost, or it can be determined by an engineering estimate. Using the first approach:

To date, the most recent estimate of the total cost is used in computing the progress toward completion. It means that if cost estimates are revised as the project progresses, that effect is recognized in the period in which the change is made. Costs and revenues of prior periods are not restated. Completed Contract This method does not recognize revenue and expense until the contract is completed and the title is transferred. All profits are recognized when the contract is completed. The completed contract method is used when:

This method is more conservative than the percentage-of-completion method. Analysts may need to rely on the statement of cash flows to assess the contribution of long-term contracts to a company's profitability. Installment Sales This method is used if the costs to provide goods or services are known but the collectability of sales proceeds cannot be reasonably determined. It recognizes both revenue and the associated cost of goods sold only when cash is received. Gross profit (sales - costs of goods sold) reflects the proportion of cash received. This method is sometimes used to report income from sales of noncurrent assets and real estate transactions. Cost Recovery This method is similar to the installment sales method but is more conservative. It ... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 4. Revenue Recognition Accounting Standards Issued May 2014

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-income-statement

In May 2014, the IASB and FASB each issued a converged standard for revenue recognition. The standards are effective for reporting periods beginning after 1 January 2017 under IFRS and 15 December 2016 under U.S. GAAP.

Key aspects of the converged accounting standards: The core principle of the new standard is for companies to recognize revenue to depict the transfer of goods or services to customers in amounts that reflect the consideration (that is, payment) to which the company expects to be entitled in exchange for those goods or services. Companies under contract to provide goods or services to a customer will be required to follow a five-step process to recognize revenue:

The standard introduces new, increased requirements for disclosure of revenue in a reporter's financial statements. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

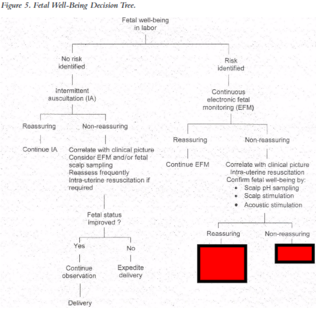

#obgyn

If abnormal FHR strip and resuscitation interventions (change position, IV fluid, O2 (only if need), stop oxy if abn tracing while in labour) not working, move on to c/s if ~3 cm. If ~8cm, fetal scalp sampling can be good to make sure baby okay to have assisted vag delivery (forceps/vacuum).

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 5. Expense Recognition

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-income-statement

The matching principle states that operating performance can be measured only if related revenues and expenses are accounted for during the same period ("let the expense follow the revenues"). Expenses are recognized not when wages are paid, when the work is performed, or when a product is produced, but when the work (service) or the product actually makes its contribution to revenue. Thus, expense recognition is tied to revenue recognition.

Expenses incurred to generate revenues must be matched against those revenues in the time periods when the revenues are recognized.

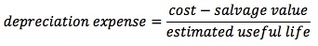

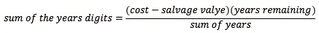

The problem of expense recognition is as complex as that of revenue recognition. For costs that are not directly related to revenues, accountants must develop a "rational and systematic" allocation policy that will approximate the matching principle. However, matching permits certain costs to be deferred and treated as assets on the balance sheet when in fact these costs may not have future benefits. If abused, this principle permits the balance sheet to become a "dumping ground" for unmatched costs. The Matching of Inventory Costs with Revenues Please refer to Reading 29 [Inventories] for details. Some issues in expense recognition: Doubtful Accounts Account receivables arise from sales to customers who do not immediately pay cash. There are always some customers who cannot or will not pay their debts. The accounts owed by these customers are called uncollected accounts. Therefore, accounts receivables are valued and reported at net realizable value - the net amount expected to be received in cash, which is not necessarily the amount legally receivable. The chief problem in recording uncollectible accounts receivable is establishing the time at which to record the loss. Under the direct write-off method, uncollectible accounts are charged to expense in the period that they are determined to be worthless. No entry is made until a specific account has definitely been established as uncollectible. This method is easy and convenient to apply. However, it usually does not match costs with revenues of the period, nor does it result in receivables being stated at estimated realizable value on the balance sheet. Advocates of the allowance method believe that bad debt expense should be recorded in the same period as the sale to obtain a proper matching of expenses and revenues and to achieve a proper carrying value for accounts receivable. In practice, the estimate of bad debt is made either on the percentage-of-sales basis (income statement approach) or outstanding-receivables basis (balance sheet approach). Warranties Warranty costs are a classic example of a loss contingency. Although the future cost amount, due date, and customer are not known for certain, a liability is probable and should be recognized if it can be reasonably estimated. Depreciation and Amortization Please refer to Reading 30 [Long-Lived Assets] for details. Financial Analysis Implications In expense recognition, choice of method (i.e., the depreciation method and the inventory method) as well as estimates (i.e., uncollectible accounts, warranty expenses, assets' useful life, and salvage value) affect a company's reported income. An analyst should identify differences in companies' expense-recognition methods and adjust r... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1418111880460

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

If abnormal FHR strip and resuscitation interventions (change position, IV fluid, O2 (only if need), stop oxy if abn tracing while in labour) not working, move on to c/s if ~3 cm. If ~8cm, fetal scalp sampling can be good to make sure baby okay to have assisted vag delivery (forceps/vacuum).

Flashcard 1418113453324

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

If abnormal FHR strip and resuscitation interventions (change position, IV fluid, O2 (only if need), stop oxy if abn tracing while in labour) not working, move on to c/s if ~3 cm. If ~8cm, fetal scalp sampling can be good to make sure baby okay to have assisted vag delivery (forceps/vacuum).

Flashcard 1418115026188

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

If abnormal FHR strip and resuscitation interventions (change position, IV fluid, O2 (only if need), stop oxy if abn tracing while in labour) not working, move on to c/s if ~3 cm. If ~8cm, fetal scalp sampling can be good to make sure baby okay to have assisted vag delivery (forceps/vacuum).

Flashcard 1418116599052

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

If abnormal FHR strip and resuscitation interventions (change position, IV fluid, O2 (only if need), stop oxy if abn tracing while in labour) not working, move on to c/s if ~3 cm. If ~8cm, fetal scalp sampling can be good to make sure baby okay to have assisted vag delivery (forceps/vacuum).

Flashcard 1418118171916

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

If abnormal FHR strip and resuscitation interventions (change position, IV fluid, O2 (only if need), stop oxy if abn tracing while in labour) not working, move on to c/s if ~3 cm. If ~8cm, fetal scalp sampling can be good to make sure baby okay to have assisted vag delivery (forceps/vacuum).

Flashcard 1418120531212

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

l FHR strip and resuscitation interventions (change position, IV fluid, O2 (only if need), stop oxy if abn tracing while in labour) not working, move on to c/s if ~3 cm. If ~8cm, fetal scalp sampling can be good to make sure baby okay to have <span>assisted vag delivery (forceps/vacuum).<span><body><html>

|

Subject 6. Non-Recurring Items and Non-Operating Items

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-income-statement

The goal of analyzing an income statement is to derive an effective indicator to predict future earnings and cash flows. Net income includes the impact of non-recurring items, which are transitory or random in nature. Therefore, net income is not the best indicator of future income. Recurring pre-tax income from continuing operations represents the company's sustainable income and therefore should be the primary focus of analysis.

Segregating the results of recurring operations from those of non-recurring items facilitates the forecasting of future earnings and cash flows. Generally, analysts should exclude items that are non-recurring in nature when predicting a company's future earnings and cash flows. However, this does not mean that every non-recurring item in the income statement should be ignored. Management tends to label many items in the income statement as "non-recurring," especially those that reduce reported income. For the purpose of analysis, an important issue is to assess whether non-recurring items are really "non-recurring," regardless of their accounting labels. There are four types of non-recurring items in an income statement. 1. Discontinued operations Discontinued operations are not a component of persistent or recurring net income from continuing operations. To qualify, the assets, results of operations, and investing and financing activities of a business segment must be separable from those of the company. The separation must be possible physically and operationally, and for financial reporting purposes. Any gains or disposal will not contribute to future income and cash flows, and therefore can be reported only after disposal, that is - when realized.

2. Extraordinary items Extraordinary items are BOTH unusual in nature AND infrequent in occurrence, and material in amount. They must be reported separately (below the line) net of income tax. Common examples are:

Note that gains and losses from the early retirement of debt used to be treated as extraordinary items; SFAS No. 145 now requires them to be treated as part of continuing operations. 3. Unusual or infrequent items These are either unusual in nature OR infrequent in occurrence but not both. They may be disclosed separately (as a single-line item) as a component of income from continuing operations. They are reported pre-tax in the income statement and appear "above the line," while the other three categories are reported on an after-tax basis and "below the line" and excluded from net income from continuing operations. Common examples are:

4. Changes in accounting principles Changes in accounting principles, such as from LIFO to another inventory method or from the percentage-of-completion method to the completed-contract method, can be either voluntary changes or changes mandated by new accounting standards. They are reported in the same manner as extraordinary items and discontinued operations. The cumulative impact on prior period earnings should be reported as a separate line item on the income statement on... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 7. Earnings per Share

#cfa #cfa-level-1 #financial-reporting-and-analysis #has-images #understanding-income-statement

Earnings per share (EPS) is a measure that is widely used to evaluate the profitability of a company.

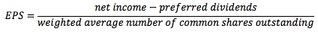

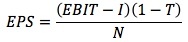

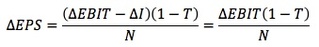

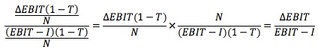

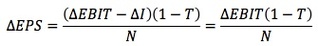

A company's capital structure is simple if it consists of only common stock or includes no potential common stock that upon conversion or exercise could dilute earnings per common share. Companies with simple capital structures only need to report basic EPS. A complex capital structure contains securities that could have a dilutive effect on earnings per common share. Dilutive securities are securities that, upon conversion or exercise, could dilute earnings per share. These securities include options, warrants, convertible bonds, and preferred stocks. Companies with complex capital structures must report both basic EPS and diluted EPS. Calculation of diluted EPS under a complex capital structure allows investors to see the adverse impact on EPS if all diluted securities are converted into common stock. Basic EPS To calculate EPS in a simple capital structure:

The current year's preferred dividends are subtracted from net income because EPS refers to earnings available to the common shareholder. Common stock dividends are not subtracted from net income. Since the number of common shares outstanding may change over the year, the weighted average is used to compute EPS. The weighted average number of common shares is the number of shares outstanding during the year weighted by the portion of the year they were outstanding. Analysts need to find the equivalent number of whole shares outstanding for the year. Three steps are used to compute the weighted average number of common shares outstanding:

Stock Dividends and Splits In computing the weighted average number of shares, stock dividends and stock splits are only changes in the units of measurement, not changes in the ownership of earnings. A stock dividend or split does not change the shareholders' total investment (i.e., it means more pieces of paper for shareholders). When a stock dividend or split occurs, computation of the weighted average number of shares requires restatement of the shares outstanding before the stock dividend or split. It is not weighted by the portion of the year after the stock dividend or split occurred. Specifically, before starting the three steps of computing the weighted average, the following numbers should be restated to reflect the effects of the stock dividend/split:

If a stock dividend or split occurs after the end of the year but before the financial statements are issued, the weighted average number of shares outstanding for the year (and any other years presented in comparative form) must be restated. Example 1. 01/01/15 - 100... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 8. Analysis of the Income Statement

#cfa #cfa-level-1 #financial-reporting-and-analysis #has-images #understanding-income-statement

Common-Size Analysis of the Income Statement

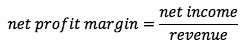

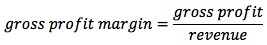

This topic will be discussed in detail in Reading 28 [Financial Analysis Techniques]. Income Statement Ratios The following operating profitability ratios measure the rates of profit on sales (profit margins).

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 9. Comprehensive Income

#cfa #cfa-level-1 #financial-reporting-and-analysis #has-images #understanding-income-statement

Comprehensive income includes both net income and other revenue and expense items that are excluded from the net income calculation.

Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding gain or loss from available-for-sale securities and foreign currency translation gains or losses. These items are not part of net income, yet are important enough to be included in comprehensive income, giving the user a bigger, more comprehensive picture of the organization as a whole. The following table is from the Statement of Stockholders' Equity section of the 3M's 2001 annual report.

This section describes the composition of comprehensive income. It begins with net income and then includes those items affecting stockholders' equity that do not flow through the income statement. For 3M, these items include:

FASB has taken the position that income for a period should be all-inclusive comprehensive income. Comprehensive income may be reported on an income statement or separate statement, but is usually reported on a statement of stockholders' equity. |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. Components and Format of the Balance Sheet

#cfa #cfa-level-1 #financial-reporting-and-analysis #has-images #understanding-balance-sheets

The starting place for analyzing a company is typically the balance sheet. Think of the balance sheet as a photo of the business at a specific point in time. It presents the assets, liabilities, and equity ownership of a company as of a specific date.

The balance sheet provides users, such as creditors and investors, with information regarding the sources of finance available for projects and infrastructure. At the same time, it normally provides information about the future earnings capacity of a company's assets as well as an indication of cash flow implicit in the receivables and inventories. The balance sheet has many limitations, especially relating to the measurement of assets and liabilities. The lack of timely recognition of liabilities and, sometimes, assets, coupled with historical costs as opposed to fair value accounting for all items on the balance sheet, implies that the financial analyst must make numerous adjustments to determine the economic net worth of the company. The analyst must understand the components, structure, and format of the balance sheet in order to evaluate the liquidity, solvency, and overall financial position of a company. Balance Sheet Format Balance sheet accounts are classified so that similar items are grouped together to arrive at significant subtotals. Furthermore, the material is arranged so that important relationships are shown. The table below indicates the general format of balance sheet presentation:

This format is referred to as the account format, which follows the pattern of the traditional general ledger accounts, with assets at the left and liabilities and equity at the right of a central dividing line. A report format balance sheet lists assets, liabilities, and equity in a single column. Balance Sheet Components Current Assets These are cash and other assets expected to be converted into cash, sold, or consumed either in one year or in the operating cycle, whichever is longer. The operating cycle is the average time between the acquisition of materials and supplies and the realization of cash through sales of the product for which the materials and supplies were acquired. The cycle operates from cash through inventory, production, and receivables back to cash. Where there are several operating cycles within one year, the one-year period is used. If the operating cycle is more than one year, the longer period is used. Long-Term Investments Often referred to simply as investments, these are to be held for many years and are not acquired with the intention of disposing of them in the near future.

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1418139667724

-tachy >160bpm for >30 but <80 min

-rising baseline

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418144386316

-tachy >160bpm for >80min

-erratic baseline

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

|

Subject 2. Measurement Bases of Assets and Liabilities

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-balance-sheets

Asset and liability values reported on a balance sheet may be measured on the basis of fair value or historical cost. Historical cost values may be quite different from economic values. The balance sheet must be evaluated critically in light of accounting policies applied in order to answer the question of how the values relate to economic reality and to each other.

Current Assets Current assets are presented in the balance sheet in order of liquidity. The five major items found in the current assets section are:

Current Liabilities Current liabilities are typically paid from current assets or by incurring new short-term liabilities. They are not reported in any consistent order. A typical order is: accounts payable, notes payable, accrued items (e.g., accrued warranty costs, compensation and benefits), income taxes payable, current maturities of long-term debt, unearned revenue, etc. Tangible Assets These are carried at their historical cost less any accumulated depreciation or accumulated depletion. See Reading 30 [Long-Lived Assets] for details. Intangible Assets Intangible assets are long-term assets that have no physical substance but have a value based on rights or privileges that belong to their owner. Generally, identifiable intangible assets are recorded only when purchased (at acquisition costs). The cost of internally developed identifiable intangible assets is typically expensed when incurred. For example, R&D costs are not in themselves intangible assets. They should be treated as revenue expenditures and charged to expense in the period in which they are incurred. One exception is that IFRS allows costs in the development stage to be capitalized if certain criteria (including technological feasibility) are met. A company should assess whether the useful life of an intangible asset is finite or infinite and, if finite, the length of its life. The straight-line method is typically used for amortization. Goodwill is an example of an unidentifiable intangible asset which cannot be acquired singly and typically possesses an indefinite benefit period. It stems from such factors as a good reputation, loyal customers, and superior management. Any business that earns significantly more than a normal rate of return actually has goodwill. Goodwill is recorded in the accounts only if it is purchased by acquiring another business at a price higher than the fair market value of its net identifiable assets. It is not valued directly but inferred from the values of the acquired assets compared with the purchase price. It is the premium paid for the target company's reputation, brand names, customers or suppliers, technical knowledge, key personnel, and so forth. Goodwill only has value insofar as it represents a sustainable competitive advantage that will result in abnormally hig... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1418147532044

- =/< 5bpm for <40 min

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

|

Subject 3. Financial Instruments: Financial Assets and Financial Liabilities

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-balance-sheets

Financial instruments are contracts that give rise to both a financial asset of one company and a financial liability of another company. Financial instruments come in a variety of forms which include derivatives, hedges, and marketable securities.

Measured at fair market value: Financial assets:

Financial liabilities:

Measured at cost or amortized cost: Financial assets:

Financial liabilities:

Accounting for Gains and Losses on Marketable Securities

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1418151726348

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418153561356

- =/> 25 bpm for > 10 min

- sinusoidal

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418155396364

- occasional uncomplicated variables

- early decels

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418157231372

- occasional late decels

- single prolonged decel >2 but <3 min

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418159066380

- late decels >50% of contractions

- single prolonged decel >3 but <10 min

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418160901388

- loss of variability in trough or in baseline

- biphasic decels

- overshoots

- slow return to baseline

- baseline lower after decel

- baseline tachy/brady

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418162736396

- FHR increases >15 bpm lasting > 15 sec (>10 bpm for >10 sec if <32 wk)

- accels present w/ fetal scalp stimulation

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418164571404

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418166406412

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418168241420

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418170076428

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418171911436

- review overall clinical situation

- obtain scalp pH if appropriate

- prepare for delivery

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418173746444

2 . Check maternal vitals

3 . Correct maternal hypovolemia, if present, by increasing IV fluids

4 . Stop oxytocin if applicable

5 . Administer oxygen at 8 to 10 L/min

6 . Rule out fever, dehydration, drug effect, prematurity

7 . Consider initiation of electronic fetal monitoring to clarify and document components of FHR

8 . If external monitor already in place, consider applying an internal fetal scalp electrode

9 . Consider fetal scalp sampling if appropriate

10. If abnormal findings persist despite corrective measures and other tests are not available (like fetal scalp pH) or desirable, the delivery should be considered

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418175581452

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418177416460

- FBS (fetal scalp blood sampling) should be repeated if abnormality persists

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418179251468

- repeat FBS in 30 min or consider delivery if rapid fall since last sample

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418181086476

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418182921484

2 . What is the baseline fetal heart rate?

3 . What is the baseline variability?

• Absent

• Minimal

• Moderate/average

• Excessive

4 . Periodic changes noted on this tracing are:

• Accelerations

• Early decelerations

• Late decelerations

• Variable decelerations

5 . This tracing is classified as:

• Normal

• Atypical

• Abnormal

6 . What would be your management?

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418184756492

- pregnancies complicated by IUGR

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418188426508

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418192620812

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418195504396

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418199698700

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418203893004

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

|

#obgyn

Meconium aspiration may cause both mechanical obstruction of the airways and chemical pneumonitis, in addition to severe pulmonary hypertension.

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1418210708748

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

Meconium aspiration may cause both mechanical obstruction of the airways and chemical pneumonitis, in addition to severe pulmonary hypertension.

Flashcard 1418212281612

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

Meconium aspiration may cause both mechanical obstruction of the airways and chemical pneumonitis, in addition to severe pulmonary hypertension.

Flashcard 1418213854476

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

Meconium aspiration may cause both mechanical obstruction of the airways and chemical pneumonitis, in addition to severe pulmonary hypertension.

Flashcard 1418216738060

- prematurity

- abn fetus

- mult pregnancy

- polyhydramnios

- premature ROM

- AROM

- high presenting part

- obstetric procedures (ECV)

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

|

#obgyn

If infant is vigorous and crying immediately after birth, suctioning the mouth and nares is not necessarily recommended in the presence of meconium

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1418218573068

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

If infant is vigorous and crying immediately after birth, suctioning the mouth and nares is not necessarily recommended in the presence of meconium

|

#obgyn

If infant is depressed at birth, tracheal intubation and suctioning of meconium from the lower airway should be done.

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Flashcard 1418221456652

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

If infant is depressed at birth, tracheal intubation and suctioning of meconium from the lower airway should be done.

Flashcard 1418223029516

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Open it

If infant is depressed at birth, tracheal intubation and suctioning of meconium from the lower airway should be done.

Flashcard 1418225913100

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418227748108

- check for cord pulsations

- if fetus already dead/too immature to survive/lethal anomaly, intervention for fetal reasons are inappropriate (allow vag deliv or c/s if transverse lie)

2. relieve cord compression

- if cord outside introitus, gently replace in vagina

- with hand in vagina, cradle cord in palm & use tips of fingers to elevate presenting part off of cord

- adjust maternal position to trendelenberg (head lower than pelvis) or knee-chest

3. method of delivery

- if cervix fully dilated & present part low, do assisted vag deliv

- if cervix not fully dilated/vag deliv dangerous, do immediate CS

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

Flashcard 1418229583116

| status | not learned | measured difficulty | 37% [default] | last interval [days] | |||

|---|---|---|---|---|---|---|---|

| repetition number in this series | 0 | memorised on | scheduled repetition | ||||

| scheduled repetition interval | last repetition or drill |

|

Subject 4. Equity

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-balance-sheets

Equity is a residual value of assets which the owner has claim to after satisfying other claims on the assets (liabilities). There are five potential components that comprise the owner's equity section of the balance sheet:

Statement of Changes in Shareholders' Equity This statement reflects information about increases or decreases to a company's net assets or wealth. It reveals much more about the year's stockholders' equity transactions than the statement of retained earnings.

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 5. Uses and Analysis of the Balance Sheet

#cfa #cfa-level-1 #financial-reporting-and-analysis #has-images #understanding-balance-sheets

Common-Size Analysis of Balance Sheets

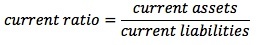

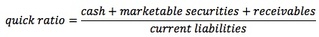

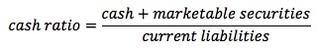

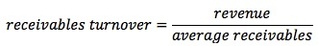

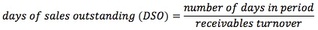

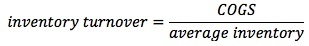

This topic will be discussed in detail in Reading 28 [Financial Analysis Techniques]. Balance Sheet Ratios Liquidity ratios measure the ability of a company to meet future short-term financial obligations from current assets and, more importantly, cash flows. Each of the following ratios takes a slightly different view of cash or near-cash items.

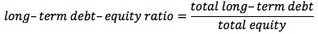

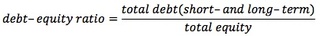

Solvency ratios measure a company's ability to meet long-term and other obligations.

Financial statement analysis aims to investigate a company's financial condition and operating performance. Using financial ratios helps to examine relationships among individual data items from financial statements. Although ratios by themselves cannot answer questions, they can help analysts ask the right questions in financial statement analysis. As analytical tools, ratios are attractive because they are simple and convenient. However, ratios are only as good as the data upon which they are based and the information with which they are compared. Fr... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. Classification of Cash Flows and Non-Cash Activities

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-cashflow-statements

The cash flow statement provides important information about a company's cash receipts and cash payments during an accounting period as well as information about a company's operating, investing and financing activities. Although the income statement provides a measure of a company's success, cash and cash flow are also vital to a company's long-term success. Information on the sources and uses of cash helps creditors, investors, and other statement users evaluate the company's liquidity, solvency, and financial flexibility.

Cash receipts and cash payments during a period are classified in the statement of cash flows into three different activities: Operating Activities These involve the cash effects of transactions that enter into the determination of net income and changes in the working capital accounts (accounts receivable, inventory, and accounts payable). Cash flows from operating activities (CFOs) reflect the company's ability to generate sufficient cash from its continuing operations. CFOs are derived by converting the income statement from an accrual basis to a cash basis. For most companies, positive operating cash flows are essential for long-run survival. The major operating cash flows are (1) cash received from customers, (2) cash paid to suppliers and employees, (3) interest and dividends received, (4) interest paid, and (5) income taxes paid. Special items to note:

Investing Activities These include making and collecting loans and acquiring and disposing of investments (both debt and equity) and property, plants, and equipment. In general, these items relate to the long-term asset items on the balance sheet. Investing cash flows reflect how a company plans its expansions. Examples are:

Financing Activities These involve liability and owner's equity items, and include:

In general, the items in this section relate to the debt and the equity items on the balance sheet. Financing cash flows reflect how the company plans to finance its expansion and reward its owners. Examples:

Purchase of debt and equity securities fro... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 2. Preparing the Cash Flow Statement

#cfa #cfa-level-1 #financial-reporting-and-analysis #has-images #understanding-cashflow-statements

The beginning and ending cash balances on the statement of cash flows tie directly to the Cash and Cash Equivalents accounts listed on the balance sheets at the beginning and end of the accounting period.

Net income differs from net operating cash flows for several reasons.

There are two methods of converting the income statement from an accrual basis to a cash basis. Companies can use either the direct or the indirect method for reporting their operating cash flow.

Direct Method Under the direct method, the statement of cash flows reports net cash flows from operations as major classes of operating cash receipts and cash disbursements. This method converts each item on the income statement to its cash equivalent. The net cash flows from operations are determined by the difference between cash receipts and cash disbursements. Assume that Bismark Company has the following balance sheet and income statement information:

Additional information:

Direct Method:

|

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 3. Cash Flow Statement Analysis

#cfa #cfa-level-1 #financial-reporting-and-analysis #understanding-cashflow-statements

Evaluation of the Sources and Uses of Cash

Analysts should assess the sources and uses of cash between the three main categories and investigate what factors drive the change of cash flow within each category. For example, if operating cash flow is growing, does that indicate success as the result of increasing sales or expense reductions? Are working capital investments increasing or decreasing? Is the company dependent on external financing? Answers to questions like these are critical for analysts and can help form a foundation for evaluating the financial health of an industry or company. Please refer to the textbook for specific examples. Common-Size Analysis of the Statement of Cash Flows This topic will be discussed in detail in Reading 28 [Financial Analysis Techniques]. Free Cash Flow to the Firm and Free Cash Flow to Equity From an analyst's point of view, cash flows from operation activities have two major drawbacks:

Free Cash Flow (FCF) is intended to measure the cash available to a company for discretionary uses after making all required cash outlays. It accounts for capital expenditures and dividend payments, which are essential to the ongoing nature of the business. The basic definition is cash from operations less the amount of capital expenditures required to maintain the company's present productive capacity.

Free Cash Flow to the Firm (FCFF): Cash available to shareholders and bondholders after taxes, capital investment, and WC investment.

Example Quinton is evaluating Proust Company for 2014. Quinton has gathered the following information (in millions):

Calculate the FCFF for Proust for the year. Solution NCC = Depreci... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

|

Subject 1. Analysis Tools and Techniques

#cfa #cfa-level-1 #financial-analysis-techniques #financial-reporting-and-analysis #has-images

Financial analysis techniques are useful in summarizing financial reporting data and evaluating the performance and financial position of companies. The results of financial techniques provide important inputs into security valuation.

Ratios Ratios express one quantity in relation to another. As analytical tools, ratios are attractive because they are simple and convenient. They can provide a profile of a company, its economic characteristics and competitive strategies, and its unique operating, financial, and investment characteristics. Ratio analysis is essential to comprehensive financial analysis. However, analysts should understand the following aspects when dealing with ratios:

Limitations: There are a significant number of estimates and subjective information that go into financial statements and therefore it is imperative that the analyst understands the numbers before calculating and relying on ratio analyses based on these numbers. An analyst needs to ask questions like:

Common-size Analysis Raw numbers hide relevant information that percentages frequently unveil. Common-size statements normalize balance sheet, income statement, and cash flow statement items to allow easier comparison of different-sized companies. They reduce all the dollar am... |

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||